5./15 WEST

Investment Thesis

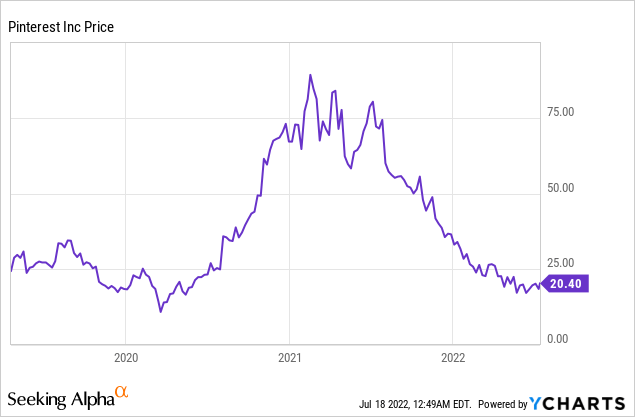

Pinterest (NYSE:PINS) is a social media company that allows users to share and discover ideas through pictures and videos, currently with global monthly active users of over 430 million. Pinterest was one of the winning stocks from the pandemic. The company saw its share price rise from $12.2 in March 2020 to over $85 in February 2021, up 600% within just a year. This can be attributed to the worldwide lockdown which significantly boosted the company’s MAU (monthly active users) and engagement rate, as a lot of people turned to Pinterest to find ideas for cooking recipes, knitting patterns and etc., as they are stuck at home. Yet, as the pandemic wanes and the lockdown eases, investors are fleeing the stock with concern over MAU growth and future prospect. As a result, the stock price has been plummeting since early last year and is now down over 75% from its all-time high.

However, I believe this is a good buying opportunity for Pinterest. The company is now expanding its foothold to the social commerce space, which I believe will open up a lot of new monetization opportunities. Despite hitting a brick wall on MAU growth, the company’s emphasis on ARPU (average revenue per user) growth will be able to fuel overall revenue growth. It is also seeing strong growth in the overseas market, as shown in its quarterly earnings. The current valuation is also compelling after the huge drop from its all-time high. Therefore I rate the company as a buy at the current price.

The Expansion To Social Commerce

Pinterest is a unique social media company. It is fundamentally differentiated from its peers like Meta (FB), Snap (SNAP), Twitter (TWTR), and TikTok. These companies mostly emphasize the interaction between users while Pinterest emphasizes idea discovery with its Pins. The expansion to social commerce makes a lot of sense as it is able to offer a personalized shopping experience while users are exploring through different Pins. This is a win-win situation for both the user and the advertiser as the user is able to buy what it wants while the advertiser can offer a highly targeted ad.

AIDA Cruises, on advertising on Pinterest

“We were very happy with our campaign with Pinterest. Given that Pinterest is home to inspirational content, especially for travel, it was a natural fit for this campaign that yielded great engagement for AIDA”

Pinterest has been making tremendous efforts on pushing this expansion. Earlier this year, the company partnered with WooCommerce, an open-source e-commerce platform, allowing over 3 million WooCommerce sellers to easily turn their products into browsable product Pins. The company also recently acquired The Yes, an AI-powered shopping platform for fashion that provides a personalized daily shopping feed that learns a user’s style as they shop. This month, it launched its own API for Shopping, Product Tagging, Video in Catalog, and Shop Tab on Business Profile. This makes it easier for merchants to create engaging shopping experiences for users on the platform.

Jeremy King, SVP of Engineering, on Pinterest’s API

“At Pinterest, our goal is to turn inspiration into action, and our vision for shopping is to make it possible to buy anything Pinners are inspired by on the platform. In 2021, the number of Pinners engaging with shopping surfaces on Pinterest grew over 215%, and 89% of weekly Pinners use Pinterest for inspiration in their path to purchase. The new shopping features such as the API for Shopping allows brands and retailers to reach high-intent Pinners during the earliest stage of their shopping journey with the most updated catalog data.”

Financials and Valuations

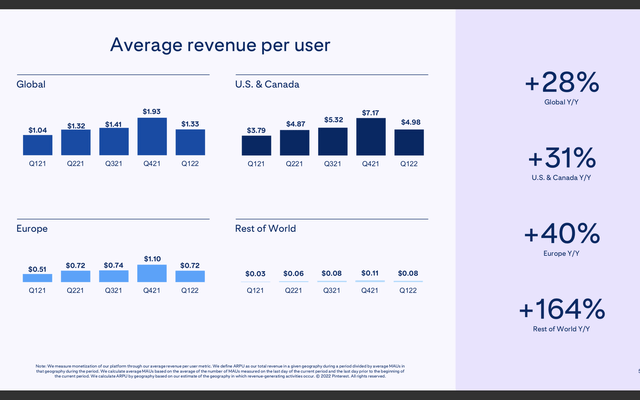

Despite the negative sentiment surrounding Pinterest, it actually posted decent earnings for the first quarter, especially when considering the challenging economic backdrop. The company reported revenue of $575 million, up 18% YoY (year over year) from $485 million. The increase is driven by the improvement in ARPU (average revenue per user) and solid overseas growth. As expected, MAU (monthly active user) decreased 9% from 478 million to 433 million as the world starts to move beyond COVID. Yet, the increase in ARPU is more than enough to offset MAU’s decline with global ARPU up 28% YoY from $1.04 to $1.33. Besides, Rest of World’s revenue was up 152% YoY while Europe’s revenue was up 27% YoY. Despite recent growth, revenue generated outside the US still only accounts for roughly 18% of total revenue. This leaves a lot of room for international expansion and I believe it will continue to bolster growth moving forward.

