underworld111/iStock via Getty Images

Introduction

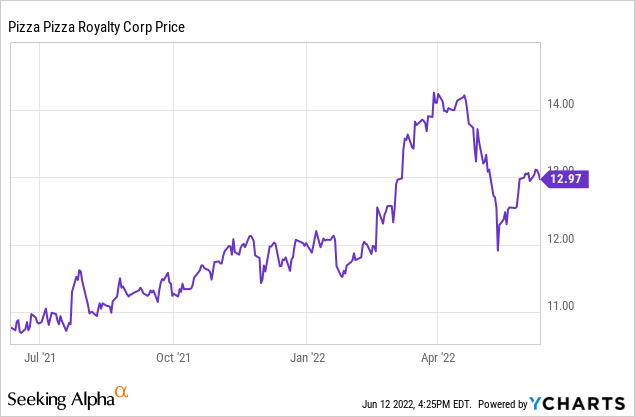

It has been almost a year since I last discussed Pizza Pizza Royalty (OTCPK:PZRIF) where I highlighted the royalty company’s 6.5% dividend yield. Since that article, Pizza Pizza has strongly outperformed the S&P 500 by approximately 30% (and that excludes the dividend income between August last year and now). The share price has been stagnating lately (of course, there always are some swings) as investors are now able to access other income opportunities. EQ Bank, for instance, offers a 3.75% interest on a 1-year GIC and 4.4% on a 3-year GIC, which makes the current 6% distribution yield from Pizza Pizza Royalty less appealing. It’s still good, but the smaller the difference with what is perceived to be a risk-free interest rate, the less excited investors will be.

Pizza Pizza Royalty Corp. is a Canadian company and has its most liquid listing on the TSX where it’s trading with PZA (or sometimes PZA.UN or PZA-UN) as its ticker symbol. The average daily volume in Canada is just under 50,000 shares per day, so that would by far be the most liquid listing to trade in Pizza Pizza shares. The company reports its financial results in Canadian Dollars, and I will use that currency as base currency throughout this article unless indicated otherwise.

All relevant financial documentation was sourced from the company’s SEDAR profile.

The distributable cash flow in Q1 was satisfying but keep in mind Q2 and Q3 are more important

Figuring out the distributable cash flow of a royalty company is pretty simple, even more so considering Pizza Pizza Royalty does not incur any capital expenditures as it just receives cash payments from franchisees.

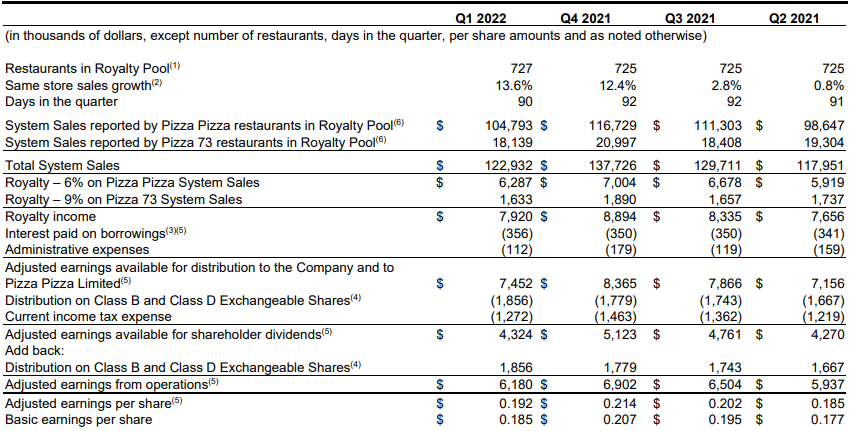

Pizza Pizza Investor Relations

The image above shows an excellent breakdown of how it works. Pizza Pizza Royalty receives 6% from the almost C$105M in revenue from the Pizza Pizza restaurants while it receives 9% from the Pizza 73 brand for a combined total of C$7.92M. Subsequently, you need to deduct the operating expenses and the interest expenses to end up with the adjusted earnings, which were C$7.45M.

