HAYKIRDI/iStock via Getty Images

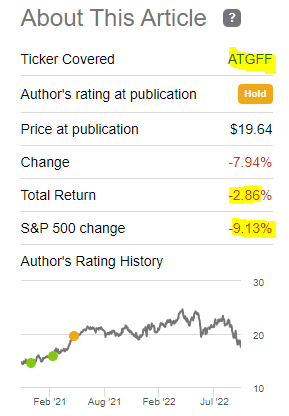

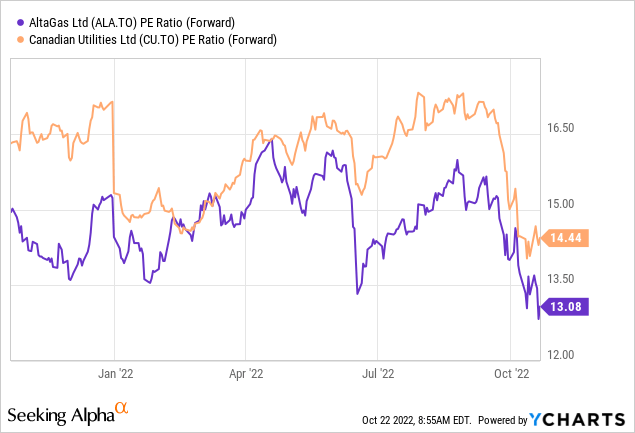

When we last covered AltaGas Ltd. (OTCPK:ATGFF) we moved to the sidelines as the valuation was not very compelling and the stock needed some time to digest its gains. Specifically we said:

On a valuation front, AltaGas is now getting to fair value as well and we think our base case here points to a $25.00 level. We base that on a minimum 4% dividend yield on its $1.00 annual payout and an 11X EV to EBITDA multiple.

Now, moving to neutral in this case is predominantly coming from a valuation standpoint. The company has executed soundly. Its internally funded capex model also allows for a dividend increase either later in 2021 or certainly in 2022, without upsetting the rating agencies. So one can “hold” here and play the long game.

Source: Moving To The Sidelines

The stock initially went higher, but has sold-off in this broad market mayhem.

Seeking Alpha

We look at the recent results and tell you why this might be getting interesting.

Q2-2022

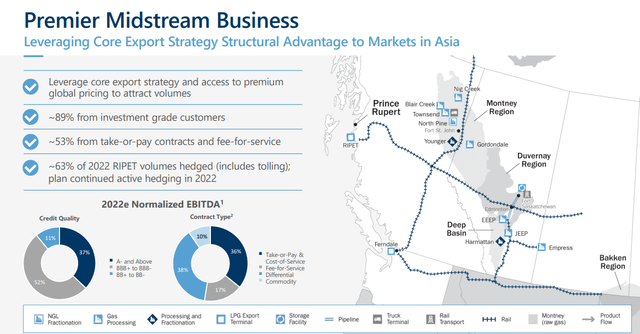

Q2-2022 results were slightly under analyst estimates as midstream underperformed slightly and offset the strong numbers from the utility segment. On the midstream side, inflation was actually a detractor, as logistical costs and hedges offset what was supposed to be a fantastic quarter for energy in general. Utilities continued to benefit from solid execution and increasing base rate. For the upcoming third quarter, we expect even better numbers than consensus, and we will get to that in our outlook below.

Outlook

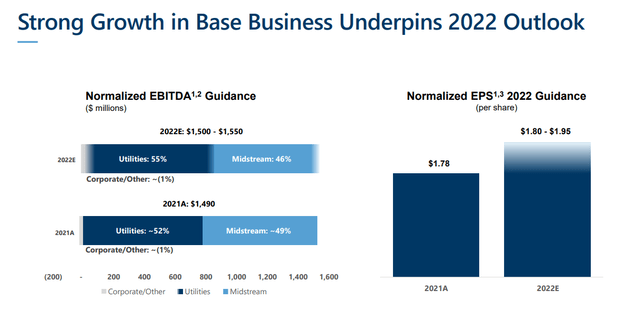

The company’s latest guidance in its September presentation was for about a 3%-4% increase in adjusted EBITDA, alongside a 5% increase (midpoint of numbers) in normalized earnings per share.

AltaGas September 2022 Presentation

There should be no issues in hitting those numbers, and the base rate increases over the next few years look locked in.

