jamenpercy

Background

There has been increased discussion lately on whether ESG has a place in investing when the primary purpose of investments has been income or capital appreciation for investors. This article is not going to get into whether corporations should be environmentally inclusive from a political, ethical, or social aspect. It is strictly a look at which aspects of ESG should matter to the total return for investors.

ESG stands for environmental, social and governance. It is 3 separate and quite different items and shouldn’t be looked at as one thing. People often look at it as one thing especially if they are political (both parties). But it is not.

In the U.S., financial planners have a legal fiduciary duty, which requires them to put the interests of clients first, with an emphasis on financial performance. This can be at odds with ESG as it puts financial performance over items like protecting the environment. A good fiduciary will take the time to determine how important, if at all, ESG factors are to their clients. If it is important, there are plenty of ESG investment products they can use that are performing at or above the market. Many people who work in the investments sector are not fiduciaries, so they don’t have that legal standard.

ESG is not a fad. A recent survey of 1130 global professional investors in 2022 by Capital Group showed only 13% thought it is a passing fad.

One portion of ESG appears more important to investors. That same survey also showed environmental at 47% was the most important to those surveyed over social 25% and governance 27%.

There is no industrywide accepted method of rating companies for ESG. This article is to give investors things to look for if doing it themselves and what to watch out for.

Environmental

Since, environmental is considered by many the most important of the 3, let’s start with that. Environmental investing is a focus on preserving our natural world. Examples of environmental topics include climate change, greenhouse gas emissions, biodiversity loss, deforestation, pollution, energy efficiency and water management.

Corporate environmental decisions probably have a slight negative impact in the short term due to an outlay of cash and new costs to plan and track environmental activities. Often investments for environmental purposes are not made to improve earnings near term, though there are many that can. For example, investments to use less energy or water or simplify a supply chain can immediately benefit earnings. Longer term, new products that benefit the environment can drive sales. I have written recently about one company Richardson Electronics (RELL) which has enjoyed a significant sales and earnings increase due to its new “green” products. But green products are just one of many high growth markets.

If you are a buy and hold or longer-term investor it may be more of a factor. Environmental investments can payoff longer term. For example, switching to a more sustainable raw material can be beneficial when there are supply issues with the former material in the future.

Investments in environmental sustainability also indicates longer term thinking versus quarter to quarter. That is generally a favorable mindset to longer term investment returns.

One problem can be knowing all that a company is doing. Many are now publishing reports on their activities so that information may be available.

My conclusion is environmental can have quite a material impact depending on what is being done. But it has not yet proven to significantly enhance profits in the majority of cases.

Social

According to Wikipedia, social focuses on working to support diversity, equity, and inclusion movements in addition to enhancing customer satisfaction and employee engagement.

Social is an important factor to investment returns for a variety of reasons. First of all, diversity works, especially for higher paying jobs. It brings in a lot of different perspectives companies traditionally didn’t have. It also increases the pool of available employees.

Sit in a parking lot for Apple, Google and any of the other mega cap tech companies and see who walks in and out. The faster growing, leading edge companies are much more diverse than average. Part of that is because they draw employees from a much larger geography. They have a wider net to bring in qualified employees. This is becoming more and more important with the tight labor market we now face. As I recently wrote in my article titled Higher Wage Inflation Is The New Normal, the labor market is likely to stay tight except in recessions, for secular and demographic reasons. Drawing qualified employees is going to remain a major issue for most publicly traded corporations. To do so they will need to cast the widest net possible.

U.S. companies have massively outperformed non-U.S. ones for decades. U.S. based companies have about 50% of the world’s market cap despite the U.S. being only about 4.3% of the world’s population. Diversity is one of the biggest differences between U.S. based companies and most foreign ones. Though there are many others as I pointed out in my article in 2019 titled America’s Edge: America Is Still Great Here’s How.

To retain and motivate those qualified employees they will need to provide the best possible working conditions for all of their employees. Morale is very important to the success of a company.

What is increasingly evident is younger professional or higher paid employees are more ESG oriented than prior generations. They have increased choices as to where they work and want to work for companies that share their values.

There are two issues with the social aspect. The first is, it can be quite hard to measure looking in from the outside like most investors do. About all you can usually see is diversity on the board and executive management. However, if both are relatively diverse, it is an indication of diversity and inclusion. Some companies talk about their diversity in securities filings. Some have an officer dedicated to diversity.

It can also be an issue if the company goes too far and brings in unqualified people to meet goals or quotas.

There have been several studies of diversity which concluded that it positively impacts corporate performance. Here is one from McKinsey. Here is another by the Harvard Business Review.

Social overall is more important to the success of a company than environmental but hard to measure.

