Joe Raedle

A combination of new management, a powerful brand, network effects, and an attractive business model, make Peloton (NASDAQ:PTON) a buy. Add the clear beginnings of an impressive turnaround including improving margins and operating cash flow, and the likelihood that the stock can power back up seems high enough that it warrants bulls’ attention.

Momentum Has Been Deep Negative for a Long Time

The stock has been an outright disaster. Despite its recent recovery, price is still down a horrifying 94% from an all-time high of $171.09 reached on January 01, 21.

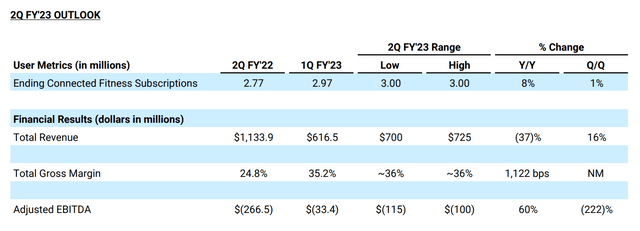

By the way, Netflix (NFLX) did nearly the same before the beginning of its long run (see NFLX stock chart between 5/23/2002 and 1/16/2004, just before it started its epic, record-breaking rise, below). Interestingly, the graphs look alike. I am mentioning it because there are some similarities between the businesses, as well. After all, you may recall that Netflix, before it went digital, also hard some hardware to contend with [yes, DVD’s, admittedly less cumbersome (but that’s a plus for Peloton, I’ll elaborate soon enough), although you had to mail those things; who still does?]. Peloton leverages similar trends including on-demand streaming, at-home fitness vs. at home entertainment, subscription models, and more. There was a time when people, analysts, market pundits, thought Netflix was headed straight into bankruptcy. Sounds just about like Peloton today.

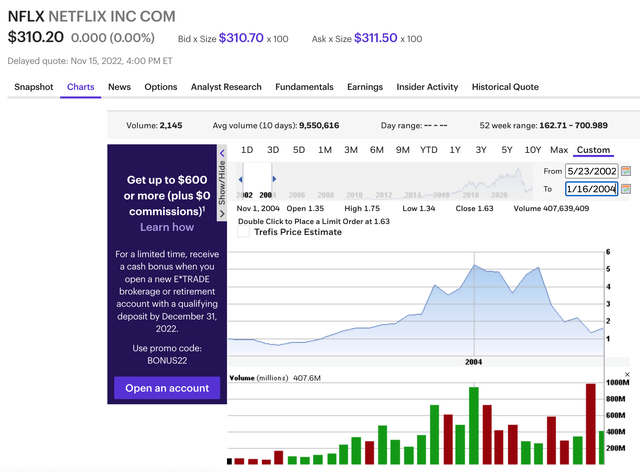

The momentum grade for Peloton sure is another way to look at it.

All recent time capsules reflect heavy distribution. Despite its recent rally, the stock has shown continued deterioration and underperformed its sector median by a wide margin during all four time periods referenced (except over the past three months; it’s rallied off its all-time low). Whoever has been holding PTON over the past few months or years has, alas and in most likelihood, incurred steep losses.

The stock’s been going down, and the company has its share of bears and shorts, for a reason. The business has been, at least by some measures, an outright disaster. Let’s drill.

Business Fundamentals and Financials Show the Extent of the Damage

The top line is where it starts to hurt.

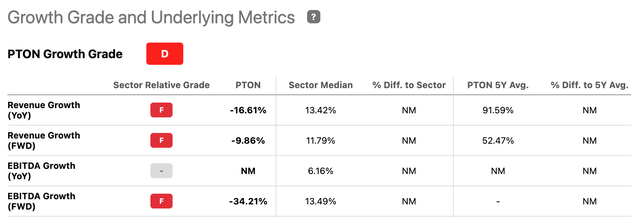

Peloton’s poor growth grade reflects the firm’s revenue and EBITDA contraction (both year-over-year and forward). The company has underperformed its sector median by a wide margin.

