Dima Berlin/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) as an investment option at its current market price. This is a closed-end fund whose objective is “current income as a primary objective and capital appreciation as a secondary objective”.

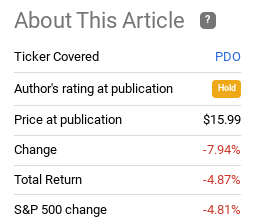

PDO is a fund I have covered twice since its inception, both times suggesting some cautious optimism. Generally speaking, this was not a great add to my portfolio in 2021 (which I covered in my last article), and that experience has made me reluctant to amplify my holding. Back in May I discussed this reality, and highlighted again that I believed a “hold” rating was appropriate. In hindsight, this outlook was vindicated as PDO has trended lower along with most of the market:

Fund Performance (Seeking Alpha)

As my followers know, I have been critical of many investment ideas in this backdrop. I see a host of macro-challenges that are causing me to be very selective on any new buys at this time. So far this caution has served me well, and I went into my evaluation of PDO expecting to reach the same conclusion. However, after this updated review, I tend to believe there is enough upside potential on the horizon that outweighs those headwinds. As a result, I am upgrading my rating to a “buy”, and I will explain why in more detail below.

What’s Happened Since May? Income Boost

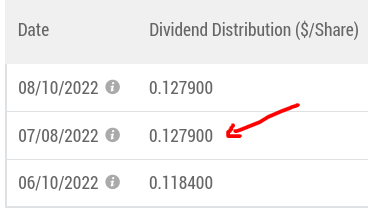

To begin, I want to touch on the changes to the fund since my last article. Top of mind is the one that shareholders are likely the most pleased with. This was an income boost, bringing the distribution close to the $.13/share mark:

PDO Distribution Rate (PIMCO)

This is relatively old news since it came about in July, but it is worth repeating here since it is a new development since I last discussed PDO. The income story is naturally very important to this fund so the reality of this increase is a welcome sign. There is not much else to say here except that PDO’s strong income metrics were a positive metric in the past and that has materialized into a higher income stream. With a rising interest rate environment, finding income plays that are growing is paramount (whether equity or credit). PDO seems to hit this objective for now, which helps support my buy rating.

Sector Weightings Mostly Consistent

Turning to PDO’s underlying holdings, I notice that the make-up of the fund has not changed too much since May. The top sectors continue to be high yield credit and mortgage-related securities (both residential and commercial). The one point I would mention is that both non-agency MBS and CMBS have seen their share of the fund increase by about 2% each since May, but that is not substantially altering the breakdown of the holdings list:

PDO’s Sector Weightings (PIMCO)

Turning first to high yield, this is undoubtedly an area that has some investors unnerved at the moment. When economic conditions deteriorate and/or the risk appetite of the market sours, this is an area that some begin to shun. In fairness, I wouldn’t advocate moving outside a comfort zone at this juncture. For one who is not used to investing in below-investment grade assets, now may not be the time to start. The U.S. is sitting in recessionary territory and the Euro-zone is facing plenty of macro-headwinds as well. Low grade issuers are certainly facing a more challenging backdrop going forward, so keep this in mind when managing expectations for this sector’s performance.

However, I don’t want to sound alarmist here. The reality is that corporate America has been holding up reasonably well in earnings. Inflation remains a sore spot and waning consumer and business confidence are having an impact. But the fact is that balance sheets remain strong (on average), so as long as conditions do not deteriorate aggressively, I see value in this sector.

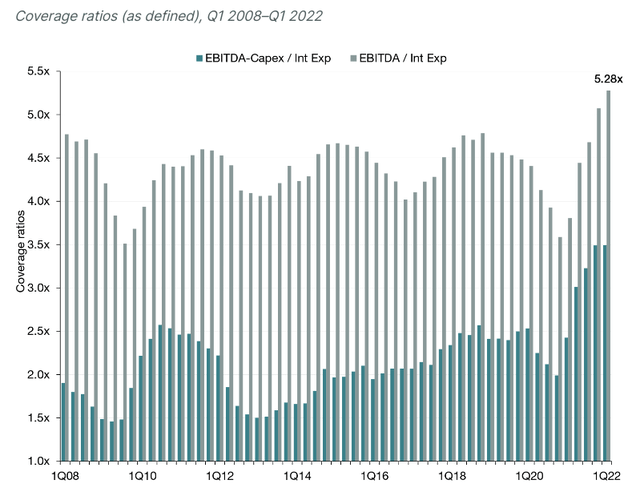

The reason is multi-fold. For one, high yield has begun to see a bit of a sell-off lately, offering up a contrarian play to bet against the market trend. That always piques my interest to some degree. Two, coverage ratios have been improving dramatically throughout the past year. This is true across the board, but when we look specifically at the high yield environment we see average coverage ratios at very strong levels:

Coverage Ratios (High Yield Issuers) (Lord Abbett)

This tells me that the high yield sector can afford to see a bit of a slowdown economically and still make good on their credit obligations. Are lower GDP growth and/or a recessionary environment good attributes for junk debt? Of course not. But what I am saying here is that coverage ratios are strong enough to handle a dip in current earnings and ride out a mild storm. Unless macro-conditions get substantially worse, I am still of the mind to expect low levels of delinquencies and defaults even in the riskier credit spaces.

The conclusion I am drawing here is that high yield credit is not necessarily an area to shun. There are positives aspects of that corner of the market. A worsening economic picture will challenge this thesis, so I again reiterate to stay within your comfort zone and know your own goals and tolerances. But for those looking for high income streams, I continue to see this as a reasonable place to be.

Home Gains Are Slowing – So What?

I will now shift to the residential mortgage space. This is a key pillar of many of PIMCO’s CEF, PDO included. With 16% exposure to residential mortgages, mostly non-agency MBS, keeping an eye on what is going on in this realm is key to any forward outlook. In my view, the residential mortgage sector continues to be very strong in terms of income and credit quality. But looking at recent headlines, one may get a different picture:

Housing Market Headline (NY Post) Housing Market Headline (Fortune) Housing Market Headline (Yahoo News)

What I am attempting to illustrate here is that major news outlets are painting a gloomy picture of the U.S. housing market at the moment. If one is watching the news or scanning articles, it would stand to reason there would be some underlying concern.

But let us talk about this for a minute. For one thing, notice what these articles are not talking about. They are suggesting home prices may decline, yes, but they are not talking about an uptick in delinquencies or foreclosures. As income investors in PDO, that would be the primary concern. Are homeowners no longer making their mortgage payments and/or is there an ongoing threat they might not? That doesn’t seem to be the case here.

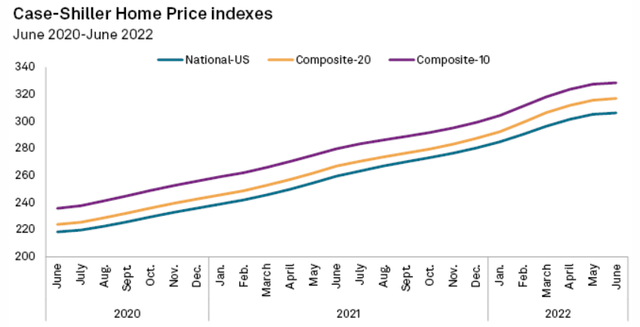

Of course, that is not to say that declining home prices are not a risk. If prices drop substantially and homeowners lose equity in their homes, then the chances increase they may stop making their payments. But how likely is that in this environment? I would surmise it is not very likely. For one thing, home prices have been rising substantially over the past few years. This means that even if we get a drop in prices now (which may not even happen in many major markets given the demand imbalance) most households are probably still going to have positive equity. The support for this statement should be evident from reviewing the country’s home price indices:

Home Prices Continual Rise (S&P Global)