Ben Silbermann, founder, on Q1 results

“Pinterest made good progress in Q1 executing on our long-term strategy. We continued to scale our native content and creators ecosystem, began beta testing Your Shop, our personalized shopping surface, and released our new open Pinterest API so that any developer can build applications for Pinners, creators, merchants and advertisers.”

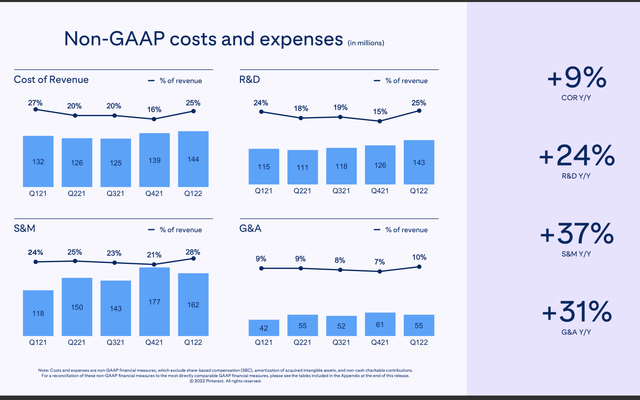

Pinterest

Net loss improved 76% from negative $(21.7)21.4 million to negative $(5.3) million. Non-GAAP net income was $69 million, down 12% from $78.5 million a year ago. Operating cash flow was $213 million, down 21.4% from $270 million. Adjusted EBITDA also dropped 8% from $(83.8) million to $(76.8) million, representing 13% of total revenue. The decline in profitability is largely due to higher investment spending back into the company. Research and development expense is up 24% YoY, sales and marketing expense is up 37% YoY, and G&A expense is up 31%. Despite causing a setback in profitability, I believe these investments are crucial for the company’s long term success. The company’s balance sheet remains very strong. It ended the quarter with $2.68 billion in cash and only $202.6 million in debt, which gives management a lot more flexibility during unprecedented times like these.

Ben Silbermann, founder, on increase in expense

We expect our non-GAAP operating expenses to grow around 10% quarter-over-quarter in Q2. For the full year, we expect non-GAAP operating expenses will grow between 35–40% year-over-year as we continue to ramp up our investments in our native content ecosystem, core Pinner experience, shopping, and headcount across research and development and sales and marketing.

Pinterest

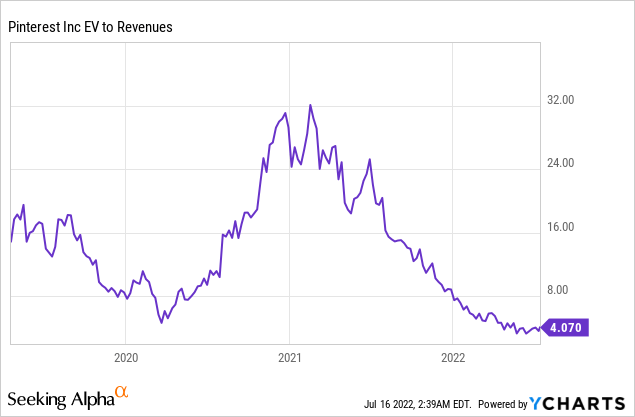

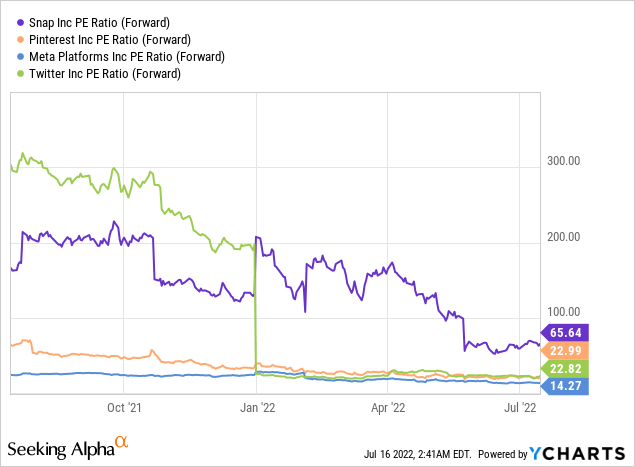

Pinterest was trading at an astronomical valuation in early 2021 with its EV/sales ratio reaching almost 32x. However, after the massive drop in share price, the company is now trading at a compelling valuation. From the first chart below you can see that the company is now trading at a historically low level on an EV/sales basis, even cheaper than the COVID low back in March 2020. When compared to other public social media companies using the P/E ratio, Pinterest is currently trading in the middle of the pack at 23x P/E, as shown in the second chart. Meta Platforms is the cheapest trading at 14.3x, Snap is the most expensive at 65.6x, and Twitter is at 22.8.

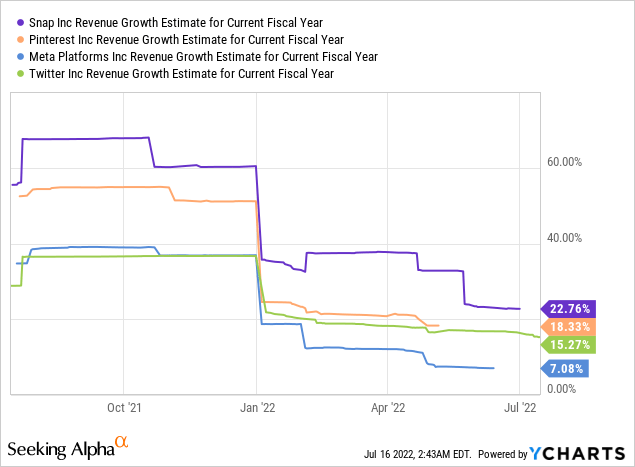

Yet, I believe the P/E ratio does not do Pinterest justice as the company has been spending a lot on research and development, sales and marketing, and G&A (e.g., headcount) to reinvest into the company. This resulted in a weaker bottom line in the short term but I believe profitability will improve significantly in the long term and the P/E ratio will come down as operating leverage starts to kick in. The company is also forecasted to grow revenue by 18.3% this year, only slightly behind Snap’s 22.8%, as shown in the third chart. However, Pinterest is currently trading at a steep 65% discount when compared to Snap. I also think Pinterest has the largest potential out of all these companies. The expansion into social commerce, international growth, and ARPU improvement will provide multiple runways for revenue growth going forward. Therefore, I believe the company’s current valuation is more than justified.

Macro Risks

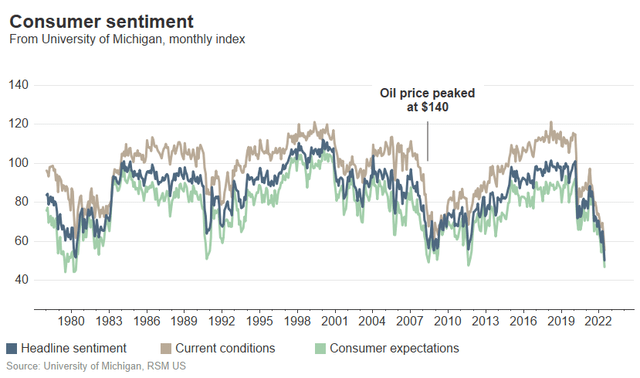

The current uncertainty regarding the macro environment will likely post strong headwinds on Pinterest in the short term. Signs of cracks are already showing with a significant slowdown in the economy across the board as high inflation rate persists and supply chain blockage continues. China is adding fuel to the fire with its zero covid policy, resulting in worse than expected GDP growth for the second quarter. The latest CPI (consumer price index) print also came in higher than expected at 9.1%, above the 8.8% consensus. While core CPI (excluding food and energy) increased by 5.9%, compared to the 5.7% estimate. This resulted in plummeting consumer confidence, which is now at levels not seen since the great financial crisis, according to Michigan Consumer Sentiment Data.

Evan Spiegel, CEO of Snap warned earlier that the macro environment has deteriorated further and faster than anticipated, and the company will miss revenue and earnings estimates. While other companies like Microsoft (MSFT), Netflix (NFLX), and Twitter (TWTR) are starting to lay off employees. I believe like Snap, Pinterest will likely see a shock in earnings. The company is highly exposed to macro headwinds as all of its revenue is generated through ads. The advertising business is quite cyclical after all and ad budgets are likely going to be cut considering the underlying economic conditions. That being said, I believe Pinterest is well positioned to be one of the winners as the economy recovers.

University Of Michigan

Conclusion

In conclusion, I believe the current sell-off of Pinterest creates a good buying opportunity for investors. Despite the negative sentiment around the company, it is actually making solid progress on different ends. I believe the expansion into social commerce will be able to significantly boost growth moving forward. Their latest earnings report also showed decent growth amid being in such a tough macro environment, driven by the improvement in ARPU and strong overseas growth. The company’s differentiated fundamentals compared to other social media companies will also prevent them from a lot of competition. After the huge drop in share price, the company is now trading at a compelling level, not to mention that the current P/E ratio is inflated due to its investment back into the business. Macro risks are a concern but I think a lot of pessimism is already priced in. It is also well positioned to take off once the economy starts to recover. Therefore I rate the company as a buy at the current price.

Be the first to comment