SteveLuker/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Just Because You Don’t Use It Doesn’t Mean It Can’t Make You Money

We don’t know, but we would be willing to bet, that not so many Seeking Alpha users live on Pinterest (NYSE:PINS) all day long. If mood boards and palettes are your thing, you probably aren’t also motivated by stock-shaming hapless authors who dare lob foolhardy ideas your way. In fact were we to take a poll here we’d probably find the average opinion on Pinterest ranged from “who?” to “LMAO no,” with a detour through “get off my lawn.”

But look, let’s imagine the company below is called Acme Inc and it sells soap or something. Take a look at the numbers.

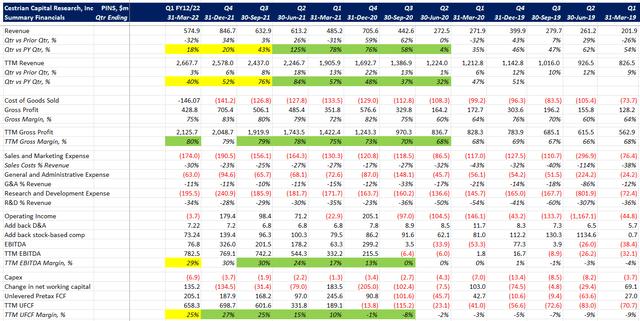

PINS Financial Table I (Company SEC filings, YCharts.com, Cestrian Analysis)

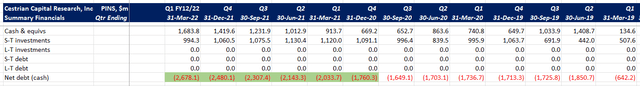

PINS Financial Table II (Company SEC Filings, YCharts.com, Cestrian Analysis)

Let’s look at some highlights here:

- 18% year-on-year revenue growth in the most recent quarter, and that was a bad quarter

- 80% gross margins on a TTM basis

- 29% TTM EBITDA margins

- 25% TTM unlevered pre-tax free cash flow margins

- $2.7bn net cash on the balance sheet

Now, run that through the grump-pa screener and a little interest gets piqued at those fat cash flow margins and the big ol pile of Jeromes on the balance sheet.

How about valuation? Normally this is the “Ha! You kids will never learn” moment.

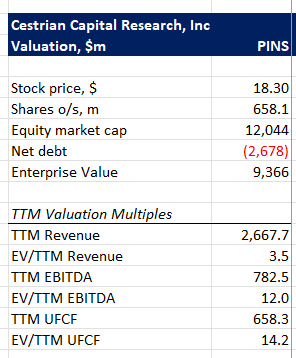

PINS Valuation Table (Company SEC Filings, YCharts.com, Cestrian Analysis)

14.2x TTM unlevered pretax free cash flow is less than you will pay for your gramps’ favorite defense contractor. And yet said member of the military-retiree complex is likely to be growing at 1%-2% on a good day.

OK. Next objection to this lightweight piece of fluff. Stock-based comp. There’s a good chunk of it here. Around $400m in the last four quarters, which is a large percentage of revenue. Yes it’s a cost to shareholders. No it isn’t excluded from the stock price. Have at it in the comments should you so desire. Never gets old.

Now, aside from the general slide in growth names, one reason that PINS has been on the wane for some time now – before the wider selloff – is that the prior management team were viewed to have undermonetized the user base. You can measure this every which way till Tuesday, or you could just look at the Pinterest website or app. (Go on. Do it. You know you want to.) There’s plenty of interesting stuff on there, but the call to action, the temptation to hit the Buy Now! button and get the good dopamine shot, that’s noticeable mainly by its absence. Which is why the board of directors just hired a new CEO with – yes – a payments background. As The Verge puts it: He has one job.

We believe this is a Buy signal for PINS stock. The valuation is low, fundamentals are strong even before Business Dad was brought in to show the kids a thing or two about making money, and smart enough the board has set up the comp plan and/or the corporate web of mutual oblivion just so – and as a result the outgoing CEO, founder Ben Silbermann, even has nice things to say about the adult supervision (see that same Verge link above).

Our strategy with PINS stock in staff personal accounts is – do nothing. We own half our original stake – the first half got sold for a nice gain on the PayPal acquisition rumor, and the remaining bag-holding chunk can just sit tight waiting for either (1) new Rock Star CEO to get the dollars rolling into the topline, thus amping up the valuation multiples, and/or (2) Rock Star to decide it’s too hard and then to spend a year or so crafting the business to be sold and Jedi-mind-tricking Silbermann into agreeing that yes, it would be best if Evil Megacorp, Inc or Masters Of The Universe Partners, LP were to buy PINS in order to, er, “help” its users and staff “fulfil their dreams.” But if we didn’t own any PINS right now we would most certainly be buying some. And depending on how deep everyone’s friends at JPMorgan push the S&P down, we may yet average down our position.

If you’re in any way inclined to believe that growth is not in fact Doomed Forever – and in financial markets most things aren’t Doomed Forever, they are usually just being accumulated or distributed by the Market Gods – then we believe PINS to be a compelling buy at this level.

Cestrian Capital Research, Inc – 30 June 2022.

Be the first to comment