Dilok Klaisataporn

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 17th.

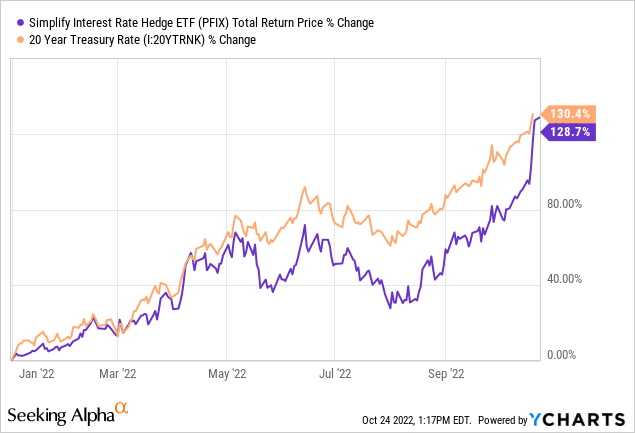

I last wrote about the Simplify Interest Rate Hedge ETF (NYSEARCA:PFIX) in May 2022. PFIX provides investors with a simple, incredibly effective way to profit from higher interest rates. PFIX sees higher returns the higher rates rise, especially as the 20Y treasury rate nears 4.0%. Interest rates have risen all year, with 20Y treasury rates breaching 4.0% in late September. PFIX was specifically constructed to benefit from these conditions, and it has, with the fund seeing returns of over 128% YTD.

In my opinion, although PFIX remains an effective way to profit from higher interest rates, the fund no longer presents a compelling risk-return profile. Risks are materially higher now, as the fund sees higher losses and volatility as 20Y treasury rates near 4.0%, as is currently the case. Returns are materially lower now, as real interest rates are nearing their historical averages. Long-term rates could continue to increase, but not as much as in the past, in my opinion at least. As PFIX no longer presents a compelling risk-return profile, I would not be investing in the fund at the present time.

PFIX – Quick Overview

I’ll start with a quick overview of the fund and its expected performance. I have a longer, more detailed explanation in my previous article.

PFIX invests 50% of its assets in 5Y treasuries. These are simple holdings, and mostly provide the fund with a little bit of income.

PFIX invests the other 50% of its assets in 7-year OTC payer swaptions on the 20Y treasury rate. PFIX buys these securities from a counterparty. In exchange, PFIX receives hefty profits if the 20Y treasury rate rises above a predetermined strike price, currently 4.00%-4.25%. PFIX would also see hefty profits as rates near 4.00%, from speculators bidding up the price of these securities. As rates have risen above 4.00%, PFIX is currently profiting from these options, and would see higher profits if rates continue to increase.

PFIX bought these swaps when interest rates were very low, so they were bought at very low prices (counterparties thought it would be very unlikely they would have to pay up, rates would have to increase too much for that). This allowed the fund to buy a lot of these swaps, meaning potential profits from rising rates were extremely high. Rates rose, and profits were extremely high, as expected.

PFIX’s strategy remains unchanged, so the fund should see further significant gains if rates continue to trend higher. Although this is a reasonable value proposition, I don’t find the overall risk-return profile of the fund to be compelling. Let’s have a look as to why.

PFIX – Risk-Return Profile

Risk and Potential Losses Analysis

PFIX is almost always an incredibly risky fund, for two reasons.

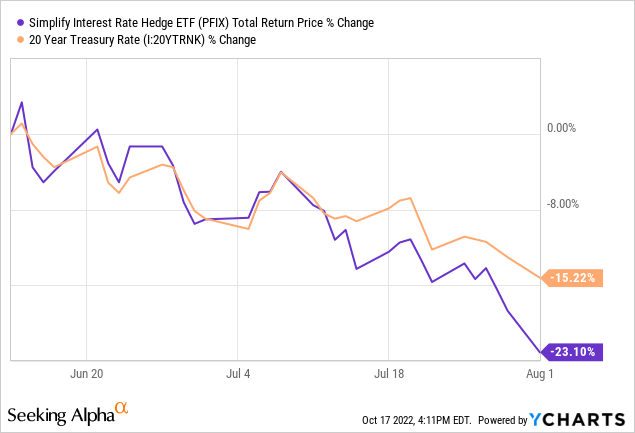

First, the fund’s options are implicitly leveraged, which magnifies potential gains when rates rise, and losses when rates decrease. Rates have almost always increased since the fund’s inception, so leverage has been a net positive, with a few exceptions. As an example, long-term rates decreased 0.5% from mid-June to early August, during which PFIX saw losses of 23.1%. The fund suffered significant losses from only a slight decrease in interest rates, due to the implicit leverage of its holdings.

Data by YCharts

PFIX’s leverage has, a few times, led to some losses in the past, and would lead to significant losses moving forward if rates were to decrease. This is a significant risk for the fund and its investors.

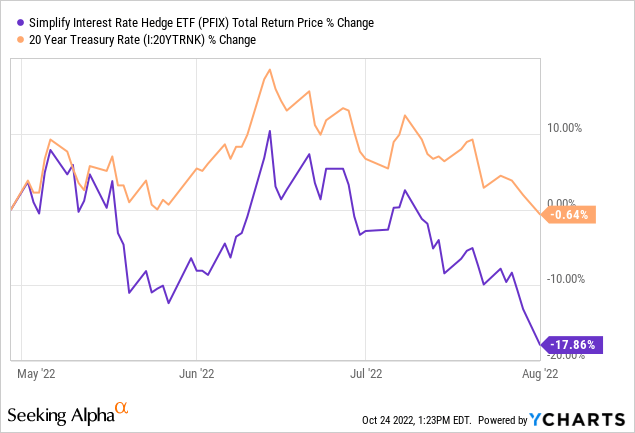

Second is the fact that the fund’s strategy is quite costly, options are expensive, and so the fund should see losses unless rates rise, even if rates are flat. This was, for instance, the case between May 2022 and August 2022.

PFIX sees losses under most scenarios, making it a relatively risky fund.

The risks above are structural, and have been an issue for the fund since its inception. There are several risks which have only become a concern quite recently, due to changing economic conditions. Two stand out.

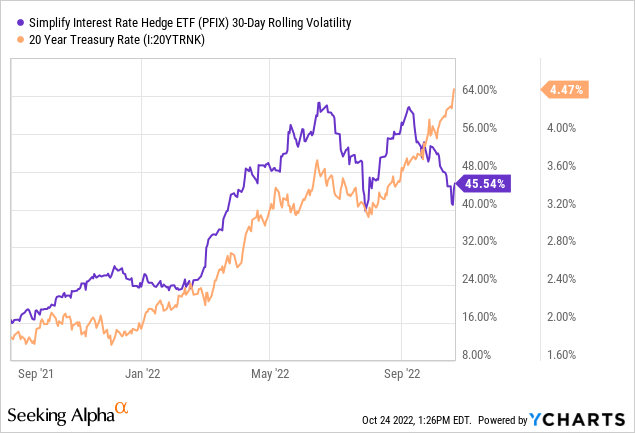

First, PFIX’s options are structured such that profits and losses increase once 20Y treasury rates near 4.00%. Option prices tend to be incredibly stable, and incredibly low, when interest rates are significantly below said range, due to the low probability of profits. Option prices start to see some movement as rates near said range, from speculators. Option prices start to see significant movements as rates hover/breach said range, from speculators, and from option profits. 20Y treasury rates breached said range last month, so heightened volatility, risk, and potential losses are to be expected moving forward.

These issues are structural, related to portfolio construction and option fundamentals, but only important when rates are relatively high, as they are now. These issues can be seen at the fund level as well. PFIX’s volatility has tripled YTD, is clearly correlated to treasury rates, but was materially higher last month. Correlation is not perfect, but strong regardless.

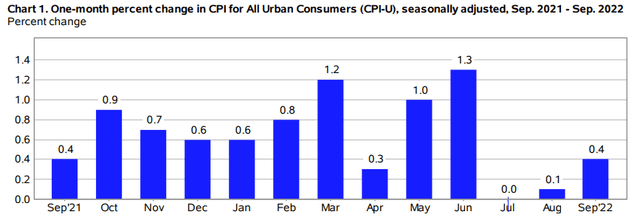

Second, PFIX should see significant losses if rates were to decrease, which seems much likelier now than in the past. Inflation has started to normalize, with month-to-month CPI averaging 2.0%, annualized, these past three months. Easier to see in graph form, see below.

