jetcityimage

Pitney Bowes Inc. (NYSE:PBI) is a leader in shipping and mailing services which are critical for businesses dealing with large volumes of parcels. From its legacy in simple postage metering and labeling, the company has shifted more towards digital offerings focusing on e-commerce solutions as a growth opportunity. This transition has been difficult considering not only changing market dynamics but also pandemic-related disruptions and the current challenging economic environment. Indeed, shares of PBI are down by more than 75% in the past 5 years.

Still, we highlight what remains a potential turnaround with an expectation that Pitney Bowes’ global e-commerce segment begins to contribute to positive earnings following a period of rapid growth. We like PBI, particularly looking at its 5.5% dividend yield which we believe is well supported by underlying cash flows for the foreseeable future. In our view, the stock is simply undervalued with significant upside from the current level.

PBI Key Metrics

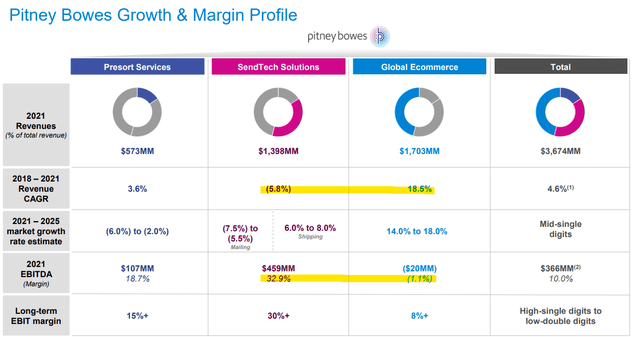

The best way to get a sense of the PBI’s financial position is to recognize that its “Presort Services” and “SendTech Solutions” segments together represent approximately 54% of the total business and have posted declining revenue over the last several years but remain profitable and generate positive cash. On the other hand, the Global Ecommerce segment delivered a strong average growth rate of 18.5% between 2018 and 2021 but was unprofitable over the period with Pitney Bowes investing in its expansion.

source: company IR

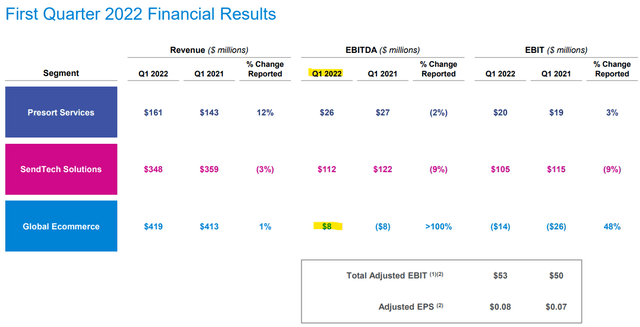

Favorably, the setup into this year is that the global e-commerce business is finally turning the corner with the operation now benefiting from scale. Pitney Bowes last reported its Q1 earnings back in late April with a non-GAAP EPS of $0.08 which was $0.05 above the consensus. Similarly, revenue in the quarter at $927 million was also ahead of estimates.

The Global e-commerce segment was able to generate a positive EBITDA of $8 million, reversing a loss of -$8 million in Q1 2021. Segment revenue growth of 1% considers what was a particularly strong comparison period in 2021 in terms of volumes. The momentum in Presort Services was also positive with revenue climbing 12% benefiting from higher average pricing.

During the conference call, management cited investments in automation, robotics, transportation, and labor management systems as supporting a higher level of efficiency despite more challenging market conditions including inflationary cost pressures.

source: company IR

Putting it all together, the results from Q1 provide some confidence that the overall business strategy is moving in the right direction. Longer-term, the expectation is that the EBIT margin for Presort Services and SendTech Solutions stabilize around levels from 2021 while the EBIT margin for Global Ecommerce climbs towards 8% from -1.1% last year.

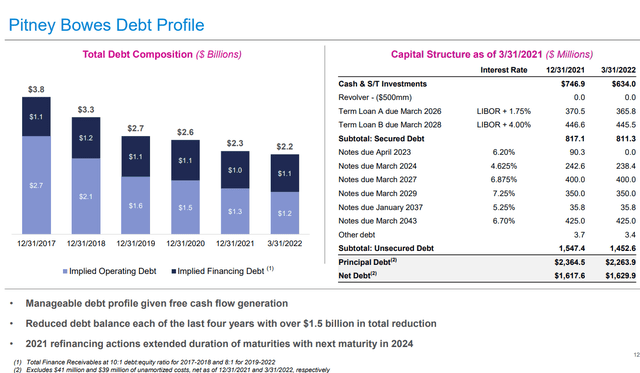

Another positive trend is the declining debt over the last few years. PBI ended the quarter with $634 million in cash and short-term investments against $2.2 billion in total debt, down from $2.3 billion last year and upwards of $3.8 billion five years ago. Keep in mind that approximately half of the current liabilities are based on “financing debt” which is part of the credit services Pitney Bowes extends to customers through its banking arm.

Our take is that it’s important to make that distinction compared to the core operating debt when considering the company’s otherwise manageable leverage profile. PBI generated approximately $394 million in adjusted EBITDA over the last twelve months and a reported $154 million in free cash flow for 2021.

source: company IR

Is PBI’s Dividend Safe

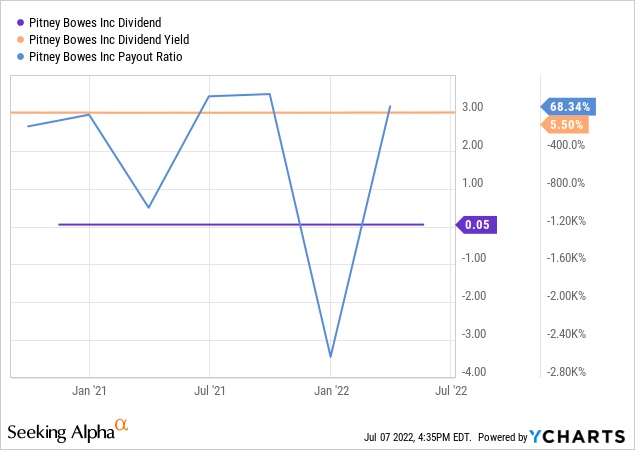

Pitney Bowes currently pays a regular quarterly dividend of $0.05 per share, yielding 5.5%. The annualized distribution of approximately $35 million represents a payout ratio of 70% against $50 million in net income over the last four quarters. The payout ratio in terms of the free cash flow in 2021 at around 22% provides a larger margin of safety. Our take is that there is every indication the dividend can and will be maintained for the foreseeable future.

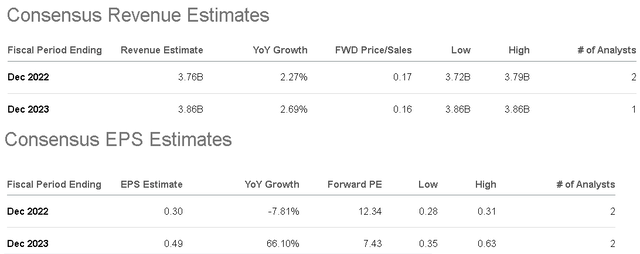

The company’s current cash position and expectation for recurring profitability provide flexibility for both the dividend and debt servicing. According to consensus estimates, the forecast for 2022 EPS at $0.30 would represent a decline of 8% compared to 2021 amid a softer operating environment into the second half of the year. Looking ahead, the expectation is that conditions improve by next year with a strong rebound in earnings towards $0.49 per share. Putting it all together, while we don’t expect a dividend increase any time soon, the quarterly payout of $0.05 per share is safe.

Seeking Alpha

PBI Stock Price Forecast

With shares of PBI down nearly 45% year-to-date, part of the weakness considers the broader market selloff and deep pessimism against the global growth outlook. Persistently hot inflation is seen pressuring consumer spending which translates directly into a softer operating environment particularly as it relates to e-commerce solutions which is precisely the area Pitney Bowes has exposure to.

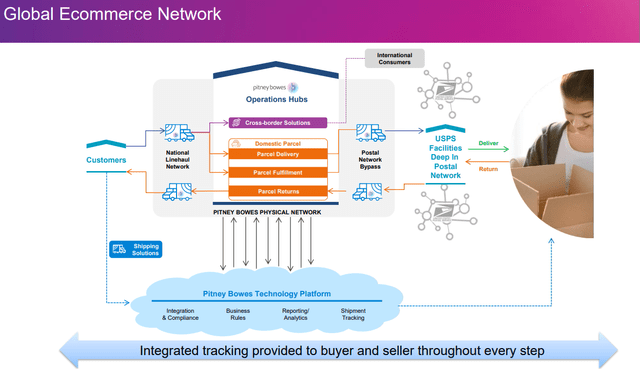

That being said, we believe the stock has good value at the current level, looking ahead to the 2023 consensus EPS which implies a 1-year forward P/E of 7.4x. There is a case to be made that the selloff has already priced in an extremely severe recession and the risks now are tilted to the upside. With e-commerce, the bullish case considers that its “Operations Hubs” logistical network captures market share with a cohort of existing and growing customer relationships driving a recurring level of sales and new growth opportunities.

source: company IR

PBI currently trading under $4.00 per share is back to pre-pandemic levels and we can make the case that the company’s outlook is stronger than where it was 3-years ago as the shift towards e-commerce is more important than ever. In our view, now is the time to take a position ahead that can play out as a sustained rally.

Seeking Alpha

Final Thoughts

We rate PBI as a buy with a year ahead price target of $5.00 per share implying a 10x multiple on the current consensus 2023 EPS. Getting past the next few quarters, assuming macro conditions at least stabilize, PBI will appear increasingly cheap with all three of its core segments contributing positive operating income. The dividend yield at 5.5% provides a good level of income with a view that the downside is limited from the current level.

The main risk to consider would be a deeper deterioration of global trade activity and consumer spending. Weaker than expected results can open the door for another leg lower in the stock. The EBIT margin and cash flow trends will be key monitoring points going forward.

Be the first to comment