Michael Vi/iStock via Getty Images

Consolidated Water (NASDAQ:CWCO) has expertise in development of various types of water resources ranging from large scale desalination and treatment facilities all the way down to individual parts and maintenance. It is on the cusp of massive growth relative to its $200 million enterprise value via the powerful catalyst of freshwater shortages in the southwestern United States, Mexico and the Cayman Islands.

Major catalyst – drought in Colorado river, Lake Mead and the surrounding basin.

It feels crass to refer to drought and the hardship that comes with it as a catalyst for growth, but CWCO is participating on the solution side to an environmental challenge. As the drought and water shortages worsen, states and countries will increase their spending on water infrastructure so as to provide clean water to their populations.

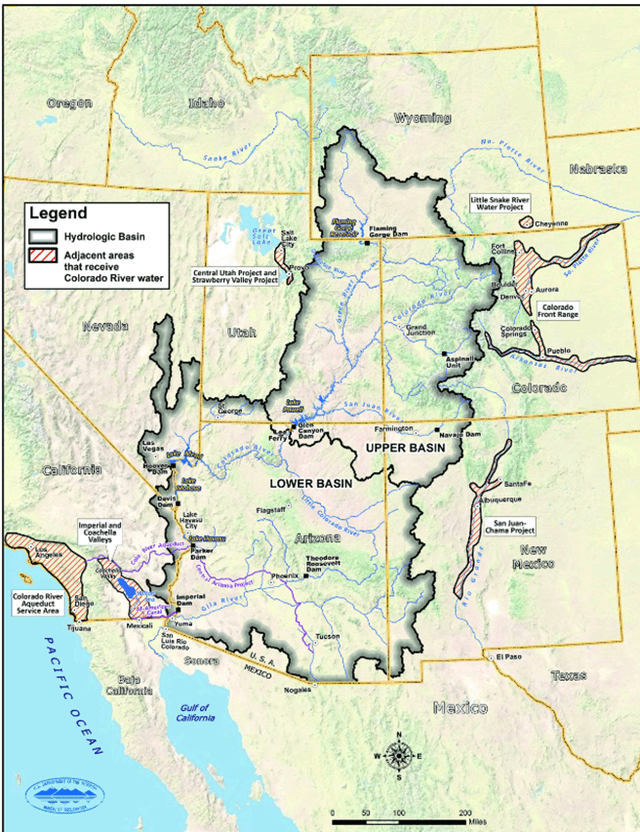

Here is the primary area of focus.

Bureau of Reclamation

Lower levels of snow accumulation are reducing the snow melt that typically replenishes the Colorado river and associated lakes. Rain volumes have been normal, but insufficient to combat the combination of evaporation and heavy freshwater use as much of the southwestern U.S. draws from this basin.

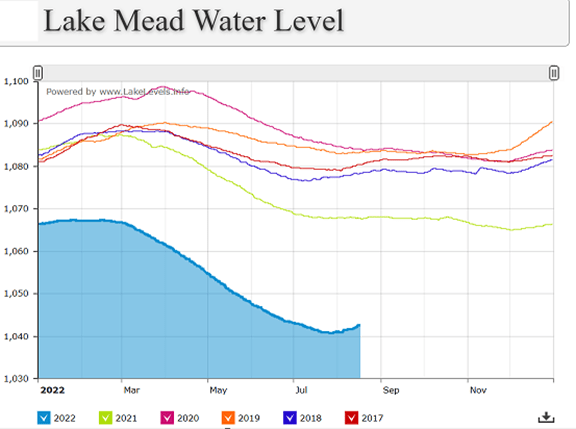

Quite simply, input volumes into the system are substantially lower than that which is drawn out resulting in a depletion of reservoirs. Lake Mead’s water level is plunging, roughly 50 feet lower than just a few years ago.

USlakes.info

In order to prevent or at least delay exhaustion of this crucial resource, the Bureau of Reclamation reduced the volume states and countries are allowed to draw from this basin.

Released August 16th

“Lake Mead will operate in its first-ever Level 2a Shortage Condition in calendar year 2023 (Jan. 1, 2023, through Dec. 31, 2023). [ ]Level 2a Shortage Condition, within the DCP elevation band of 1,045 and 1,050 feet, with required shortage reductions and water savings contribution for the Lower Basin States and Mexico, pursuant to Minute 323, as follows:

- Arizona: 592,000 acre-feet, which is approximately 21% of the state’s annual apportionment

- Nevada: 25,000 acre-feet, which is 8% of the state’s annual apportionment

- Mexico: 104,000 acre-feet, which is approximately 7% of the country’s annual allotment

- There is no required water savings contribution for California in 2023 under this operating condition.”

For those not steeped in water production, an acre foot is a volume of water equal to 1 acre in area and one foot deep. So, these are massive numbers and the cost to replace this water from other sources will be in the $10s of billions in the near term and the $100s of billions in the long term.

The Bureau of Reclamation intends to further tighten water supplies to the surrounding states in the coming years so as to preserve resources.

“a range of actions will be needed to stabilize elevations at Lake Powell and Lake Mead over the next four years (2023-2026). The analysis shows, depending on Lake Powell’s inflow, that the additional water or conservation needed ranges from 600,000 acre-feet to 4.2 million acre-feet annually.”

As states and countries get less freshwater allocated from this basin they will need to replace that volume by other means whether it be recycling via water treatment or desalination of ocean water. The states are putting out RFPs on various water projects.

This is where CWCO comes in.

Due to proprietary technology at CWCO subsidiaries Aerex and PERC, along with their existing expertise in desalination for the Cayman islands and Bermuda, CWCO is winning some big bids.

- 5/17/22 – $82 million wastewater treatment plant in Arizona

- 5/10/22 – $20 million desalination plant in Cayman Islands

- January 2022 – Upgrade of a 20 million gallon per day facility in Florida

- Potential resumption of Rosarito 50-100 million gallon per day desalination plant

I think these projects are just the tip of the iceberg. As freshwater allocations drop, the affected states will increasingly have to launch more water projects.

The whole water utility sector is poised to benefit, but I think CWCO will benefit disproportionately for 5 reasons:

- CWCO’s product set is specialized in water production which is precisely what the municipalities need

- Dry Powder – roughly $50 million in cash and almost no debt

- Small enterprise value makes each bid won far more impactful to shareholders

- In November of 2021 Cayman Islands relaxed its COVID restrictions which is bringing tourism back. As the only publicly traded water utility company serving the Cayman Islands this only benefits CWCO.

- Valuation

Just in the last 8 months, CWCO has won contracts that sum to approximately its entire enterprise value of $200 million.

Valuation

Looking at the set of water utilities they seem to trade in a tight range of 29X-37X earnings.

|

Company (ticker) |

Forward estimated P/E multiple |

|

Artesian Resources (ARTNA) |

29.8X |

|

York Water Company (YORW) |

33.37X |

|

Essential Utilities (WTRG) |

29.06X |

|

American States Water Company (AWR) |

26.10X |

|

American Water Works Company (AWK) |

35.78X |

|

California Water Service Group (CWT) |

34.45X |

|

Middlesex Water Company (MSEX) |

37.62X |

|

Global Water Resources (GWRS) |

75.21X |

|

Consolidated Water (CWCO) |

20.36X |

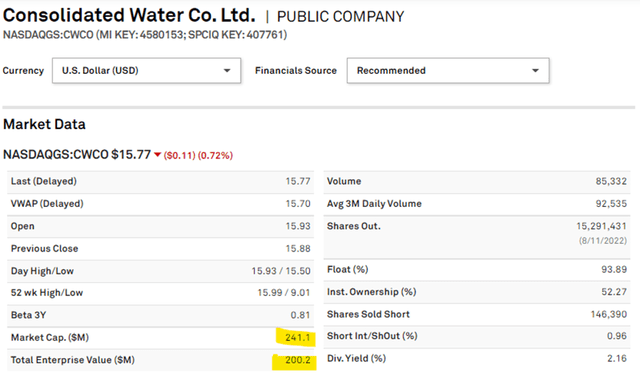

CWCO is the exception at 20.36X forward earnings. On a leverage adjusted basis, CWCO is even cheaper as it has just over $49 million in cash and minimal debt, which makes its enterprise value actually lower than its market cap.