BLS

If inflation continues to normalize, the Federal Reserve would ease or cease hiking, leading to lower interest rates across the economy. Although this is far from certain, it is definitely possible, and much more possible now, with some signs of inflation easing, than in prior months. In my opinion, interest rates are unlikely to decrease in the near future, but the possibility, and risk, remains.

Do remember that for PFIX, it is the 20Y treasury rate which matters the most, and that rate is strongly affected by investor sentiment, trading, and the like. Relevant rates could decrease even if the Federal Reserve continues to hike rates, if investors start to expect fewer, slower, rate hikes moving forward.

PFIX should see significant losses if interest rates were to decrease, a possibility under current economic conditions. Risks are materially higher now than in the past, a negative for the fund and its shareholders.

Potential Returns Analysis

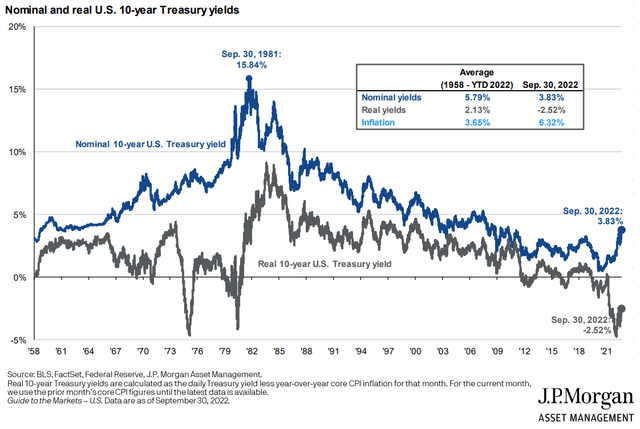

PFIX should see significant gains if interest rates continue to increase, but rates simply have much less room to grow now than in the past, in my opinion at least. Importantly, the data seems to bear this out. As per J.P. Morgan, real interest rates, normalized for annual inflation, reached a trough of -5.0% a few months back. Rates reached -2.5% in late September, and have risen to -1.6% as of today. Real interest rates have hovered around 0% for the past decade, so most of the increase has already occurred, although we still have some ways to go until inflation and rates are fully normalized.

J.P. Morgan Guide to the Markets

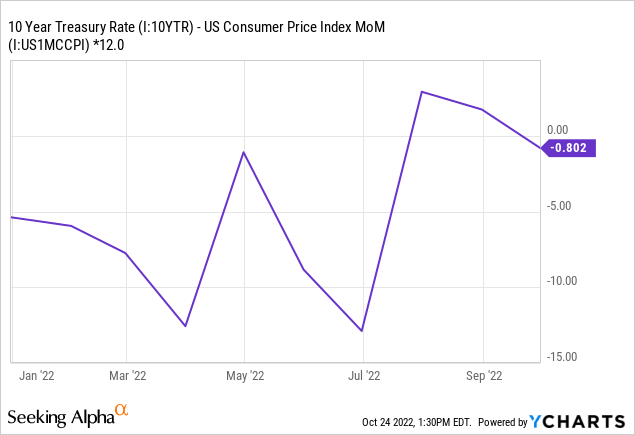

The above analysis uses annual inflation figures, which is standard. Month to month figures might better reflect short-term inflation and inflation moving forward, albeit at much higher volatility. Using monthly CPI, it seems that inflation has almost completely normalized by now, with real rates of -0.80% as of today, although with a lot of volatility. (Graph of this below)

As should be clear from the above, interest rates have mostly normalized by now, although not completely so, and conditions remain in flux. Still, it does seem that further rate increases are less likely now than in the past, and any possible increase would be smaller too. Rates simply have much less room to grow now than earlier in the year.

PFIX’s returns are dependent on interest rates remaining elevated or increasing, so potential returns are lower than in the past, while risks are higher too. The risk-return profile of the fund has materially worsened, in my opinion at least.

Conclusion

PFIX provides investors with a simple, incredibly effective way to profit from higher interest rates. In my opinion, although PFIX remains an effective way to profit from higher interest rates, the fund no longer presents a compelling risk-return profile. As such, I would not be investing in the fund at the present time.

Be the first to comment