Khosrork

Without a doubt, one of the biggest problems faced by investors today is the incredibly high rate of inflation that has been permeating the economy. This has forced many people all over the nation to take on second jobs or join the gig economy simply to obtain the extra money that they need to keep food on their tables. Fortunately, as investors, we do not need to resort to such things simply to obtain the extra money that we need to make ends meet today. This is because we can put our money to work for us. One of the best ways to do this is to purchase shares of a closed-end fund that specializes in the generation of income. These funds are nice because they provide us with easy access to a professionally-managed diversified portfolio that can in many cases boast a higher yield than any of the underlying assets.

In this article, we will discuss the PIMCO Income Strategy Fund II (NYSE:PFN), which is a fund that focuses on providing investors with a very high level of income. As the name of the fund implies, it is offered by PIMCO, which is one of the most well-known fund houses in the fixed-income arena. As might be expected, this is a bond fund, although it also invests in other types of fixed-income securities. As of the time of writing, it boasts a jaw-dropping 11.32% yield. While that is certainly an attractive yield, the problem is that most assets whose yield surpasses 10% are likely to decrease their distribution in the near future. Let us investigate and see if that is the case with this fund since the last thing that we want to do is purchase a fund prior to a distribution cut. This could be a very big deal with this fund today since the fund appears to be a little overvalued at the current price.

About The Fund

According to the fund’s webpage, the PIMCO Income Strategy Fund II has the objective of providing its investors with as high a level of current income as possible while still preserving principal. This is a very common objective for fixed-income funds for a few reasons. The first is that fixed-income securities by definition preserve capital. These securities pay their face value back to the investor at maturity so anyone that bought the bond at face value had no loss of principal. With that said, very few individuals or funds actually do hold bonds to maturity. This is one of the reasons why funds fluctuate in the market (individual bonds do as well but anyone holding until maturity does not have to care about that).

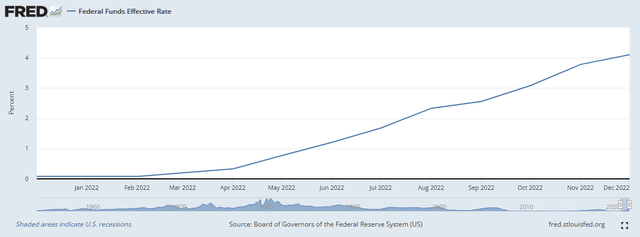

The second reason why that is a very common objective is that fixed-income securities deliver nearly all of their investment return through the interest payments that they make to investors. This is because their potential for capital gains is limited as they have no connection to the financial performance of the issuing company. This makes sense as a company will not increase the amount that it pays in interest to its bondholders just because its profit goes up. These securities, rather, are priced based on interest rates. In short, when interest rates go up, bond prices go down, and vice versa. Over the past year, interest rates have been climbing at a very rapid pace in the United States. We can see this quite clearly by looking at the federal funds rate, which is the rate that banks charge each other for overnight loans and which serves as the basis for all other interest rates in the economy:

Federal Reserve Bank of St. Louis

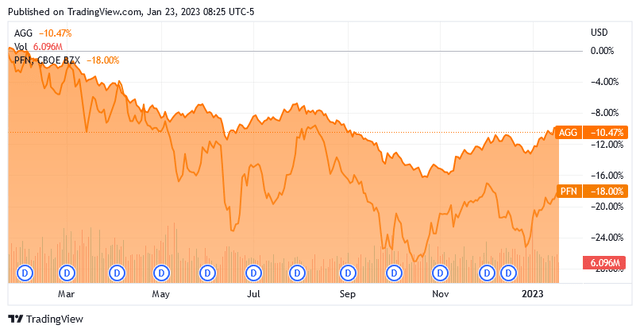

As we can clearly see here, the effective federal funds rate went from 0.08% a year ago to 4.10% today. That is actually one of the most rapid increases in history. As bonds are priced based on an inverse correlation to the federal funds rate, we can expect that bond prices declined over the period. This is indeed the case as the Bloomberg U.S. Aggregate Bond Index (AGG) has declined 10.47% over the period. The PIMCO Income Strategy Fund II has declined as well over the period:

Admittedly, when we consider that the PIMCO fund boasts a substantially higher yield than the index fund, the difference between the closed-end fund and the index is not as great as might be assumed. However, the PIMCO fund did still underperform the index. There are a few reasons for this that we will discuss over the remainder of this article.

It is important to note that the PIMCO fund holds somewhat different assets than the index in many cases. According to the fund’s official description,

“The fund has the flexibility to allocate assets in varying proportions among floating- and fixed-rate debt instruments, as well as among investment grade and non-investment grade securities. It may focus more heavily or exclusively on an asset class at any time, based on assessments of relative values, market conditions and other factors.”

This differs somewhat from the index, which can only hold fixed-rate investment-grade securities. The fact that the PIMCO fund can hold floating-rate assets can give it an advantage in today’s environment. This is because of the rising interest rates. Basically, as interest rates increase, the price of fixed-rate bonds decreases. This is because nobody will buy an existing bond at a lower yield when they can purchase an otherwise identical brand-new bond with a much higher yield. Thus, the price of the existing bond adjusts so that it gives the same yield-to-maturity as an identical newly-issued bond. That does not necessarily happen with floating-rate securities, however. As a floating-rate security’s yield increases with interest rates, it should hold its value better than a fixed-rate bond during a rising-rate environment.

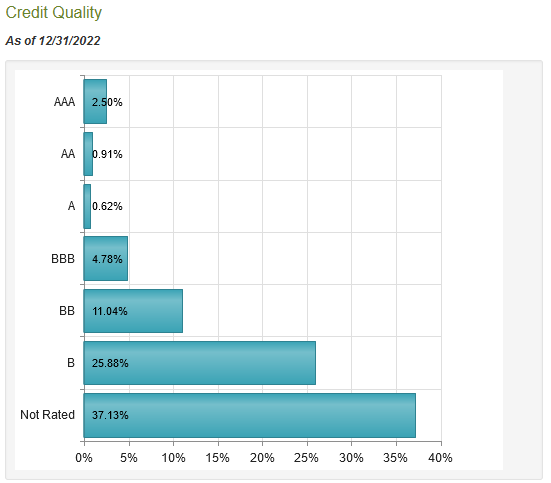

One unfortunate downside of floating-rate fixed-income securities is that they are normally issued by below-investment-grade companies. These companies tend to have a significant amount of other debt or somewhat volatile cash flows and so are presumed to be at a higher rate of default than investment-grade companies. This is something that may concern investors that are highly concerned about principal preservation, which is a category that would include most retirees. One way that we can evaluate the risk of loss due to defaults is by looking at the credit ratings that have been assigned to the assets in the fund’s portfolio. Here they are:

CEF Connect

As we can clearly see, approximately 45.73% of the securities in the portfolio are rated B or higher. Although BB and B ratings are both below-investment grade, they are not as risky as many other junk bonds. According to the official bond ratings scale, BB and B-rated securities are issued by companies that have the sufficient financial strength to cover their debt obligations through a short-term economic shock. While they may be vulnerable to long-term economic problems, such an event has not occurred since the Great Depression and can be presumed to be relatively rare. Thus, we can see that a sizable proportion of the portfolio should have a relatively low risk of default and the losses that would accompany such an event. However, 45.73% is still a minority of the portfolio and we do not know what the risk of the remaining assets actually is.

There is another way that the fund can protect us against losses due to default, however. One of the best ways is to have a substantial number of positions. This ensures that only a small percentage of the portfolio is invested in any individual position and as such any default would have a negligible impact on the entire portfolio’s value. This fund is certainly doing a reasonable job at this as it has 413 separate positions as of the time of writing. Although this is not nearly as many positions as some funds have, it should still be enough to ensure that any single default has no real effect on investors. The fund is still certainly at risk if a substantial number of companies were to default on their debt obligations all at once but in such an event, it is fair to assume that the economy has far worse problems than a few investors losing money. Thus, it does not appear that defaults across the portfolio are things that we really need to worry about.

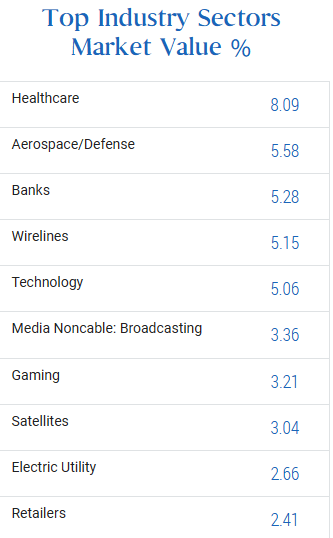

Another nice thing about the fund for those seeking safety is that it is fairly well diversified across a number of industry sectors. We can see this quite clearly here:

PIMCO

One thing that immediately draws my attention is that this fund has nearly no exposure to the traditional energy sector. This is surprising since prior to the pandemic, America’s various shale companies were responsible for approximately 15% of the total issuance of junk bonds in the market. I mentioned this in a previous article. Admittedly, this is not the only fund that we have seen eschew fossil fuel companies as various investment managers have committed themselves fully to environmental, social, and governance investing, which has generally had the effect of depriving traditional energy companies of capital. I have not seen anything that indicates that PIMCO has subscribed to this philosophy, however. The reason that the exclusion of the energy sector is notable though is that it was by far the best-performing sector in 2022 and the fact that many of its high-yield bonds are now backed by very financially strong companies appears to create a very compelling investment case for anyone seeking income and capital preservation.

For the most part, though, the fact is that the fund’s diversification across sectors represents a real advantage for us as risk-averse investors. This is because we frequently see situations in which one sector experiences a lot of financial trouble but others do not. One example of this would be hotels and other hospitality companies during the height of the pandemic fears. These firms saw their business and revenues plummet as people opted to stay home and eschew traveling. The same cannot be said for the technology industry, which experienced massive growth due to the increasing popularity of remote work during that time. As a company’s ability to repay its debt depends directly on its cash flow, developments like this have an effect on the default risk of a given bond issue. Thus, the fact that the PIMCO Income Strategy Fund II has exposure to a variety of different sectors should help reduce the risk of losses due to default when any individual sector experiences problems.

Overall, the takeaway here is that despite the fact that the fund is invested in numerous speculative-grade fixed-income securities, we should not have to worry too much about the risk of loss due to financial problems of any individual company or even sector.

Leverage

As stated earlier in this article, closed-end funds such as the PIMCO Income Strategy Fund II have the ability to earn yields that are far beyond that of any individual asset in their portfolios. One method that is employed by this fund to accomplish this is the use of leverage. In short, the fund borrows money and then uses that borrowed money to purchase fixed-income securities. As long as the purchased securities have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the overall yield of the portfolio. As the fund can borrow at institutional rates, which is substantially lower than retail rates, this will usually be the case.

However, the use of debt is a double-edged sword. This is because leverage boosts both gains and losses. This is likely one reason why the fund declined more than the index over the past year. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I do not usually like to see a fund’s leverage exceed a third of its assets for this reason. The PIMCO Income Strategy Fund II, fortunately, satisfies this requirement. As of the time of writing, the fund’s levered assets comprise 31.51% of the portfolio. Therefore, it appears that the fund is striking a reasonable balance between risk and reward here.

Distribution Analysis

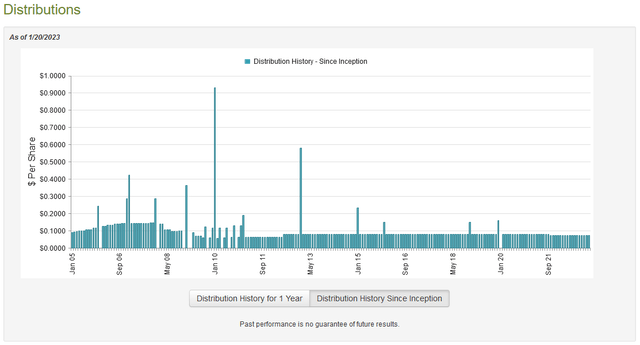

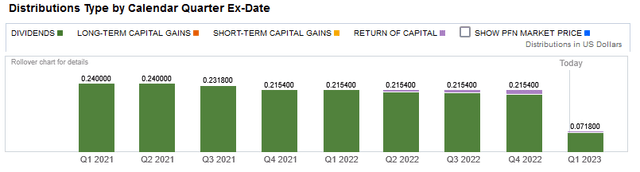

As stated earlier in this article, the primary objective of the PIMCO Income Strategy Fund II is to provide its investors with a high level of current income while still ensuring the preservation of capital. In order to accomplish this objective, the fund invests in a portfolio consisting primarily of high-yielding fixed-income securities. It then levers up these securities in order to boost its yield. It therefore might be expected that the fund itself would boast a comparably high distribution yield. This is certainly the case as the fund currently pays out a distribution of $0.0718 per share ($0.8616 per share annually), which gives it an 11.32% yield at the current price. The fund has generally been remarkably consistent about its distribution over the years, although it did cut it back in 2021:

This is easily one of the best track records of any fixed-income fund. However, the fact that it did cut back in 2021 may be concerning to an investor that is seeking a secure and consistent source of income that can be used to cover their bills and finance their lifestyles. However, it is important to keep in mind that anyone purchasing the fund today will receive the current distribution at the current yield so the fund’s past record is not necessarily relevant. It is certainly comforting to know that the fund’s distributions are almost entirely classified as dividend income, although it has begun paying a small amount of return of capital in the past few quarters:

The reason why this may be comforting is that dividend income is generally the most sustainable type of distribution that a fund can pay out. This is because a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them, which is obviously not sustainable over any sort of extended period. A capital gains distribution requires that the fund actually generate sufficient capital gains every quarter to cover the distribution and that is not always possible. The fact that this fund is only paying out dividend income seems to imply that it is paying the distribution solely out of the income that it receives from the assets in its portfolio. As I have pointed out in the past though, it is possible for these distributions to be misclassified. As such, we want to investigate exactly how this fund is financing its distributions so that we can determine exactly how sustainable they actually are.

Unfortunately, there is not a particularly recent document that we can consult for this purpose. The fund’s most recent financial report corresponds to the eleven-month period that ended June 30, 2022. As such, it will not include any information about the fund’s performance over the past six months. Fortunately, though, the Federal Reserve began its shift towards a tighter monetary policy in March so this document should give us some pretty good insight into how well the fund is handling that situation, which has caused some havoc in the fixed-income market. During the eleven-month period, the PIMCO Income Strategy Fund II received a total of $60,414,000 in interest and $1,205,000 in dividends from the assets in its portfolio. This gives the fund a total income of $61,619,000 during the period. The fund paid its expenses out of this amount, leaving it with $52.001 million available for investors. This was unfortunately not nearly enough to cover the $62.269 million that the fund actually paid out as distributions during the period. At first glance, this is certain to be concerning as the fund is clearly failing to cover its distributions.

However, there are other methods that the fund can employ in order to obtain the money that it needs to cover the distribution. One of these is to earn money through capital gains. As might be expected from the weak bond market that started around the beginning of 2022, the fund failed miserably at this. Although it did achieve net realized gains of $77,080,000, these were more than offset by the $226,310,000 net unrealized losses that the fund suffered. Overall, its assets declined by $141,662,000 during the eleven-month period after accounting for all inflows and outflows. Thus, the fund overall failed to cover its distribution. With that said though, the fund did have sufficient net realized gains to cover the distribution when combined with its net investment income. In fact, it had sufficient gains to likely carry the distribution for quite a while if its net investment income remains steady. The fund probably can maintain its distribution for quite a while as long as it does not suffer too many more losses and since the worst is likely behind us as far as the interest rate hikes are concerned, that seems the most likely scenario. Overall, then, investors probably do not have to worry too much about a distribution cut here.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a sub-optimal return on that asset. In the case of a closed-end fund like the PIMCO Income Strategy Fund II, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. Unfortunately, this is not the case with this fund today. As of January 20, 2023 (the most recent date for which data is currently available), the PIMCO Income Strategy Fund II had a net asset value of $7.26 per share but the shares actually trade for $7.54 per share. This gives the fund’s shares a 3.86% premium to net asset value at the current price. Generally speaking, it is not a good idea to buy any fund at a premium. This one is especially expensive right now since it has averaged a 0.28% discount over the past thirty days. As such, it would be a very good idea to wait for the price to come down somewhat before purchasing shares of this fund.

Conclusion

In conclusion, the PIMCO Income Strategy Fund II certainly looks like a very well-managed fixed-income fund. This is exactly what we have come to expect from any fund bearing the PIMCO name. The fund is well-diversified and the fact that it can invest in both fixed-rate and floating-rate securities should improve the fund’s ability to generate profits and capital gains in any interest-rate environment. The 11.32% yield also appears to be surprisingly secure. The only real problem here is that the fund is very expensive compared to its usual price so it might be a good idea to wait a bit until the shares return to trading at a discount.

Be the first to comment