Sanjog Mhatre

Investment Thesis: While MakeMyTrip Limited might come under pressure in the next quarter if earnings growth remains negative – a return to positive territory could mean further upside for the stock.

In a previous article back in July, I made the argument that MakeMyTrip Limited (NASDAQ:MMYT) would need to see a further rebound in growth across the Air Ticketing segment and a rebound in earnings growth in the next earnings quarter to justify further upside from here.

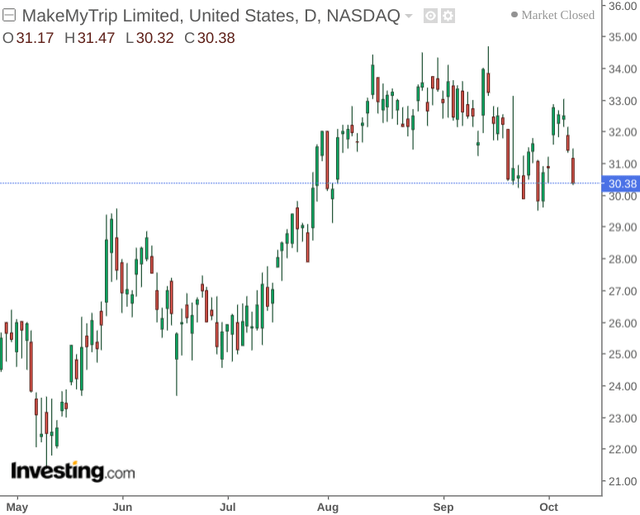

At the time, the stock had climbed to above the $30 mark and has remained above this level to date:

In this article, I would like to expand on my previous view and look in more detail at what specifically investors might be looking for in the upcoming earnings quarter to justify further upside going forward.

Performance

In spite of the recovery in revenue, MakeMyTrip Limited has still been operating at a loss – with diluted earnings per share still having shown a loss of -$0.09 for the three months ended June 2022, as compared with a loss of -$0.22 for the three months ended June 2021.

From this standpoint, should we see a continued rise in revenues being sufficient to push earnings back into positive territory – then this could be a catalyst for further upside from here.

Moreover, with international travel having resumed from 27th March 2022 along with the high season of travel in India from October to March having arrived – there is a strong chance that we could see a spike in both Air Ticketing sales as well as Hotels & Packages going forward.

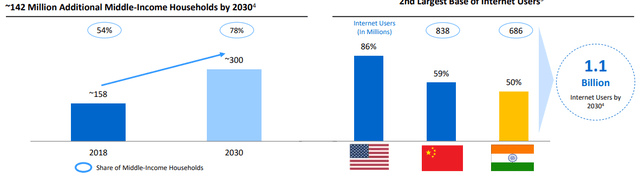

From a longer-term standpoint, MakeMyTrip Limited could be in a good position to capitalise on growth in the domestic market – owing to India being anticipated to have 1.1 billion internet users by 2030 along with 142 million additional middle-income households.

MakeMyTrip Ltd Investor Presentation: August 2022

In this regard, MakeMyTrip is not as reliant on overseas demand as other Western OTAs might be – as the company has a large domestic population to draw from as a potential customer base.

From a balance sheet standpoint – we can see that MakeMyTrip has seen a significant increase in its non-current liabilities since March 2018 – and as such has a higher ratio of total non-current liabilities (a proxy for long-term debt) relative to total assets:

| March 2018 | June 2022 | |

| Total non-current liabilities | 6552 | 235700 |

| Total assets | 1765456 | 1314457 |

| Total non-current liabilities to total assets ratio | 0.00 | 0.18 |

Source: Figures sourced from MakeMyTrip Fiscal 2019 Second Quarter Results and Fiscal 2023 First Quarter Results. Amounts in USD thousands, except the total non-current liabilities to total assets ratio. Total non-current liabilities to total assets ratio calculated by author.

For the upcoming quarter, investors may also look to see evidence that the company has the ability to bolster revenues without also having to see a further increase in its non-current liabilities. Should the company be able to achieve this, then this could be received as encouraging news by investors and serve as a catalyst for potential upside.

Looking Forward

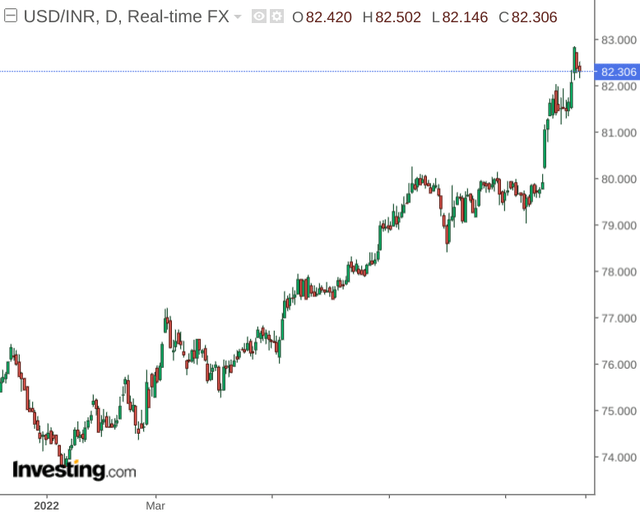

Going forward, while inflation and a slowing of economic growth is a concern globally – a stronger dollar could in fact be advantageous for MakeMyTrip.

Given that the U.S. dollar has strengthened significantly against the Indian Rupee – this could mean that travellers who would have otherwise made bookings in the United States may opt for domestic travel instead. Additionally, a stronger dollar could further fuel demand for travel to India by U.S. customers.

In this regard, the upcoming high season for travel in India could prove to be profitable.

Of course, this is somewhat of a double-edged sword as expectations on the part of investors are likely to be higher as a result. Should MakeMyTrip fail to see a significant boost in revenue and earnings growth, then the stock may not be able to maintain the gains seen since May.

Conclusion

To conclude, MakeMyTrip Limited has potential to see upside should earnings rebound into positive territory across the high season for travel across India. While I still see the stock as a hold for now given the risk that the company may fail to meet earnings expectations – strong performance in the upcoming quarter would be a bullish signal.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment