Joe Raedle/Getty Images News

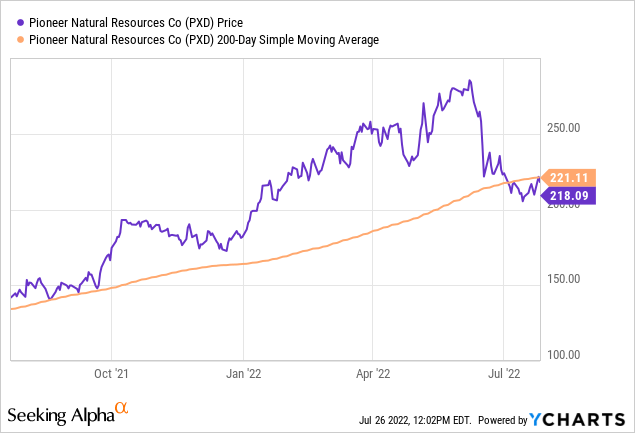

The stock of Permian O&G producer Pioneer Natural Resources (NYSE:PXD) is down 20%+ since June and has recently snapped back to its simple 200-day moving average after a significant dip below that technical level (see graphic below). Yet while the stock has dropped, consensus EPS estimates have risen by $0.30/share over the past 60 days. That’s good news for shareholders because Pioneer is a very shareholder-friendly company: It’s targeting payouts of up to 75% of free cash flow while being disciplined and growing production at a relatively moderate rate (~5%). Meantime, the company has a very strong balance sheet and is well positioned for any potential pull-back in O&G prices. As a result, I’m upgrading my rating on PXD from HOLD to BUY and expect the stock to end the year above $250 while generating excellent dividend income along the way. Indeed, PXD could quite easily generate a total return of 20% by year-end.

Investment Thesis

Most of you are already aware of the current bullish macro environment for oil and gas producers: Putin’s horrific and unprovoked war on Ukraine resulted in oil sanctions by the U.S. and its Democratic and NATO allies. Those developments, combined with U.S. shale producers and OPEC being extremely disciplined with respect to growing production, have resulted in tight global markets for both oil and natural gas. The resulting price gains, while awful for consumers (especially those in the EU), have been a pleasant surprise for long-suffering O&G investors. In fact, prior to COVID-19, the returns in the energy sector had been abysmal, causing many investors to flee the sector. I say that because Barron’s pointed out in an article this weekend that “Energy Stocks Punch Above Their Weight In Earnings”:

Energy stocks make up just 4% of the S&P 500 but are expected to account for 12% of the index’s earnings in the second quarter.

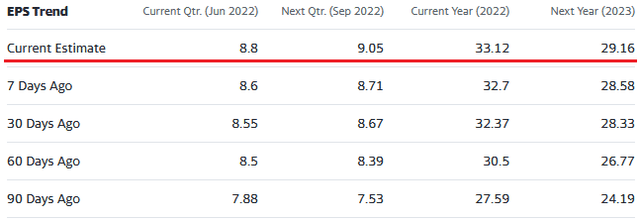

This certainly appears to be the case with Pioneer Natural Resources. Take a look at the current consensus earnings estimates:

As mentioned earlier, while the stock has fallen over the past couple of months, the Q2 EPS estimates actually rose $0.30/share to $8.80. The full-year estimate has risen by over $3/share to $33.12. Given the current stock price at pixel time of $217, that equates to a (six-month) forward P/E of only 6.6x. That’s exactly one-third that of the average S&P 500 P/E of 19.8x.

Meantime, as I reported in a previous Seeking Alpha article back in April, “PXD Could Pay $20/share In FY22 Dividends.” At this point, I’m confident enough in that prediction on PXD that I will change “could pay” to “will pay” more than $20/share in dividends. Here’s why.

