JHVEPhoto/iStock Editorial via Getty Images

It’s been about 9½ months since I bought Pitney Bowes Inc. (NYSE:PBI), and in that time the share price has collapsed, down about 51% against a loss of about 19% for the S&P 500. The company has recently released financial results, so I thought I’d review the name yet again to see if it makes sense to buy more, hold what I’ve got, or take my punishment and sell. I’ll make this determination by looking at the updated financial history here, and by looking at the valuation.

As we know, Pitney Bowes stock is quite a different thing from the underlying business, so it must be treated separately. I also need to write about the short puts that I sold last January. They were at the time deep out of the money puts, and they are now very deep in the money puts.

Welcome to the “thesis statement” portion of my article. I offer this to people who want a bit more than the bullet points and title that come with every article, but may not want to commit to the time needed to wade through an entire piece. I think Pitney Bowes’ financial performance was rather good, and I’m particularly impressed by the growing strength of the capital structure. Over the past four quarters, long-term debt has declined by about 5.2%, or just over $122 million. At the same time, the shares are trading at very low levels. This combination of turnaround in progress and cheap valuation is too compelling to pass up at this point, so I’ll be adding to my position. Finally, the puts I sold last January have moved in price from $.30 to $1.10, so that trade’s not worked out well in some ways. That said, I’m very happy to let them expire worthless if the shares spike in price, and I’m equally happy to be exercised on these. While I normally love to sell puts, I think the shares themselves represent superior value at the moment, given that I’m still of the view that the dividend is sustainable here.

As an aside, I’m very curious to see how this article will impact my subscriber numbers. I don’t pay much attention to these numbers as some, but in the past, I’ve noticed that subscriptions jump after I post one of my thinly veiled brag articles. I assumed that people subscribe after hearing about how a stock investment turned out very well and that I’ll make a similarly prescient call in the future. Now that I’m writing about an investment that’s been quite painful for the year, I wonder if my credibility will suffer, and that will manifest in a drop-off in subscriber numbers. Or maybe subscribers leave because they grow tired of the bad jokes. Who can say?

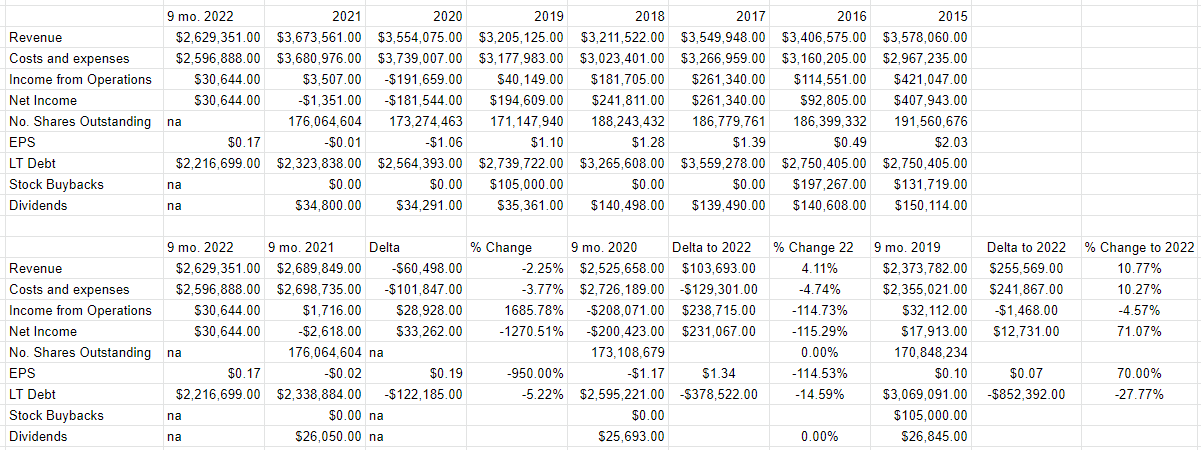

Pitney Bowes Financial Snapshot

The most recent financial performance has improved in many ways from the year-ago period, largely as the result of “other (income) expenses” turning from negative $40.9 million to positive $20.3 million. The company also saw restructuring charges decline by about $7 million, down to $66.2 million. So, the financial performance improved, but we can’t get away from the fact that the business may be slowing relative to last year. Although I didn’t include it in the graphic below, the chief culprits here were “support services” (down 6.2%), “financing” (down 7.2%), and “rentals” (down 9.7%). At the same time, expenses were broadly up relative to the same period in 2021, most notably “financing interest expense,” which was up by just under 7%, and “other components of net pension and post-retirement” (up by 356%).

Last year may be an anomaly, though, so I took the liberty of comparing the most recent 9 months to the same periods in 2020, and 2019 for your enjoyment and edification.

When we review the most recent period in comparison to 2020, and 2019, we see that the company is actually growing over time. For instance, revenue during the first nine months of 2022 was about 10.8% higher than it was during the same period in 2019 and is up about 4.1% relative to 2020. Income from operations and net income are also both up substantially from the same periods in 2019 and 2020. All of this leads me to suggest that 2022 is likely further evidence of ongoing turnaround in the business.