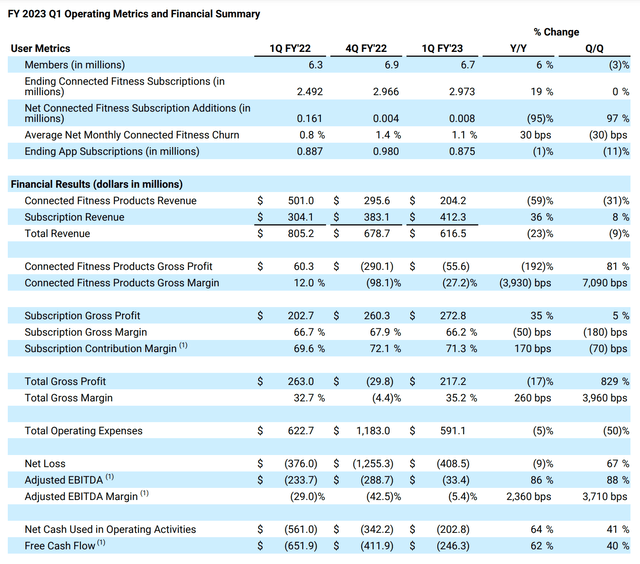

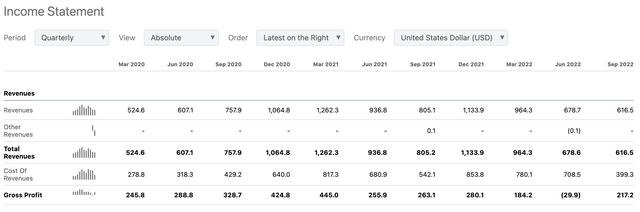

Total 1Q ’23 revenue of $616.5 million was down nearly 10% sequentially and more than 20% year-over-year. No good.

Quarterly sales have been decelerating for a year. Granted, there is cyclicality; the end-of-year holiday season looms large. There is another silver lining; if (lower margin) hardware or connected fitness product revenue is under pressure, (higher margin) subscription revenue is growing. 1Q ’23 revenue included $204.2 million of connected fitness product revenue [down sharply both year-over-year (59%) and quarter-over-quarter (31%)] and $412.3 million of subscription revenue, up 36% year-over-year and 8% quarter-over-quarter. An interesting emerging dichotomy.

Peloton 1Q FY2023 Shareholder Letter

Total revenue fell short of Peloton’s guidance, but the shortfall was driven by a $26.5 million Tread+ reserve charge, accounted for as a reduction to revenue (related to the refund consumers are entitled to if they wish to return their Tread+). (The full refund period’s been extended to November 6, 2023 and the recall return reserve’s been increased, in case more Members opt for it.) Other than the Tread+ return reserve, revenue performance would have ended above the mid-point of Peloton’s guidance range.

Peloton users who own Peloton hardware devices like the stationary bike or the treadmill are connected-fitness subscribers, a rather captive audience (if you own the hardware, which is quite an investment, chances are you’ll subscribe and stick to the ecosystem). Other users simply subscribe to the exercise digital app without hardware, a customer base you’d expect to be more volatile. The company sold $204 million worth of equipment or about 100,000 bikes or treads (assuming an average price of around $2,000 per machine) in the quarter, good for nearly as many subscriptions (some buyers may have bought two or more pieces but subscribed only once). However, connected fitness subscriptions are only up from 2.966 to 2.973 million (or around 7,000) during the quarter, essentially stagnating. Close to 90,000 subscriptions did not pan out, out of around 3 million, hence a 3% quarterly churn, or around 1% monthly, quite low in the end. (Average net monthly connected fitness churn, defined as subscription cancellations, net of reactivations, divided by the average number of beginning subscriptions in each month, does not include data related to digital subscriptions for members who pay a monthly fee for access to the content library on their own devices.)

Some investors may rightfully see an erosion of revenue, but it’s likely temporary (more on this below). Meanwhile, two first key trends are emerging. Subscription revenue is growing and connected fitness churn remains stubbornly low.

