Wagner Meier

Petrobras (NYSE:PBR) is the state-owned Brazilian oil company with a market capitalization of almost $90 billion. The company recently announced a windfall dividend of $17 billion on the back of its strongest quarter ever. As we’ll see throughout this quarter, Petrobras remains incredibly undervalued and can drive substantial returns.

Petrobras 2Q 2022 Financial Performance

Petrobras generated incredibly strong financial performance throughout the quarter.

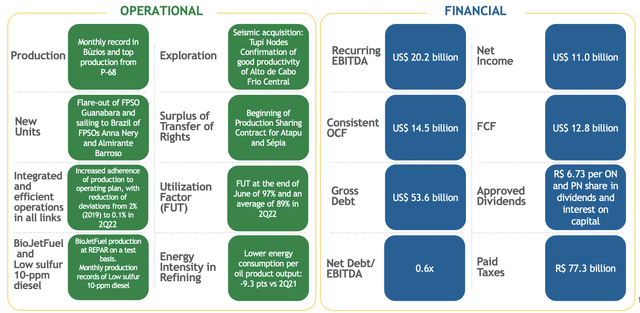

Petrobras Investor Presentation

Petrobras Financial Performance – Petrobras Investor Presentation

Petrobras generated a monthly production record and has continued to explore new assets. Brazil continues to increase its production as new assets continue to be found and Petrobras is the center of that. The company generated a massive $20.2 billion in recurring EBITDA and $12.8 billion in FCF, meaning an annualized FCF yield of more than 60%.

The company approved a massive $17 billion dividend, showing an almost 20% yield. The company’s gross debt of almost $54 billion is very manageable for the company (less than 5 quarters FCF). We’d like to see the company aggressively repurchase debt to save on the billions of interest payments especially in a rising debt environment.

Petrobras External Market Environment

Supporting Petrobras is the incredibly strong external market that the company operates in.

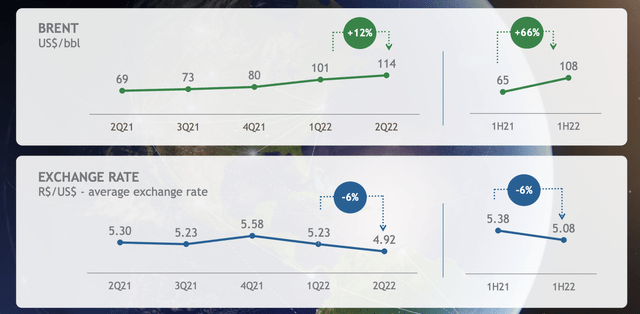

Petrobras Investor Presentation

Petrobras External Market – Petrobras Investor Presentation

The company saw average prices throughout the quarter of $114/barrel Brent. The 1H 2022 for the company was $108/barrel, just over 1% below current prices of $110/barrel. We don’t expect prices to stay at $114+ forever, however, we do expect the company to be able to comfortably average more than $100/barrel through 2022.

Its low costs and substantial time in a lower priced environment mean that the company is prepared to generate massive profits at current prices. From a financial perspective the company benefits from the weakening of the Brazil R$/USD$ which lowers its operating costs. However, the current is still stronger than where it was a year ago.

Petrobras Financial Positioning

Petrobras is well positioned financially, however, we see room for that to improve. We expect that political uncertainty and the company’s unpopularity at a time of high prices on the home front is pushing it to use its capital for dividends.

