We Are

PIMCO has long had a very strong reputation for its bond funds. This is something that could prove attractive in today’s inflationary environment since most of us are finding that we need considerably more income to enjoy the lifestyle that we are accustomed to. Fortunately, as investors, we are generally not going to need to be forced to get second jobs or perform odd tasks since we can make our money work for us. One of the best ways to do this is to purchase shares of a closed-end fund that specializes in the generation of income, as most of PIMCO’s bond funds do. The advantage of a closed-end compared to other types of funds is that they can use certain strategies to produce higher yields than any of the underlying assets possesses. In this article, we will discuss the PIMCO Income Strategy Fund (NYSE:PFL), which currently boasts a phenomenal 11.68% yield. This is certainly a large enough yield to turn anyone’s head but unfortunately, like most of PIMCO’s closed-end funds, it is a bit expensive at the current price. However, the general consensus is that we are paying for the quality of management and admittedly, the expense is not too bad when we consider the performance of the fund. Thus, let us investigate and see if this fund could be a good addition to a portfolio today.

About The Fund

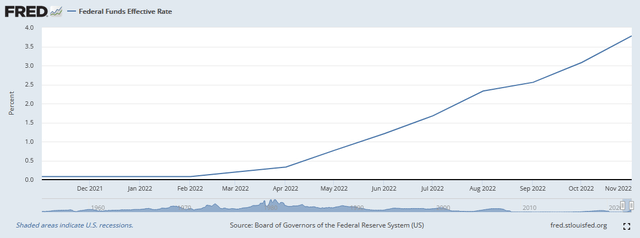

According to the fund’s webpage, the PIMCO Income Strategy Fund has the stated objective of providing its investors with a high level of current income. This is not exactly surprising for a fixed-income fund since these securities deliver nearly all of their investment return in the form of direct payments to the investors. After all, unlike common stocks, fixed-income securities do not really benefit from any growth and prosperity at the issuing company. For example, a company will not increase the amount that it pays to its creditors just because its profits went up. However, the amount paid to the creditors will also not go down just because the company’s profits do. These securities are vulnerable to interest-rate risk, however, which could make the fund’s secondary objective of the preservation of capital difficult to achieve. As everyone reading this likely knows, the Federal Reserve has been aggressively raising interest rates since March as part of its monetary tightening regime. As of the time of writing, the federal funds rate is at 3.78%, up from 0.08% back in February 2022:

Federal Reserve Bank of St. Louis

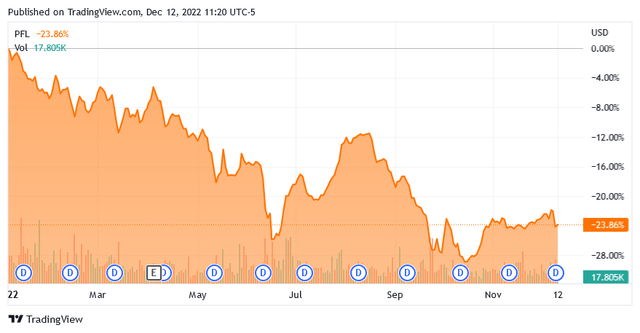

This is important because bond prices move inversely to interest rates. This is because newly issued bonds will have a yield that corresponds to interest rates at the time the bond is issued. So, in a rising rate environment, new bonds will have a higher yield than existing bonds. As such, nobody will buy an existing bond if they can get a new one with the same interest rate. The price of existing bonds then declines until they deliver the same yield-to-maturity as a new bond with the same characteristics. The fact that bond prices decline in a rising interest rate environment has had an impact on the fund’s share price. The PIMCO Income Strategy Fund has declined 23.86% year-to-date:

This is quite a bit more than the 12.69% decline registered by the iShares Core U.S. Aggregate Bond ETF (AGG) over the same period. There are a few reasons for this, which we will discuss over the course of this article. However, when we consider that the PIMCO fund has a substantially higher yield, the performance difference between the two is not nearly as bad as we might expect.

It seems likely that the fund will continue to suffer a declining share price at least for the next few months. According to economists at Deutsche Bank, the Federal Reserve will continue to raise rates into 2023 to a peak of 5.10%, which is obviously quite a bit higher today. The bank projects that the Federal Reserve will then leave rates at that level while evaluating the impact on the economy. Jerome Powell’s comments at the Brookings Institution a few weeks ago implied a similar scenario. As the PIMCO Income Strategy Fund’s portfolio correlates inversely with interest rates, this implies that it will have a falling share price until interest rates do finally peak. Deutsche Bank expects this peak to arrive in May so we have another five to six months to wait. Of course, the fund will continue to pay out distributions over the whole time and one could dollar cost average in to reduce unrealized capital losses from this scenario. Eventually, it seems likely that the Federal Reserve will cut rates someday and the fund’s share price will shoot up at that point but current predictions are that such a loose monetary policy will not occur for a considerable period of time.

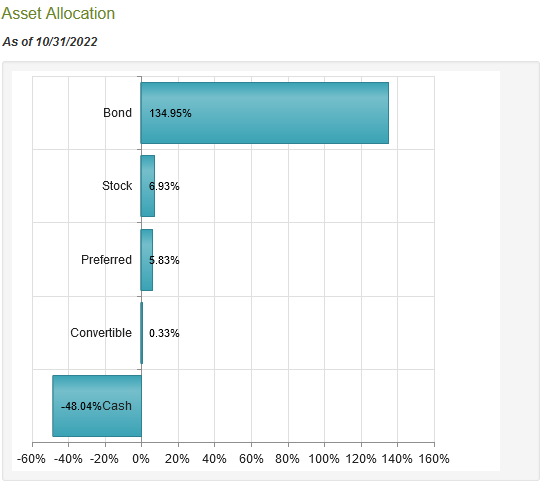

The PIMCO Income Strategy Fund does not consist solely of bonds. In fact, it contains a 6.93% weighting to common stock and a 5.83% weighting to preferred stock:

CEF Connect

Preferred stock has many of the same characteristics as bonds. The most important of these characteristics is that it is priced based on interest rates, just like bonds. However, in most cases preferred stock will have higher yields than bonds issued by the same company because it is a bit riskier. Thus, the presence of these securities in the portfolio does boost the fund’s income slightly. The common stock that is included in the portfolio provides the potential to provide capital gains as common stock can appreciate much more than bonds regardless of economic circumstances. However, both the common stock and preferred stock have such small weightings here that they are unlikely to have much of an effect on the performance of the overall portfolio.

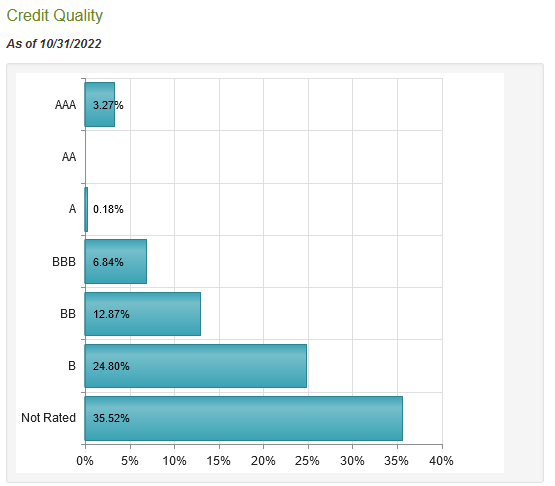

Curiously, for a fund that has a secondary objective of capital preservation, the PIMCO Income Strategy Fund contains a sizable proportion of speculative-grade bonds. These bonds, which are colloquially called “junk bonds,” are generally considered to be at a fairly high risk of default. Yet, the fund’s portfolio is 73.19% weighted toward these securities:

CEF Connect

A speculative-grade bond is anything rated BB or lower. Admittedly, we do not know that all of the bonds in the unrated category are junk bonds despite my including them in the 73.19% figure. However, it does seem highly unlikely that any company with the financial strength to be issuing investment-grade bonds will opt to pay the higher interest rates that accompany unrated securities. Thus, these are probably junk bonds. This may concern investors that are concerned about the preservation of capital since a default by the issuing company usually means the loss of some or all of the investment. The fund has taken some steps to protect itself against this risk, though. One way is by having a large number of securities in the portfolio. The PIMCO Income Strategy currently has 414 holdings so the percentage of the portfolio represented by any individual issuer is quite small. As such, a single default will not have a noticeable impact. Granted, a massive number of defaults will be noticeable but such an event represents bigger problems with the economy than the loss of a few investors’ money. Overall, it appears that most investors in the fund do not have to worry much about default risk.

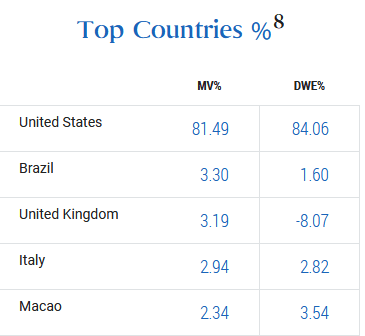

The PIMCO Income Strategy Fund invests in more than just domestic companies and other entities. We can see this in the fact that only 81.49% of the issuers whose securities comprise the portfolio are American entities:

PIMCO Funds

This is something that is nice to see because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take an action or impose a policy that has an adverse impact on an asset in which we are invested. One example of this would be nationalization, which is when countries take control of a company or industry without compensation to the investors. While this is most common in emerging nations, some people consider the U.S. government’s actions with respect to General Motors (GM) in 2009 to be a nationalization and it did violate existing laws with respect to the bondholders. Another example would be a government outright defaulting on its debt, which Argentina has become somewhat famous for over the years. The only realistic way to protect ourselves against this risk is to ensure that only a small percentage of our assets is exposed to any given country. The fact that this fund is invested in multiple countries is thus nice to see, although international diversification is not as critical with fixed-income securities as it is with common stocks.

Leverage

As mentioned in the introduction, closed-end funds like the PIMCO Income Strategy Fund have the ability to utilize certain techniques that have the effect of boosting their yield beyond that of any of the underlying assets. One of these strategies is the use of leverage, which basically means that the fund is borrowing money and using that borrowed money to purchase fixed-income securities. As long as the borrowed money has a lower interest rate than the purchased securities do, the strategy works pretty well to boost the portfolio’s yield. As the fund is able to borrow at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt is a double-edged sword because leverage boosts both gains and losses. This is one reason why the PIMCO fund has underperformed the bond index so severely. As a result, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I typically like to see a fund’s leverage under a third as a percentage of assets for this reason. The PIMCO Income Strategy Fund complies with this restriction as its leveraged assets only account for 31.25% of the portfolio. Thus, the fund appears to be striking a reasonable balance between risk and reward.

Distribution Analysis

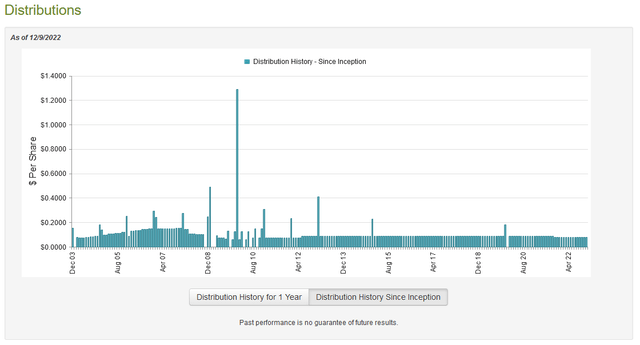

As mentioned earlier, the primary objective of the PIMCO Income Strategy Fund is to provide its shareholders with a high level of current income. In order to accomplish it, it maintains a leveraged portfolio of fixed-income assets, which deliver the majority of its total return through direct payments to investors. The fund passes these payments through to the investors so we can assume that it likely has a very high yield itself. This is certainly true as the fund pays out a monthly distribution of $0.0814 per share ($0.9768 per share annually), which gives it an 11.68% yield at the current price. The fund has generally been consistent about this yield over the years, although it did cut the distribution back in September 2021:

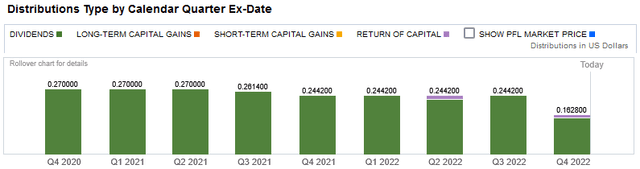

The general consistency here is something that will undoubtedly appeal to those investors that are looking for a stable source of income with which to pay their bills and finance their lifestyles. The cut last year is somewhat understandable since the markets began to predict a tightening in monetary policy as inflation began to take hold in the second part of last year so the fund likely cut its distribution in anticipation of that. This is certainly not out of line with actions that were taken by several of the fund’s peers. More conservative investors will also likely appreciate the fact that nearly all of the fund’s distributions are classified as dividend income, with very few capital gains or return of capital:

The reason why this can be nice to see is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. The same is true of capital gains as we have no guarantee that the fund can generate sufficient capital gains to maintain its distributions, particularly in a period of monetary tightening. However, as I have pointed out in the past, it is possible for these distributions to be misclassified. As such, we should still investigate exactly how the fund is financing its distributions so that we can figure out how sustainable they are likely to be.

Fortunately, we do have a relatively recent document that we can consult for this purpose. The fund’s most recent financial report corresponds to the eleven-month period ending June 30, 2022. As such, it will provide us with a great deal of insight into the fund’s performance in the first half of 2022 when the Federal Reserve switched from a free money policy to monetary tightening. It admittedly would be nice to have a report dated more recently than that to provide us with more information about how it is handling the monetary tightening policy but we will have to wait a few more months for that. During the eleven-month period, the PIMCO Income Strategy Fund received a total of $30.927 million in interest and $570,000 in dividends from the assets in its portfolio. This gives the fund a total income of $31.497 million during the period. The fund paid its expenses out of this amount, leaving it with $26.309 million available for shareholders. This was unfortunately not nearly enough to cover the $31.501 million that the fund paid out as distributions during the same period. This is certainly concerning as the fund obviously is not generating enough income to maintain its distribution.

However, the fund does have other methods that can be used to obtain the income that is needed to cover the distribution. The most common of these methods is capital gains. As might be expected though, the fund did fail to generate sufficient capital gains during the period. It reported net realized gains of $22.077 million but this was more than offset by $96.771 million in net unrealized losses. Overall, the fund’s assets declined by $67.784 million during the eleven-month period. With that said, the fund did manage to have sufficient net realized gains to cover its distribution when combined with the net investment income. However, there is no guarantee that it will be able to consistently generate such gains, particularly if its asset base continues to decline during a period of monetary tightening. Thus, it is possible that the fund may have to cut its distribution again but for now, it seems to be okay.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the PIMCO Income Strategies Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. As is usually the case with PIMCO funds though, that is not the case with this one. As of December 9, 2022 (the most recent date for which data is currently available), the PIMCO Income Strategy Fund had a net asset value of $8.08 per share. However, the shares currently trade for $8.39 per share. This gives the shares a 3.84% premium to the net asset value. This is relatively in line with the 3.93% premium that the shares have traded at on average over the past month but it is still a premium and generally we do not like to buy closed-end funds at a premium. This is admittedly a small premium though and the fund’s yield will more than refund the premium in the first year so it is probably not a big deal as it is unlikely that we will ever see this fund trade at a discount.

Conclusion

In conclusion, the PIMCO Income Strategy Fund certainly appears to be one of the better fixed-income closed-end funds available on the market today. The fund has a large and diversified portfolio that allows it to pay its investors an incredibly high yield. The nice thing is that this distribution appears to be sustainable for the time being, although there is admittedly no guarantee that it will always be so. The downsides here are that the fund is trading at a premium and its share price is likely to decline a bit more over the next few months as the Federal Reserve continues to raise rates. However, the high sustainable yield may make the fund still worth buying today.

Be the first to comment