Governance

Governance includes things like board composition, management structure, executive and board pay, conflicts of interest and shareholder communication. All of these should be important to shareholders. That makes this the most important category for investors.

Many of the worst corporate scandals occurred in part due to poor governance. A 2019 study by the Diligent Institute found that the top fifth of performers on corporate governance in the S&P 500 index outperformed the bottom fifth by 15% over a two-year period.

I usually read the most recent proxy statement to look at executive and board pay. Keep in mind it’s not high pay that is the problem. Companies need to pay what it takes to attract and retain qualified leaders. It’s excessive pay, pay significantly above companies of similar size or complexity.

The 10-K usually has a section on insider transactions between the company and its directors and/or executives. I always read that to see if it is material. If it is relatively large then I try to draw a conclusion if insiders may be taking advantage of their position with the company. I started my career as a Bank Examiner for the government. When we examined a bank, we always looked very closely at conflicts of interest by insiders. This was because history showed the more abuse, the worse the bank did.

Poor working conditions can create a lot of turnover, which can heavily impact a company through increased costs to hire and train new employees. It also can be a problem through a loss of expertise, or a loss of business if those employees are moving to competitors. Looking at a site like Glassdoor can be an indication of morale as employees rate employers there.

Shareholder communication is also a factor to look at. Is the company insular or accessible? The more communication the better. The trend here is also important. If you see communication declining, that is a red flag.

Performance

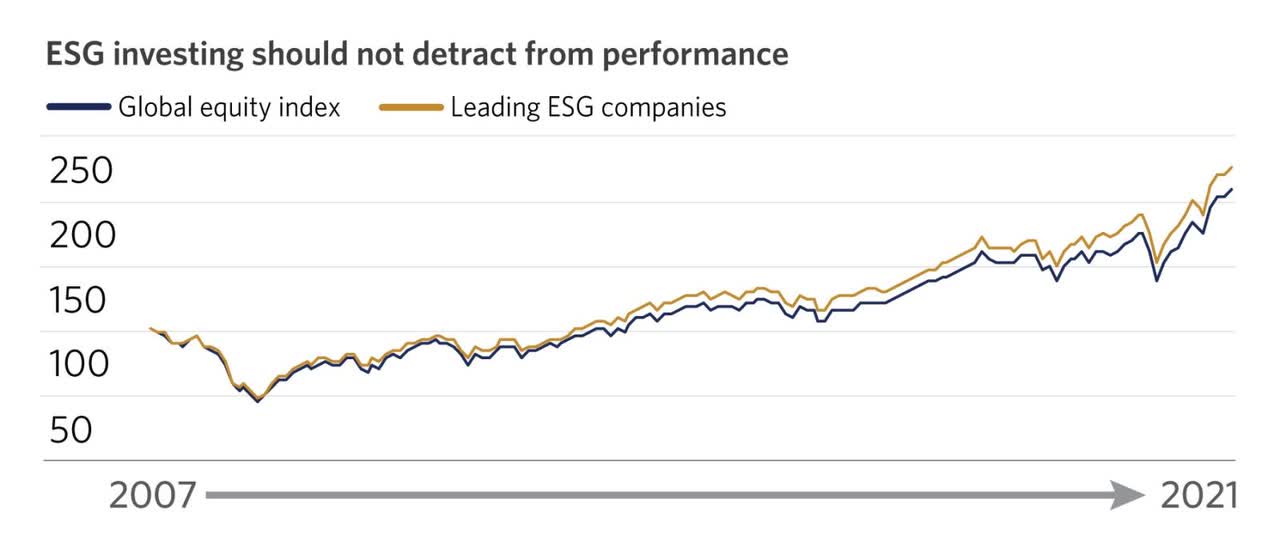

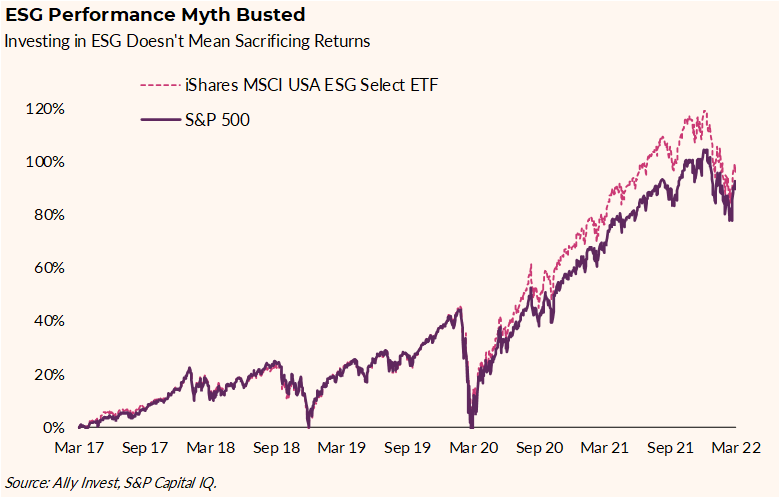

ESG labeled companies have moderately outperformed the market in recent years. Below are a couple of charts showing performance of ESG companies and ESG funds versus the market as a whole.

