acilo/E+ via Getty Images

Recent Events

- Supply chain issues and the Respironics recall started levelling the stock in June 2021.

- Shareholders on September 30th voted to replace the CEO effective October 15th.

- On October 12th, the company reduced sales guidance, booked a EUR 1.3B impairment charge on the Respironics business based on the DOJ consent decree, and recorded a EUR 165M restructuring charge.

- Following the reduced guidance, multiple analysts have downgraded the stock.

- Rising interest rates, a weaker Euro, and forced selling from British pensions have further exacerbated the decline.

- During third quarter earnings call, the company announced the following: a layoff of 4,000 employees to lower operating expenses; a EUR $1B credit facility, and postponement of settling share repurchase forward contracts to conserve cash.

Disproportionate Decline

Although there have been a plethora of negative events affecting Philips (NYSE:PHG), the over $40B decline in market capitalization is disproportionate. Assume that Respironics is currently worthless. Philips acquired Respironics in 2007 for $5B. Prior to the pandemic and recalls, Respironics accounted for ~11% of sales (2019). Based on the maximum Enterprise Value of $60B in 2021 and assuming the percentage of sales is representative of the value of the segment, Respironics would have been worth at most $7B. Perhaps, the fair value of Philips was $40B in 2021, and it was overvalued by 50%. Also, imagine supply chain issues reduced fair value by 25%, or $10B. To calculate market capitalization, subtract net debt including capital leases of $6B. Even with these extremely conservative assumptions, the calculated market capitalization would be $12B and is still higher than the current market value.

Outstanding businesses

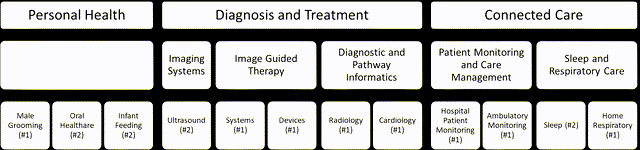

As shown below, Philips has a leading market share in a number of high-margin businesses. Each segment exhibited double-digit Adjusted EBITDA margins since 2017. As a consequence, free cash flow averaged more than $900M from 2017 through 2021. Many of the underlying businesses compete primarily on quality of care, innovation, and client service as opposed to price. In addition, structural impediments to competition increase the likelihood of sustained profitability. For example, significant barriers to entry exist within the Imaging Systems business in the Diagnosis and Treatment segment. MRI machines and CT scanners are technologically complex and innovations are patent protected. In addition, physicians and staff need training for complex medical devices and significant switching costs exist. Also, Philips has recently entered into long-term contracts with hospital systems in the US to act as an enterprise technology provider. These have the potential to increase switching costs and result in vendor lock-in.

Philips 2022 Q2 Earnings Call Presentation and Poppertech

Risk and Reward

Low expectations have set up the possibility for a massive advance as these various issues fade. The company has a reasonable amount of debt and low interest payments, so solvency is not a major concern. Once the company completes the replacement units required for the recall and sells excess inventory required to address supply chain issues, operating cash flow should become positive again. Given the initialization of the credit facility and postponed settlement of the share repurchase forward contracts, liquidity should not be an issue either.

Assuming free cash flow returned to average 2017-2021 levels, the company would return about 9% of the current market capitalization. Although significant risks still remain, particularly in the short term, the potential long-term returns make this a compelling investment. In addition, the write-downs and announcements in the most recent quarter set the bar low for potential outperformance next year. The new CEO is incentivized to lower expectations as much as possible now so that the company will consistently outperform guidance later.

Risks include an unfavorable negotiation of the consent decree with the Department of Justice, continued supply chain issues in China, and further deterioration of economic conditions in Europe. These might cause Philips to raise capital at disadvantaged rates, cut the dividend, or sell a subsidiary to raise cash. Given the high expected volatility of the stock in both the short and long term, position size should be relatively small compared to other portfolio holdings. If conditions in Europe cause the valuation to plunge further and the company announces neutral or positive results next quarter, then my recommendation would likely change to Strong Buy.

Be the first to comment