5./15 WEST

Pinterest (NYSE:PINS) has had a difficult 18 months due to management turnover, low revenue growth and declining user numbers. Some of these issues appear to have now stabilized, and while the short-term may continue to present macro-related headwinds, Pinterest is positioned for profitable long-term growth. Cost discipline, along with further monetization of the existing user base should provide strong returns from current stock price levels.

Market

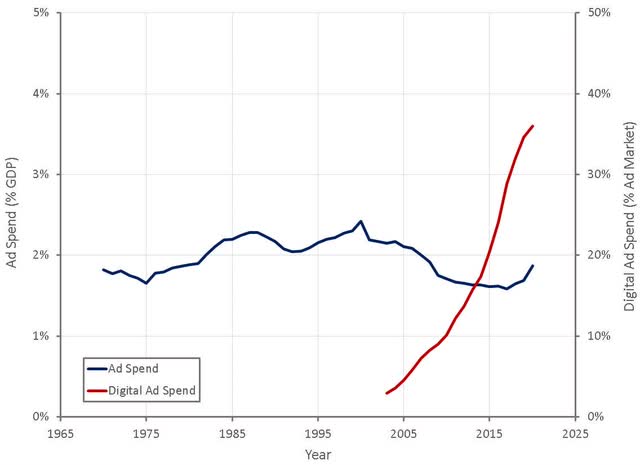

Contrary to the challenges faced by social media companies, overall advertising spend has been fairly robust in 2022. For example, US media owner’s advertising revenue grew by 11% in the first half of 2022. Performance across channels has varied significantly though, with strong growth in out-of-home, search and retail media, while social media has performed poorly. Social media ad sales growth has slowed from 38% in 2021 to 7.5% in the first quarter of 2022 and -1% in the second quarter. This is at least in part due to ATT impacting the effectiveness and pricing power of social media ads. Ad revenue is currently only forecast to grow 4.8% in 2023, due to economic weakness and a lack of major cyclical events. CPG verticals (food, drinks, personal care, and household goods) will potentially be an area of weakness, given inflationary pressures on consumer spending.

Pinterest has stated that the demand environment for digital advertising remains challenging. In the second quarter of 2022, strength came from retail and international advertisers, while CPG, big-box retailers and mid-market advertisers were sources of weakness. Larger specialty retailers and larger e-commerce platforms were more resilient. Home, food, fashion and beauty are all important categories for Pinterest. Weaker demand in Europe appears to have become more of an issue for Pinterest in the third quarter of 2022.

Figure 1: US Ad Spend (source: Created by author using data from The Federal Reserve and ibisworld.com)

In addition to post-pandemic headwinds and macroeconomic weakness, social media companies are also dealing with the impact of Apple’s (AAPL) privacy initiatives. The effect of ATT on digital advertisers varies though, and depends on a number of factors, including:

- Quality of first party data

- Reliance on targeted advertising

- Reliance on advertising directed at driving app downloads

Given Pinterest’s quality first party data, tilt towards brand awareness and lack of advertising targeting app downloads, their problems are more likely to be the result of difficult comparable periods and weak demand in certain categories than ATT.

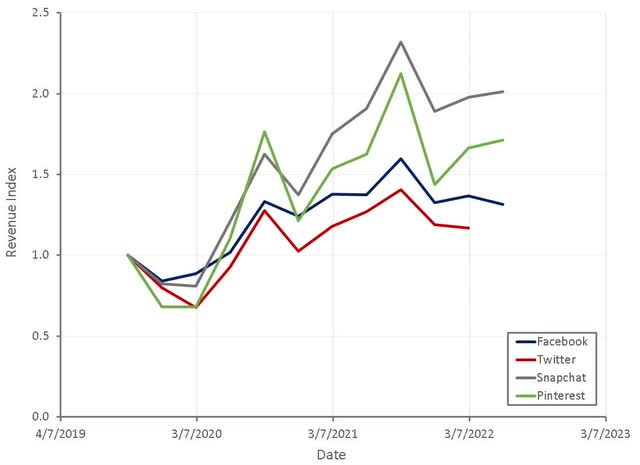

Figure 2: Social Media Company Revenue (source: Created by author using data from company reports)

CEO

Pinterest recently appointed a new CEO, which is likely a response to the company’s perceived problems over the past 12-18 months. Bill Ready was CEO of PayPal (PYPL) and previously worked as President of Commerce, Payments and Next Billion Users at Google (GOOGL) (GOOG). This appointment may be a reflection of Pinterest’s desire to capitalize on user intent by focusing on shopping.

Ready points to the inspiration provided by Pinterest and the commercial intent of Pinners (50% are there to shop) as reasons for taking the position. Most platforms driving discovery have users with low intent and most platforms that have users with intent tend to lack discovery. Ready also highlighted Pinterest’s combination of human curation and computer vision capabilities. To better capitalize on these attributes, Pinterest still needs to turn intent into action though.

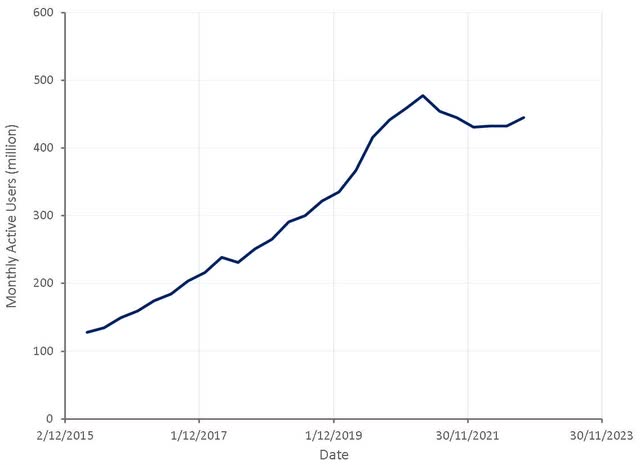

Users

One of the biggest concerns for Pinterest has been the decline in user numbers following the pandemic. Some of this was due to lower search traffic, as a result of Google changing their algorithm, but most of it was due to a normalization of user behavior. Management has also pointed towards increased competition for user attention from other video-centric platforms, a dynamic that has been more prominent in Pinterest’s mature markets. Pinterest now appears to be largely past these headwinds and returning to pre-pandemic trend growth with normal seasonal variation. The commercial impact of this has been relatively muted though, as declines were concentrated amongst web users, while the majority of revenue is generated by mobile users.

Pinterest has been actively trying to increase engagement with notifications and by improving the relevance of home feed recommendations and the quality of search results. This is likely to be more important for Pinterest than other social media companies as usage is episodic. Sessions grew faster than MAUs in the third quarter, indicating improved engagement.

Figure 3: Pinterest Monthly Active Users (source: Created by author using data from Pinterest)

Pinterest has also faced modest headwinds due to the war in Ukraine. They estimate that due to lower engagement in Russia, Ukraine and other countries in Europe, MAUs are approximately 5 million lower than otherwise would have been expected.

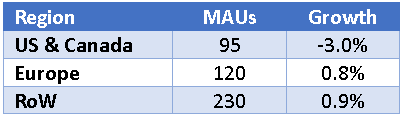

Table 1: Pinterest MAUs by Geography (source: Created by author using data from Pinterest)

Advertising

Pinterest’s advertising business is likely to continue facing headwinds in the short-term due to the macro environment, but longer-term they are well positioned due to their ability to offer:

- A brand-safe environment

- Differentiated user demographics

- Users with high commercial intent

Pinterest appears to believe they are evolving from more of an experimental platform for advertisers to a core part of their marketing strategy. This is likely to be tested in coming months as consumer spending continues to be pressured by inflation.

While Pinterest is more of a top of the funnel advertising platform, they have also built a significant performance advertising business over the past few years which can be used to drive conversions. Pinterest is able to offer advertisers differentiated first-party signals, which may lessen the blow of ATT. They are also attempting to leverage users who opt into IDFA to improve prediction of which opt out users will convert.

Pinterest’s API for conversions attempts to help explain Pinterest’s contribution to attributable conversions. Adoption has been reasonably strong amongst advertisers targeting lower funnel actions, like checkouts. Beta results have shown a 36% increase in attributed conversion volume when using both conversion API and tags compared to using tags only.

Pinterest’s ability to target users and attribute conversions in a privacy first world will be important determinants of the success of their ad business. This is something that can be aided by keeping user activity on the platform through their shopping business.

Shopping

Shopping continues to a focus for Pinterest, although this is a long-term initiative and progress so far appears to have been modest, although is increasing rapidly. Shopping revenue is growing at twice the rate of overall revenue.

Pinterest eventually wants to make every product that users encounter on the platform shoppable, even if the product is within a scene or other user-generated content. Pinterest’s API for shopping was made generally available across all of their shopping-enabled countries in the third quarter. This API makes it easier for merchants to upload their catalogs and metadata while also sending real-time data on SKU-level pricing and inventory.

While making Pinterest easier for merchants is an important method of increasing the shoppable inventory on the platform, Pinterest must ultimately create user demand for shopping to be successful. Pinterest’s efforts in this area are focused on connecting users with relevant shoppable content.

