Spencer Platt

Thesis

We follow up on our previous article on Philip Morris (NYSE:PM) stock. Our price action thesis has played out accordingly, as we urged investors to use its previous rally to cut exposure. PM has also significantly underperformed the SPDR S&P 500 ETF (SPY) since we published. It registered a return of -11.57% against the SPY’s -0.32% over the same period. Therefore, we urge investors to pay attention to price action when investing. Don’t fight against the market. Instead, investors should try and interpret its expected behavior through significant price structures.

As a result of the steep decline over the past month, PM is now technically short- and medium-term oversold. Its valuation has also improved markedly and is more balanced now.

Philip Morris is also slated to report its Q2 earnings on July 21, as investors parse the company’s guidance for H2’22.

Accordingly, given its oversold technicals and improved valuation, we revise our rating from Sell to Hold. We will watch for more constructive price action before reassessing our rating subsequently.

Philip Morris – Expect Better Days Ahead

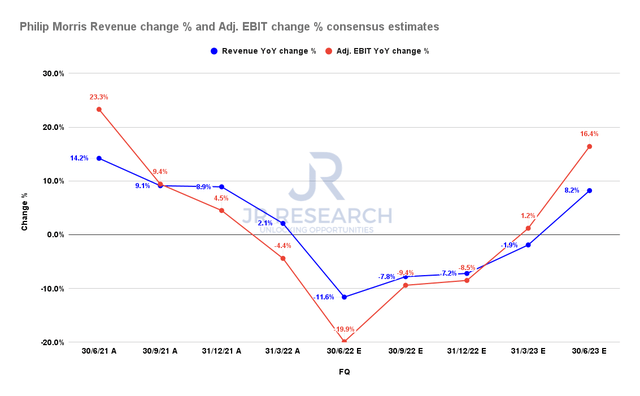

Philip Morris revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Philip Morris articulated in a mid-June conference that it sees a better Q2 than expected, as CFO Emmanuel Babeau highlighted (edited):

We expect Q2 to be probably better than what we thought with a very robust, strong underlying business continuing, core business doing well, and probably some shipment of combustible cigarettes that are going to be eventually happening in Q2 when maybe we were thinking that some of them could happen in Q3. So that’s going to have some positive impact on the performance of Q2 versus initial expectations. Notwithstanding, we need to finish the Q2 to see exactly how it ends up. I think the first message is that we see the business continuing to perform well, okay? And that’s, of course, very good news. (Deutsche Bank Global Consumer Conference)

The consensus estimates (generally bullish) also concur as Philip Morris’s revenue and adjusted EBIT growth are projected to reach a nadir in Q2. Therefore, investors need to carefully watch for management’s guidance on whether a recovery through FY23 could pan out.

But, Margins Could Be Stagnating

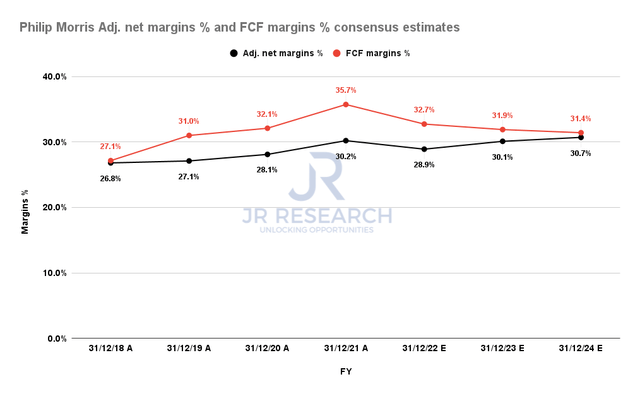

Philip Morris adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

However, the company’s profitability is estimated to remain relatively stagnant through FY24, even as its revenue growth is expected to recover. Accordingly, PM’s free cash flow (FCF) profitability could also decline to 31.4% by FY24, from the peak margins seen in FY21.

As management suggested, we don’t expect those one-off charges to carry forward from Q2. Also, the currency headwinds are unlikely to be structural. However, we believe the inflation headwinds and the extent and duration of an increasingly likely global recession could impact its profitability, given its international exposure. Therefore, we believe the modeling is credible, and the market could also have adjusted to these potential headwinds ahead of time.

Hence, investors need to consider the FCF margins impact in their valuation models accordingly.