S&P Global Market intelligence

This cash provides the dry powder to execute on upcoming water projects and amplifies the amount the incremental revenues will grow earnings because they can capitalize the projects without taking on interest expense. In other words, the gross margin of the next $50 million spent flows straight to earnings.

Upcoming rebound to island earnings

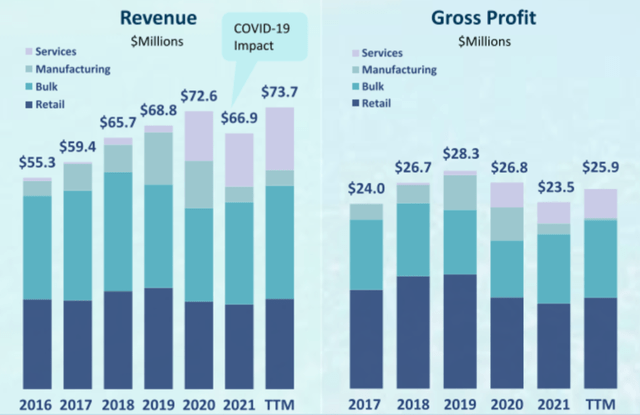

CWCO has been growing nicely with exception of 2020 and 2021 which took a hit as a result of COVID.

CWCO

CWCO generates a large amount of desalinated water in the Cayman Islands and Bermuda. This water is then sold either directly to the population via CWCO’s retail segment or sold to local distributors in the bulk segment. In the graphs above you can see a sharp decline in bulk and retail revenues in the 2020-2021 period.

As COVID becomes less of a threat, these islands are opening back up to tourism which, as you know, makes up a huge portion of their economies. As tourist traffic returns there should be a nice pop in revenues from both the bulk and retail segments.

In fact, tourism has already returned quite nicely in 2022 which is likely the impetus for the new $20 million dollar project CWCO was awarded with the Cayman Islands. Unlike the United States, which has historically had ample amounts of freshwater, these islands rely almost entirely on desalination, so as population and/or tourism grow they need more desalination.

Rosarito as a driver of growth

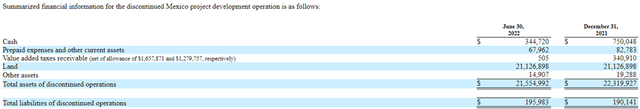

While the U.S. government is recognized as a nearly guaranteed payer, governments of less economically successful countries are a bit less reliable and CWCO experienced this first hand as the government of the Mexican state Baja California canceled CWCO’s Rosarito project long after development had already begun.

The contractually agreed upon plan was for CWCO to build and operate a 50 million gallon per day desalination plant in Rosarito followed by an additional 50 million gallon per day a few years down the road. To enable fulfilling its end of the deal, CWCO purchased 20.1 hectares of land on the coast of Baja California at a site ideal for desalination. It further began the process of ordering supplies and equipment for the development until the Mexican government suddenly terminated the contract.

This left CWCO with a substantial amount of capital lost and resulted in substantial impairment charges at the time of project cancellation. Since then, Consolidated Water has been seeking a way to recover damages using international trade pathways. Via arbitration filed in February of 2022, CWCO is seeking $57.8 million (51 million US dollars plus 137 million Pesos) in damages from the government of Baja California.

In July of 2022, Baja California began discussions with CWCO for resolving this outside of the arbitration process which would be long and costly for all parties involved.

I believe the renewed discussions from Baja California were a result of 3 things:

- Desire to avoid arbitration

- Need for clean water

- Further need for clean water given the reduction in allotment to Mexico from Lake Mead.

The exact nature and timing of resolution are unknown, but I think the most likely outcome would be restoration of the plans for CWCO to build and manage a 50-100 million gallons per day desalination plant for Baja California.

Such a resumption would simultaneously solve the arbitration dispute and solve Mexico’s need for more freshwater.

Whether it is payment of the arbitration amount or resumption of the contract, the outcome would be almost pure profit for CWCO as the project has already been written down on the books to basically just the $21 million cost of the 20.1 hectares of land that CWCO bought to enable fulfillment of the project.

10-Q

Summary of growth drivers

CWCO’s existing development pipeline already approximates its entire enterprise value. Given the powerful drought induced restrictions to water allocations in the southwestern U.S. and Mexico, these developments are just the tip of the iceberg. This tiny company could multiply in size over the next few years and substantially increase profits in the process.

I view the reward to risk as highly favorable given that CWCO is trading at a fairly cheap multiple on existing earnings. This minimizes the downside if the growth fails to manifest and increases the upside of growth as it is not priced in.

Beyond the U.S. situation, restoration of tourism in the islands, is a clear and immediate driver of higher revenues and these segments are the highest profit margin in CWCO’s business.

Longer term growth

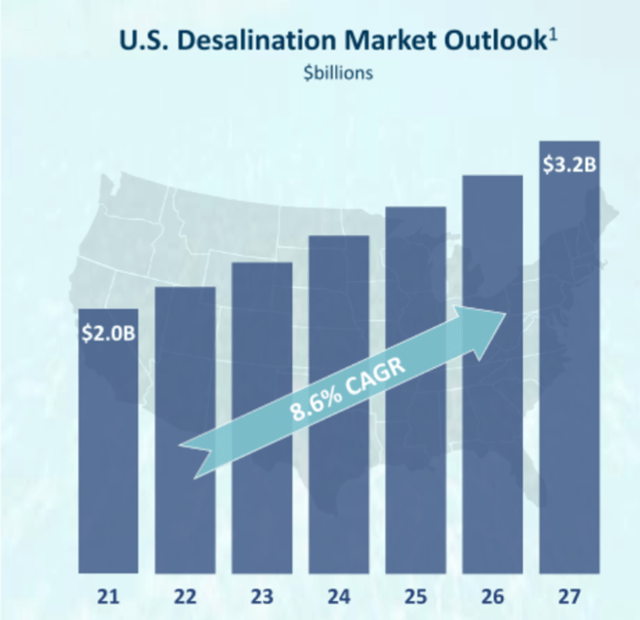

Despite its small size, CWCO is a market leader in desalination. The U.S. has historically had ample freshwater so it has not really needed desalination resulting in it being an underdeveloped industry in the U.S. So far desalination is just a couple billion dollar industry in the U.S.

CWCO

The Cayman Islands, however, do not have freshwater and rely almost entirely on desalination. CWCO is the primary provider for the Cayman Islands, and has the expertise to port that technology over to the U.S. if and when we need to up our desalination as the freshwater basins run dry.

It is a bit tricky to quantify the upside potential as it remains unknown precisely how many bids CWCO will win, but given their momentum I think it will be quite a few. I see CWCO as a potential double over next few years.

Earnings momentum

CWCO’s $0.18 of earnings per share and $ 21.1 million revenues beat on both the top and bottom line in 2Q22 but what I find most assuring is how broad based the strength was. From the earnings release:

Second Quarter 2022 Financial Highlights

- Total revenue increased 26% to $21.1 million.

- Retail revenue increased 15% to $6.5 million.

- Bulk revenue increased 26% to $8.4 million.

- Services revenue increased 34% to $5.1 million.

- Manufacturing revenue increased to $1.1 million.”

They are seeing increased customer demand across each segment which suggests they are well positioned for a world with increasing water demand.

Risks to investment

Payment risk: CWCO operates at a high level of accounts receivable. The islands are often behind on their payments and of course Mexico has straight up not paid on Rosarito. Historically, the islands have consistently made good on their payment, just on a delayed basis and based on the last conference call there is increased hope that Mexico will make good on its obligations as well. Nevertheless, this history illustrates that CWCO is working with less than investment grade counterparties so perhaps apply some discounting to contractual revenues as they are not guaranteed to be received.

Fallibility of analyst: Like any other analyst I can make errors in my estimates of future earnings. I like to believe my error rate is lower than most when working within my area of expertise (REITs), but CWCO is well outside my wheelhouse.

Given my relative unfamiliarity with water stocks and utilities as well as my geographic unfamiliarity with the islands and Mexico, it is entirely possible I am missing significant risks to CWCO. So while I believe everything in this report is accurate, it is even more important to do your own due diligence on this one.

Be the first to comment