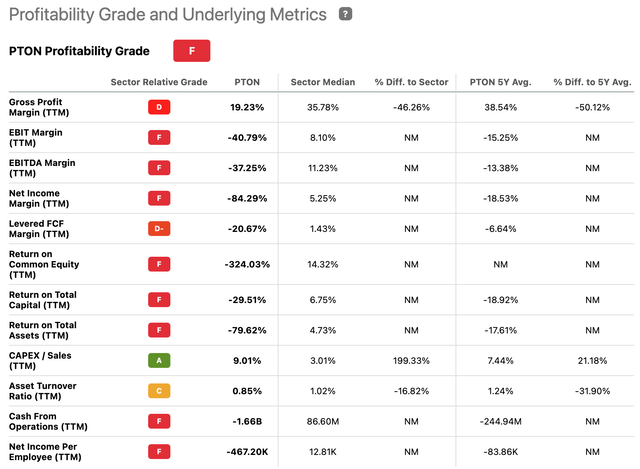

If the top line hurts, the bottom line hurts even more. Check out Peloton’s profitability grade below. Gross profit margin seems to score much lower than sector median. EBITDA margin, net income margin, and levered FCF margins are all deep negative, as are returns on equity, capital, and assets. So is cash from operations.

In the most recent quarter, Peloton incurred a net loss of $409 million on a mere $617 million in revenue. There is no way around it, it’s bad, alarmingly so.

Of course, it’s tough to secure high margins in a highly competitive environment. Some of Peloton’s rivals have been around for years or even decades, others are free. Youtube videos do the job and cost… the time a user needs to watch an ad (if that). From Bowflex to NordicTrack to Beach Body, Tonal, Echelon, Hydrow, Flywheel, Concept2, Nautilus, not to mention your local gym or Zumba class or Tae Bo slash martial art school, and the flood of digital workout apps and most abundant online freeware imaginable (YouTube and TikTok are amazing conveniences after all), there is no dearth of alternatives, free, cheap, or not.

It’s no wonder then that Peloton’s margins are under pressure, except the tables, rankings, and numbers above again fail to capture emerging trends. At the heart of it, Peloton offers an integrated, connected (tech-enabled), high-quality solution that capitalizes, not only on a large addressable market, but also on high user retention and potential profit capture from a shift toward a subscription (vs hardware) mix. Low churn means the connected-fitness leader has pricing power and can boost margins. The most recent quarter shows as much (see below for detail) and qualifies as no less than a turning point. Peloton has high subscription profitability potential with network effects and can thus pull off a major turnaround, edifying no less than an economic moat in the process; strangely, it may already be happening.

Even Valuation Gauges Fail to Excite. Until You Dive In.

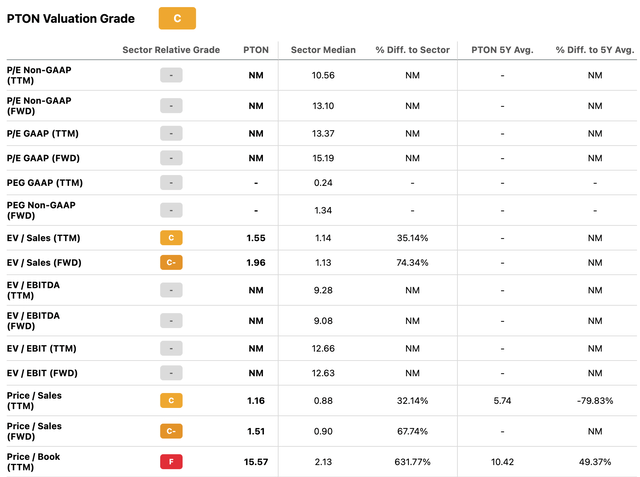

Enterprise value over sales and price per sales (both trailing 12 months and forward) constitute key metrics here, and they show the firm’s stock, despite it trading close to an all-time low and down nearly 95% from its top, is not exactly cheap.

Price per book depicts an even more sobering picture.

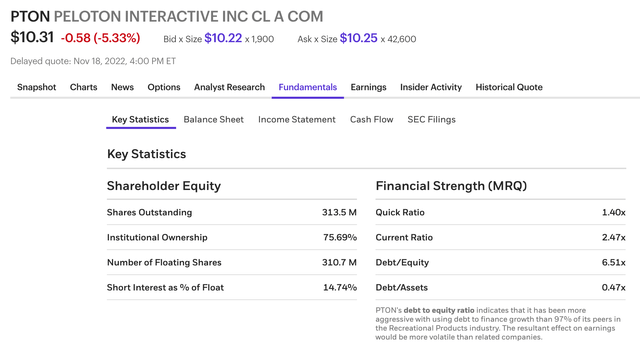

The balance sheet is not exactly a picture of a healthy business either. The high debt-equity ratio (see below) indicates that Peloton has been more aggressive with using debt to finance growth than 97% of its peers in the Recreational Products industry.

