MarsBars

The energy industry was one of the rare winners this year, but the recent downturn has taken a lot of chips off the table. This has created opportunities for income and value investors with dry powder sitting on the sidelines. This brings me to Phillips 66 (NYSE:PSX), which is now trading well below its recent high. In this article, I highlight what makes PSX an attractive income and growth investment, so let’s get started.

Why PSX?

Phillips 66 is an energy company that’s headquartered in Houston with a diversified business model. PSX’s refining assets are primarily located in the U.S. midcontinent, which has a better outlook for refined products compared to the west coast. While it’s primarily in the refining business, it also holds interest in marketing, chemical and midstream assets that provide diversification and more earnings stability.

This is reflected by PSX’s 50% ownership stake in DCP Midstream (DCP), giving PSX exposure to valuable NGL infrastructure and processing assets, and by its 50% joint venture with Chevron (CVX), in CPChem, which has seen growth coming from petrochemical projects in the Gulf Coast.

PSX’s integrated business model has been a key differentiator, allowing it to weather energy crunches better than upstream focused peers. This is reflected by its history of paying an uninterrupted dividend since it was instituted 10 years ago. The dividend is also well-protected by a 45% payout ratio and comes with a 7.5% 5 year CAGR.

Meanwhile, PSX continues to be a solidly profitable enterprise, generating $1.1 billion of operating cash flow during the first quarter. Moreover, refining’s adjusted earnings improved to $140 million, compared to a $1 billion loss a year ago, driven by higher distillate yields, and this should enable strong margins in the coming quarters.

Management is putting capital to good use, as it repaid $1.45 billion of maturing debt in April, and it maintains a BBB+ rated balance sheet, with a net debt to capital ratio of 33%. Also encouraging, they’ve indicated plans to restart share repurchases, with $2.5 billion remaining on its share repurchase authorization with no expiration date.

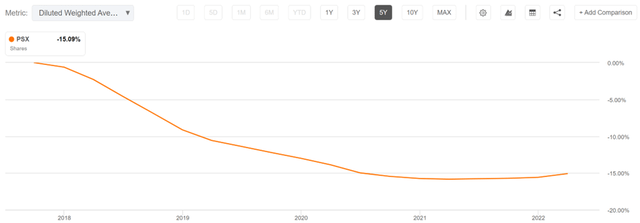

As shown below, PSX has retired an impressive 15% of its outstanding share count over the past 5 years, with the bulk of share repurchases made prior to 2021.

PSX Outstanding Shares (Seeking Alpha)

Risks to PSX include the cyclical nature of the refining industry, which could impact margins and volumes down the line. However, PSX should continue to see benefits, at least in the near-term, as the global supply and demand imbalance continues, enabling PSX to continue repurchasing shares in the interim. This imbalance was highlighted by management during the recent JP Morgan (JPM) Energy Conference:

Considerable amount of capacity was taken offline during COVID because of demand destruction and there just wasn’t the ability to keep those assets viable. So, I think something like 4.5 million barrels a day of capacity was taken offline. As demand resurged, we saw things tightening. We saw inventories dropping. And then you layer on top of that the Russian invasion of Ukraine that just exacerbated and accelerated, I think, that challenge.

And what we are seeing today is there is a rebalancing of things, whether it was immediate products coming from Russia, filling out refineries or the impact of crude trade disruptions, it’s really setup things to be here for quite some time because there is no great relief coming in refining capacity. Nobody is interested in adding refining capacity.

In fact, it would take too long to add new refineries to North America, some refining capacity showing up in China, Middle East, other locations, Africa, but it takes time. This isn’t something that will work its way out in a few months. It’s going to take more than that. The market is working though. I think that supply and demand tends to respond to pricing. It’s not necessarily driven by an election cycle it’s driven by market fundamentals.

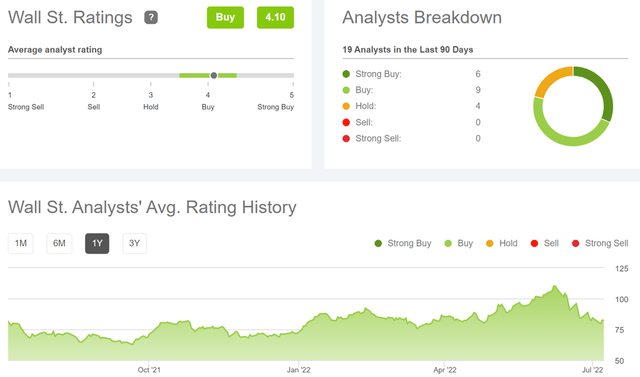

Meanwhile, I see value in PSX at the current price of $82 with an enterprise value to EBITDA ratio of 16.6x, sitting well below its near-term peak of 20.8x in early June. Sell side analysts have a consensus Buy rating on PSX with an average price target of $114.49, implying a potential one-year 44% total return including dividends.

PSX Analyst Ratings (Seeking Alpha)

Investor Takeaway

Phillips 66 is an integrated energy company with a diversified business model, which has allowed it to weather energy crunches better than its upstream focused peers. The company is profitable and generates strong cash flow, which it is using to repurchase shares and pay dividends. Given the recent share price weakness, I find PSX to be a solid long-term investment with potential for significant upside.

Be the first to comment