Pinterest recently acquired THE YES to help provide users with personalized shopping experiences. THE YES is an AI powered shopping platform for fashion that was founded in 2018. It enables people to shop a personalized feed based on the user’s active input on brand, style and size. Pinterest will likely look to integrate these capabilities and extend them into other categories like home, beauty and food. Pinterest has also introduced Your Shop, a personalized shopping experience which will be augmented by THE YES.

Pinterest is also working on removing friction from the shopping experience by testing seamless checkout with an increasing number of merchants. Pinterest is piloting a hosted checkout program with Shopify (SHOP) that will allow users to check out directly with the merchant while on Pinterest. They are also testing mobile deep linking that takes users straight to the retailer’s app and checkout page.

Video Content

Like most social media platforms, Pinterest is making video one of their focus areas. 10% of users’ time on the platform is now spent watching video, including the Watch tab and Idea Pins. A lot of this is directed towards user generated content, but also increasingly Pinterest TV and content provided through partnerships.

Pinterest believes that sourcing content outside of users is both efficient and effective. Brands and publishing partners include Tastemade, Refinery 29, Chef Club and Jelly Snack. Pinterest has also announced partnerships with Warner Music Group, Warner Chappell music, Merlyn and BMG to expand the music experience on the platform. These deals will enable users to add songs to their content. It is not currently known how much these types of initiatives will cost, but content could become a significant cost driver for Pinterest in a similar manner to Snap (SNAP).

Video has been a revenue headwind over the past few years, as it is currently lightly monetized and has been taking an increasing share of user time on the platform. This should begin to change going forward though, as Pinterest is now beginning to monetize the video surface. For example, Idea Ads were launched in the second quarter and Pinterest believe that they will be accretive to engagement and revenue in time. Idea Ads are promoted Idea Pins, and allow businesses to combine images and video to try and drive brand awareness and / or a specific action.

To support content creators, Pinterest is continuing to build publishing tools and recently acquired VOCHI. VOCHI is a video creation and editing app that leverages computer vision-based video segmentation to apply effects to moving objects in a video or to images in static photos. The app also offers filters and other editing tools. Earlier in the year the app had approximately 500,000 monthly active users, of which around 20,000 were subscribers. At the time of the acquisition VOCHI’s annual revenue run rate was approximately 4 million USD.

Other Initiatives

Pinterest has also recently had some success with their standalone collage making app, Shuffles. The app is currently on in limited release and the majority of users are in the Gen Z demographic. Shuffles was launched in July 2022 and has gained popularity due to the popularity of collage-style video “mood boards” on TikTok. Shuffles was created by Pinterest’s in-house incubator, TwoTwenty, which was also involved in the creation of Pinterest TV. TwoTwenty is focused on researching and testing new product ideas and iterating on those that gain traction.

Financial Analysis

Pinterest’s revenue growth has been relatively weak in 2022, and it is not clear that the growth rate has bottomed yet. While comparable periods will get easier going forward, and a return to user growth will help, macro conditions remain difficult. Weak consumer spending has been creating challenges for Pinterest’s more price sensitive mid-market and SMB advertisers. Pinterest’s management also stated that October was trending at the low-end of their Q4 guidance range.

On the positive side, Pinterest are beginning to see traction in some emerging verticals, like automotive, financial services and travel. This growth is likely driven at least in part by post-pandemic consumer behavior. Pinterest’s shopping ads are also performing well, with revenue growing 50% YoY in the third quarter.

Pinterest’s user base is still largely either under monetized, or not monetized at all. This is slowly changing though as Pinterest’s adtech matures, Pinterest continues to gain traction with advertisers in existing markets outside North America and Pinterest introduces advertising to new geographies. For example, Pinterest launched ads in Japan in the second quarter of 2022 and expanded in Chile, Argentina and Colombia in July.

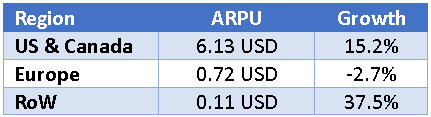

Table 2: Pinterest ARPU by Geography (source: Created by author using data from Pinterest)

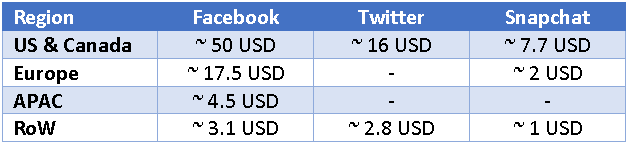

Comparing Pinterest’s ARPU by geography to other social media companies makes it clear that Pinterest’s international advertising business still has a significant runway.