Based on the condensed consolidated balance sheets, financial tables, in the latest shareholder letter, total liabilities seemed to stabilize, even managing to go down from 3,435.6 on June 30, ’22 to $3,334.0 million on September 30, ’22 (including 0% Convertible senior notes, just under $1 billion). Unfortunately, Total Stockholders’ equity went down from $592.9 million to $258.5 million in the same timeframe, contributing to further deterioration of the debt equity ratio (now well above 10, not pretty).

No wonder the stock has its fair share of skeptics including all manners of bears, shorts, and detractors.

Shorts, Insiders, Institutions Don’t Seem To Be Too Bullish

Given the above, it’s no surprise to see Short Interest for Peloton as a percentage of Float approach 15% (see above) [with a rather low short interest ratio of 2.6 (days to cover)]. Some don’t buy the turnaround and are speculating the stock will go down some more.

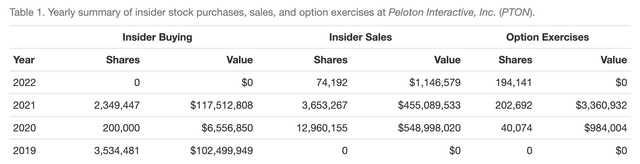

Meanwhile, not one insider has bought the shares in 2022. Although, in all fairness, insiders aren’t selling much either.

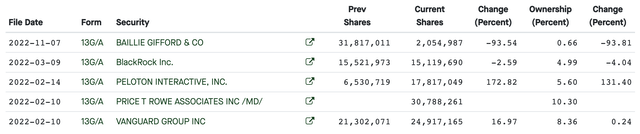

It does get worse, at least to an extent. On November 7, 2022, Baillie Gifford, which has a reputation for being a long-term investor, liquidated 93.54% of its stake.

Not all institutions, however, are liquidating.

T. Rowe Price Associates still owns more than 10% of shares. Vanguard Group and Morgan Stanley both own more than 5%, BlackRock around 4%. Still quite a following.

If the company starts to turn around, there sure is a huge runway for institutional accumulation.

Both the stock and the business seem to make for a challenging investment, to say the least. So, what is it that compels at least some of these institutions to hold – and me to see the shares as a compelling buy?

Note: I’m not betting (and sure won’t speculate) on the company getting bought out by an Amazon, Nike, Apple, or any other tech/fitness behemoths. I’d much rather have the opportunity to be organic and long-term, offering plenty of upside in the process, rather than a one-shot price movement that’ll hardly make up for the sustained losses incurred by most multi-month/year bag-holders.

New Management Lays the Foundations for a Major Turnaround

A turnaround often requires a new pilot, and there indeed is a new CEO in town. Barry McCarthy started as Peloton’s CEO and President just about 9 months ago (just enough time to start to make an impact). He served as CFO of Spotify from 2015 to January 2020, and CFO of (guess who) Netflix from 1999 to 2010. McCarthy serves on the boards of directors of Spotify and Instacart. (In addition, he has served as a board member of Chegg, Eventbrite, Pandora, etc.). He has also served as a consultant at Technology Crossover Ventures, one of the largest growth equity firms and an early investor in (guess who again) Netflix; he sure gets what has the potential to create shareholder value, a key and welcome trait.

CFO Liz Coddington is also new (started in June 22, comes from Amazon AWS), and so are Andrew Rendich, Chief Supply Chain Officer, and Tammy Albarrán, Chief Legal Officer.

Fresh blood, here to make a difference, and the new CEO and Co. seem to have initiated a solid turnaround; it’s sure starting to make an impact. Let’s dive in again.

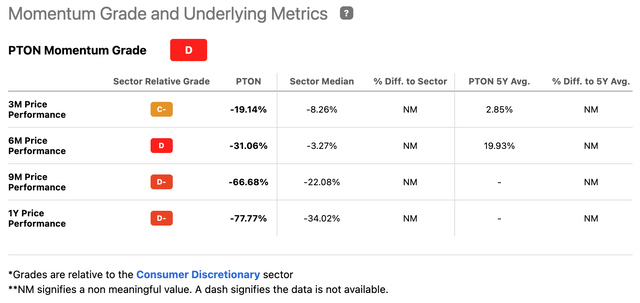

Revenue is expected to start to recover in 2Q FY’23, based on Peloton’s outlook, down 37% year over year but up 16% sequentially.