Earnings

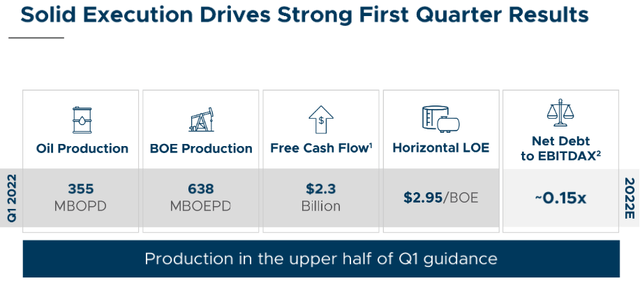

In the Q1 EPS report, PXD generated $2.3 billion of free cash flow and returned 88% of that to shareholders via $250 million (11%) in share buybacks and the balanced going toward the base and variable dividends which resulted in an aggregate $7.58/share in dividend income for PXD shareholders. That’s a very attractive buyback/dividend payout ratio that I certainly wish ConocoPhillips (COP) would follow as opposed to that company’s massive over-emphasis on the dividend.

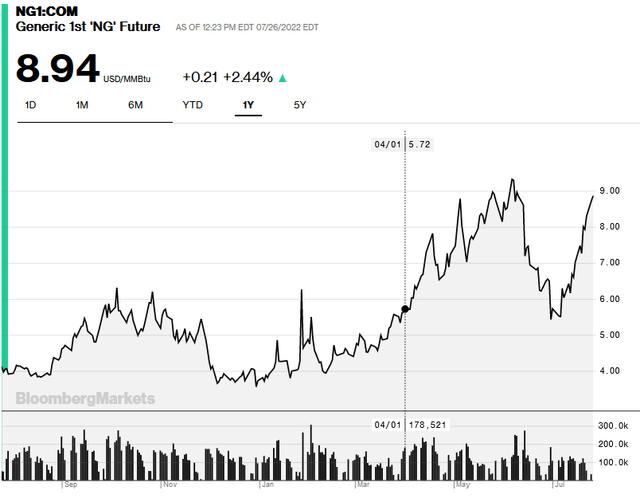

Due to a very disciplined use of capital, PXD’s return on capital employed was greater than 30% in Q1. I suspect PXD’s ROCE will be even higher in Q2 given the strength in oil and natural gas prices. Note that the price of natural gas during Q2 was significantly higher than during Q1:

That’s important for PXD shareholders, considering the company has significant associated natural gas production from its Permian wells in the Midland Basin. As the graphic below shows, PXD’s oil production in Q1 was 55.6% of total production:

That means that natural gas and NGLs accounted for 44.4% of PXD’s total production and that the rise in the price of natural gas – as a result of higher LNG exports combined with strong natural gas demand for power generation during a sweltering summer – will be a windfall for Pioneer in Q2 (and likely for some time to come).

Going Forward

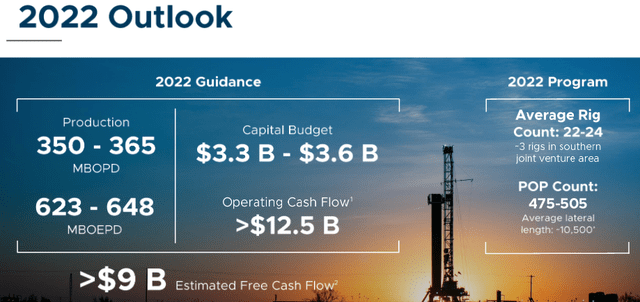

Forward guidance given during the Q1 presentation is as follows:

Note the $9 billion in estimated free cash flow equates to a whopping $35.16/share based on the 256 million fully diluted shares outstanding at the end of the quarter.

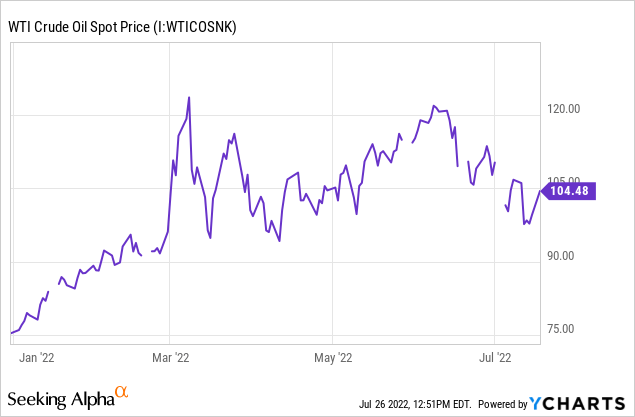

Also, note that the price of natural gas popped higher after that guidance was issued and the price of oil has averaged higher in Q2 as compared to Q1 as well:

Now, given the earlier estimate of $9 billion in FCF, and using the Q1 payout ratio of ~11% allocated to the buybacks and 89% to dividends, that means PXD could pay out an estimated ~$8 billion in dividends this year, or $31.29/share based on the 256 million fully diluted shares reported at the end of Q1. Suffice it to say, I’m very confident that PXD will exceed the $20/share in dividends I suggested in my previous Seeking Alpha article in April.

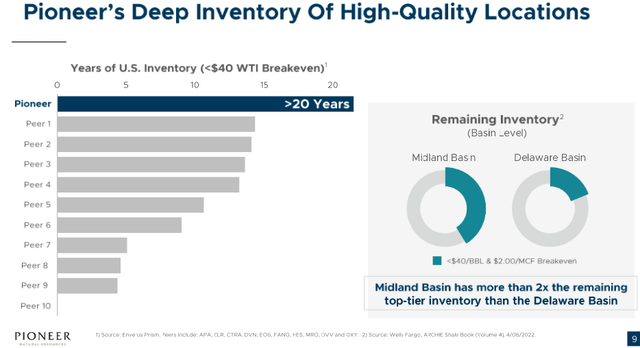

Longer term, PXD is well positioned given 20+ year inventory of excellent Permian Basin drilling locations that breakeven at under $40/bbl WTI:

Risks

The risk of investing in a commodity producer (and commodity price taker …) like PXD is obviously the global supply/demand balance which can be impacted by the global economy (high prices and/or a recession equates to demand destruction) and/or by supply (i.e. increased production by US shale producers and/or OPEC).

From a balance sheet perspective, PXD is in great shape, ending Q1 with $2.4 billion in cash and net debt of only $3.3 billion. Pioneer has ample liquidity ($4.4 billion) and expects to reduce net debt to EBITDAX to ~0.15x by year-end. That being the case, in my opinion, PXD is well positioned and prepared for any significant downturn in O&G prices.

Summary and Conclusions

My earlier dividend-per-share prediction on Pioneer Resource was way too low. That, combined with a recent decline in the share price while Q2 and FY22 earnings consensus estimates rose significantly, is enough for me to change my rating on PXD from HOLD to BUY. In my opinion, PXD is dirt cheap here and likely to end the year above $250 for a share. That, combined with the expected dividend payouts (base+variable), means that investors can expect a total return to investors of 20% (or even higher) over the next six months. The Q2 report is due out on Aug. 8 after the market’s close. I suggest investors establish a position in PXD prior to that report. Q2 is likely to be stellar, and I expect management to raise guidance going forward.

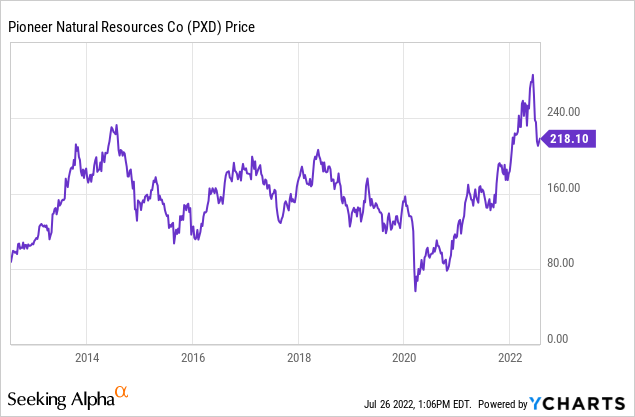

I’ll end with a long-term price chart of Pioneer and caution the current perhaps overly exuberant energy investor that the price of the stock is about where it was back in 2015:

The point being that O&G prices are cyclical.

Be the first to comment