Daniel Grizelj/DigitalVision via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Darkest Hour?

As everyone knows, it is a terrible time to invest in high growth, lossmaking software companies. If you own any still – what on earth are you thinking? – toss ’em over the side. Especially MongoDB. Yet another NoSQL database company with no earnings and not even a fat prepaid deferred revenue balance to keep the wolf from the door. Sell. Easy. Goodnight folks.

Well, that’s the easy analysis and just because it’s easy doesn’t mean it’s wrong. Everything is wrong in the world right now and instinctively that means it’s best to either not own stocks at all, or if you do, just keep loading up on that good Exxon Mobil because if gas is $5, XOM must be a good bet, right?

The thing with financial markets is it is always Opposite Day. The problem is it’s hard to tell whether it is only Opposite Day i.e. you are facing only one rug pull, or whether it is in fact Opposite Opposite Day i.e. the market knows you think it’s going to zig, so it feints as if to zag, but then it sees you recognizing a zag and decides to heck with it and then zigs. ‘Cept you had dumped all your zig positions because the pain trade was zag. So now you’re in pain because… you see the problem here. (And that’s what stop-loss orders are for. To save you from your own over-thinking).

Let’s for a moment assume that we don’t know whether it is Opposite Day or Opposite Opposite Day. Let’s assume that we can use our old friend the stop loss to insure against us calling the Wrong Kind Of Opposite. And then let’s go look at MongoDB (NASDAQ:MDB) together. Because if it’s just your regular kind of Opposite Day then the stock looks pretty interesting. And if it’s your second-order-derivative of Opposite, then, the chart gives you a proximate stop-loss position that you can use.

First, let’s turn to some fundamentals.

MDB Stock Key Metrics

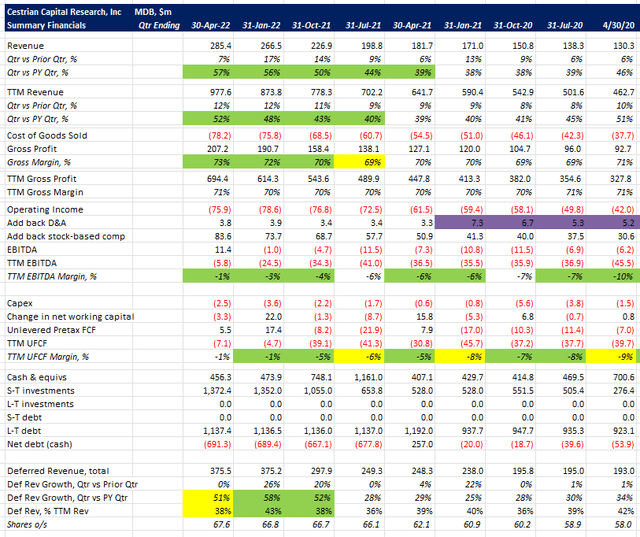

MDB Financials (Company SEC filings, YCharts.com, Cestrian Analysis)

The first thing that stands out is that revenue growth is accelerating. Most economies around the world have some problems right now and so any company that can show not just consistent but accelerating levels of growth deserves attention. MDB revenue growth was 52% pa on a trailing-twelve-month basis in the April quarter just reported; that’s up sequentially every quarter since the April 2021 quarter.

Gross margin is holding steady at 71% on a TTM basis; EBITDA margins are almost in the black; and unlevered pretax free cashflow is also on the brink of breakeven. We expect positive TTM EBITDA and TTM cashflow within 2-3 quarters.

The balance sheet is solid with approximately $1.8bn of gross cash and $1.1bn of gross debt, leaving $700m net cash. Assuming the company moves into flat or better cashflows, the cash reserves are more than adequate.

Deferred revenue at MDB is unusually weak for a modern software business. Most such companies sell substantial contracts upfront and book the business in as remaining performance obligations i.e. contract is sold, creating the liability (the obligation), the service has yet to be delivered, hence, remaining. Some proportion of that RPO is prepaid and that shows up as deferred revenue – which, confusingly, is a balance sheet liability matching the cash or accounts receivable item on the asset side. It’s a liability because it’s something that the company is on the hook to deliver. Many software companies today have very large RPO and deferred revenue balances and that means the revenue visibility is very good – which helps you sleep a little better at night if you own them, always a good thing when you are paying Eleventy Hundred And Seventy Four Times Next Year’s Revenue for these things. In addition, you can often gain a little glimpse into the future if you look carefully at the evolution of RPO. If RPO is big vs. TTM revenue and it is growing faster than TTM revenue… then there’s a good chance that TTM revenue growth is going to accelerate. It’s not a linear relationship and you can’t bank on it but you can say… it’s a clue. At MDB, you don’t have so much easy-sleeping, nor so much of a clue about future growth rates. Deferred revenue stands at less than 40% of TTM revenue so it’s not a particularly meaningful indicator.

