JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis

Pentair plc (NYSE:PNR) launched its “Transformation program” in Q2 FY21, which focuses on accelerating growth and driving margin expansion through transformation. This should be accomplished by enhancing its capabilities, decreasing complexity, and streamlining its operations. By 2025, the company aims to achieve a margin expansion of at least 300 basis points through this program. To offset rising costs the company is implementing price increases across the board for all of its products and services which should drive revenue and margin growth in FY22. In addition, due to supply chain issues, the company has built up a healthy backlog in its short-cycle business. This should be beneficial for revenue growth as the supply chain eases up.

Revenue growth potential looks solid

If we look at the company’s growth rate, it accelerated meaningfully post-COVID as consumers spent more time at home. Within the Consumer Solutions segment, the pool business is experiencing strong demand from dealers and builders. Although historically this has been a short-cycle business with low lead times, the supply chain issues have caused the lead times to increase, which has resulted in a significant backlog. This robust backlog should help revenue growth as the fiscal year progresses and the supply chain-related inefficiencies subside. Additionally, the company is about to enter its traditionally robust quarters for the pool business, Q2 and Q3, which should also help the company’s revenue growth as the year progresses. The company’s Commercial water business is also expected to do well with a rebound in quick-service restaurants and convenience stores and the hospitality sector is also showing signs of improvement with a rebound in travel and tourism.

Through acquisitions, the company is increasing the products and services it offers to customers in the commercial water solutions business. In May 2021, the company acquired Ken’s Beverage Inc (KBI), which has helped PNR to enhance the service it provides to its food and beverage clients. Furthermore, in March 2022, the company announced the acquisition of Manitowoc Ice, which designs and manufactures ice machines. This acquisition is expected to be completed by the second or third quarter of 2022. The acquisition of this business gives PNR the ability to expand its water treatment offerings while also growing its food service, commercial, and industrial end-market presence. On a pro forma basis, the company is expecting this business to generate $700 mn, with Manitowoc Ice contributing $325 mn, KBI $125 mn, and Everpure to generate $225 mn in FY22.

Looking forward, the strong demand from the end markets and the larger installed base from the new pool builds over the last couple of years should support the replacement side of the business. The rising interest rate concerns should have relatively less impact on PNR sales as the company is more skewed towards the aftermarket and replacement industry within the pool and water treatment businesses. Furthermore, the price increases, strong backlog, and the acquisition of Manitowoc Ice should drive revenue growth in FY22. Last quarter, pricing contributed 10 percentage points to revenue growth. With Pentair continuing to implement price increases, this should be a meaningful contributor to revenues going forward as well. Given the positive prospects, the company has raised its revenue growth guidance for the Consumer Solutions business from mid-to-high single-digit growth to high single-digit growth.

The Industrial & Flow Technologies (IFT) segment has also seen an increased backlog due to the supply chain challenges in the market. This business is expected to benefit from the investments that the large beer manufacturers are making and from the sustainable gas business. This is a longer-cycle business, and a strong backlog and orders should drive the topline growth as we move through the fiscal year 2022.

The strong demand, higher pricing, and healthy backlog across both the business segments bode well for the company’s revenue growth. Management has given revenue growth guidance of 9% to 11% for this year and the current consensus estimate is at 9.46% Y/Y growth which I believe is achievable.

Beyond 2022, I believe many investors are worried about the company’s residential exposure and slowdown in housing due to interest rate hikes and this has resulted in a significant correction in Pentair’s stock price as well. However, Pentair derives 70% of its business from replacement demand which is somewhat less cyclical. For residential businesses, especially pool businesses, this proportion is even higher. There are 5.3 mn pools in the existing pools in the U.S. versus around 100k annual new builds over the last two years. So, the existing pool base accounts for a much high requirement of consumables and parts than new pool installations. I believe investors’ fears surrounding the extent of a slowdown in the demand for Pentair products are overblown.

The company also has good inorganic growth opportunities which should complement organic growth. The company has a strong balance sheet with net leverage of ~1.3x. The company’s leverage is expected to increase to 2.5x post its Manitowoc Ice acquisition. However, it will come back to ~1.5x levels by the FY2023 end and I expect the company to continue exploring more strategic and tuck-in acquisitions which will add to its long-term growth.

