vitapix/E+ via Getty Images

Water is one of the most important resources, if not the most important resource, for life in order to exist and thrive. And while the planet is covered in it, the vast majority is not potable. It stands to reason, then, that there would be a significant market opportunity for companies that can provide water, treat water, distribute water, and more. One such firm that has done exceptionally well from a share price perspective in recent months is Consolidated Water (NASDAQ:CWCO). Although the company had a rather rough 2021 fiscal year compared to the year prior, the picture is looking up this year and the business continues to land some rather valuable contracts that should add value to investors moving forward. Given the uptick we have seen in price for the firm’s shares, however, I do think the company is only a ‘hold’ prospect these days. But investors would be wise to keep a close eye on the firm with the expectation of perhaps buying in again should shares decline or if fundamentals continue to improve.

A few great months

The last article I wrote about Consolidated Water was published in December of 2021. At that time, I acknowledged that the company had experienced pain because of the COVID-19 pandemic. However, I also said that the pain will eventually let up and that the company was exhibiting some signs of recovery. On top of this, I said that shares were looking rather cheap and, as a result, probably offered some opportunity moving forward. Since then, the business has outperformed even my own expectations. While the S&P 500 has declined in value by 12.9%, shares of Consolidated Water have risen by 33.3%.

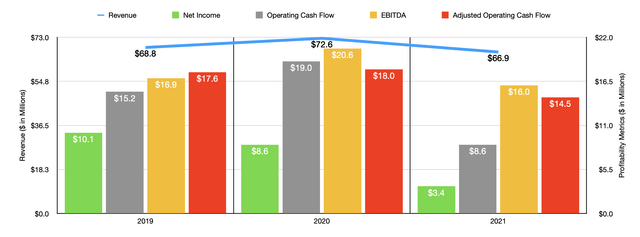

Author – SEC EDGAR Data

This share price strength came even in spite of another rough year for the business. During its 2021 fiscal year, Consolidated Water generated revenue of $66.9 million. That was actually 7.9% below the $72.6 million generated in 2020. Not only that, it was also below the $68.8 million the company reported for its pre-pandemic year of 2019. According to management, the decline in sales between 2020 and 2021 was driven largely by a significant revenue decline associated with the company’s manufacturing segment. Sales under that segment plummeted from $12.4 million to just $4.1 million. This decline came as the segment’s largest customer, which accounted for 80% of the segment’s sales in 2020, decided that, for the purpose of inventory management, it was suspending its purchases of Consolidated Water’s products. Without this decline, revenue would have actually risen by 4.3% year over year.

Profitability for the company also worsened in 2021. Net income from continuing operations totaled $3.4 million. That compares to the $8.6 million seen in 2020. Other profitability metrics posted similar results. Operating cash flow dropped from $19 million to $8.6 million, while the adjusted equivalent declined from $18 million to $14.5 million. Even EBITDA declined, falling from $20.6 million to $16 million. The worsening on the company’s bottom line was driven in part by the drop in revenue. However, the company also suffered from a significant operating loss associated with the same segment. Without that loss, operating income for the company would have actually increased in 2021 by 10%. This likely would have filtered down into the company’s bottom line, including in its cash flow data.

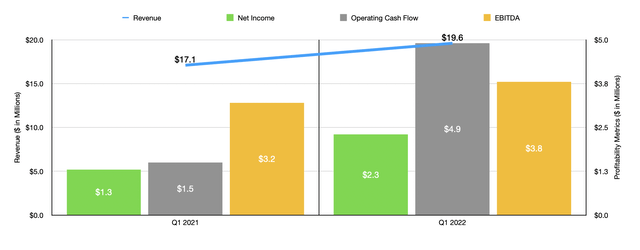

Author – SEC EDGAR Data

The good news for investors is at the business is showing some good signs so far this year. In the first quarter of 2022, revenue of $19.6 million came in 14.6% above the $17.1 million reported the same time one year earlier. Profitability figures were also encouraging. Net income of $2.3 million handily surpassed the $1.3 million reported one year earlier. Operating cash flow more than tripled, skyrocketing from $1.5 million to $4.9 million. Meanwhile, EBITDA also improved, rising from $3.2 million to $3.8 million.

Fundamental data aside, the company also boasted some attractive contracts recently. Most recently, management announced a contract wherein the firm will construct a wastewater treatment plant for a customer in Arizona. This project will take an estimated 26 months and involves an $82 million fee for the company’s services. For that, management landed yet another contract. This came in the same month, just seven days earlier in fact, on May 10th when the business announced a comprehensive contract involving the design, construction, and operation of a desalination plant in the Cayman Islands for $20 million.

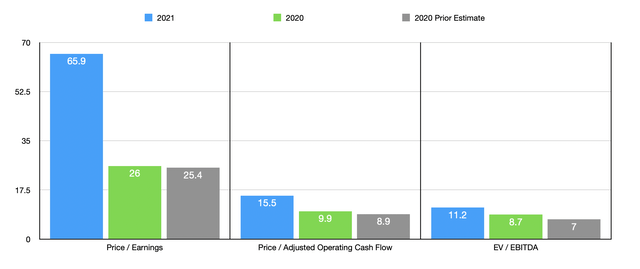

Author – SEC EDGAR Data

Given how early it is in the 2022 fiscal year and given an absence of guidance as to what to expect for the year as a whole, I think the best way to value the company is through the lens of the 2021 fiscal year as well as by comparing that data to the 2020 fiscal year. On a price to earnings basis, shares of Consolidated Water are trading at a multiple of 65.9. This compares to the 26 the company would be trading for if financial results recover back to what the firm experienced in 2020. When we consider how volatile earnings have been in recent years, I do not think this is the best way to value the firm. For instance, if we use the price to adjusted operating cash flow multiple, we are looking at a reading of 15.5. That’s up from the 9.9 we get if we rely on 2020 figures. Using the EV to EBITDA approach, we end up with multiples of 11.2 and 8.7, respectively, for the 2021 and 2020 fiscal years. To put this in perspective, when I last wrote about the firm, my calculations for the 2020 fiscal year were 25.4, 8.9, and 7, respectively. Using our 2020 figures, Consolidated Water has gotten more expensive in two out of three scenarios.

Takeaway

Right now, I would say that, in many ways, things are looking up for Consolidated Water. The contracts the company was recently awarded are promising and we are seeing some nice signs of a recovery. Shares are far from overpriced at this time, but they also aren’t incredibly cheap either. I would make the case that the firm might be slightly undervalued, but it is more likely than not closer to fairly priced. Long term, I suspect the company will do well for itself and its shareholders. But given the run-up we have seen in price and what that means for the company’s multiples, I do think there are better prospects to be had on the market right now.

Be the first to comment