Net net – this is a company featuring accelerating revenue growth, about to become cashflow positive, with a solid balance sheet, but lacking the revenue visibility common amongst its peers.

Is MongoDB Overvalued Now?

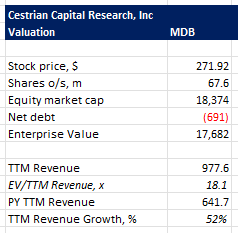

MDB’s valuation multiples are as follows:

MDB Valuation Table (Company SEC filings, YCharts.com, Cestrian Analysis)

18x revenue is way down from the peak, and relative to other software names, 18x TTM revenue in exchange for 52% growth and cashflow breakeven (ish!) isn’t out of line – it’s cheaper than many as a function of growth, and that’s likely because the revenue visibility is lower as we mention above.

Now, when it comes to valuing stocks, we don’t subscribe to the notion that there is a ‘correct’ price. The market doesn’t use that method so, why would we? Valuation to us is a far more postmodern exercise insofar as we treat it as a relative rather than an absolute matter. If a stock is valued more highly than a direct comparable, that can sometimes be justified based on higher growth rates, or higher margins, more revenue visibility and so forth. That’s one kind of relative assessment. The other is to assess the stock relative to its own history, or in other words, look at the stock’s chart. That can tell us something about the past and, if pattern-recognition has any benefit to it whatsoever, a little about future possibilities too.

Where Will MongoDB’s Stock Be By 2025?

(You can open a full page version, here).

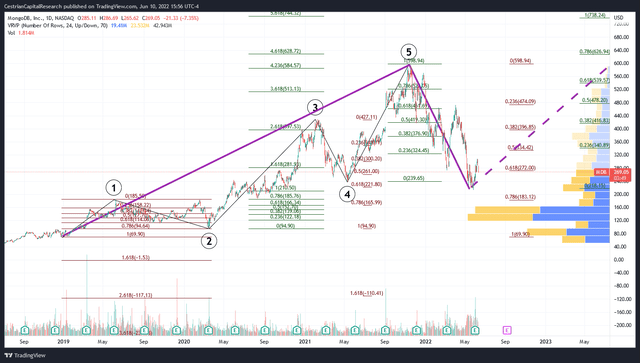

MDB Chart (TradingView, Cestrian Analysis)

MDB has put in a 5-wave-up structure since the 2018 lows, forming a larger-degree Wave One up. It then corrected down to $215, near the 0.786 retracement level of that entire Wave One up, then bounced upwards to $305, fell again, tried to hold support at the 0.618 retracement level, failed, and now sits at $268, just below that 0.618 level. That is a heavy selloff for sure and we believe that MDB can now an enter a move up – perhaps starting a larger-degree Wave 3 up, which typically tops between the 100% – 1.618 extension of Wave 1 – meaning in the range of $730-1060. If that sounds crazy to you? Everything bullish sounds crazy in this kind of market we’re in right now. But just as red hot markets go cold, frozen markets warm up. We may not be at the bottom of this correction yet, but with sentiment on the floor, every fear gauge set to max, and retail surrender in the air, there may not be too far to fall yet if indeed there is falling to be done.

MDB can fall too, of course. And that’s what stop-loss orders are for. The recent bottom in MDB is still quite close in the rear view, so placing a stop just below that level – say in the $210 zip code – can protect holders in case it is in fact Stock Armageddon.

Is MDB Stock A Buy, Sell, or Hold?

The recent sell-off in MDB provides an opportunity to invest and trade against the recent lows. So with that in mind we believe MDB to be a compelling buy on this basis:

1 – Place a stop-loss just beneath the recent low – in the $210 region.

2 – If playing with a long timeframe, target the 100% extension of Wave 1, meaning the stock could run to $752.

3 – If playing shorter term, consider taking profits around $330 should they arise – that’s the 0.5 retracement level of the whole larger degree Wave 1 up.

Cestrian Capital Research, Inc – 11 June 2022

Be the first to comment