Khanchit Khirisutchalual

Thesis update

This post is an update to my original DoubleVerify (NYSE:DV) thesis.

I continue to recommend going long on DV ($26 as of this writing). It is a leading player that rides on the strong tailwinds of digital advertising and has the support of several blue-chip customers. More importantly, the 3Q22 earnings report indicates that DV is executing well in achieving its strategic growth objectives, which I believe is more important than short-term financial performance as DV is still in an investment mode. Despite the weak macroenvironment today, if one were to look over the longer term, I believe it should continue to grow at high levels for the foreseeable future on a CAGR basis.

Earnings update

Strong performance relative to consensus estimates, albeit some misses

DV’s Activation division was particularly strong, contributing to the company’s ability to surpass revenue and adjusted EBITDA estimates for the quarter.

Activation and faster-growing channels like Social and CTV drove 3Q22 total revenues to surpass consensus estimates and prior guidance, prompting management to raise prior FY22 revenue guidance. In addition, thanks to strong top-line growth and careful cost management, 3Q22 adjusted EBITDA results topped analysts’ projections and came in above the high end of previous guidance.

Contrarily, macroeconomic and foreign exchange headwinds caused 3Q22 measurement revenue to fall just short of consensus estimates. Considering the many temporary headwinds that have slowed international growth, this was not a terrible miss.

Strategic performances are in line with long-term growth

Strong performance was evident across all three of DV’s business lines from my perspective, as the firm is committed to its stated goals of increasing both its client base and its average revenue per client, as well as its geographic footprint.

Long-term growth opportunities have been actively pursued, resulting in the introduction of new products like the Authentic Attention Snapshot, which was released in Q3 and is now used by 600 clients, and the expansion of social platform partnerships like the introduction of Twitter Beta, the growth of TikTok and LinkedIn, and the addition of channels. While Retail Media Network revenue increased by over 130%, CTV measurement volume increased by 53% year over year. These are all qualitative signs that, to me, indicate DV is growing as expected.

Management also claimed that it closed more deals in the third quarter than in the first half of the year, with a win rate of 80% or higher thanks to the value proposition it presented to prospective customers. According to DV, the percentage of greenfield wins in Q3 was 71%, the highest it has been all year. Greenfield wins that can be attributed to international expansion show that companies can gain traction with customers despite challenging market conditions. The key takeaway is that despite these challenges, DV is still growing its customer base. Despite the fact that I’ve noticed a slowing in DV’s overall growth and some strain in international markets, I still think the company is more resilient than its competitors thanks to its competitive pricing, relative under penetration of certain market segments, and compelling product vision.

Tracking data

Guidance is not great, but not terrible either

Management commentary suggests Q4 revenue guidance reflects some uncertainty about the macro environment, especially in the Activation segment, despite the fact that revenue guidance was raised. The guidance isn’t great, but it’s also not terrible. Given the current state of the economy as a whole, it is challenging for any business to provide exceptional guidance with much certainty.

The fact that the revised FY22 Adjusted EBITDA guidance did not increase in tandem with the revised revenue guidance caught my eye because it may indicate a slightly higher cost intensity in 4Q22. This is something to keep an eye on, as it could mislead some investors into thinking DV is not becoming more profitable.

Valuation

Price target update

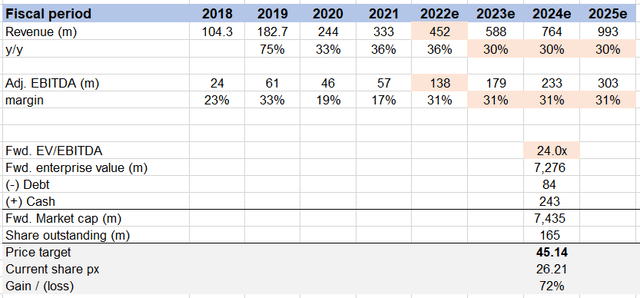

There is a minor change to my price target in FY24, from the initial $51 to $45. This is to reflect the expected growth slowdown in 4Q22 and a more conservative approach over the next few years. My belief remains the same that DV will continue to enjoy strong secular tailwinds which supports its high growth rate, but have toned down the growth estimates from 36% CAGR to 30% CAGR.

In terms of EBITDA margins, I increased my estimates from 29% to 31% to reflect consensus expectations. Something to highlight here is that DV has very high gross margins (80+%), which could potentially increase further to 90% if it raises prices. Which means I am underestimating the EBITDA margin potential of DV.

Conclusion

Simply put, I remain of the opinion that DV’s true worth exceeds its current price. In the future, I believe that DV will be helped by several secular tailwinds in digital advertising such as:

- Increasing proportion of media budgets and time spent on digital platforms

- A greater emphasis on brand protection, fraud detection, and content moderation across all forms of digital media;

- More time spent on rapidly expanding and emerging digital channels like social media and connected television.

Be the first to comment