OlegEvseev/iStock via Getty Images

Pernod Ricard (OTCPK:PDRDF), the world’s No. 2 company in wine and spirits sales, beat analysts’ estimates in its latest quarterly report, reporting revenues of €3.30 billion against the expected €3.12 billion. Once again, this company proves to be a reliable consumer staples, and even in a difficult macroeconomic environment it did not raise concerns.

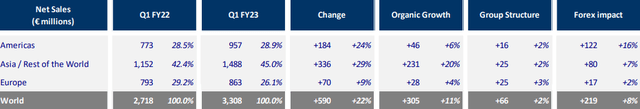

Highlights Q1 FY2023

Revenue growth over Q1 FY2022 was 22%, of which 11% was organic and 7% was due to the positive impact of the exchange rate.

Going into how this growth was achieved by geographic area, we can see that there are some areas that have suffered more and others less.

Americas

In America the growth was 24% of which only 6% was organic while 16% was due to the favorable exchange rate. It is evident how the EUR/USD exchange rate at a 20-year low has predominantly affected the total growth of 24%, which is why I find the latter figure rather misleading. Just as the company has benefited, similarly it will be disadvantaged in the future when the dollar stops appreciating. This is not to say that the overall performance has not been good, after all we are talking about a low-growth consumer staples, however, it is unreasonable to expect revenues to rise 24% in the future as well. The results achieved in America in recent months are the exception, not the norm. As for America’s weight in total revenues, it went from 28.50% to 28.90%, so a small positive change. The best performing brands in this Q1 FY2023 are Jameson, The Glenlivet, Malibu, and Jefferson’s.

Asia/Rest of the World

In Asia/Rest of the World growth was 29%, of which 20% was organic and 7% was due to the favorable exchange rate. Unlike Americas, in Asia/Rest of the World there was actually very strong underlying growth, as only a small part was due to the exchange rate. After this result, revenue exposure to these geographic areas increased from 42.4% to 45%. Behind this excellent result were a number of reasons:

- In China growth of 9% was driven by price increases over FY2022, record sales during mid-autumn festivals, and double-digit growth for Martell (although there are still the lockdown issues).

- In India, growth was as high as 21%, thanks to the success of international brands such as Jameson, Absolut, and Scotch’s portfolio. In addition, Blenders Pride and Royal Stag also achieved excellent growth.

- In Japan there was double-digit growth thanks to Ballantine’s, Chivas Regal, and Perrier-Jouët; in Africa there was also strong growth, but Martell and Jameson are the most requested spirits.

Europe

In Europe, growth was 9%, of which 4% organic and 2% due to the favorable exchange rate. Certainly, in this geographic area the company is struggling to grow since its products are already well integrated in society compared to, for example, emerging economies. Organic growth of 4% is low, but it is difficult to grow more given the popularity of this company in Europe. Americas organic growth was only 6%, so in that respect these two macro areas are very similar. Revenue exposure from Europe has decreased compared to Q1 FY2023, from 29.20% to 26.10%, giving ground mainly to the Asian segment. Finally, it should be noted that the performance was negatively affected by a sharp decline in demand in Eastern Europe due to the war between Russia and Ukraine.

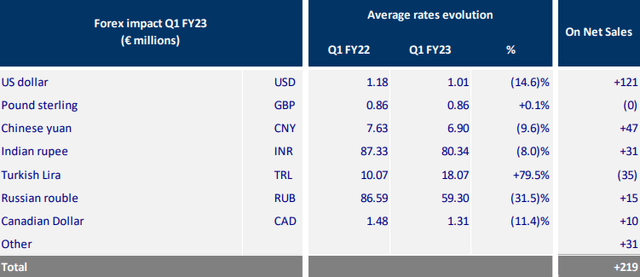

In this other image we can see in detail what the reference exchange rates are for this quarterly report. Focusing on EUR/USD, Q1 FY2023 considered an average exchange rate at 1.01, very different from last year’s 1.18. Since we have been below parity for some time, I expect that there may be a positive impact from the exchange rate for the next quarter as well. However, I do not exclude that it may manifest itself throughout FY2023.

Guidance FY2023

- As a first aspect, Pernod Ricard expects to have a positive exchange rate effect for the entire FY2023, so it is likely that the U.S. can continue to experience double-digit growth in the next 3 quarters.

- As a second aspect, the company talked about investments to improve its exposure in the U.S. since organic growth is low, but maintaining a CapEx of no more than 7% of net sales.

- The dividend payout will be kept on 50% of net profits and there will be throughout the fiscal year a buyback between €500-750 million. Therefore, a double remuneration for shareholders is planned.

Is it worth buying Pernod Ricard now?

Since the all-time high, Pernod Ricard has lost about 20%, certainly an unusual amount for such a solid company. Nevertheless, my rating is a hold rather than a buy, since I do not believe that at the current price we are paying it cheap.

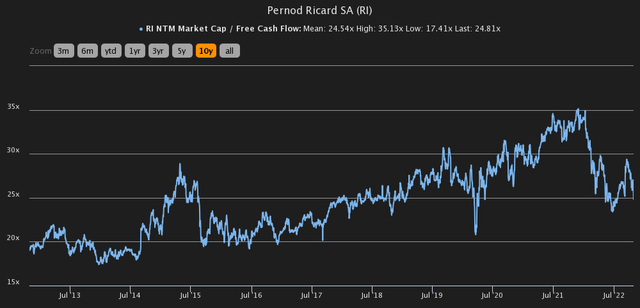

Looking at the NTM Market Cap/ Free Cash Flow we can see that the current value is within the average of the last 10 years. Certainly, it is much cheaper now to invest in it than a few months ago, but personally I would still wait.

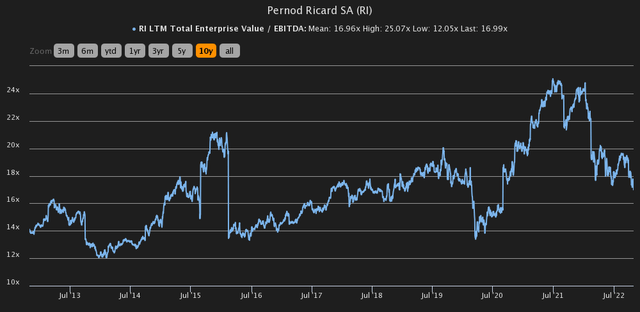

Same goes for the LTM EV/EBITDA. Currently we are on 16.99x when the historical average is 16.96x, so we are far from minimum values and in line with the average ones.

For a French investor perhaps it might still be convenient to start opening a position, since he gets a single tax on the dividend. For everyone else, on the other hand, double taxation on a dividend of 2.35% is not the best, especially considering that there are solid companies in the United States that issue one even higher than 4%. Also, the multiples are not lower than the historical average, so the potential capital gain I don’t think is that high also because we are talking about a consumer staple with a centuries-old history behind it. I would start to be interested in buying if the price collapses to around €135 per share, but not before. While not at a discount, I would still never short this company because it is very solid both economically and financially, so it may never reach my rather low price target.

Be the first to comment