master1305/iStock via Getty Images

Investment Thesis

Pinduoduo Inc. (NASDAQ:PDD) Q3 earnings smashed analysts’ expectations. Not only smashed expectations, but I now question the validity of analysts’ consensus estimates.

Put another way, I have to question, if Pinduoduo’s +350% y/y jump in operating profits was to dramatically decelerate in 2023, isn’t it very likely that Pinduoduo can continue growing its operating profits by at least 25% CAGR in 2023?

As it stands right now, including the premarket jump, Pinduoduo’s market cap is approximately $95 billion. That means that by estimates, Pinduoduo is priced at 15x next year’s operating profits. That is GAAP operating profits.

Context Matters So Much More

Countless protestors have taken to the streets in several of the major cities in China. Needless to say, this is a reminder, if one was needed, that China’s political decisions over how it deals with matters can sometimes be at odds with capitalism.

China’s political leaders appear to have other imperatives leading their decisions, aside from economic considerations.

I don’t wish to fall into more contentious discussions. But these insights are extremely important to keep in mind, as we progress with the remainder of this analysis.

Revenue Growth Rates Still Sizzling

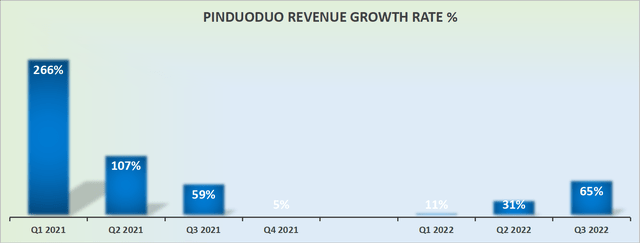

I’ve been an ardent Pinduoduo bull. My argument had been that if Pinduoduo could sustain close to 30% CAGR, the valuation would make sense.

As you can see above, notwithstanding the challenging comparables with Q3 2021, revenues in the most recent quarter were up 65% y/y.

Put simply, Pinduoduo is relentlessly taking market share from everybody. Big and small. But particularly small, independent competitors, that just can’t keep up.

Let’s get to the core of the bull thesis, before moving on to discussing Pinduoduo’s valuation.

Profitability Profile: Based on GAAP

Operating profits were up. And not just up, but up a lot. More specifically, operating profits were up 388% y/y. And yes, that’s the GAAP operating profit figure.

Non-GAAP was also very strong, and up 277% y/y. With this in mind, can you remember the bear case facing Pinduoduo?

The bear case was that as soon as this company stopped with their voucher discounting on their merchandise, their revenues CAGR would decline.

However, this set of results categorically crushes that bear case. The stock isn’t as shorted as it once was. Nevertheless, there is still a 4.5% short interest on the stock.

But is there a new bearish argument now?

PDD Stock Valuation — 15x GAAP Operating Profits

This time last year, PDD had a net neutral balance sheet. This means that its cash and debt balance was equal. This time around, PDD has $1.4 billion of net cash.

Hence, this is my point: despite clearly investing for growth, delivering growth, and on top of that delivering cash flows too, PDD also ended up with a substantially improved balance sheet.

By my newly updated estimates, I now believe that Pinduoduo is likely to make around $5 billion in operating profits this year.

And this leads me to question what sort of operating profits are possible in 2023?

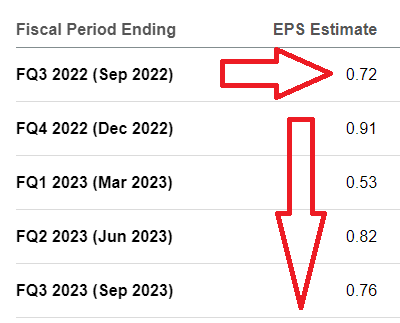

Allow me to shed some perspective. For Q3 2022, PDD’s non-GAAP EPS was $1.21.

Not only was the Q3 non-GAAP EPS substantially higher than analysts’ Q3 estimates. But equally importantly, it brings into question the validity of those estimates for the next several quarters.

PDD analysts’ EPS consensus

In fact, consider this, analysts presently expect that from seasonally strong Q4, and well into the next several quarters, non-GAAP EPS figures are going to be at least 30% lower than the recent non-GAAP EPS figure. I’m speechless.

While according to my own estimates, I believe that if PDD were to grow its operating profits next year by 25% y/y, that would see Pinduoduo’s full-year GAAP operating profits reaching $6.3 billion.

Of course, I believe that this figure is extremely conservative. But there again, even my extremely conservative estimate is dramatically higher than what analysts are expecting.

So, either I’m extremely foolish and wrong in my expectations. Or analysts’ financial models are fully inadequate. It’s probably a bit of both.

The Bottom Line

Here’s what we know. Pinduoduo is under-promising and over-delivering. But does the fact that it’s Chinese warrant a discount? Yes, surely. But how big a discount is valid? I don’t know.

From my perspective, 15x GAAP operating profits for a company growing at +30% CAGR seems more than fair. And as we stand right now, Pinduoduo’s GAAP operating profits are not growing at +30%. They are not growing at +40%. They are not even growing at +50%. They are higher still, in the most recent quarter.

Even if we accept the view that Pinduoduo’s growth rates will slow down soon, and grow at a subdued 30% CAGR, the odds still look favorable.

Be the first to comment