Prostock-Studio/iStock via Getty Images

Introduction

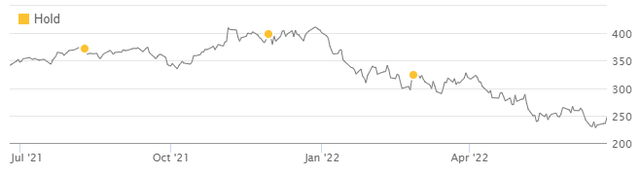

We review our Hold rating on ANSYS, Inc. (NASDAQ:ANSS). Since we last reiterated our rating in February, ANSYS shares have fallen by a further 20%, and are now 40% below their December 2021 peak:

|

ANSYS Share Price vs. Librarian Capital Rating History (Last 1 Year)  Source: Seeking Alpha (23-Jun-22). |

We downgraded our rating on ANSYS from Buy to Hold in May 2020, when the share price was $263.51. After more than two years, the share price is now 6% lower.

In the last few months, ANSYS has reported strong Q1 2022 results and raised its 2022 outlook operationally. Shares are now trading at approx. 32x guided 2022 Non-GAAP EPS. However, we still view ANSYS stock as too expensive.

ANSYS Hold Case Recap

ANSYS is a global leader in engineering simulation software and services. We recognise the quality of its business, but expect future returns in its stock to be limited because of valuation.

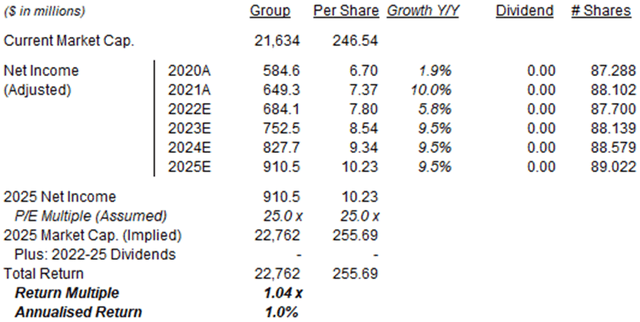

Our key assumptions and illustrative forecasts for ANSYS are as follows:

|

Illustrative ANSYS Return Forecasts  Source: Librarian Capital estimates. |

- 2022 EPS to be in the upper half of latest guidance ($7.53-$7.94)

- Thereafter, Net Income to grow by 10% annually

- 2022 share count as guided; thereafter, it is to grow by 0.5% annually

- P/E at 25.0x at 2025 year-end

With shares at $246.54, these imply a total return of just 4% (1.0% annualized) by 2025 year-end, mostly due to a downward re-rating.

ANSYS stock had traded above 60x at various points, for example when it first peaked at $413.19 in February 2021. We first described this as “part of a speculative bubble in certain Technology stocks and unsustainable” in our November 2021 update, and this view has been proven correct in 2022.

We review each of the key assumptions in light of recent events below.

Assuming 10% Net Income Growth

Our assumption of a 10% Net Income growth is likely on the optimistic side.

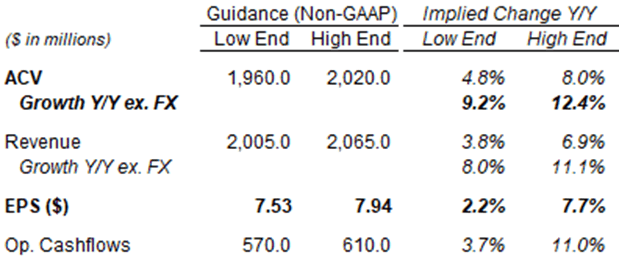

The latest 2022 outlook, released with Q1 2022 results in May, is for a Non-GAAP EPS of $7.53-$7.94, implying year-on-year growth of 2.2-7.7%:

|

ANSYS 2022 Outlook (Non-GAAP)  Source: ANSYS results release (Q1 2022). NB. Operating Cash flow outlook is after $60-80m of income tax cash outflows related to R&D capitalization timing. |

