dszc

Investment Thesis

Pioneer Natural Resources (NYSE:PXD) is the largest Midland Basin (Texas) oil and gas firm, paying out 80% of free cash as a variable dividend. PXD maintains a stock of over twenty years’ worth of high return inventory, amounting to a nearly debt-free balance sheet at 0.1x debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) estimate for 2022.

Estimated Fair Value (EFV) = PE of 8 times E23 EPS of $35 = 8 X $35.00 = $280 per share.

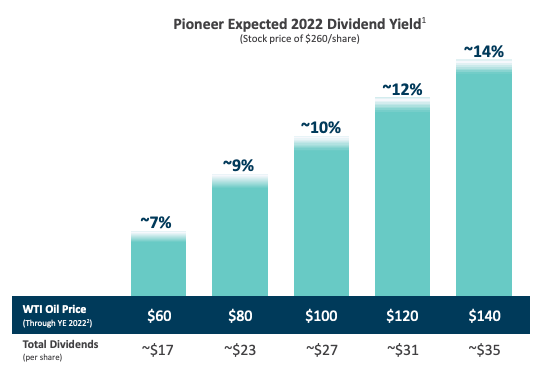

PXD is a compelling investment for income investors, and expects dividends to be well into the double digits should oil prices increase beyond $100/bbl. We expect the dividends to remain at or above the present level of ~11%, as the EIA expects oil to remain at or above its current price of ~$95 well into 2023.

June 2022 Investor Presentation

|

Pioneer Natural Resources |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

2.9 |

3.0 |

3.0 |

|

Price-to-Earnings |

7.1 |

7.0 |

7.0 |

|

EV/EBITDA |

4.2 |

4.1 |

4.1 |

Operations

PXD operates primarily in the Midland Basin in central Texas and has a large stock of breakeven $40/barrel oil. In FY2022, PXD expects to produce 630 MBOE/d in oil, generating an estimated free cash flow of over $9 billion in FY2022.

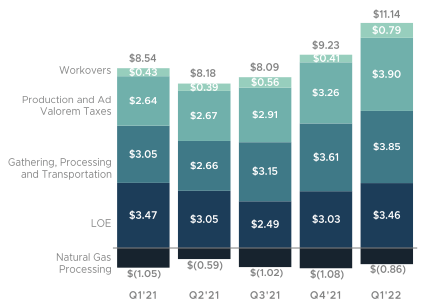

During 1Q22, PXD had a realized price of nearly $94.60 which led the basin in realized price. Realized price is the cash market price gotten, subtracting adjustments for costs to deliver the product (extraction, transportation, processing). Due to the high price of oil and the no hedging strategy, the total margin for 1Q22 is a whopping $68.48/boe, easily beating its competitors.

Production Costs (per BOE) (June 2022 Investor Presentation)

By the end of 2022 estimated debt-to-EBITDA will be down to only 0.15x, which is very low and expected to stay low. While PXD has no plans for aggressive M&A or expansion outside Midland, it acquired two firms in FY2021, both of which expanded its holdings within its current area of operations. The low leverage target allows the variable dividends to remain high even when undertaking M&A or other expansions.

Expansion within PXD’s area of operations is driven by an increase in lateral length of rigs, breaching 10,500 feet on average (for reference, it was 8,700 in 2016) with fifty new wells in 2022. By 2023 PXD is targeting 15,000 lateral feet with one hundred new wells laid. The expansion of rigs laterally is important to note because it allows significantly more oil/gas to be drilled without increasing drilling costs; this essentially means that with every additional lateral foot drilled the overall costs of the well stay roughly the same while the amount of oil that can be extracted increases, allowing for massive increases in ROI.

Cash Return Strategy and ESG

PXD additionally has a share buyback program of which it has executed $250 million in repurchases in 1Q22 (of $4 billion authorized). Combined with the dividends, 88% of total free cash has been returned to shareholders in 1Q22. 1Q22 saw a big 25% increase in base dividend quarter over quarter bringing it to $3.12 annualized. The variable dividend is an 80% payout ratio of free cash flow after paying the base dividend.

Despite the bad reputation of oil and gas companies, PXD has improved its ESG standards greatly over the last few years already reaching significant targets. These include a 59% decrease in gas flaring activities and a 41% reduction in freshwater usage. PXD originally released several conservative estimates for environmental changes but has since revised them to include a 75% reduction in methane emissions in total by 2030 and a significant reduction of freshwater usage. Already, PXD can boast that it is significantly ahead of peers for scope 1 and 2 emissions reductions, being in the top quartile for oil and gas producers.

Risks

PXD currently operates on a zero-hedging strategy which means that they undertake no price risk mitigation through derivatives available at future prices. Most producers will “lock in” prices for at least some of their production into the next year or two in order to mitigate downside price risk. This has the advantage of being able to withstand significant price declines in crude markets and allowing companies to survive during a bust. Hedging has cost as the curve on oil futures slopes down over time meaning if you sell in the futures market you generally get a lower price than if you sold at the current market price. Options also have costs if the hedges end up not being necessary. In summary, hedging will give you a lower but more predictable revenue stream. The disadvantage is during strong oil markets with prices moving up the company will only be able to take advantage of higher prices on unhedged production over the hedge horizon and future production that was never hedged. PXD believes that they stand more to lose than gain by hedging because of their pure-play position in the very cheap Midland Basin (<$40/bbl breakeven price). At the present time this may be true, but during the height of COVID-19 when demand was at an all-time low, but production remained high, oil spot price hit $21.48, and the futures price actually went into the negatives as traders panicked to offload derivatives that they could not meet delivery. A major oil crash may cause PXD to be unable to find a buyer of oil at-or-higher-than-breakeven cost.

Oil and gas production is an environmentally difficult business and spills or other dangers to personnel or the environment are ever-present. PXD has made huge strides in the last year for environmental consciousness and has been included in S&P’s ESG index.

Conclusion

PXD is a free cash machine and expects to pay out well over 80% of free cash to investors through 2022. While the potential for explosive capital appreciation may not be present, as PXD does not have major expansion plans, it does maintain a significant and cheap (<$40/bbl breakeven) pure-play inventory very close to key refining locations in Texas.

Given the strong oil price environment, an industry-leading inventory, and much lower than average debt on their balance sheet, we believe that PXD is a good way to capitalize on the present market in the form of a dividend stock.

Be the first to comment