PM – The Market Justifiably Digested Its Premium

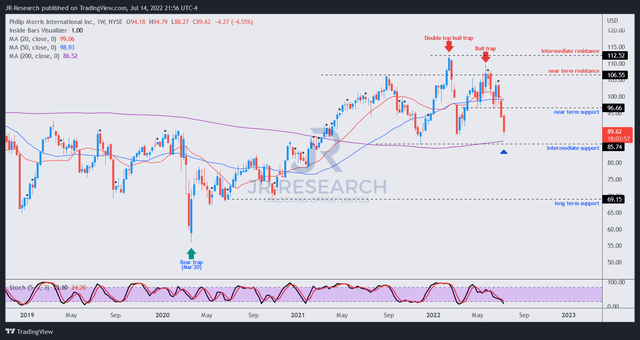

PM price chart (TradingView)

We discussed in our previous article that we expected the retracement to fall to the gap between its near-term and intermediate support zone. Therefore, our price action thesis has played out accordingly. The twin bull traps seen above have exacted some well-justified battering on PM, given its unsustainable premium at those levels.

However, the steep sell-off has also sent PM into technically oversold levels on the short- and medium-term charts. As a result, we believe it could attract dip buyers, coupled with the covering of directionally-bearish bets.

Notwithstanding, we have not yet observed constructive price action that could portend a sustained bottom.

PM – Valuation Has Improved, But Could Still Underperform The Market

PM valuation metrics (TIKR)

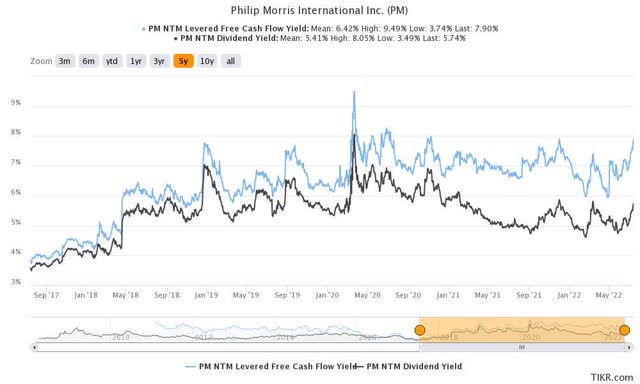

PM was rejected by its May bull trap at an NTM FCF yield of 6.5%. Therefore, we posit that the market considered that level too low to compensate for the headwinds that could impact PM moving ahead.

Notably, the rejection also occurred close to the 5Y mean of its FCF yield of 6.4%. As a result, investors who bought in May without assessing price action have significantly underperformed the market over the past two months, as PM has fallen 18.4% from its May highs.

| Stock | PM |

| Current market cap | $138.92B |

| Hurdle rate [CAGR] | 5% |

| Projection through | CQ4’26 |

| Required FCF yield | 7% |

| Assumed TTM FCF margin in CQ4’26 | 32% |

| Implied TTM revenue by CQ4’26 | $37.79B |

PM reverse cash flow valuation model. Data source: S&P Cap IQ, author

PM posted a 5Y total return CAGR of 5.08% (adjusted for dividends). Therefore, we believe applying a hurdle rate of 5% is appropriate, with an FCF yield of 7%. Our assumption is predicated on the market’s rejection of further buying upside despite posting an FCF yield of 6.5% in May. We also observed that PM last traded at an FY24 FCF yield of 7.34%.

Accordingly, we derived a TTM revenue target of $37.79B by CQ4’26, based on a blended TTM FCF margin of 32%. Philip Morris could still miss our revenue target based on the revised consensus estimates, so caution is still warranted. But if it could guide for much-improved profitability through FY26, the company may meet our revenue target. Therefore, we believe PM is closer to a reasonable valuation (based on its historical performance) than in May/June.

However, a 5% hurdle rate could still underperform the market. Therefore, investors may want to consider a lower entry point to help them improve their probability of market outperformance. There’s no need to rush.

Is PM Stock A Buy, Sell, Or Hold?

We revise our rating on PM from Sell to Hold.

Given its recent steep fall, its risk/reward profile is more well-balanced now. Also, its short- and medium-term technicals are oversold. Notwithstanding, we have not observed constructive price action suggesting a sustained bottom.

However, we believe the stock could still underperform the market at the current levels. As a result, investors can consider waiting for a lower entry point to improve their chances of outperforming the market.

Be the first to comment