Margins should improve going further

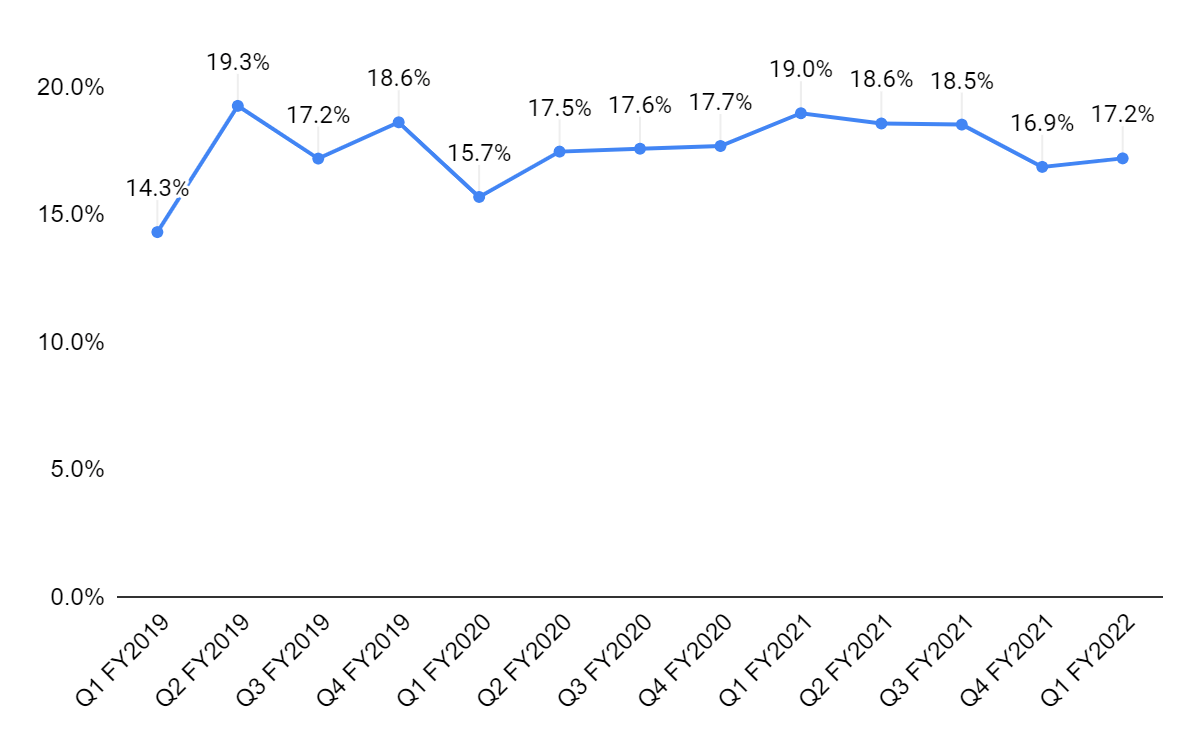

The company’s margins decreased in 2020 due to the impact of Covid before recovering in 2021. It decreased again in Q4 2021 and Q1 2022 due to the impact of recent acquisitions, supply chain inefficiencies, and elevated inflation. The Consumer Solutions segment margin was down 350 basis points Y/Y to 21.6% due to higher inflation and the acquisitions of KBI and Fleetco, which operate at a lower margin. The Industrial & Flow Technologies segment margin was up 10 bps year over year to 14.6%. This was due to SKU reduction, driving productivity, and a shift in the business model from configured-to-order to engineered-to-order. This resulted in greater efficiency at plants, leading to an improvement in margins.

PNR’s adjusted operating margin (Company data, GS Analytics Research)

The company has been implementing price hikes across its business portfolio to offset the inflationary costs. The inflation is mainly coming from the oil-based freight and supply chain challenges, which were exacerbated due to the Covid lockdowns in China. The lockdown in China should lead to incremental freight costs as the company will have to bring in products ahead of its strong season. The company is facing supply chain challenges for resins, motors, drives, and electronics and is facing inflationary costs in freight, metals, electronics, motors, castings, and moulding. The rise in inflation is expected to continue moving further into the year, however, the price hikes that the company is taking should turn the price/cost differential positive. This should result in margin improvements in the second half versus the first half. Furthermore, the inclusion of newly acquired higher-margin businesses such as Manitowoc Ice and Everpure should offset the low-margin KBI service offering.

The company’s longer-term margin improvement prospects look encouraging. In Q2 FY21, the company launched its “Transformation program” to accelerate growth and drive margin expansion through its four pillars. The first pillar is reducing complexity by simplifying and enhancing operations at its plants. The second pillar is to eliminate non-value-added activities, streamline processes, work directly with customers and suppliers, and automate these processes through digitization. The third pillar focuses on modernizing G&A, and the fourth pillar is delivering decision-making speed through improved processes and analytics.

The company is focusing on pricing, sourcing, operations and distribution, and organizational effectiveness. With pricing and sourcing being the two biggest opportunities for PNR, the company has brought in outside partners to help them transform these key processes. This program is structured into multiple phases, with the planning phase being completed the company is now moving towards the execution phase. Through this program, the company is targeting margin expansion by 300 bps by 2025.

Valuation & Conclusion

PNR’s stock is currently trading at 12.45x P/E FY22 consensus EPS estimate of $3.73 and 11.73x P/E FY23 consensus EPS estimate of $3.96, which is at a discount to its five-year average forward P/E of 18.55x. The company’s revenue growth prospects look good in the near term given the strong backlog and increased pricing. Also, the margin in 2H FY22 is expected to be better than in 1H FY22 as the company realizes higher pricing. In the longer run, the company’s “Transformation program” should accelerate both the revenue and margins by improving its capabilities, streamlining operations, and reducing complexities. I believe investor concerns surrounding the impact of the rate hike has resulted in a significant correction in its stock price. However, the company’s exposure to replacement parts especially in its residential business provides downside support to its revenues. Further, I believe the company has good growth prospects and the valuation is attractive. Hence, I have a buy rating on the stock.

Be the first to comment