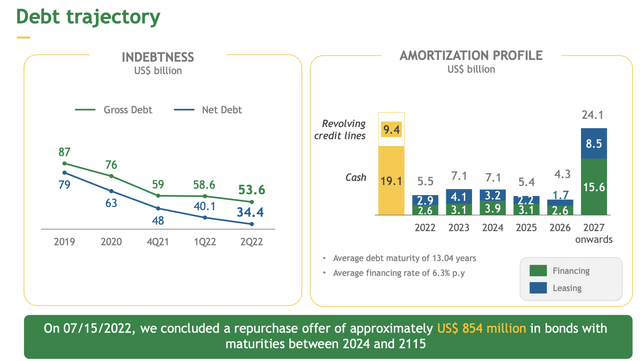

Petrobras Investor Presentation

Petrobras has steadily reduced both its gross and net debt from prior levels. In 2019 before the COVID-19 induced oil crash those numbers were $79 and $87 billion respectively. Since then, with the most recent quarter, the company has reduced those numbers to $34.4 billion and $53.6 billion respectively. In just a few more quarters, it can get those numbers to 0.

The company’s debt per year is manageable and the company continues to have minimal cash. If anything else, in a world of rising interest rates, we’d like to see the company pay down its debt as it comes due rather than rolling it over.

Petrobras Asset Base

Supporting Petrobras’ future shareholder returns is the company’s impressive asset base.

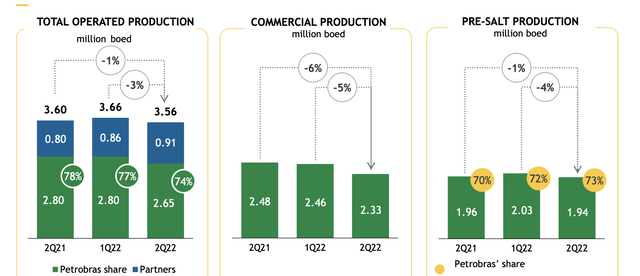

Petrobras Investor Presentation

Petrobras Asset Base – Petrobras Investor Presentation

The company’s operated production dropped by 3% QoQ, while its commercial production dropped by 5% QoQ. The company’s pre-salt production specifically dropped by 4%, but this impressive low cost production now makes up the lion share of the company’s overall production. The company’s share of the production here continues to be roughly 73%.

Among the company’s growing assets are its Buzios assets. The company hit a 92% production share with record production at more than 600 thousand barrels/day. The company is eying more than 2 million barrels/day in production by the end of the decade from a rapidly expanding Buzios development. It’ll cost $10s of billions but it’s comfortably affordable.

The company did have a slightly higher lifting cost due to more maintenance, however, its total cost per barrel produced was $42/barrel. It’s also worth noting that $20/barrel of this was taxes meaning that in a worst case situation the company’s costs are a mere $22/barrel.

Petrobras Shareholder Rewards

Putting all of this together, Petrobras has the ability to generate substantial shareholder rewards.

The company earned $12 billion in 2Q 2022 FCF up from $8 billion in 1Q 2022. That means annualized FCF of $40 billion at $108/barrel Brent, or almost half of the company’s market capitalization, below current prices. The company has announced a $17 billion or a ~20% dividend yield, and it has the cash to generate shareholder rewards through numerous avenues outside of that.

We’d like to see the company continue reducing its debt to save on the several billion of annual interest. The company has only looked at small buybacks, however, we’d like to see a buyback on the order of $10 billion. That’d enable additional cash to the Brazilian government through shareholder returns on its 64% stake.

Thesis Risk

The largest risk to the thesis is oil prices. Outside of taxes Petrobras has a lifting cost of roughly $22/barrel. Oil prices have dropped below this level below, however, we don’t see them as sustainable at that level obviously. We see the company as one of the most profitable companies at $100+/barrel, and expect it to continue performing well at higher prices.

Conclusion

Petrobras is back on the radar again after announcing a record breaking $17 billion dividend. We expect that this is on the basis of the company’s desire to maintain favor among a Brazilian government seeing price unhappiness among the populace. However, regardless the company is continuing to perform well and we expect that to continue.

The company has the ability to continue paying substantial dividends and investing in its future. It has a strong integrated portfolio and its Buzios asset development continues to have substantial growth potential. Overall, given this potential we recommend investing in Petrobras for the long run taking advantage of its opportunity.

Be the first to comment