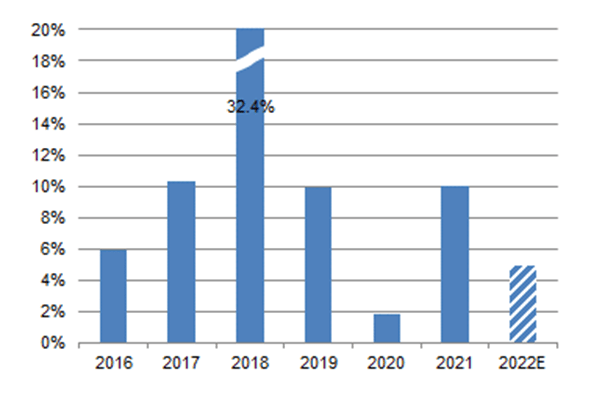

At mid-point, the 2022 outlook implies an EPS growth of approx. 5%, which would represent a continuation of ANSYS’ track record where, except a bumper year in 2018, Non-GAAP EPS growth has been at or below 10%:

|

ANSYS EPS Growth (Non-GAAP) (2016-22E)  Source: ANSYS company filings. |

The 2022 Non-GAAP EPS guidance is net of a $0.14 impact from the loss of Russia/Belarus revenues and a negative impact from a strong USD, offset by a slightly smaller share count. However, ex-currency growth is expected to be 9.2-12.4% in Annualized Contract Value (“ACV”) and 8.0-11.1% in revenues, and ANSYS’ EBIT margin has been shrinking consistently in the past, so underlying Net Income growth is also likely to be less than 10%.

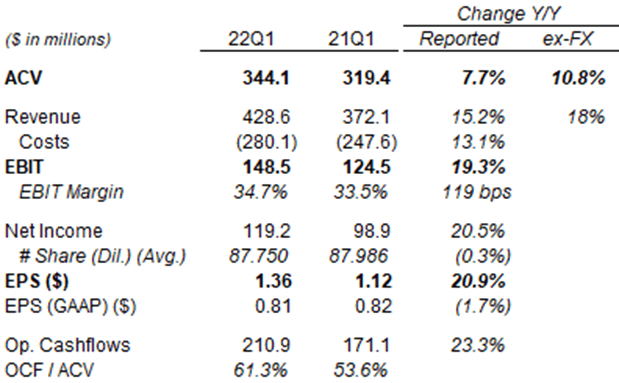

For Q1 2022, ACV grew 10.8% year-on-year excluding currency in Q1 2022; revenues grew more because of the upfront recognition described above, which also helped EBIT margin expand year-on-year:

|

ANSYS Key Financials (Non-GAAP) (Q12022 vs. Prior Year)  Source: ANSYS results release (Q1 2022). |

However, we do not regard growth rates for each quarter as necessarily representative.

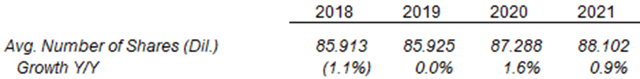

Assuming 0.5% Share Count Growth

Our assumption of a 0.5% annual share count growth compares with an average figure of 0.4% in 2018-21:

|

ANSYS Share Count & Share Count Growth (2018-21)  Source: ANSYS company filings. |

ANSYS does have share buybacks from time to time. It repurchased $155.6m of its shares in Q1 2022 (at an average price of $311.14), equivalent to 0.7% of its current market capitalization. However, since 2018, the share count has continued to increase as a result of both share-based compensation and acquisitions.

ANSYS has been an active acquirer and often uses its stock as part of the deal consideration – for example using stock to pay for 40% of the $775m Livermore Software acquisition in September 2019 and for 33% of the $700m Analytics Graphics acquisition in October 2020. We expect further acquisitions and stock issuance to continue.

Assuming 25x P/E

Our assumption of a 25x P/E is lower than for other technology companies. for a number of reasons.

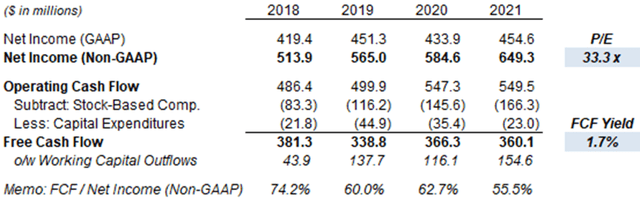

Our P/E multiples are based on Non-GAAP EPS, and cash conversion from Non-GAAP EPS to Free Cash Flow (“FCF”) was only 55.5% in 2021, having fallen consistently in recent years:

|

ANSYS Net Income & Cash flows (2016-21)  Source: ANSYS company filings. |

The gap between Non-GAAP Net Income and FCF is largely due to stock-based compensation, which is a real cost to shareholders but not included in ANSYS’ Non-GAAP financials.

With shares at $246.54, ANSYS has a P/E of 33.3x. However, its FCF Yield is just 1.7%, which translates to a multiple of more than 60x. We believe the P/E multiple should be more like 25x, which would translate to a FCF Yield of 2.2%. This compares with a current yield of 3.2% on 30-year U.S. Treasury Bonds, with ANSYS’ lower yield justified by its growth potential.

Valuation

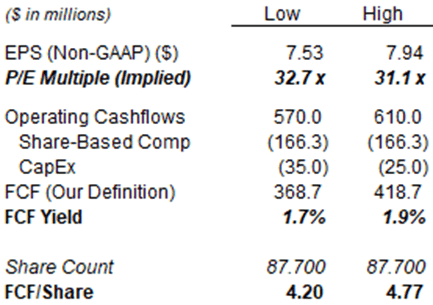

Relative to its 2022 outlook, ANSYS stock is trading at a P/E of 31.1-32.7x, or approx. 32x at mid-point:

ANSYS Cash Flows & Valuation (2022E)

Source: ANSYS company filings. NB. Assume share-based compensation costs to be the same as 2021. |

Optimistically assuming the same share-based compensation costs as in 2021, the implied FCF Yield is 1.7-1.9%. (We have not excluded the $60-$80m cash tax impact expected from a change in R&D capitalization timing.)

We believe ANSYS stock is currently too expensive.

Where We Can Be Wrong

Where we are most likely to be wrong on ANSYS is on its costs. Revenue growth is solid and, should management bring costs under control, earnings growth should pick up significantly and a much higher P/E multiple can be justified.

We are frankly puzzled by the continuing deterioration in ANSYS’ EBIT margin. Software businesses should have at least some operational leverage, and EBIT margins are already based on revenue numbers that include some revenues from multi-year contracts being recognised upfront.

Scenarios where ANSYS’ cost structure can improve significantly include: A bid from buyers who can extract cost synergies, interest from private equity and a change in management strategy, including due to activist investors. It is also possible that R&D costs will start to fall, now that capital markets are more difficult and even large profitable Technology companies like PayPal (PYPL) have started to cut their headcounts.

We will continue to monitor the situation at ANSYS.

Is ANSYS Stock A Buy? Conclusion

ANSYS shares have now fallen by 40% below their peak in December 2021, but we believe they are still too expensive.

With shares at $246.54, we expect a total return of just 4% (1.0% annualized) by 2025 year-end, mostly due to the P/E falling.

We expect Net Income to grow at 10% or less annually and for the share count to continue growing, consistent with ANSYS’s record.

ANSYS’s cash conversion is poor due to the size of its share-based compensation costs that are excluded from GAAP EPS.

ANSYS shares are currently trading at 32x guided 2022 Non-GAAP EPS, but we believe a multiple of 25x is more appropriate.

We reiterate our Hold rating on ANSYS stock.

Be the first to comment