Katrina Wittkamp

Investment Thesis

General Mills (NYSE:GIS) is a consumer-staples powerhouse with a significant North American market share. Despite volume decreases in 1Q24, GIS managed to offset with pricing actions for a net revenue growth of 4%.

Despite short-term headwinds and new trends, GIS represents a solid dividend payer over the medium and long term. The sector’s resilience against macroeconomic pressures, coupled with GIS’s growth initiatives in promising segments like pet foods and international markets, makes it a potentially attractive dividend income investment over the long term.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $4.85 X 18 = $87.30

As operating margin and FCF conversion return to form, we believe that a higher P/E closer to the consumer staples average margin of 22x is more appropriate.

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

1.9 |

1.8 |

1.8 |

|

Price-to-Earnings |

14.7 |

13.9 |

13.3 |

Operations

In 1Q24, volume decreased by 200bps, which was offset by positive pricing of 700bps. Net sales growth ended the quarter at a 400bps increase year over year.

|

Segment |

% of total FY23 Revenues |

1Q24 Net Sales Growth % |

1Q24 Change in Operating Profit % (constant-currency) |

|

North American Retail |

61% |

4% |

3% |

|

International |

17% |

9% |

52% |

|

Pet |

12% |

0% |

-10% |

|

North American Foodservice |

10% |

4% |

10% |

Despite headwinds and volume decreases, the North American retail segment remains the largest revenue driver. Accounting for 63% of revenues, the segment has been experiencing dynamic shifts. Cereals are on the way out for younger consumers; the typical marketing of cereal as a breakfast item could be a relic of the past with younger generations viewing it increasingly as a snack. GIS reports that despite some downtrends in cereals consumption, it is still breakfast for roughly 20% of Americans.

|

Sub-Segment |

% of total FY23 Revenues |

1Q24 Net Sales Growth % |

|

U.S. Snacks |

18.0% |

8% |

|

U.S. Morning Foods |

18.0% |

3% |

|

U.S. Meals and Baking |

22.0% |

-1% |

|

Canada (Constant Currency) |

5.0% |

4% |

North American Foodservice is a B2B provider of both retail products and bulk baking supplies. The food service segment had 4% organic net sales growth, even with a 600bps headwind for flour pricing. Management is reporting that flour pricing headwinds are alleviating. With higher supply chain efficiency, this segment could see double-digit growth in 2024 with help from the return-to-work push.

The newest segment is the pet segment. Acquired from Tyson Foods in 2021, the pet segment saw flat sales and a 10% decrease in operating profit year over year in 1Q24. However, fiscal 2023 saw a 9% growth in sales. The decrease in operating profit was attributed to input cost increases. GIS expects this to moderate over time.

The International segment saw 9% organic sales growth and 52% operating profit increase year over year. The international segment makes up 17% of revenues.

Capex and Expansion

GIS targets 4% of net sales toward capex. Currently, the spending priorities are increased capacity for high-demand items and cost-saving measures.

The HMM (Holistic Margin Management) program is a cost-savings program on the supply chain and production side, which is claimed to yield 4% cost of goods savings per year. On top of this cost savings, GIS reports that its supply chain will be at around 95% service level – meaning that 95% of goods ordered are delivered on time. This is a significant recovery from the low 80% of 2022.

In particular, the pet segment is an area in which GIS considers ‘capacity constrained’ and has increased investment to $200 million over 2 years to add significant factory space. While this will not yield results in 2024, the area may offer more recession-resilient growth. Data suggests that people continue to buy premium pet food even when they cease buying luxuries themselves or switch to generic brands. The advent of the “humanization” of pet products will likely provide secular growth in the medium term. In particular if we head into a recession, it could provide a critical area for GIS.

GIS ended the August 2023 fiscal year with a net debt to EBITDA of 2.7x, which puts them in a favorable position for acquisitions. Previously, it was rumored that GIS was one of the food giants that had submitted bids to purchase Hostess Brands, which ended up being sold for 17x EBITDA to J.M. Smucker. GIS management stated that increasing organic growth by 50% through portfolio realignment via acquisitions and divestitures. Given the trends in the breakfast area, in our view, it is likely that GIS will target international or snack bolt-ons. If this does not come to fruition, then it is likely that existing brand-related expansions will take place.

Risk

The cereals industry has been in secular decline over the last decade, with GIS posting negative volume growth in 1Q23 and an anemic 3% net sales growth in the morning foods segment. Morning Foods makes up 28.6% of the retail segment or about 18% of total GIS sales. Volume growth can only be offset by price increases for so long, with Kellogg’s taking the radical step of spinning off the cereals segment. GIS has an estimated 34.2% market share, which is up since 2020; however, the newly streamlined Kellog’s cereals segment could pose a threat. On the other hand, evolving consumer trends might provide GIS with an opportunity to market cereal as a snack rather than just a breakfast item. In our view, this is a generational inflection point that will be critical to take advantage of if GIS continues to dominate on the breakfast table.

Though we are not in a classic recession as measured by GDP, which is being driven by a massive expansion of Government expenditures, consumer behavior is drifting toward recessionary patterns. During a recession, consumers typically exhibit caution. Consumers prioritize essential goods, gravitating to value-oriented products while reducing discretionary spending on name-brands. However, consumers typically eat at restaurants less, which drives equivalent spending toward grocery items. These factors usually cancel out, resulting in flat growth in volume for companies like GIS. Media spending was elevated in the “double-digit” area, contributing to SG&A spending increases of 7% year over year.

Outlook

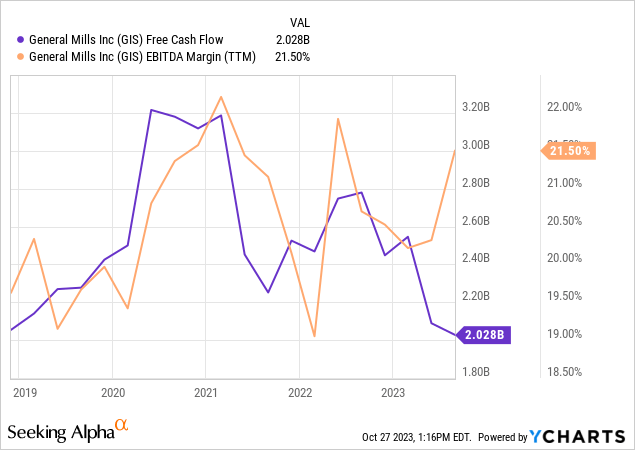

Ycharts

Full-year 2024 guidance was reaffirmed, with organic growth of 3-4%, with 4-6% operating profit expansion. Management expects a return to form of 95% free cash conversion, noting that alleviation of grain pricing headwinds and supply chain improvements have provided much-needed tailwinds in this area.

GIS increased the dividend by 9% for 1Q24, bringing the annual payout to $2.36, with a planned 2% reduction in outstanding share count for all of 2024. The current forward dividend yield is 3.6%.

GIS is facing challenges in the volume area as consumers become more conscious of their spending. GIS offers non-cyclical and recessions-resistant dividend yield despite slowdowns in volume growth. The North American area is almost certainly near its market saturation point, but GIS has significant areas to grow margins and volume in pet, food service, and international areas. In our view, GIS is a good buy for the dividend-minded investor wanting a buy-and-forget stock, with some potential upside.

Be the first to comment