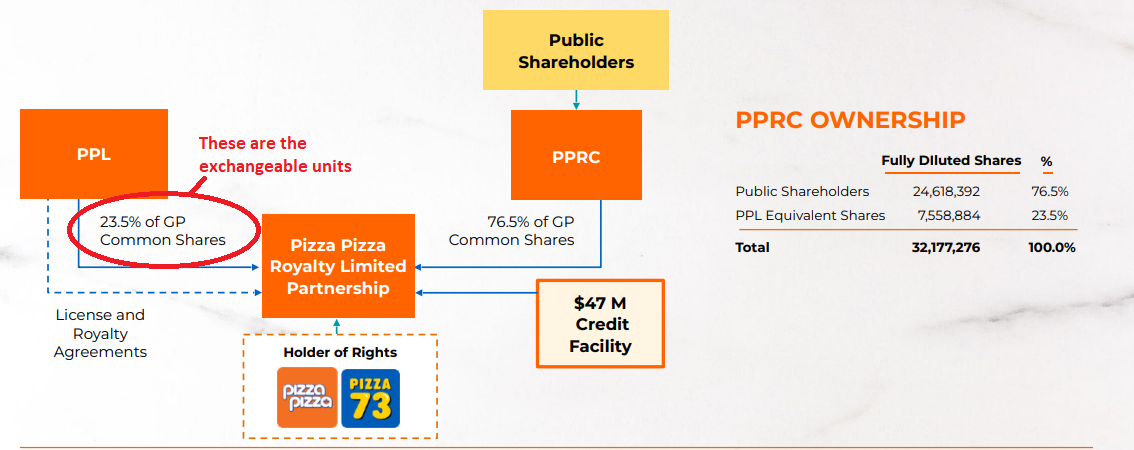

The next element is slightly more complicating. PZRIF has ‘exchangeable units’ on the liabilities side of its balance sheet. You could call them ‘phantom stock’: they exist, and the owners are entitled to the same economic benefits as the common unitholders, but they haven’t been officially converted into common units yet. As they do qualify as equity, Pizza Pizza has included them on the equity portion of the balance sheet. The image below shows the breakdown of the share ownership.

Pizza Pizza Investor Relations

The concept with exchangeable units sounds confusing but is rather simple. There are 7.558 million exchangeable shares which can be converted into 7.558 million common units. So, for all purposes, we should assume these are ‘shares’ when it comes to calculating the distributable cash flow per share.

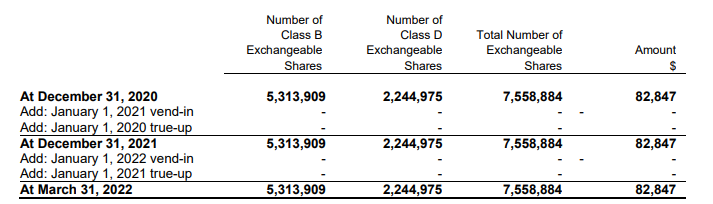

Pizza Pizza Investor Relations

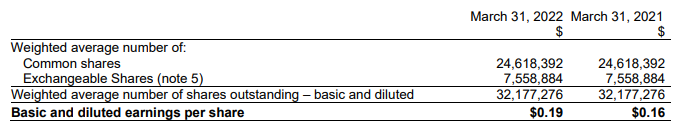

That’s also how the company approaches it as it first deducts the distribution to the exchangeable shareholders but then adds it back again after deducting the taxes. So, for all intents and purposes, we should work with just under 32.2M shares outstanding.

Pizza Pizza Investor Relations

In the first quarter of this year, the adjusted earnings from operations were C$6.18M, and divided over the 32.177M share count, the adjusted earnings per share came in at C$0.192. This means the monthly distribution of C$0.065/share was not fully covered as this would require distributable earnings of C$0.195/share (the total distribution in Q1 was just C$0.19 as PZRIF hiked the dividend during the quarter).

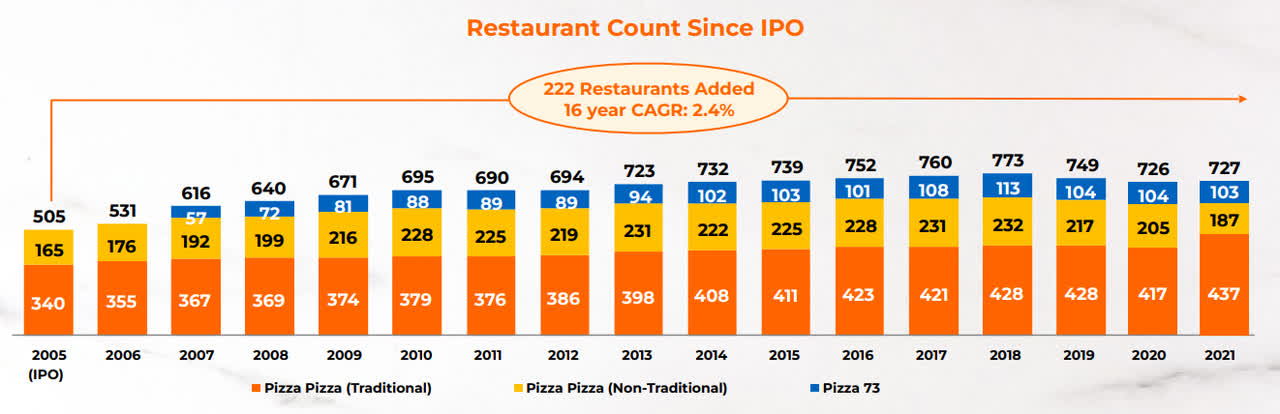

I’m not worried about seeing the distribution not being fully covered by the adjusted earnings as the first quarter of the year is traditionally the weakest. The next two quarters will be very important, and I think the company will do better than the C$0.772 and C$0.773 adjusted earnings per share generated in 2020 and 2021, as there will be no more COVID restrictions this year. I don’t anticipate PZRIF to jump back to the C$0.885/share it generated in 2019, as it lost about 45 franchises between 2019 and 2022, so the royalty pool has shrunk by about 6%. But C$0.80-0.85 for the entire year should be doable, which means the current distribution rate of C$0.78/year (paid monthly) would then be fully covered.

I like royalty companies because they take a cut from the top line

The business model of royalty companies is simple: they usually get a cut from the top line of the businesses they have a royalty on. For Pizza Pizza Royalty, the model is as easy as it gets: it receives a 6-9% royalty on the top line revenue of the Pizza Pizza and Pizza 73 franchises. If a customer spends C$20 in a franchise, C$1.2 (Pizza Pizza franchise) to C$1.8 (Pizza 73 franchise) will be forwarded by the franchisee to the franchisor, Pizza Pizza Royalty.

This makes the stock a good inflation hedge, as fellow contributor Trapping Value has been pointing out in the past. Because you are exposed to the top line, you don’t have to deal with higher energy expenses and higher labour expenses (or even just finding enough staff to operate a franchise which also is creating some headaches in certain areas). And if the price of a pizza gets hiked by 10%, you’ll immediately see a 10% increase in the royalty revenue generated by Pizza Pizza Royalty.

So, while the royalty company is immune to operating issues, we still have to keep an eye on how the franchises are doing. After all, if they would all go out of business, zero dollars would be streamed up to the royalty company as there would be no revenue to report. So that’s the main risk here: seeing franchises leave the royalty pool because they go belly up. That’s also the normal course of business, as pretty much in every quarter, restaurants get added and removed to and from the royalty pool. If a franchisee goes belly-up due to bad management decisions, it’s not unthinkable another restaurant could be opened soon thereafter with a new management.

Pizza Pizza Investor Relations

I also think a low-budget pizza chain like Pizza Pizza Royalty (which is generally not seen as qualitative as, for instance, Boston Pizza) should also be relatively immune to economic shocks. Sure, some consumers will no longer be able to afford getting a pizza, but it’s not unlikely another consumer could fill that gap as I can see people downgrade from going out to a restaurant on Date Night to ‘let’s save some money, order in a pizza and watch Netflix’.

Investment thesis

And that’s why I like the royalty model. Pizza Pizza is taking a cut from the revenue of its franchisees which in return can use the branding and name recognition associated with the two main brands. Pizza Pizza does not have to deal with increasing expenses as its own overhead expenses were just C$112,000 in the first quarter. The royalty company does have to service a loan (almost C$47M) and is currently only making interest payments and we can expect these interest payments to go up as the interest rates increase. But with an EBIT margin of 94% in the first quarter of the year, Pizza Pizza Royalty can easily handle a higher interest bill.

The current share price of just under C$13 means the current dividend yield is just over 6%. That’s relatively attractive but investors should realize the well-being of the royalty company depends on the pizza sales in the Pizza Pizza and Pizza 73 restaurants.

I currently have no position in Pizza Pizza Royalty but would be interested on a dip.

Be the first to comment