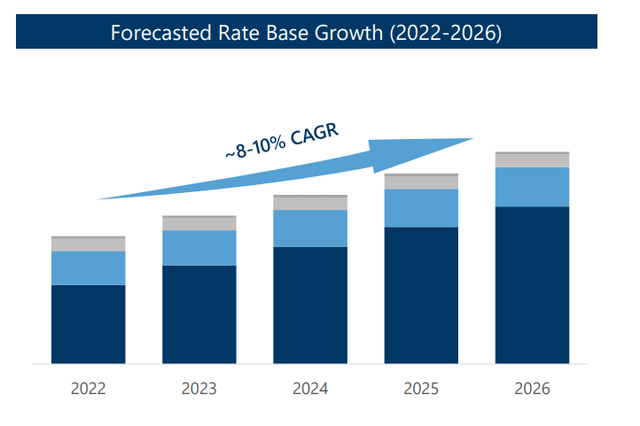

AltaGas September 2022 Presentation

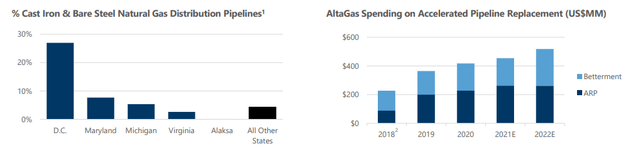

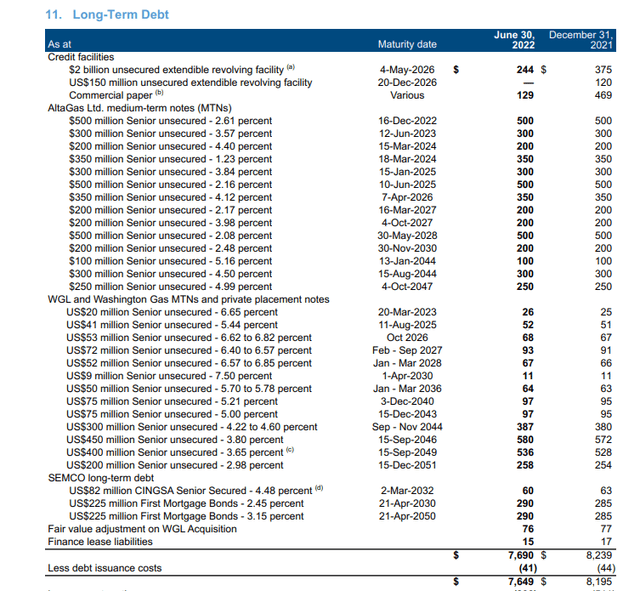

AltaGas had previously run a very leveraged balance sheet, and that balance sheet was the precise reason we had many bearish calls on this company in the past. A bad balance sheet with mandated capex creates a dangerous situation if regulatory authorities lower the return on equity number in base rate reviews. Even now, AltaGas has a lot of planned capex for pipe replacements.

AltaGas September 2022 Presentation

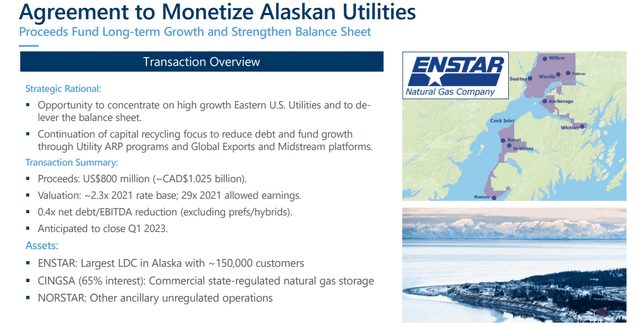

The difference is that the company can handle all of this in a cash-flow neutral manner. For this year, capex plus dividends should only slightly exceed operating cash flow (Source: our estimates and company guidance). Next year looks to be exceptionally good for the company as its Alaskan Utilities Sale goes through in the first quarter.

AltaGas September 2022 Presentation

The disposition happened in the range of 16-17X EV to EBITDA. AltaGas is comfortably trading under 11X EV to EBITDA right now. The sale was quite helpful for crystallizing value, and AltaGas should be able to throw that debt to EBITDA number finally under 5.0X (4.8X by our estimates) for 2023.

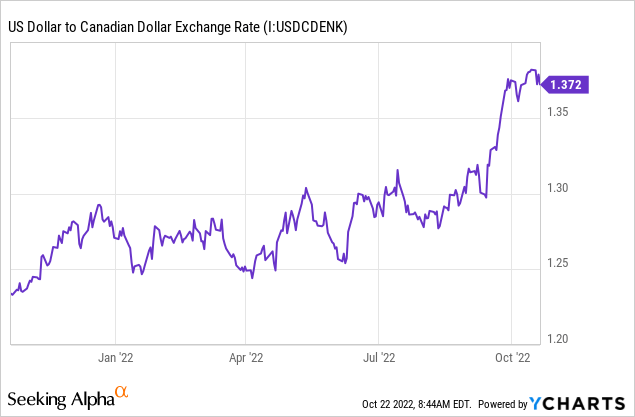

AltaGas also remains in a unique position to capitalize on US Dollar strength from its utilities segment, as its entire utilities segment is US based.

AltaGas September 2022 Presentation

At 1.37, the USD-CAD rate really helps AltaGas and earnings will surprise on the upside in Q3 and Q4, all other things being equal.

The company does hold a good deal of US dollar denominated debt, but the net impact of this weaker Canadian dollar will definitely help EBITDA.

The same table above shows us that AltaGas won’t have to tap the debt markets in the near future. Yes, we have the maturing $823 million in the near future, but that is more than offset by the Alaskan Utilities sale. The $2.0 billion revolving facility should also help smooth things over.

Valuation & Verdict

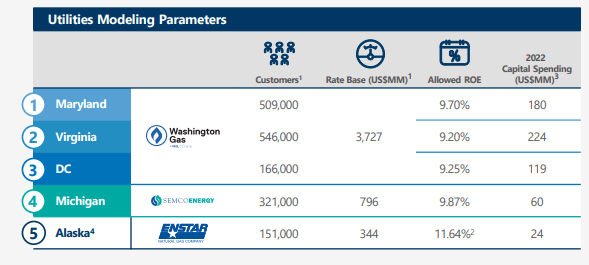

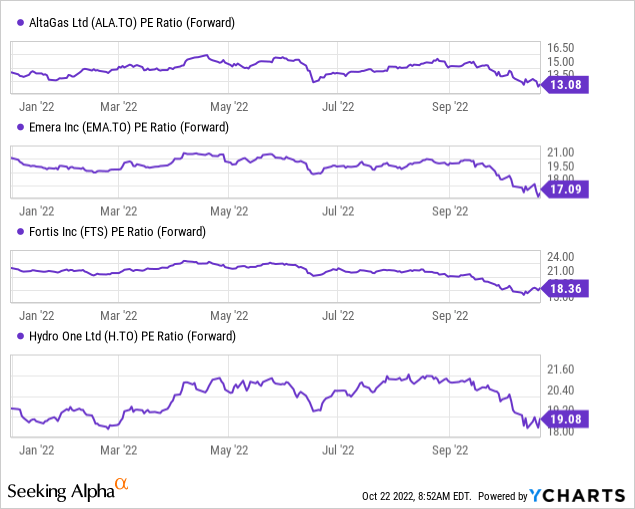

Among the Canadian utility segment, the Alaskan Utilities deal should propel it right to the top in terms of valuation. We have Fortis Inc.(FTS) and Emera Incorporated (OTCPK:EMRAF) [EMA.TO] struggling at near 6.0X Debt to EBITDA and Hydro One Limited (OTCPK:HRNNF) at near 5.5X. Fascinatingly, all 3 trade at least 4 P/E multiples higher than AltaGas.

The only real competitor for capital here is Canadian Utilities (OTCPK:CDUAF) which is at a similar debt to EBITDA level (5.0X).

AltaGas is likely suffering from an identity crisis as it does not really fit the utility segment or the midstream segment and people have a hard time blending multiples. But AltaGas is also cheap if you apply an adjusted funds from operations (AFFO) metric and run its numbers against Pembina Pipeline Corporation (PBA) or Enbridge Inc. (ENB). The AFFO yield is about 15% for AltaGas vs about 11% each for ENB and PBA. Its midstream assets are top-tier and would likely fetch at least a 12X EV to EBITDA multiple.

AltaGas September 2022 Presentation

All said and done, AltaGas is a buy, but there are two major risks.

Risks

The first caveat is that the Alaskan Utilities sale has to go through. Based on what we see, that looks like a done deal.

The Transaction was approved by the Boards of Directors of both TSU and AltaGas.

The Transaction is not subject to any financing contingency, and fully committed financing from TSU’s indirect shareholders for all funds necessary is already in place. TriSummit expects the permanent financing of the Transaction to be approximately 50 – 55 percent common equity with the remaining financing to be in the form of long-term debt. TriSummit anticipates having access to the U.S. private placement market as part of the permanent financing plan.

Following the close of the Transaction, ENSTAR will maintain its existing headquarters in Anchorage and will continue to operate as a standalone utility in Alaska. Its current management team and employees will remain in place.

Transaction closing

The Transaction is expected to close no later than the first quarter of 2023, subject to certain customary closing conditions, including regulatory and government approvals and clearances, including approval by the Regulatory Commission of Alaska and compliance with applicable requirements under the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976, and the satisfaction of customary closing conditions.

Source: Trisummit

Nonetheless, Capital markets have been extremely fragile the last few weeks and investors must be aware of the risk.

The second risk is a continued escalation in bonds yields. As a utility, AltaGas remains extremely sensitive to the risk-free rate, and all the positives in place will mean nothing if the bond markets remain unidirectional.

AltaGas trades OTC in the US markets and the average trading volume is about 7,000 shares a day in the last 30 days. It is far more liquid on the TSX trading as ALA:CA, with an average trading volume of close to 800,000 shares a day.

A Second Verdict

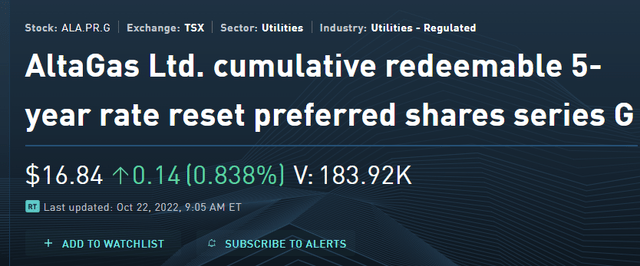

While AltaGas shares are a buy, investors wanting a high yield from a quality play, may consider its preferred shares. We like the Series G (ALA.PRG:CA).

The issue yields 6.29% and resets in September 2024 at Government of Canada 5 year bond yield plus 3.06%. That reset (if yields stay the same), works out to about a 6.76% on par or about 10.03% on current price.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment