mattjeacock

Even though value and growth are two distinctively different investment styles, they’re not mutually exclusive. On the contrary, some stocks may have features of both, which increases the chance of considerable returns. This is exactly what I see in the case of PetroTal (OTCQX:PTALF)(TSXV:TAL:CA). The company, which is registered in Canada and is operating in Peru, has achieved impressive production growth, although it’s facing some logistic issues lately. With the currently operating Block 95 still having room for growth, PetroTal could more than double its production by the end of the decade though Block 107.

While the logistical issues and other potential risks should be taken into account, the current enterprise value implies that an investor is getting the 2P reserves after-tax NPV of the Bretana field of Block 95 at a 60% discount and all the potential of Block 107 is for free. Management intends to do an uplisting on the TSX by 2022 year-end, while a shareholder return may be announced in Q1’23, which should make the company more visible to investors and acts as a near-term catalyst.

Company overview

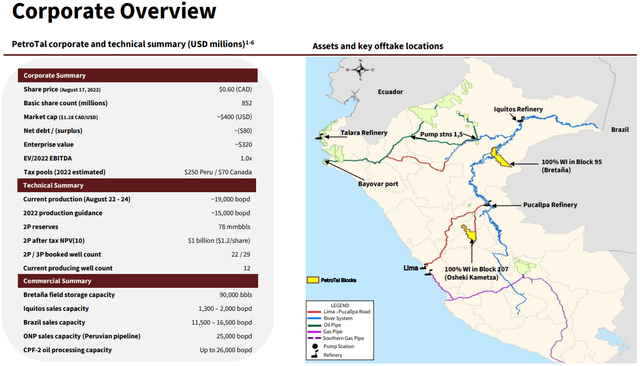

PetroTal is a Canadian oil and gas company with assets in Peru. It was formed in 2017 as a result from a merger between Sterling Resources and the Peruvian assets of Gran Tierra Energy (GTE). The two main assets of PetroTal are Block 95, which includes the Bretana field, where current production is taking place, and Block 107, which is not in production yet, but has serious potential.

Company overview (Petrotal)

As of 24th August, there are 852.2M shares outstanding, 27.9M of performance share units (PSU) and 62.7M of performance warrants. The ownership structure is dominated by institutions with the biggest shareholder being Meridian Capital International with 18.5% stake, followed by Kite Lake Capital Management (10.5%) and Burggraben Holding (8.1%).

Recent performance

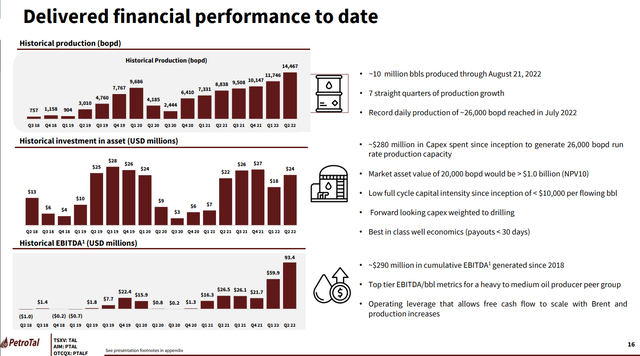

PetroTal has been consistently increasing production prior to the lockdowns in response to the pandemic, which led to sharp decline in oil prices. After that, production has been on an uptrend again as 14.5kboe of daily rate was reached in Q2’22.

In terms of financial results, the increase in production in conjunction with higher oil prices have led to cash flow bonanza. Since the beginning of the year, PetroTal has generated around US$100M of free cash flow and according to recent guidance from the Q3’22 operational update, is expected to achieve US$211M of free cash flow for 2022. In turn, the financial position of the company has greatly improved and management intends to fully repay its US$80M of remaining bonds and may initiate a shareholder return program in the beginning of next year.

Petrotal’s recent performance (Petrotal)

It has to be noted, that there are some challenges with receivables this year, as they have reached US$123.7M at the end of Q3’22. The majority of them are owed by the state-owned Petroperu, which as operator of the North Peruvian Pipeline (ONP) is a main trading partner of PetroTal , which uses the pipeline to get its production to market. Petroperu has been shaken by scandals and its financial condition deteriorated recently. However, a few weeks ago it was announced that the state-owned entity will receive capital injection from the government, which should allow it to repay its obligations to trading partners.