1Q FY2023 Shareholder Letter, Peloton

It’s only the start of the top line’s recovery, hopefully. Sure, some will argue that the global home fitness market size, which accounted for USD 11.3 Billion in 2021 and is projected to achieve a market size of USD 17.3 Billion by 2030, is only expected to rise at a CAGR of 4.9% from 2022 to 2030. How disappointing, specially given how competitive the market is. Tough to pull robust top line growth in such a setting.

But the aforementioned analysis misses the point. Critically, the North America connected gym equipment market is expected to reach US$ 1,084.17 million by 2028 from US$ 216.89 million in 2021. The segment – Peloton’s – is thus estimated to grow at a CAGR of 25.8% from 2021 to 2028. Now a much more compelling value proposition.

Peloton, being the leader in the connected fitness segment, is likely to grow at least as fast, if not faster, i.e., not at the too-often-assumed 5%, but at close to 20% CAGR, once post-COVID adjustments (read, haphazard returns to the gym, more on this below) are past and complete.

The top line is likely to stun bears, shorts, and other market naysayers soon. If this comes true, and when it does, the stock price is likely to rerate, and power up. A first critical key to a successful turnaround thus seems to emerge.

Further, 1Q ’23 Gross profit was $217.2 million, yielding a gross margin of 35.2% (vs. ~35% guidance and sector median). Connected Fitness gross margin of (27.2)% was negatively impacted by the increase to the Tread+ recall reserves. Excluding these, adjusted Connected Fitness Gross margin was (11.6)% for the quarter, and adjusted total Gross Margin was 38.3%, now higher than sector median. Subscription gross margin of 66.2%, while modestly underperforming expectations, is well above sector median, with subscriptions now feeding the bulk of revenue.

A second critical key to a successful turnaround seems to emerge then. Major cost reduction initiatives including a restructuring plan to variabilize the cost structure, simplification of operations by exiting owned-manufacturing in Taiwan, and reorganization of the last mile delivery by expanding relationships with third party vendors, not to mention multiple rounds of layoffs, all the while affirming Peloton’s pricing and premium brand positioning (that emerging moat we briefly alluded to above and we’re about to revisit below), may ultimately help the firm secure 1) a subscription gross margin close to 70% (very high compared to sector median, more like a typical tech) and 2) a breakeven to low positive Connected Fitness (hardware) gross margin, good for a gross profit margin well above 40-45% based on a revenue mix increasingly tilted toward majority subscriptions (currently, two third of revenue). Clearly, this is the direction the new CEO is going, and he seems to be making strides.

The third major improvement of late concerns free cash flow. Let’s quote the CEO himself (1Q FY2023 Shareholder Letter):

Our results show we’re making significant progress. Take by way of example, FCF which was negative $747 million in 3Q22, improved to negative $412 million in 4Q22, improved again to negative $246 million in 1Q23, and is forecast to reach near breakeven for the second half of FY23. Or take gross margin, which improved Q/Q from negative 4.4% in 4Q22 to positive 35.2% in 1Q23 (…), or adjusted EBITDA which improved Q/Q from negative $289 million to negative $33 million in 1Q23. Or take liquidity. We ended the quarter with $938 million of unrestricted cash in the bank and an unused revolving credit line of $500 million.

Clearly, the firm’s odds are starting to look much better. The rally of the last few weeks seems to suggest that something’s cooking.

Low Churn and Powerful Network Effects Will Drive Profitability

So, we have a firm that is hopefully contemplating a major boost to its top line (after transitory pandemic adjustments and a recall soon to end), slashing costs, reducing cash burn, and increasing gross margins to ultimately reach profitability. It does not stop here, however.

Some Tread, Bike, and other Connected Fitness subscribers (including I) may have struggled with the concept of exercising every day for years. No longer, with Peloton. See, they don’t have to go to the gym, commute in traffic or in the rain or snow, why not risk a car accident, to get to their gear. Exercising is a few steps, really, a thought away. No friction, no struggle. Akin to the concept of reduction in drag in a peloton. Riders can save energy by riding close (drafting) to other riders, thereby reducing drag to as little as 5%-10%. Bike riders save energy and indeed reduce drag, and so do Peloton customers, both because equipment is at their fingertip and so is the Peloton community and a whole ecosystem.

