filo/E+ via Getty Images

Investment Thesis

Due to the multiple CEO changes over the past few years, it is evident that Petróleo Brasileiro S.A. – Petrobras (NYSE:PBR) (NYSE:PBR.A) is in more for uncertainties ahead. As with predecessors, the President-elect Luiz Inacio Lula da Silva will install a new management team over the next few months, yet again, triggering more sweeping changes across the board. The one most keenly watched will be the company’s dividend strategy, since the new President has been most vocal about his intention to cut dividend payouts.

As highlighted in our previous article, PBR’s LTM dividend yield of 38.11% was not sustainable, due to the recently moderated oil/gas prices and growing political risk. Now that the stock has retraced by a tragic -36.81% from the recent highs, is it a safer buy now? Well, it depends on individual investors, really.

PBR will remain under state control for the foreseeable future, with any hopes for privatization utterly dashed indeed. So, one must understand that sudden management and policy rehaul will remain a common occurrence for the company. Then again, these risks could also be buttressed by the sweet dividend yields of approximately 31.1% in FY2023 and 12.9% in FY2024, made even sweeter after the Lula discount. Therefore, highlighting the stock’s suitability for those with higher risk tolerance and keen eye for short-term benefits. No pain, no gain, indeed.

PBR’s Dividends Will Be Cut, But Still Improved From Pre-Pandemic Levels

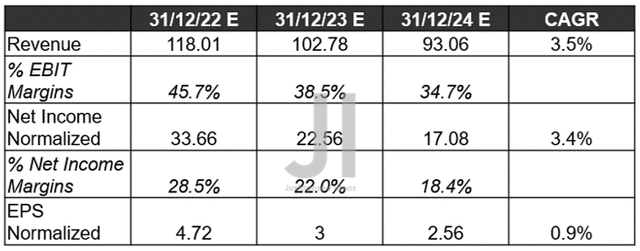

PBR Projected Revenue, Net Income (in billion $) %, EBIT %, and EPS

Despite the painful stock plunge over the past few weeks, it is apparent that Mr. Market has quietly upgraded PBR’s top and bottom line by 3.73% and 9.21% through FY2024, respectively, since our previous analysis in July 2022. Thereby, improving its EBIT and net income margins to 34.7% and 18.4%, compared to FY2019 levels of 23.4% and 12.2%, respectively. As a result, we may potentially witness adj. EPS of $2.56, indicating an easy doubling in its profitability since FY2019.

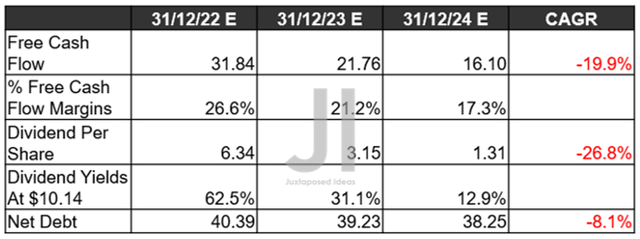

PBR Projected FCF (in billion $) %, Debts, and Dividends

In the short term, PBR’s dividends remain safe, since the Brazilian Federal Court has blocked the prosecutors’ motion to suspend the $8.5B in dividend payouts for FQ3’22. Barring any major political upheaval, we expect the company to continue paying a generous part of its Free Cash Flow (FCF) generation as dividends from FQ4’22 onwards, approximately at 30% as opposed to the current 60%, as witnessed during Lula’s previous Presidency between 2003 and 2010.

Furthermore, PBR is expected to still report excellent FCF margins of 17.3% by FY2024, despite the supposed higher capital expenditure towards renewable energy and oil refineries under Lula’s administration. Not too bad indeed, though notably lower compared to FY2019 levels of 22.4% and FY2021 of 37.3%.

Therefore, analysts are expecting PBR’s dividends to be cut by -50.31% by FY2023 and another -58.41% by FY2024. However, $1.31 per share is nothing to sneeze at, since the number indicates a more than decent yield of 12.9% based on current share prices of $10.14. Otherwise, an excellent 15.41% yield if the stock continues to fall to $8.5 over the next few weeks. We’ll see, since things remain uncertain until the Fed truly pivots and terminal rates freeze.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Petrobras: More To Fall – More Political Risk Than Ever

So, Is PBR Stock A Buy, Sell, or Hold?

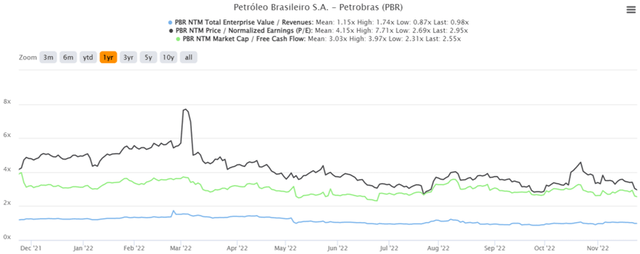

PBR YTD EV/Revenue and P/E Valuations

PBR is currently trading at an EV/NTM Revenue of 0.98x, NTM P/E of 2.95x, and NTM Market Cap/FCF of 2.55x, nearer to its YTD low of 0.87x, 2.69x, and 2.31x, respectively. The stock is also trading at $10.14, down -37.86% from its 52 weeks high of $16.32, nearing its 52 weeks low of $9.56.

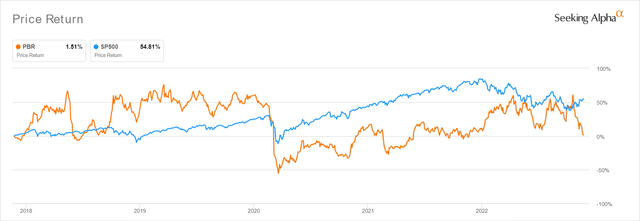

PBR 5Y Stock Price

However, it is impossible to ignore the cyclical nature of the oil/gas stocks, given the end of this supercycle by the end of 2022, as also witnessed during the start of the pandemic. Crude oil prices have continued to moderate to $77.51 at the time of writing, compared to $123.70 in early March, $122.11 in mid-June, and $92.61 in early November 2022. Market analysts are also predicting that spot prices will fall further to the low $70s through 2024, indicating the end of war-driven oil heydays, though still at a notable premium from the pre-pandemic average of $60s. Combined with PBR’s growing political risk, the stock is definitely speculative and only suitable for those who are looking for short-term gains.

Nonetheless, PBR also looks more attractive at current blood-bath levels with an improved margin of safety now. Assuming that market analysts were right, the company is also expected to disburse excellent dividend yields of 31% over the next few quarters. Thereby, negating some of the political headwinds, since it would take some time for those management changes to be implemented anyway. Therefore, we are re-rating the PBR stock as a speculative Buy now, though portfolios should also be sized appropriately, since we will experience more volatility in the short term.

Be the first to comment