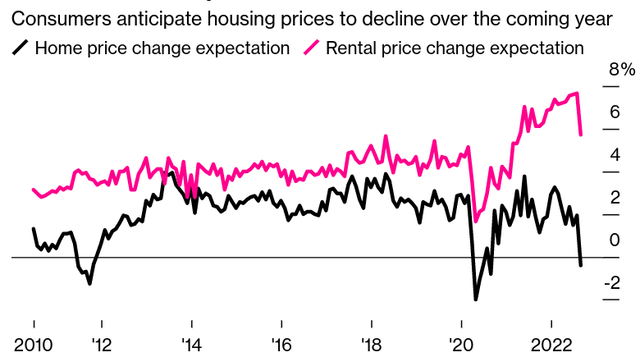

The takeaway for me is that worries of a “housing price correction” are a bit overblown. I don’t see the risk as zero, and PDO investors should continue to monitor this area closely. But there is plenty of room for a cool-down in home prices without impacting the desirability of this asset class. Beyond my own personal take, it looks for now like American consumers have similar thoughts. While the majority of Americans appear to expect home prices to decline over the next year, the expectation is a drop in the 0-1% range:

Consumer Expectations (Bloomberg)

Ultimately, this doesn’t look like a calamity to me.

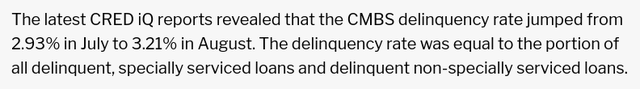

A similar conclusion is drawn when I look at the commercial MBS space. This is an area that is also generating some negative headlines. In fairness, office and retail space continued to be challenged by a world that has changed because of Covid-19. People are working from home more and shopping outside the home less. This makes that property less desirable. Further, delinquencies have picked up in the commercial sector, rising above 3% in August:

CMBS Delinquency Trends (CNBC)

Again, this is an area to monitor. An uptick in delinquencies is never a positive sign and readers need to evaluate this trend with care. But we should also recognize a rise of around a quarter of a percentage point does not warrant a massive risk-off approach either.

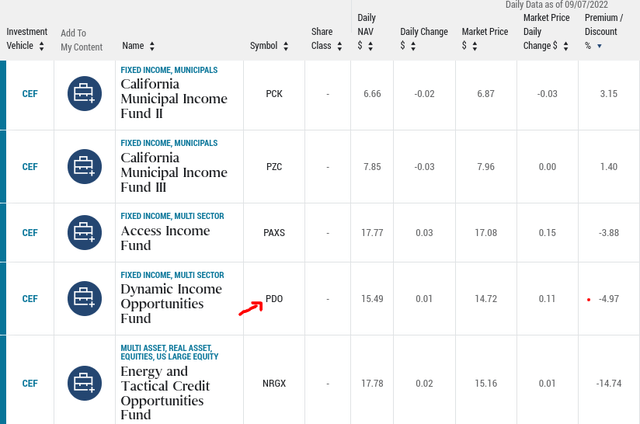

Valuation A Positive For The Value-Oriented

My next focus area is on PDO’s valuation. This is a fund that has notoriously been trading in discount territory, after briefly managing a premium in 2021. After the close yesterday (9/7), this story remains in-tact. PDO has a discount to NAV in the 5% range. This makes it cheaper than all the PIMCO CEFs on offer, except one:

The simple takeaway for me is this helps justify a buy rating. Is PDO guaranteed to move higher from here? Absolutely not. The fund’s underlying value could be pressured and/or the discount could widen further. PDO has a history of trading at even cheaper valuations, so keep that in mind. But it does suggest some value, especially relative value. This makes me lean towards PDO as an option when considering credit options from the PIMCO family.

Income Story Projects Confidence

Another area to briefly touch on are the fund’s income metrics. Similar to the valuation story above, this is a supportive attribute for PDO. The fund’s distribution boost was welcome (as discussed above), and current coverage ratios suggest the yield is well supported:

There is not a whole lot else to say except that PDO remains a strong income asset. The UNII figure of $.90/share is very healthy. It shows plenty of room for error in terms of income production and is also suggestive of a year-end special distribution. There is not much to dislike in this graphic.

So, Where Are The Risks?

This review has been a projection of a fairly bullish opinion. I do stand by this rating shift and expect better days are ahead for what has been a struggling fund in terms of total return performance. However, that does not mean this is a risk-free option. Quite the contrary. I already highlighted above some of the warning signs within the residential and commercial mortgage markets. So investors need to assess these trends, their own outlook, and how that impacts whether or not they should be buying PDO for that exposure.

