Olemedia

Investors wanting to add lithium exposure to their portfolio may want to consider Pilbara Minerals Limited (OTCPK:PILBF). The stock has been on a bit of a run as of late on the back of rising production numbers and higher lithium prices, but there may be some gas left in the tank. The company looks set to increase production again this quarter as output reaches, or comes very close to reaching, nameplate capacity. This should occur as the company continues getting ever higher prices for its spodumene concentrate (“SC5.5”) sold through its innovative digital Battery Material Exchange (“BMX”) platform. These factors should lead to another record quarter as revenues and cash flows continue their upward rise.

Note: Unless otherwise stated, all references to dollars ($) are to the Australian currency.

Company Backgrounder

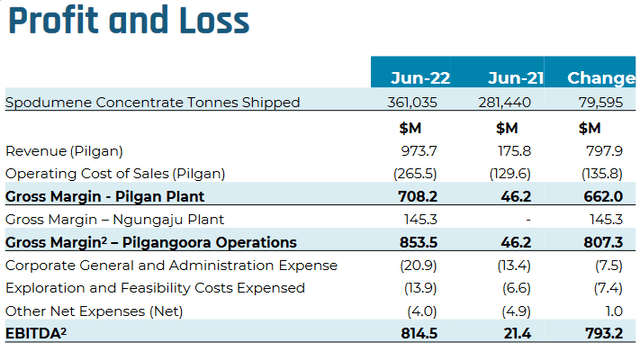

Pilbara is an Australian hard rock miner that operates two 100%-owned properties in Western Australia. The first is its flagship Pilgangoora Project located in the mineral rich Pilgan region of WA. In the most recent fiscal year (the company uses a July-June FY), the site was responsible for most of Pilbara’s revenue as it contributed 315k tonnes to the company’s sales, which translated to about $708 million of gross operating margin.

Cost on a CIF China basis came in at $844/dmt which is, of course, much lower than the average realized selling price of ~US$2,382/dmt (CIF China) (A$3,295/dmt) that the company received for the ore. We should even see an improvement on these numbers next quarter, as management expects Pilgan to produce much closer to its 380ktpa nameplate capacity in the upcoming fiscal year.

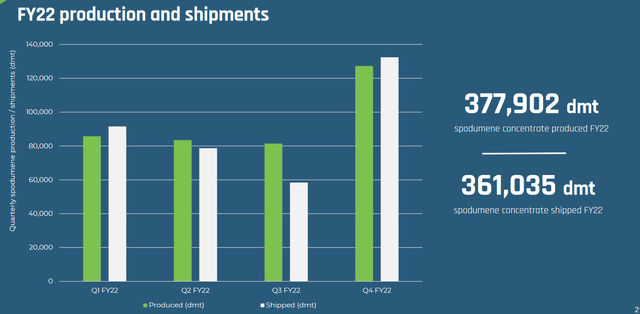

Pilbara’s other major project is the nearby Ngungaju mine that it shrewdly bought back in 2020 after that mine’s former owner filed for receivership. Pilbara initially kept the property closed but decided to restart the project when lithium prices began rising at the end of last year. The site only produced 46k tonnes of SC5.5 this year, which contributed $145 million to gross operating margins, but production has since fully ramped and management expects it to produce between 180-200ktpa this fiscal year. Management did not provide cost per tonne information for the site given that it was still being commissioned at the time and costs may change once the site is fully ramped. The addition of Ngungaju was already having a noticeable impact on Pilbara’s overall production numbers in Q4.

It should be noted that Pilbara is involved in several other projects. These include the expansion of the Pilgan plant that will lead to the addition of 100ktpa of capacity. The company is also in a JV with POSCO Holdings Inc. (PKX) that will eventually see Pilbara add midstream capacity. However, seeing as how these projects are still some ways from completion, the focus of this article will be on the valuation of current production from the company’s two active properties.

Higher Production at Higher Prices

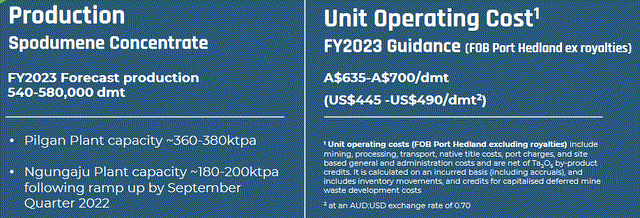

We’ll begin by considering the FY23 production and operating cost guidance provided by management in the exhibit below.

Management expects production to come in at, or just below, nameplate capacity; and they expect production costs to be somewhere between $635-$700/dmt. As previously mentioned, the company has been receiving record bids for its SC5.5 on the BMX Auction Platform. In September’s auction, Pilbara was able to sell SC5.5 at US$6,988/dmt (~A$10,750/dmt @ AUDUSD 0.65).

Granted, lithium prices have been on fire recently, so we’ll assume that prices will average US$4,000/dmt (~A$6,150/dmt @ AUDUSD 0.65) over the 2023 fiscal year. If we’re conservative and assume that FY23’s production will come in at the midpoint of guidance (560k dmt) while production costs come in at the high end ($700/dmt), we can project FY23 revenue to come in at just below $3.45 billion and the Gross Margin to be ~$3.05 billion; about 3.6x FY22 levels. EBITDA would also increase by a similar multiple even if we assume a doubling of exploration and Gen & Admin costs.

Using those numbers, it may be tempting to value Pilbara stock by multiplying its current share price by 3.6 and calling it a day. However, given the almost 50% increase in the stock price since earnings were released, it’s reasonable to assume that a lot of this projected growth has already been priced-in. Also, we should bear in mind that if lithium prices got cut down to US$4,000/dmt, liquidity in the space would probably suffer and the premium paid for future production would shrink. In addition to that, the company doesn’t sell all of its material at the spot price. Although during the Q4 call, Alex Eastwood, Pilbara’s Chief Legal Officer, mentioned that, “all our offtakes have price review mechanisms,” implying that there is some room to move on price even within the contracts.

So, to get around these problems, we’ll use the pre-earnings share price of US$2/share on the U.S. markets and $3 per share on the Australian ASX. And instead of multiplying those prices by 3.6, we’ll multiply them by 2. Using this much more conservative approach, which values the share price at US$4 or A$6, still gives us a lot of upside on the stock. Meaning investors might still be able to achieve a very good return at today’s prices.

Takeaway

The market took notice of Pilbara when it released excellent FY22 results and projected an even better FY23 performance. Since the release, however, the stock has appreciated by an impressive 50% while the broader market has been on a downward spiral. This may have led some investors to question whether it was too late to buy. But a close look at its FY23 forecasts, shows that although it’s had quite a run, Pilbara still has some gas left in the tank.

Risk

The primary risk to the thesis is a fall in lithium prices. The metal’s price has run up substantially over the last year, and if it were to pull back sharply Pilbara would be negatively impacted.

Be the first to comment