JHVEPhoto

Investment Thesis

Pentair plc (NYSE:PNR) is experiencing strong demand across its end markets, however, due to the supply chain constraints, the volumes are being affected. The pricing actions taken in the last few quarters are benefiting the revenue and offsetting the higher inflationary cost pressures. The company’s revenue and margin should continue to benefit from the higher price realization in 2H FY22. The company’s transformation program is expected to improve margins by ~300 bps by the end of 2025.

Pentair’s Revenue Growth Prospects

Pentair’s sales have been predominantly driven by higher price realization and acquisitions in Q2 FY22 as the volumes were impacted due to the supply chain constraints. Pricing contributed 14% to Q2 revenue growth, which is an improvement versus 10% in Q1.

In July, Pentair completed the acquisition of Manitowoc Ice, which is a leading provider of commercial ice makers. The acquisition should help PNR’s commercial water solutions business deliver scaled end-to-end water filtration and ice solutions to food service customers. After this acquisition, Pentair’s water treatment business, which historically derives two-thirds of its business from residential and one-third from commercial end markets, should see two-thirds of its revenues from commercial market.

The hospitality industry globally is yet to recover to pre-COVID levels, and as these markets recover, this acquisition and increased commercial exposure should benefit the water solutions business’ growth and profitability. Manitowoc is expected to contribute ~$135 mn to the total revenue post the acquisition.

Given the significant growth of the pool business since 2019 and sales expected to exceed $1 bn in the water solutions business post-acquisition of Manitowoc, Pentair will be separating its pool business from the consumer water solutions segment. Effective January 2023, the three segments will be Pools, Water Solutions, and Industrial & Flow Technologies. This new operating structure should improve customer service, and drive focus and the profitability of Pentair.

PNR’s pool business has nearly doubled in revenue and income since 2018. The pandemic changed consumer behaviour as consumers were investing in backyard improvement and home remodelling. The revenue in Q2 FY22 was up 20% Y/Y due to the strong pool season. The strong pool season should continue in Q3 FY22 as well. The pool industry is estimated to be serving roughly 60% installed base, 20% major remodelling, and 20% new pool construction. There are approximately 5.4 million pools installed in the U.S. and the average age of these installed bases is approaching 20 years. The supply chain constraints in the pool products such as variable speed pumps, automation, and sanitization have led to an increased backlog. This increased backlog should support growth in the back half as the supply chain constraints ease. Further, a significant increase in the installed base during Covid, ageing pools, as well as increased exposure to commercial end-market (which is benefitting from reopening) should provide downside support even if the economy slows due to rising interest rates.

In the Industrial & Flow Technologies segment, demand in the residential flow remains healthy with the improvement in the supply chain constraints leading to backlog returning to historical levels. In the commercial flow business, the backlog remains high due to the strong demand and supply chain constraints. In industrial solutions, the orders and backlog in the longer business cycle remain strong, especially in the sustainable gas solutions business.

Looking forward, in 2H FY22, pricing should contribute double-digits to revenue growth, which will be partially offset by volumes down in the range of low-single-digit to mid-single-digit. The pricing actions taken over the last couple of quarters should contribute significantly to the revenue, with small price increases in the period to offset the rising labour costs. The volumes in the pool business are expected to be lower Y/Y in 2H FY22 due to the tougher comparisons. The company is expecting Y/Y sales growth for FY22 in the range of 8% to 10% which looks achievable.

PNR Margins

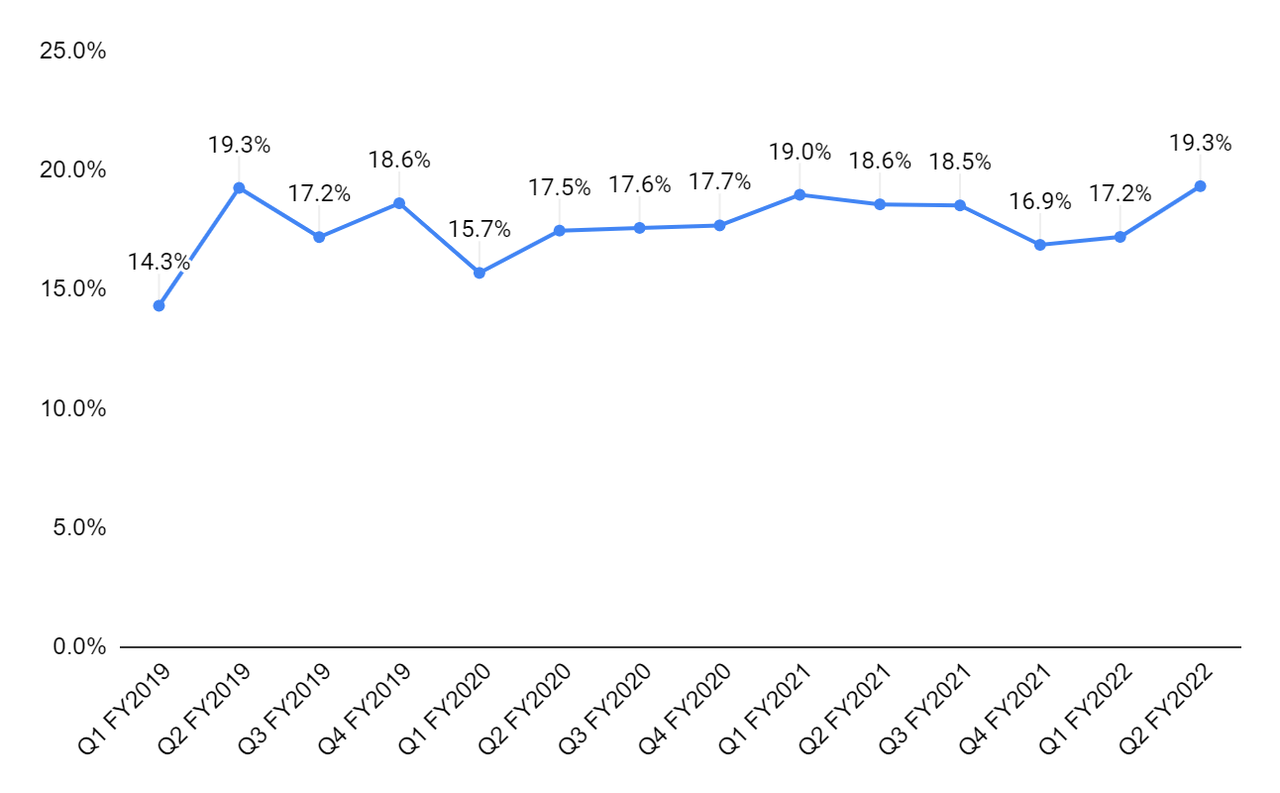

The higher price realization is more than offsetting the inflationary cost pressure, however, the supply chain challenges are impacting productivity. Last quarter, the company was able to improve its adjusted operating margin both year over year and sequentially to 19.3%. The commodity and metals prices have started seeing some correction, which should benefit the margin in 2H FY22. The supply chain has improved in heaters, lighting, and cleaners, which should improve the productivity at factories. Apart from this, PNR’s transformation program, which we discussed in our previous article, should benefit profitability in FY22 and beyond. Management is targeting 300 bps margin improvement by 2025 through its transformation program.

PNR’s adjusted operating margin (Company data, GS Analytics Research)

Valuation & Conclusion

The stock is currently trading at 11.23x FY22 consensus EPS estimate of $3.72 and 10.70x FY23 consensus EPS estimate of $3.91, which is at a significant discount to its five-year average forward P/E of 18.26x. The company’s near-term sales growth should be supported by the higher price realization, partially offset by the tougher comps. The long-term prospects for the company look good with the larger installed pool base and remodelling activities in the industry. The company’s transformation program should drive margin growth in the long term, whereas higher price realization should benefit the margins in the near term. I believe risk-reward is attractive at these levels and have a buy rating on the stock.

Be the first to comment