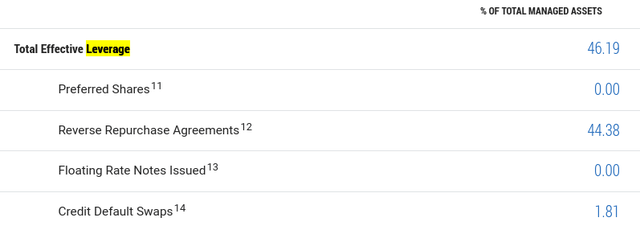

Beyond that, readers should recognize PDO is a highly leveraged fund:

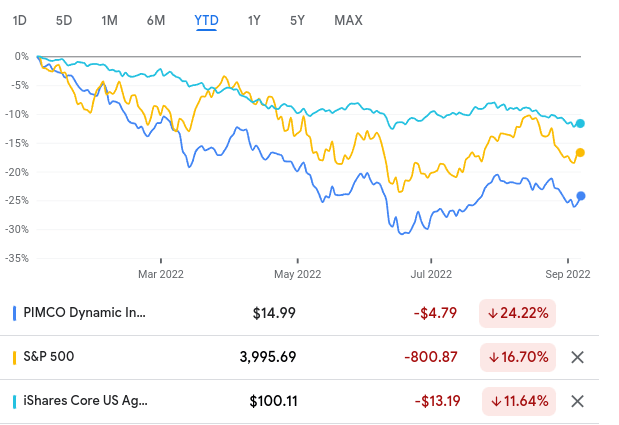

This is a lot of leverage – PDO utilizes a strategy of reverse repos that is essentially short-term borrowing. The challenge is that when interest rates rise, this type of borrowing (along with most types) gets more expensive. The uptick in leverage expenses pressures the net income of the fund. One has to look no further than year-to-date performance of PDO (along with most PIMCO CEFs) to understand the impact a rising rate environment can have:

YTD Performance (Google Finance)

Of course, past is past. But it matters now anyway. Why? Because the rising interest rate environment that has pressured credit markets is set to remain in place for the next 6-12 months. While some market participants had been hoping the Fed will shift to a more dovish tone and perhaps even cut interest rates in 2023, the Fed has thrown cold water on that outlook.

In fact, last week Cleveland Fed Reserve President Loretta Mester remarked:

My current view is that it will be necessary to move the fed funds rate up to above 4 percent by early next year and hold it there. I do not anticipate the Fed cutting the fed funds rate target next year.

The relevance is that PDO could very well continued to be challenged by this macro-trend. It has hurt the fund in 2022, and could continue to do so as we wrap up the year and move into 2023. This is a very important risk readers need to consider when buying at current levels.

Another factor to evaluate is PDO’s emerging markets exposure. While it is only 9% of total fund assets (see sector breakdown above), that is still a significant amount if that sector performs poorly. This is indeed a space I am reluctant to buy up for either equity or fixed-income positions right now. So I do not view PDO’s inclusion of these assets favorably.

One reason why has been the consistent rise of the U.S. dollar. This is pressuring many EM as they too struggle with inflation and debt obligations. With the Fed set to continue with its current path of raising rates, the dollar will likely continue to rise over the next few months as well:

US Dollar’s Rise (Yahoo Finance)

As EM local currencies lose value, this makes debt obligations more difficult to manage. This is undoubtedly another reason behind PDO’s poor performance, and is a risk that does not appear to be abating. Thus, readers must consider this in their analysis as well in the short-term.

Bottom-Line

Despite receiving a lot of glowing coverage, PDO has been far from a winner since inception. I readily admit I was burned by this investment option, and I steered cash into different sectors/themes/ideas as 2022 went along. Looking ahead now to 2023, I see a brighter picture. PDO remains one of the cheapest options in the PIMCO CEF family. The underlying debt in the high yield and mortgages spaces is well supported in the current climate. This does not mean the debt is not at risk if market conditions worsens, but right now there is no need for panic. Further, the income story is extremely positive and the fund’s duration is limited compared to other credit options. That is helpful in a rising rate environment.

To sum this all up, PDO seems like a reasonable buy to me here. I would caution investors to manage expectations because the macro-climate is a challenging one and PDO faces risks with EM exposure and a high amount of leverage. But I see more upside than downside. Thus, I upgraded my rating to “buy”, and suggest readers give this fund some consideration at this time.

Be the first to comment