Edward Jones Ally Invest. S&P Capital IQ

Both charts show a moderate outperformance by ESG stocks or funds. I attribute this outperformance to three factors.

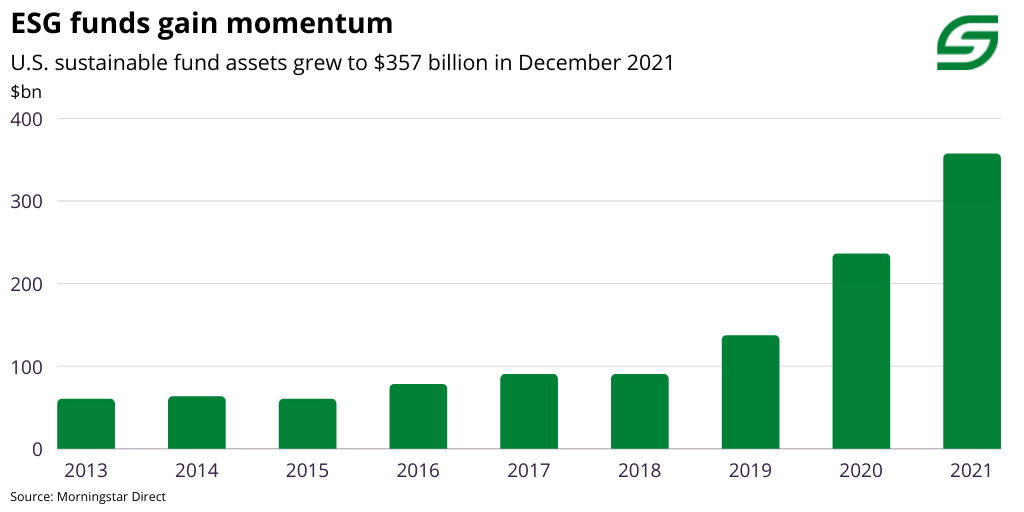

The first is demand. The first thing they teach you in Economics 101 is pricing is a function of supply and demand. As shown by the chart below, demand has soared, especially in the last 5 years. That pushed prices up, more than the market as a whole, especially in the period where demand increased the most.

Morningstar

The second factor helping ESG returns was that many ESG fitting companies are also the newer, cutting edge, companies found in tech, and health research. ESG funds are overweighted to those industries. Those were also in a bubble over the past 5 years until very recently. The second chart showed a relatively strong outperformance for 5 years through the end of 2021 and a drop off in the first quarter of 2022. That drop off was about the same time the bubble was unwinding.

The third factor is certain aspects of ESG itself do benefit investors financially. I am talking specifically of governance. Governance matters for investor returns. I also believe that social matters based on the outperformance of our most innovative companies such as Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN) and others that are quite diverse. This is also shown by various studies. But measuring various social aspects can be difficult as you can only see a very limited picture of the company from the outside.

Drawbacks

The biggest drawback currently is there is no standard way to measure ESG. Measurements are all over the map. Many of the larger funds and ETFs are putting a lot of effort into analyzing ESG activities of companies. Work is being done, but it’s often done in different ways by different people. Determining the benefits and impact of various ESG factors can be quite difficult.

Greenwashing is an unsurprising problem. Greenwashing is using ESG as marketing, despite only partially meeting ESG criteria. Again, using my prior example, a soft drink claiming 30% less calories, still has way too many calories if drunk regularly. Be careful to insure the ESG labeled activities are really beneficial to investment returns. Also, just because a company is included in ESG funds does not mean it’s compliant with environmental and social issues. Some companies embrace ESG labeling to hide otherwise poor financial performance.

Takeaway

To date, ESG investments have moderately outperformed the S&P 500 in the U.S. Two of the 3 reasons for this will likely eventually revert to the mean. In fact, one already has. That is that ESG companies are weighted toward companies caught up in the recently burst bubble. Another factor for outperformance has simply been driven by demand for ESG stocks and funds. Elevated demand raises prices. However, there are also sustainable reasons for ESG investments to outperform. These are better governance and diversity. Of the two, governance is much easier to determine and measure.

But that’s the overall problem with ESG, proper measurement. I believe governance can be determined and measured even by individual investors. The larger ESG category is not there. It is also not entirely clear it has outperformed if you strip out demand and overweighting on bubble stocks.

My recommendation for financial outperformance is to focus on governance and less on ESG itself.

Be the first to comment