Table 3: Social Media Platform ARPU by Geography (source: Created by author using data from company reports)

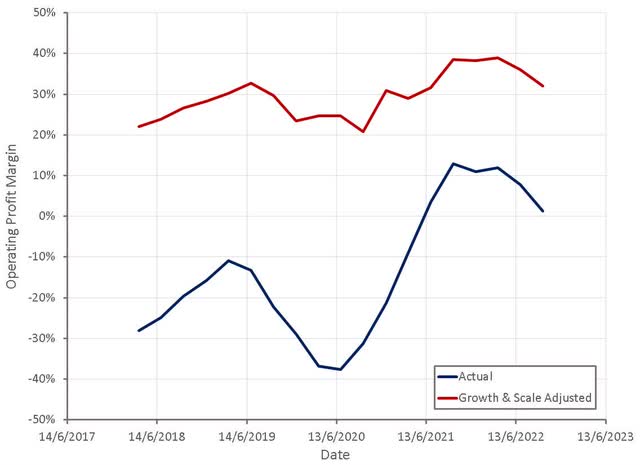

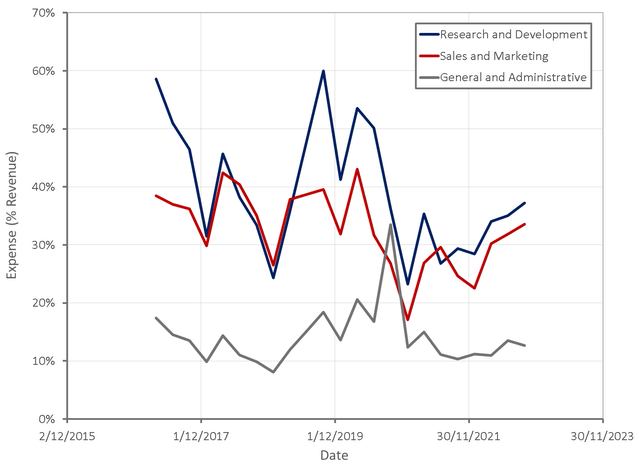

From a profitability perspective, 2022 has been relatively difficult for Pinterest as they have continued to invest in the business, even as growth has failed to materialize. Pinterest plans to return to meaningful margin expansion in 2023 and longer term, should be a highly profitable business.

Figure 4: Pinterest Adjusted Operating Profit Margin (source: Created by author using data from Pinterest) Figure 5: Pinterest Operating Expenses (source: Created by author using data from Pinterest)

Pinterest has dramatically reduced their pace of hiring relative to 2021, in response to macro weakness. This should be supportive of margins once the digital advertising market stabilizes and revenue growth reaccelerates.

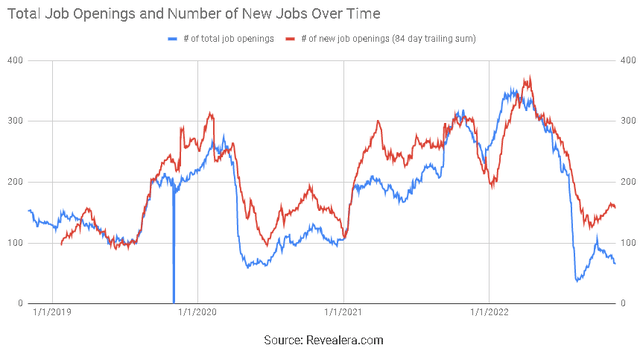

Figure 6: Pinterest Job Openings (source: Revealera.com)

Pinterest may also be a beneficiary of the chaos that has enveloped Twitter. The seemingly rushed layoffs appear to have left Twitter without the controls necessary to provide brand safety to advertisers. In addition, Twitter appears to be shifting towards a more open approach to content moderation, which appears to have spooked the advertising base. For example, media buyer Group M has told advertisers that Twitter is a ‘high risk’ media buy. Twitter is considered non-essential for advertisers, making the decision to pause spending fairly easy for most. Other social media companies, including Pinterest, could benefit from a reallocation of advertising dollars but this is not guaranteed in the current environment. Advertisers may instead choose to use this as an excuse to reduce spending.

Conclusion

Pinterest’s user base continues to grow and is still under monetized, providing the company with a significant growth opportunity. Success in shopping could also provide further upside. Given Pinterest’s potential for high profit margins as the business scales, the stock appears relatively inexpensive. Pinterest plans on managing dilution from stock-based compensation going forward, which may indicate that management believes the stock is currently undervalued, but larger buybacks would be a more positive indicator and supportive of the share price.

Be the first to comment