My wife does not use our in-home fitness gear; she goes to the gym. Once in a blue moon, that is; see, she has a much harder time. She needs to change, drive (door-to-door, 10-15 minutes times two), spend gas, put miles on the Bugatti (kidding), she’s not the best driver so after all she takes a chance. Bonus #1, wait in line for some piece of equipment that’s not necessarily the cleanest. Bonus #2, catch a bug? Sure, Covid’s gone, except it’s not and may never will be, and then people forget that there are tons of other germs out there. The flue is only for starters. No wonder then many customers have gotten used to paying for fitness services they don’t use – such as gym memberships. Me, nope. Of course, I miss on the so-called social aspect, but then if I start chatting, I’m not exercising and getting my heart – and mind – in tiptop shape.

Peloton is so addictive because it’s the whole package, right here, right now. The moment I’m inspired (it usually does not last long), I’m ready to go, and so is Peloton, and a whole community, right downstairs. The firm offers an integrated solution (equipment, technology, instructors, production team, music and music rights, membership support services, logistics and fulfillment, etc.). Even the music rights strategy is of notable interest. Per the same 10k (2022):

We have built a world class music rights content management and reporting system to meet the needs of our music rights holders in order to support our highly-engaged, growing global community. Peloton is increasingly seen by our partners as an impactful music discovery platform, which has created opportunities to progressively and meaningfully enhance our classes with custom music experiences. We expect this to continue as we invest in music-first technology to improve the quality of our Members’ experience, strengthen our competitive advantage over other fitness platforms, and add value to our Members.

Another highly differentiating asset is Peloton’s skilled, charismatic, and diverse pool of instructors, who offer a multitude of classes, moods, formats, content, and cater to a mosaic of goals, experience levels, characters, in a constellation of verticals at different schedules with varying durations (real time or not). Variety increases consumers’ perception of value; Peloton offers plenty of it and retains customers. I’ve discovered shadowboxing; it’s changed my life. I can’t wait to add Row. Work 86% of my muscles in just 15 minutes? Bring it on. Sure, Peloton has serious competition. Concept2 is popular at local gyms, highly rated, offers all the basics at nearly a third of the price, and enjoys a solid reputation (bonus: no subscription fees); but it doesn’t offer any live or on-demand rowing classes, create an ecosystem/community that’ll have me stick to my routine, and thus fails to engage in as compelling a fashion as Peloton, to invoke a few elements of comparison. The hefty monthly subscription fee I already pay, since I already own two Peloton machines; adding Row actually diminishes my cost per machine per (single) account.

No wonder the churn is low and the company’s brand, for all the noise and critics, is gaining traction in the marketplace (no fad) and enjoying often compelling word-to-mouth. You hear family or friends are on the platform; once they are, you can connect through the Leaderboard, and you’re not leaving anytime soon. You’re part of a growing community. The more, the merrier. A low churn and high brand equity make for powerful sales/marketing tools. Add the fact that the firm enjoys a first-mover advantage and indeed powerful network effects. The more bikers or runners on the leaderboard, the more opportunities I have to get my heart going biking or running against “The Star*ish” or “Pastry_Come_After” and try to finish first. How many times did I get caught up in these games? I’m never alone, or very rarely. It works.

Peloton’s customer acquisition strategy is also of interest. The firm is not just dependent on selling expensive hardware. Peloton’s digital subscription lets customers work out without owning Peloton gear. The app-based classes cost less than the hardware/connected fitness option, and they offer running, yoga, etc. Underlying is the assumption that people who use the app, are more likely to eventually get the tread, row, or bike. The community, the Leaderboard, the lifestyle, are all compelling magnets. Of course, once a customer buys the connected equipment, they are often locked-in, as well as generate higher revenue.

Per the company’s annual report (10k, 2022):

Peloton Digital is included with all Connected Fitness Subscriptions. As of June 30, 2022, 71% of our Members on Connected Fitness Subscriptions used Peloton Digital to supplement their workout regimen. Peloton Digital also helps us attract new Connected Fitness Subscriptions by serving as an acquisition tool for new Members.