Logistical issues

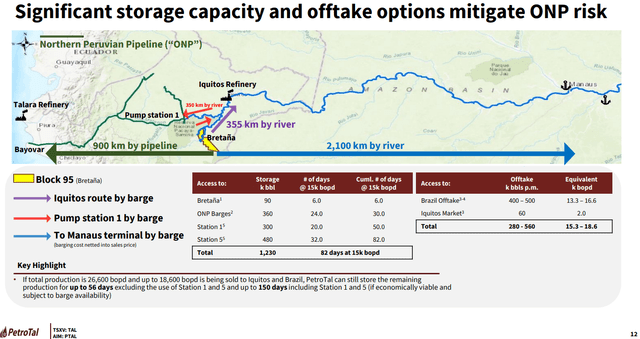

The shortest route for PetroTal’s production to reach international markets is through the above mentioned ONP pipeline. However, the pipeline is very old as it was built in 1977 and corrosion problems are leading to constant leakages, which not only disrupts operations, but pollutes areas inhibited by indigenous people. As a response to the oil spills, there’s civil unrest and blockades of infrastructure. PetroTal had to close down operations this year for a period of time, due to such civil unrest. The operational challenges of the pipeline continued in Q3’22 and the company was forced to constrain its production, which amounted to 12.2kboe/day – breaking the quarterly growth trajectory.

Petrotal’s storage capacity (Petrotal)

In order to mitigate some of the risk of the constant operational disruptions for maintenance of the ONP pipeline, PetroTal has developed significant storage facilities and is expanding the capacity of its route by river to Brazil. However, this is not an all-round solution, since most of the storage capacity is outside the Bretana field, so production still has to leave the premises of the company, which could be prevented by civil unrest in the area. Also, exporting through barges may be impacted by low river levels as it was the case recently. I expect that ONP problems will persist and repair and maintenance on isolated areas of the pipeline will be only a temporary solution. In order for the issue to be generally resolved, the whole pipeline must be renovated, but that would be a costly endeavour for the poor state of Peru. As long as river levels are normal, PetroTal could export its production through the Brazilian route, and in cases when dryness in the area persists, barges would have to be loaded at reduced capacity.

Expansion plans

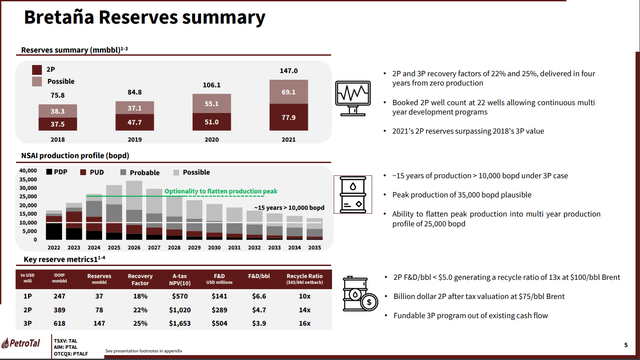

Bretana field production plan (Petrotal)

Through exploration, PetroTal has been consistently expanding the reserves at the operating Bretana field and envisions a path to flattening production to levels around 25kboe/day for multiple years just from this field. The latest news from the field are encouraging as well 13H has been successfully tested for production of 8kboe/day in the beginning of November.

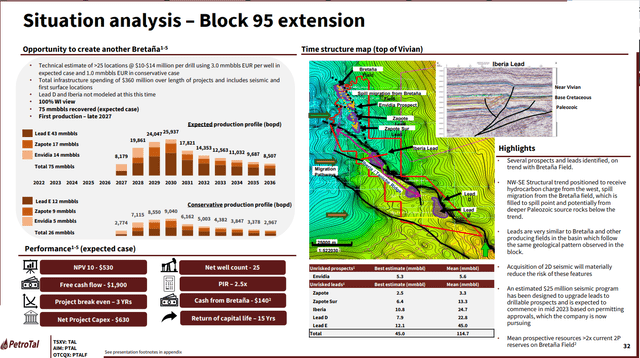

Other prospects from Block 95 (Petrotal)

Besides Bretana, Block 95 has lots of very promising extensions, which could be put into operations by the second half of the decade and further support production growth. Funding of the expansion could be done by own funds, if current oil prices remain persistent and the company continues to generate significant cash flows.

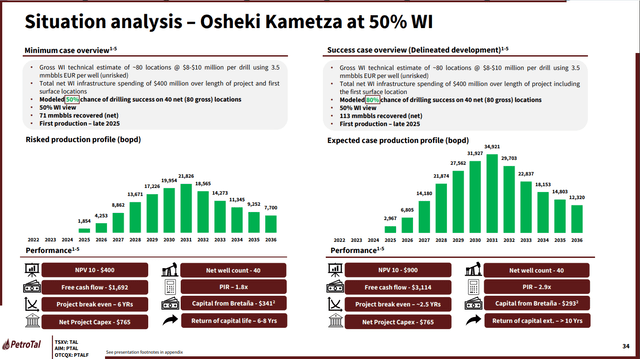

The Osheki Kametza field of Block 107 (Petrotal)

The other property of the company – Block 107 has impressive prospects. The main area of interest of it is the – Osheki Kametza field, which according to the company has the potential to double the production from the currently operating Block 95. However, as it’s likely to be capital intensive, PetroTal is looking for a JV partner for the development of this prospect. For that reason, the production scenario of the company is based upon 50% working interest, although currently it’s the sole owner of the asset.

Share price and valuation

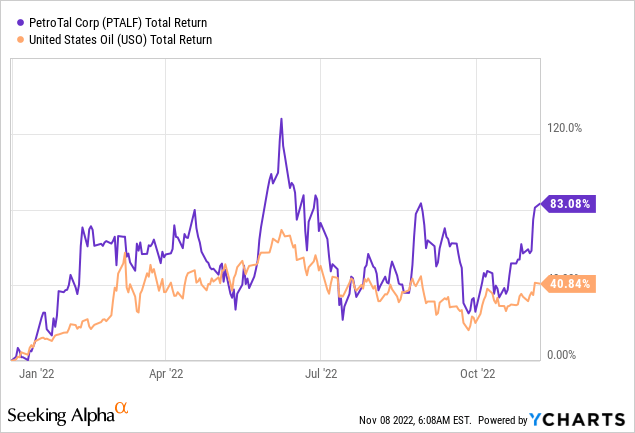

PetroTal has awarded investors with more than 83% share price increase YtD, more than double that of the United States Oil ETF (USO). However, when looking at the company’s reserves and production growth trajectory, I think there’s more room to the upside. The current market cap of around US$510M implied more than 40% FCF yield, when using company’s recent guidance for 2022 FCF. Moreover, the current EV of about US$400M is 2.5x lower than the estimated NPV of the 2P reserves, discounted at 10%, of just the Bretana field, without taking into account all the remaining potential of Block 95 and Block 107.

Besides the risks, related to operating in Peru, including the logistical issues, there are a few other factors that I believe are causing what appears to be a wide valuation gap. First of all, unlike many energy companies, PetroTal is not returning any value to its shareholders in terms of dividends and/or buybacks, yet. However, this could change soon. Management has indicated intentions to fully retire the outstanding bond issue and begin a capital return program. In turn, this could put the company on the radar of investors, who want some of the profits to be shared with them regularly. Also, the CEO of PetroTal has said that a process of uplisting on the TSX is in motion and could be completed by the end of the year. As a result, the company may become more visible for investors.

Risks

Political risk

Peru has been in a political turmoil lately, as the current leftist president survived two impeachment trials and another legal battle seems to be forming. There also huge protests in the capital city of Lima. In such an environment, politicians may see in PetroTal’s profits a chance to buy themselves out by promising more social spending. However, PetroTal’s CEO has ruled out the possibility of windfall taxes, explaining that it would require constitutional changes.

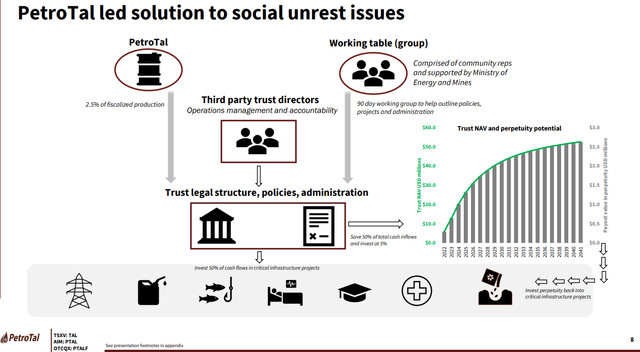

Petrotal’s social fund (Petrotal)

While the company couldn’t change the bigger picture in the country, it’s taking steps to strengthen the relationship with the local communities in its area, in order to reduce the risk of unrest disrupting its operations. One such initiative is the 2.5% social fund, which should invest in social infrastructure for the benefit of the local community.

Logistics risk

The impressive production growth trajectory of the company has been disrupted in Q3’22 by logistical issues and further growth may be constrained as well. The ONP pipeline seems very unreliable, so the efforts of PetroTal to further develop and increase the capacity of the Brazilian route through river seems like the best available option. However, in case of persistently dry weather, water levels may decrease, which limits the loading capacity of the barges.

Conclusion

With PetroTal, investors shouldn’t choose between value and growth, as the stock is offering both. The current market price implies 40% FCF yield for 2022 and 60% discount of the EV to the estimated NPV of the Bretana field. On top of that, there’s significant potential for growth from the rest of Block 95 as well as Block 107. A possible introduction of a shareholder return program and uplisting on the TSX could acts as upside triggers. However, the company has to deal with logistical issues, which could hamper the production growth and Peru is not very stable politically. For that reason, I think that the stock should be considered only by investors with high risk tolerance.

Be the first to comment