Another bright spot in the financial statements relates to the improvement in the capital structure. Long-term debt has been declining nicely, from just over $3 billion at the end of Q3 2019 to just over $2.2 billion today. I think it’s also worth pointing out that the company currently has cash and short-term investments of about $606 million, or 27% of total debt.

Given all of the above, I think it’s reasonable to conclude that the company is turning around and that the capital structure is improving. Given that, I’d be happy to buy more of this stock at the right price.

Pitney Bowes Financials (Pitney Bowes investor relations)

The Stock

My regulars know that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits, while the stock is a speculative instrument that gets traded around based on long-term expectations about the business. Given that the financial statement valuation of the business is “backward-looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two.

Additionally, this stock, like all stocks, can be affected by changes in the overall market. The crowd may change its views about the desirability of “stocks” as an asset class, and that will impact individual stocks to some degree. Let me flesh this idea out a bit by using this painful investment as an example. My shares of Pitney Bowes are down about 51% since I bought them, and the market is down about 19% since then. It’s impossible to prove the case, but I’m of the view that some portion of that 51% loss can be “blamed” on the reduced attractiveness of equities as a group.

So, to sum up, the business chugs along, while the stock bounces up and down based on the crowd’s ever-changing views about the future. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. I like to buy stocks when the crowd is particularly down in the dumps about a given stock, because those expectations are easier to beat.

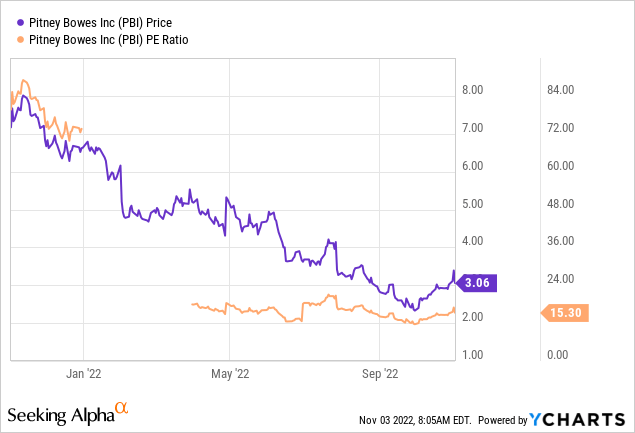

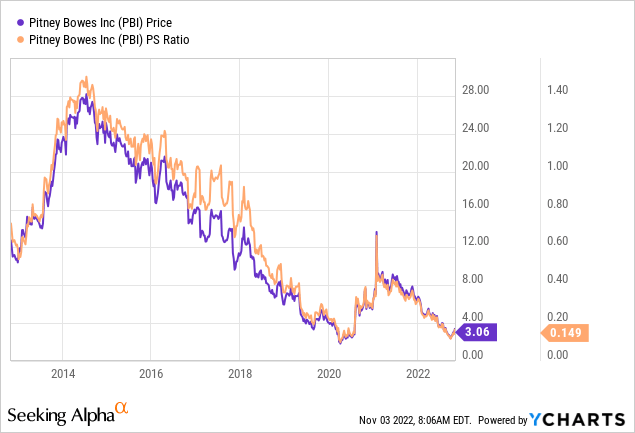

Another way of writing “down in the dumps about a given stock” is “cheap.” I like to buy cheap stocks because they tend to have more upside potential than downside. As my regulars know, I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship of price to some measure of economic value, like sales, earnings, and the like. I like to see a stock trading at a discount to both its own history and the overall market. On that basis, it’s obvious to me that Pitney Bowes is cheap. For instance, the shares are trading near pandemic lows on a price-to-sales basis, per the following:

This compares favorably to the last time I looked at this stock, when the shares were trading at a price-to-sales ratio of $.31, or more than twice the current level. In my previous missive, I characterized the valuation here as “middling.”

In order to validate (or refute) this view, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Pitney Bowes at the moment suggests the market is assuming that this company will not grow at all from current levels, which I consider to be nicely pessimistic. Given the above, I’ll be adding to my Pitney Bowes position today.

Options Update

In my previous article, I recommended selling the January 2023 puts with a strike of $4 for $.30. These last traded hands at $1.10, so that trade hasn’t worked out well, and if things don’t change, it looks like I’ll be obliged to buy some more of this stock at a net price of $3.70 early next year. I actually don’t mind this entry price too much, so I won’t take my lumps on these puts, either.

I also feel compelled to write that I think the shares represent better relative value than the puts at the moment, and for that reason, I’ll simply buy a few more shares at current levels. In my previous missive, I concluded that the dividend is reasonably secure, and nothing has happened to change my mind on that score.

The next few months will be painful for Pitney Bowes shares possibly, but I think the combination of improving capital structure, very compelling valuation, and ongoing evidence of turnaround is too compelling to pass up. For that reason, I’m adding to my Pitney Bowes position.

Be the first to comment