Of course, the app as a stand-alone subscription service could develop into its own growth opportunity. After all, recurring subscription revenue carries wider profits margins and does not require the costly, fastidious delivery of heavy equipment. The higher the number of prospects willing to use Peloton Digital content on non-Peloton hardware, the larger the potential install base or TAM and the opportunity for monetization. The integrated hardware (Connected Fitness) user experience in the premium segment of the marketplace is but one customer profile/user case. Essentially, Peloton is creating a multiple-segment/price-entry subscription modality to broaden market adoption and ultimately accelerate the top line. Pre-owned rentals, expanded retail strategy (Hilton, Dick’s Sporting Goods, Peloton store on Amazon, etc.), are part of the strategy and only for starters. Peloton has a vast pool of monetization opportunities ahead if it wishes [on-screen advertising, sponsorships, events, healthy food, beverages, vitamins and supplements, shopping (expanded apparel, accessories, equipment, etc.), dating app, international, corporate, lifestyle, and more.)] Sky is the limit.

Second Look at Valuation Shows More Promise

Let’s proceed with a simple sum-of-the-parts framework approach. Peloton has a money-losing hardware segment and a gross profit generating subscription-based business. Let’s assign a zero value to the hardware segment; right now, it’s about fair. Subscription-based businesses à la Netflix or Spotify and other group peers trade at an average of (5 to 5.5) x EV/gross profit multiple. Assign a 2023 gross profit of $1 billion to Peloton’s subscription business for 2023 (it was $272.8 million in 1Q FY’23) and you get yourself a $5.25 billion Peloton enterprise value with 380 million shares outstanding, or around $14 per share, just about 40% above current price. Adjust for net cash, which is not expected to be much of a contributor at all (if it’s not negative!) if you must.

But then there are a number of ways these numbers can get upgraded, and the stock see a major rerating. As suggested above, gross profit may get multiple boosts through major revisions of sales trajectories (as is made clear above), while SG&A-type cost-cutting programs are well on their way, and they seem to be gaining significant traction already. As growth trajectories evolve, so may the valuation multiple. Sentiment on Peloton is horrific, contributing to the current depression, to the point that issuing a buy rating nearly feels scary. The global economic outlook (rising interest rates, inflation, geopolitical conundrums, etc.) sure does not help. Long-duration stocks, i.e., with positive operating cash flow expected in the distant future, suffer most.

What if the hardware business can flip back to gross margin positive? There sure is potential for the market to assign greater value to the segment. Essentially, though, valuing Peloton at a low multiple (similar to exercise equipment companies) is inadequate.

Risks Abound But Seem Well Priced In

Peloton is a contrarian call, thus makes for a risky investment, no doubt about it. High risk, high reward, as they say.

As in any major turnaround, execution is key, and the current CEO has sure inherited a mess. Boosting sales, gross margins, and operating cash flow, continuing to fight churn (check out Facebook’s Marketplace, lots of Peloton gear for sale there, it’s always too much), and reaching profitability, require solid management. The development of an economic moat is admittedly instrumental to all of the above; it thus remains one of Peloton’s key opportunities – and risks.

The firm has a first-mover advantage, leading market position, and brand recognition. Its integrated platform including connected fitness subscription and mobile app solutions, give it a competitive advantage versus traditional fitness products, services, and vendors. But the firm must still contend with various sources of competition (see above for detail).

Supply chain, sourcing, manufacturing, logistics, product quality and safety, market vision and product innovation, sales and marketing, technology, and brand reputation, all carry major opportunities, and risks as well.

Peloton also competes for talent in technology, media, fitness, supply chain, logistics, retail, marketing, finance, legal, etc.

Finally, Peloton must overcome risks of legal proceedings, regulatory investigations, and governmental inquiries that could trigger major expenses, divert management’s attention, and materially harm financial and operating results.

Conclusion

Peloton may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- A market disruptor and technology leader leading the expanding connected fitness market segment,

- Endowed with the green shoots of a major turnaround (stabilizing sales, improving gross margins and operating cash flow), which disastrous financials (lack of profitability, cash burn) have long managed to mask.

- Negative momentum and market sentiment have punished the stock, presenting bargain hunters with an opportunity.

Solid appreciation potential exists within the next five years but this is a contrarian, thus by definition risky, investment. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for greater visibility into Peloton’s future top line, cash flow, and earnings – might prefer to dollar average.

Be the first to comment