bleex/iStock Unreleased via Getty Images

On Thursday morning, we received third quarter results from cigarette giant Philip Morris (NYSE:PM). The company is in the midst of some very turbulent times, given the Russia/Ukraine situation as well as a volatile foreign exchange market. Overall, the company announced decent results from the quarter, although shares may be weighed down a little in the near term due to some acquisition cost headwinds.

For the quarter, net revenues of more than $8 billion were down 1.1% over the prior year period, but up almost 7% when excluding currency movements. When excluding results from Russia and Ukraine, pro forma net revenues were around $7.25 billion, a little less than the street’s expectation for $7.3 billion, but likewise up nicely ex-currencies. The company announced that its market share for heated tobacco units in IQOS markets was up by 1.3 points to 7.7% on a pro forma basis, as Philip Morris continues to transition to a smoke-free future. Pro forma IQOS users at quarter end were estimated to be 19.5 million, up 3.6 million in the past 12 months.

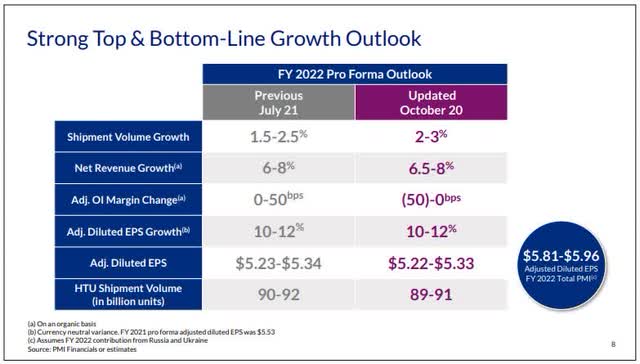

When it comes to bottom line results, results don’t get any cleaner due to all of the adjustments. Reported EPS of $1.34 dropped from $1.55 in the prior year period, but almost all of that decline was due to the significantly stronger US dollar. Investors in this name have seen how the greenback’s strength in the past decade hurt results, and that situation is playing out again this year. Pro Forma adjusted EPS of $1.33, which excludes Ukraine and Russia, was a little below the street’s expectation. However, this number was up more than 8% year over year if you exclude the 23 cents per share hit from foreign exchange. With these results in the book, the company made some slight adjustments to its full year guidance, which can be seen in the graphic below.

Philip Morris 2022 Guidance (Company Q3 Earnings Slides)

Despite the significant currency headwinds, management reiterated its yearly forecast for $10.5 billion in operating cash flow, along with $1 billion in capital expenditures. As a point of reference, currencies have cost the company $737 million in operating cash flow for the first nine months of this year. The company continues to generate free cash flow in excess of total dividend payments, which should be around $7.7 billion this year. During Q3, the quarterly payout was raised 2 cents to $1.27 per share per quarter, which meant an annual yield of 5.87% as of Wednesday’s closing price.

There were two major pieces of news that came out of Thursday’s earnings release outside of the company’s quarterly results. The first was an update to its offer for Swedish Match, a large acquisition that I covered earlier this year, while the second was an update to its commercial agreement regarding IQOS in the United States with Altria (MO). The key details from the earnings press release are below:

PMI has reached an agreement with Altria Group, Inc. to end the companies’ commercial relationship covering IQOS in the U.S. as of April 30, 2024. Thereafter, PMI will have the full rights to commercialize IQOS in the U.S. As part of the agreement, PMI will pay a total cash consideration of $2.7 billion, of which $1.0 billion was paid at the inception of the agreement using available cash. The remaining $1.7 billion, plus interest, will be paid by July 2023 at the latest.

Earlier today, Philip Morris Holland Holdings B.V. (PMHH), an affiliate of PMI, announced an increase in the price in its recommended public offer to the shareholders of Swedish Match AB (Swedish Match) to SEK 116 in cash per share (compared to SEK 106 in cash per share previously).

Philip Morris still expects the Swedish Match deal to close during the current quarter. As I mentioned previously, this deal will be funded with a lot of debt, which is going to increase interest expenses quite a bit in the near term, especially with interest rates soaring recently. However, the total deal could end up being cheaper in dollar terms than the original offer, given the weakness in the Swedish Krona. Philip Morris finished Q3 in a net debt position of nearly $22 billion, but that could be over $35 billion by the end of the year, depending on the timing of the two transactions detailed above.

Previously, management expected the Swedish Match deal to be accretive to operating margins and adjusted earnings per share, so we’ll see if the higher bid changes that math at all moving forward should the deal close as expected. As a reminder, Philip Morris has suspended its share repurchase program due to the pending acquisition, so if the deal goes through, look for the company to use free cash flow initially to pay down debt before buybacks start again. It would not surprise me to see the buyback on hold for at least another year or two, as the company is prioritizing a major acquisition here.

As for Philip Morris shares, they were down slightly in Thursday morning trade. While the Q3 results were decent when excluding currencies, investors may be digesting the impact of the increased offer for Swedish Match as well as the Altria news impacting the balance sheet in the short term. The street is still fairly bullish on the stock, with the average price target of nearly $104 going into earnings. The company is doing quite well overall, but results are being significantly pressured by the stronger US dollar.

In the end, I don’t think the quarter changes the long-term picture at all for investors, with PM stock continuing to be an income investor favorite thanks to its strong dividend. In fact, there may be an opportunity here to grab a 6% annual yield should shares come down a little bit more from here. 2023 will be an interesting year if the Swedish Match deal closes, and it could be a really good one if the dollar were to actually pull back in any meaningful way.

Be the first to comment