metamorworks

A Quick Take On Global Engine Group Holding

Global Engine Group Holding Limited (GLE) has filed to raise $17 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides IT related consulting services to businesses in Hong Kong, Taiwan and southeast Asian markets.

GLE is still a tiny firm in fragmented and highly competitive markets.

I’ll provide an update when we learn more IPO details.

Global Engine Overview

Hong Kong, China-based Global Engine was founded to provide a wide range of business planning to technical design and operations services to companies in the telecom, data center and Internet of Things industries.

Management is headed by founder, Chairman and CEO Andrew Lee, who has been with the firm since inception in 2018 and was previously Managing Director at 21Vianet Group Limited and Commercial Director at Hutchison Telecom Hong Kong Limited.

The company’s primary offerings include:

-

Business planning

-

System design

-

Project management

-

Development and operation services

-

Feasibility studies

-

Maintenance

-

Support

Global Engine has booked fair market value investment of $459,000 in amount due to related party as of December 31, 2021 from investors including China Information Technology Development Limited and individual investors.

Global Engine – Customer Acquisition

The firm pursues clients seeking its consulting and implementation service offerings via a direct business development approach.

For its most recent fiscal year ended June 30, 2021, the company generated 81.3% of its revenue from Hong Kong and 18.7% from Taiwan.

General & Administrative expenses as a percentage of total revenue have trended higher as revenues have increased, as the figures below indicate:

|

General & Administrative |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended December 31, 2021 |

6.2% |

|

FYE June 30, 2021 |

7.2% |

|

FYE June 30, 2020 |

1.7% |

(Source – SEC)

The General & Administrative efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of General & Administrative spend, rose to 9.0x in the most recent reporting period, as shown in the table below:

|

General & Administrative |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended December 31, 2021 |

9.0 |

|

FYE June 30, 2021 |

8.5 |

(Source – SEC)

Global Engine’s Market & Competition

According to a 2021 market research report by HKTDC Research, the telecommunications industry in Hong Kong in 2019 was approximately $12.3 billion and represented 3.5% of Hong Kong’s gross domestic product.

In December 2020, the Hong Kong government enacted its Smart City Blueprint 2.0, which created “over 130 initiatives aimed at making the lives of the general public more convenient.”

As of September 2020, the ICT industry and related fields employed approximately 76,200 people in Hong Kong.

Also, Hong Kong’s household broadband penetration rate was an impressive 95% in September 2020, while ‘its internet connections are among the highest in the world.’

The ICT consulting and services market in Hong Kong is highly fragmented and very competitive.

Global Engine Group Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Increasing gross profit but reduced gross margin

-

Higher operating profit

-

Decreased cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$ 4,718,726 |

125.7% |

|

FYE June 30, 2021 |

$ 3,297,248 |

157.3% |

|

FYE June 30, 2020 |

$ 1,281,720 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended December 31, 2021 |

$ 1,308,448 |

33.3% |

|

FYE June 30, 2021 |

$ 1,296,803 |

101.6% |

|

FYE June 30, 2020 |

$ 643,233 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended December 31, 2021 |

27.73% |

|

|

FYE June 30, 2021 |

39.33% |

|

|

FYE June 30, 2020 |

50.19% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended December 31, 2021 |

$ 1,015,023 |

21.5% |

|

FYE June 30, 2021 |

$ 1,058,998 |

32.1% |

|

FYE June 30, 2020 |

$ 431,347 |

33.7% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended December 31, 2021 |

$ 858,108 |

18.2% |

|

FYE June 30, 2021 |

$ 897,889 |

19.0% |

|

FYE June 30, 2020 |

$ 395,756 |

8.4% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended December 31, 2021 |

$ 254,665 |

|

|

FYE June 30, 2021 |

$ 1,848,370 |

|

|

FYE June 30, 2020 |

$ (55,046) |

|

As of December 31, 2021, Global Engine had $1 million in cash and $3.3 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was $483,960.

Global Engine Group Holding Limited IPO Details

Global Engine intends to raise $17 million in gross proceeds from an IPO of its ordinary shares, although the final figure may vary.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

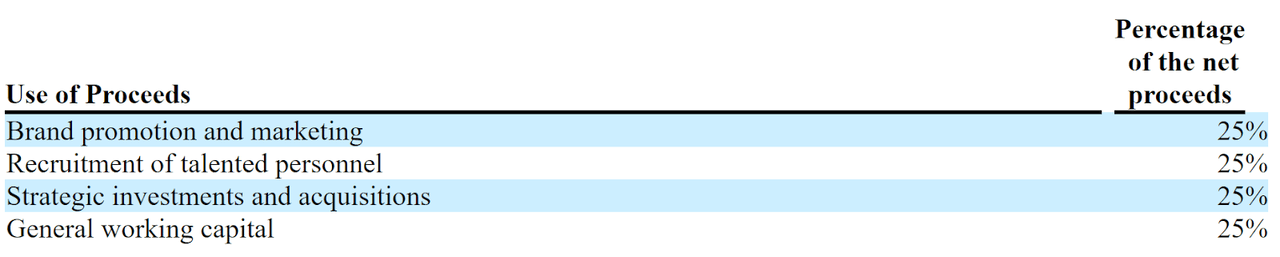

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of Proceeds (SEC EDGAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is “not currently a party to any material legal or administrative proceedings.”

The sole listed bookrunner of the IPO is Univest Securities.

Commentary About Global Engine’s IPO

GLE is seeking U.S. capital market funding to continue its general corporate expansion efforts.

The company’s financials have generated increasing topline revenue, growing gross profit but reduced gross margin, increased operating profit but reduced cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021, was $483,960.

General & Administrative expenses as a percentage of total revenue have risen as revenue has increased; its General & Administrative efficiency multiple was 9.0x in the most recent reporting period.

The firm currently plans to pay no dividends (although it has paid dividends in the recent past) and plans to retain future funds for its growth plans.

GLE’s trailing twelve-month CapEx Ratio is 3.6, which indicates it is spending significantly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing ICT consulting services in Hong Kong and Taiwan is large but fragmented and highly competitive.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Univest Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 24.0% since their IPO. This is a top-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the regions in which it operates are subject to arbitrary and capricious regulatory actions which may occur on little or no notice.

While the firm has performed admirably as a tiny consulting services company, there is a question as to its ability to profitably expand its operations within or outside its existing geographic focus.

I’ll provide a final opinion when we learn more IPO details from management.

Expected IPO Pricing Date: To be announced.

Be the first to comment