f11photo/iStock via Getty Images

Piedmont Office Realty Trust, Inc. (NYSE:PDM) owns a portfolio of Class A office properties located primarily in the Sunbelt region of the United States, with enhanced exposure to the Atlanta and Dallas markets, which together account for just over 40% of their total net operating income (“NOI”).

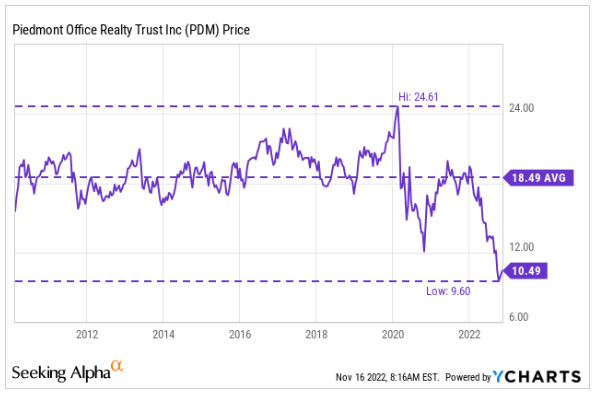

Presently, the stock is trading at some of their lowest trading levels in their operating history. YTD, shares are down over 40%. And though they are off their 52-week lows, they are up just 3% on the month. The broader S&P 500 Index, in contrast, is up 8% over the same period.

YCharts – Share Price History Of PDM

At a forward multiple of just 5.3x core funds from operations (“FFO”), the stock offers an attractive value proposition. In addition, the company offers a fully covered dividend payout that is currently yielding about 8% at current pricing. Continued leasing strength paired with impressive cash spreads is also noteworthy, given the current market environment in the overall office sector. A recently acquired trophy property that is 95% leased is also sure to contribute meaningfully to future earnings growth. For investors seeking to add a quality office operator to their long-term portfolios, PDM offers value with significant upside potential.

Nearly Double-Digit Cash Spreads On Healthy Total Leasing Volumes

During Q3FY22, PDM completed a total of 54 leasing transactions totaling 444K square feet (“SF”). Half of these transactions were attributable to new signings, representing approximately 30% of the total square footage signed during the period. This brings total leasing volumes through nine months to 157 transactions totaling 1.7M SF, with new signings accounting for a third of the total square footage signed.

While the momentum in leasing is positive, the current quarter’s volume in square footage was down from the second quarter. Then, the company signed 724K SF. And in Q1, volume amounted to 552K SF. The lower volume of square footage was offset, however, by strong cash leasing spreads, which came in at 9.9% during the quarter, excluding the impacts of one significant renewal, which drove a headline roll-up of 33.1%. Regardless, the nearly 10% spread during the quarter is still significantly better than the 3% and 5% spreads reported in Q2 and Q1, respectively.

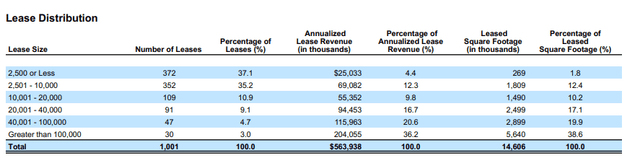

Roll-up strength could be partly attributable to a greater distribution of leases less than 20K SF. Of their total leases, nearly 85% were 20K SF or less, with over 70% of that less than 10K SF. While large, rated entities such as U.S. Bancorp (USB), The State of New York, and Amazon (AMZN), are among PDM’s top tenants, it is the smaller tenants that are driving the market.

Q3FY22 Investor Supplement – Lease Distribution Summary By Square Footage

This would make sense since smaller tenants generally are less able to accommodate hybrid working schedules due to their relative lack of technological resources compared to their larger counterparts. And as it relates to roll-ups, PDM is in a much stronger position to drive rents with smaller tenants than say, an Amazon, who is in a much better position to negotiate terms favorable to them, especially in the current environment where they are under significant pressure by investors to reduce costs.

Notable Signings Above 20K SF And The Pipeline Ahead

In addition to smaller signings, PDM also had several notable signings above 20K SF. One was a new signing in their Minneapolis market for 35K SF with a term through 2028. This signing was a relocation of a financial services firm, where, notably, all staff is required to work in person 100% of the time.

Another large signing was in their Dallas market, which was the largest renewal and overall signing during the quarter, at 178K SF with a term of two to five years. Additionally, the renewal of this property with Ryan LLC, a top 20 twenty tenant, came at a significant roll-up and had no pre-rent or tenant improvement allowances attached to it.

Looking ahead, the company has an active pipeline of 300K SF, with 150K SF already completed through the date of their release. Assuming they are able to close on the pipeline by the end of the fourth quarter, that would take their total leasing levels in 2022 to about 2M SF, which would not be that far off the 2.3M SF signed in 2019 and 2021.

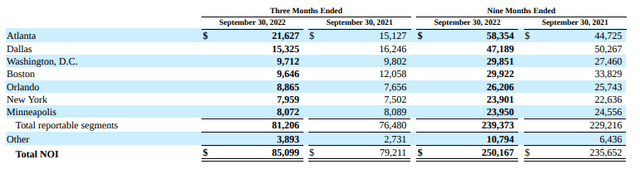

Atlanta’s Growing Share Of Total NOI

Leasing activity also continues to be concentrated in Atlanta, which is their largest and strongest market, representing over 40% of the total new signings over the past four quarters. And in October, PDM signed an additional six deals in the market totaling 57K SF.

At present, the region accounts for a quarter of total NOI. This is up from about 19% in 2021. The greater exposure is a net benefit, considering the appeal of the location to individuals and businesses alike.

Q3FY22 Form 10-Q – NOI Disaggregation By Operating Region

In recent years, companies have relocated in greater numbers to Atlanta, drawn by favorable monetary incentives and a robust labor market, among other considerations. In addition, Atlanta was also ranked as the best place to live in the U.S. by Money magazine, citing the moderate size of the city and its cultural and economic significance to society and the overall macroeconomic landscape.

The 1180 Peachtree Street Acquisition

In one of their largest bets on the city, PDM recently completed their acquisition of 1180 Peachtree Street, which is a landmark asset and one of the most recognizable buildings in Atlanta. By acquiring the building, PDM became one of the largest owners in the Midtown region, accumulating a position of over 1.3M SF over the last twelve months, alone.

At a leased rate of 95%, with a weighted average lease term (“WALT”) of seven years and in-place rents approximately 20% below market rates, the building promises to be a primary driver of future earnings growth.

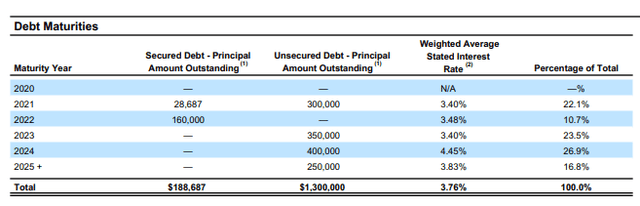

The acquisition did come at a significant price, however. In total, the purchase amounted to +$465M. This included the assumption of an existing secured note, which often is a net negative to credit standing. But in this case, the note came with a reasonable 4.1% fixed rate of interest. In addition to assuming the existing mortgage, PDM also entered into a +$200M unsecured floating rate facility to front the cash portion of the acquisition.

Q3FY22 Investor Supplement – Debt Maturity Schedule

In the near-medium term, these debt holdings will weigh on earnings via higher interest expenses. And in fact, full-year guidance for core FFO was narrowed down in the current quarter in recognition of this. At the end of Q2, management was expecting a range of $1.99/share to $2.05/share. That was trimmed at the top end to $2.01/share.

Despite the increase in leverage resulting from the transaction, management expects the acquisition to be leverage neutral following the disposition of non-core assets. Currently, there are at least two assets that will likely be offloaded in the coming months. And both are in their Cambridge market to two separate buyers, where terms have already been agreed upon. Still, given current market dynamics, this doesn’t necessarily mean a deal is a certainty. Management recognized as much by conveying caution when asked to provide details regarding pricing.

If PDM does ultimately sell the properties, that would likely cover the majority of their floating rate debt issued for the Peachtree acquisition. And it would also increase their financial flexibility ahead of another maturity set for later in 2023.

The Atlanta Market Will Carry PDM Forward

PDM is reaping the benefits of operating in the Sunbelt region of the U.S., particularly in Atlanta, which accounts for a quarter of their total NOI and is one of the most attractive markets in the country, with economic indicators that continue to track ahead of national averages. In the third quarter of 2022, for example, the unemployment rate in Atlanta was 2.7% compared to 3.5% overall. In addition, the Atlanta economy also expanded at a 5.3% YOY rate during the quarter, which represents an increase of over 150K jobs.

The job growth is clearly feeding into PDM’s operating results, as evidenced by the significant amount of leasing activity concentrated in the region. To capitalize further on the market opportunity, the company placed a large bet on a landmark trophy asset in the heart of Midtown. With the building already 95% leased with in-place rents 20% below market values, it is sure to be a primary driver of future period earnings growth.

While the transaction did result in higher leverage levels, the company is still reasonably capitalized with a debt to gross asset ratio still under 40% and a net debt multiple that is just slightly above prior period levels. Granted, the building will dilute earnings in the near term due to the higher interest expenses associated with the debt. But PDM already has two buyers lined up for the disposition of two non-core properties, which, if completed, should offset a healthy chunk of the added leverage.

For income investors, the 8% dividend yield is one additional draw to the stock, in addition to its significant upside potential. At the end of 2021, the stock traded at a multiple of FFO of about 9.3x, yet total occupancy then was 130 basis points lower than where it stands today. Additionally, total leasing volumes weren’t significantly higher than where they are currently. And their debt position, too, wasn’t too far off current levels.

Even at a 7.0x multiple, which would be more in line with other office-focused REITs, shares would still have over 30% upside potential. While hybrid working arrangements do create a secular headwind for the office sector, current multiples are not reflecting the appeal of higher quality buildings in the demand environment. For investors seeking significant upside with favorable risk/reward considerations, PDM is among the best value plays in the REIT sector today.

Be the first to comment