utah778/iStock via Getty Images

Earnings of Pinnacle Financial Partners, Inc. (NASDAQ:PNFP) will likely somewhat increase this year relative to last year on the back of anticipated topline growth. The recent team expansion and higher interest rates will play a pivotal role in net interest income growth. Further, strong growth in the BHG business will most probably drive the bottom line. On the other hand, the above-normal provisioning expense in the last nine months of 2022 will likely restrict earnings growth. Overall, I’m expecting Pinnacle Financial to report earnings of $6.87 per share for 2022, up 2% year-over-year. Compared to my last report on Pinnacle Financial, I have slightly revised upwards my earnings estimate mostly because I have revised upwards the non-interest income estimate. The year-end target price suggests a high upside from the current market price. Therefore, I’m upgrading Pinnacle Financial to a buy rating.

Team Expansion to Play a Pivotal Role in Loan Growth

Pinnacle Financial Partners’ loan portfolio increased by a remarkable 4.7% in the first quarter of the year, which exceeded my expectations. The management mentioned in the earnings presentation that it anticipates mid-teen percentage loan growth for 2022. This target doesn’t appear out of the norm or difficult to achieve because the company has easily achieved double-digit loan growth in the past. Moreover, Pinnacle Financial has already performed quite well during the first quarter of the year.

Further, Pinnacle Financial has continued to aggressively recruit revenue-generating team members in the recent past. The company has hired 176 financial advisors recently, as mentioned in the conference call. To put this number in perspective, 176 is 6% of the 2,841 employees at the end of 2021.

The strong job market can also give a boost to loan growth. The country’s unemployment rate was near multi-year lows of 3.6% in May 2022. Considering these factors, I’m expecting the loan portfolio to increase by 12.7% by the end of December 2022 from the end of 2021. Meanwhile, deposits growth will likely slightly lag loan growth this year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 15,566 | 17,624 | 19,693 | 22,139 | 23,151 | 26,101 | |||

| Growth of Net Loans | 85.5% | 13.2% | 11.7% | 12.4% | 4.6% | 12.7% | |||

| Other Earning Assets | 3,268 | 3,847 | 4,338 | 8,268 | 11,047 | 11,527 | |||

| Deposits | 16,452 | 18,847 | 20,181 | 27,706 | 31,305 | 34,779 | |||

| Borrowings and Sub-Debt | 1,921 | 2,033 | 2,938 | 1,887 | 1,464 | 1,649 | |||

| Common equity | 3,708 | 3,966 | 4,356 | 4,687 | 5,093 | 5,410 | |||

| Book Value Per Share ($) | 57.6 | 51.2 | 56.7 | 62.0 | 67.1 | 71.3 | |||

| Tangible BVPS ($) | 28.7 | 27.3 | 32.4 | 37.3 | 42.7 | 46.5 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Excess Cash May Boost the Margin

Neither the asset nor the liability side of Pinnacle Financial’s balance sheet is very sensitive to interest rate changes. Asset yields are made sticky by the fixed-rate loans, which constituted around 42.5% of total loans at the end of March 2022, as mentioned in the presentation. Meanwhile, variable-rate loans (linked to Libor/SOFR and prime rates) made up 52.8% of total loans.

Moreover, the sizable bond portfolio will likely make the average earning-asset yield somewhat sticky. Bonds made up around 21% of total earning assets at the end of March 2022. Around 77% of the bond portfolio is fixed rate based, as mentioned in the presentation.

The deposit book has historically been not too sensitive to rate changes. The company’s deposit beta in the last up-rate cycle was 40% to 45%, as mentioned in the presentation. This means that a 100 basis points hike in interest rates increased the average deposit cost by 40 to 45 basis points.

The results of the management’s interest-rate sensitivity analysis given in the presentation showed that a 100 basis points increase in interest rates could boost the net interest income by only 1.2% over twelve months. As a result, Pinnacle Financial does not stand to gain much from a rising rate environment given its existing balance sheet positioning.

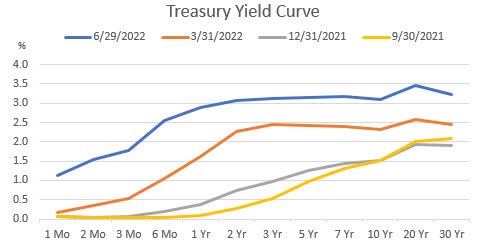

However, the excess cash position presents an opportunity to significantly improve the margin this year, provided the management is capable enough. Interest-earning deposits with other banks, which are the biggest component of cash equivalents, made up 9% of total earning assets at the end of March 2022. This excess cash gives Pinnacle Financial the chance to promptly change its asset mix in favor of higher-yielding assets as rates rise. Even if the company is unsuccessful in deploying its excess cash, the net interest margin still stands to benefit from the recent shift in the yield curve.

U.S. Treasury Department

Considering these factors, I’m expecting the margin to increase by 20 basis points in the last nine months of 2022 from 2.89% in the first quarter of the year.

Revising Upward the Non-Interest Income Estimate

Pinnacle Financial surprised me by reporting a 12% year-over-year jump in non-interest income for the first quarter of 2022. Some of the growth was attributable to a gain of $5.5 million on the re-measurement of an investment. This line item will not recur in the coming quarters.

Nevertheless, non-interest income will likely trend upwards in the remainder of the year thanks to the anticipated growth of the Bankers’ Healthcare Group (“BHG”) segment. BHG lends to patients as well as medical and other professionals for re-sale. As BHG operates on a gain-on-sale model, its income is reported in the non-interest income line item. The management mentioned in the presentation that it expects fees from BHG to increase by 20%, and other fee income to increase by 7% to 9% year-over-year in 2022.

In my last report on Pinnacle Financial, I estimated a non-interest income of $40 million for 2022. I have now decided to revise my estimate upwards to $43 million, in line with the management’s guidance. My estimate revision is also attributable to the first quarter’s surprise.

Provisioning to Remain Slightly Above Normal

The Federal Reserve projects the Fed Funds rate to reach around 3.5% this year. Such a high interest rate environment is likely to hurt the portfolio’s credit quality and increase the threat of delinquencies. The last time the Federal Funds rate was above 2.0%, i.e. the third quarter of 2019, PNFP’s non-performing loans and loans 90 days past due altogether made up 0.24% of total loans (source: 3Q2019 10-Q filing). In comparison, non-performing loans and loans 90 days past due made up 0.12% of total loans at the end of March 2022, as mentioned in the presentation.

Nevertheless, I’m not too worried because even if non-performing loans double in the next few quarters, they will remain easily covered by allowances. Allowances for loan losses made up 1.1% of total loans at the end of March 2022.

Considering these factors, I am expecting the provision expense to be slightly above normal in the year ahead. For the full year, I’m expecting the provision expense to make up around 0.16% of total loans, which is the same as the average from 2017 to 2019.

Expecting Flattish Earnings this Year

The anticipated loan growth, margin expansion, and fee income will likely drive the bottom line this year. On the other hand, higher provisioning expenses will limit earnings growth. Overall, I’m expecting Pinnacle Financial to report earnings of $6.87 per share for 2022, up 2% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 543 | 736 | 766 | 822 | 932 | 1,034 | |||

| Provision for loan losses | 24 | 34 | 27 | 192 | 16 | 43 | |||

| Non-interest income | 145 | 201 | 264 | 318 | 396 | 428 | |||

| Non-interest expense | 367 | 453 | 505 | 577 | 660 | 764 | |||

| Net income – Common Sh. | 174 | 359 | 401 | 305 | 512 | 522 | |||

| EPS – Diluted ($) | 2.70 | 4.64 | 5.22 | 4.03 | 6.75 | 6.87 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

In my last report on Pinnacle Financial, I estimated earnings of $6.58 per share for 2022. I have increased my earnings estimate because I’ve revised upwards the non-interest income estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

Upgrading to a Buy Rating

Pinnacle Financial is offering a dividend yield of 1.2% at the current quarterly dividend rate of $0.22 per share. The earnings and dividend estimates suggest a payout ratio of 12.8% for 2022, which is in line with the five-year average of 14.4%. Therefore, the dividend is very secure. The company will most probably continue its trend of an annual dividend hike at the beginning of next year.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Pinnacle Financial. The stock has traded at an average P/TB ratio of 1.84 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 27.3 | 32.4 | 37.3 | 42.7 | ||

| Average Market Price ($) | 61.7 | 56.9 | 46.2 | 89.7 | ||

| Historical P/TB | 2.26x | 1.76x | 1.24x | 2.10x | 1.84x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $46.5 gives a target price of $85.5 for the end of 2022. This price target implies a 17.4% upside from the June 29 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.64x | 1.74x | 1.84x | 1.94x | 2.04x |

| TBVPS – Dec 2022 ($) | 46.5 | 46.5 | 46.5 | 46.5 | 46.5 |

| Target Price ($) | 76.2 | 80.8 | 85.5 | 90.1 | 94.8 |

| Market Price ($) | 72.8 | 72.8 | 72.8 | 72.8 | 72.8 |

| Upside/(Downside) | 4.7% | 11.1% | 17.4% | 23.8% | 30.2% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 4.64 | 5.22 | 4.03 | 6.75 | ||

| Average Market Price ($) | 61.7 | 56.9 | 46.2 | 89.7 | ||

| Historical P/E | 13.3x | 10.9x | 11.5x | 13.3x | 12.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $6.87 gives a target price of $84.1 for the end of 2022. This price target implies a 15.6% upside from the June 29 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.2x | 11.2x | 12.2x | 13.2x | 14.2x |

| EPS 2022 ($) | 6.87 | 6.87 | 6.87 | 6.87 | 6.87 |

| Target Price ($) | 70.4 | 77.3 | 84.1 | 91.0 | 97.9 |

| Market Price ($) | 72.8 | 72.8 | 72.8 | 72.8 | 72.8 |

| Upside/(Downside) | (3.3)% | 6.2% | 15.6% | 25.0% | 34.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $84.8, which implies a 16.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 17.7%.

In my last report, I adopted a hold rating because at that time the market price was quite close to my target price. Since then, the stock price has plunged sharply leading to a high price upside. Based on the total expected return, I’m upgrading Pinnacle Financial Partners to a buy rating.

Be the first to comment