imaginima

Ebix (NASDAQ:EBIX) is a challenging company to analyze, but opportunity for intrepid value investors lies beneath the company’s messy surface. After being victimized by a brutal short attack earlier this year and with the long-awaited EbixCash IPO still on hold in India, Ebix investors are nursing their most recent wounds – and if the stock price is any indication, many are heading for the exits.

The bearish sentiment and EBIX’s depressed market value offer risk-tolerant value investors an attractive opportunity to scoop up shares in a mostly successful company that’s priced for total failure.

About Ebix

A US-based company headquartered in Atlanta, Ebix Inc. (Nasdaq:EBIX) has morphed (and consistently grown) over the decades into a multi-faceted corporation with diverse operations sprinkled across a number of countries and continents. Ebix was originally incorporated as Delphi Information Systems, Inc. in 1976 and went public under that name in 1987. The company was bleeding cash when a man now quite familiar to Ebix shareholders, an Indian-American businessman named Robin Raina, became involved as a VP in 1997 before being promoted to president and CEO in 1999.

Raina has presided over tremendous revenue and profit growth at Ebix over the past 23 years, becoming so closely associated with the company’s public image that he could easily be mistaken for a founder-CEO. In fact, he now owns 13.9% of the company.

In September 1999, Ebix began operating online insurance exchanges in the United States – which remain the bread-and-butter of its operations to this day. Around the same time, the company changed its name from Delphi Information Systems to ebix.com, Inc.

Unlike many of its dot-com peers, Ebix would go on to thrive in the post-bubble world, continuing to offer and expand its online infrastructure exchanges to the insurance, financial, and healthcare industries in the United States and around the world. Like other survivors of the dot-com crash, Ebix would go on to quietly drop the “.com” from its name following the bubble’s collapse.

In recent years, the Indian segment of the business (EbixCash) has taken on a somewhat different character than the rest of the company and has grown to the point where it rivals the US division in its importance to Ebix’s financials. Ebixcash, a wholly-owned subsidiary of Ebix, has its own pending IPO in India that is currently awaiting regulatory approval. As Ebix has grown over the decades, so has its complexity – making it one of the more difficult small-caps to analyze due its wide range of segments and services.

A consistently profitable company that has grown its revenue every year from 2000 through 2021, Ebix took investors on a wild ride from $0.28/share in November 2002 to $86.90 in February 2017. The ride has only gotten bumpier since. During the market panic of March 2020, Ebix’s share price plummeted to ~$9, only to rebound to ~$60 less than a year later during the January 2021 meme stock mania, which Ebix appears to have been tangentially caught up in due to its high short interest.

Speaking of shorts, following a devastating short report issued by Hindenburg Research in June 2022, EBIX plunged to as low as $14.59/share before marginally recovering to today’s level of ~$18.

The market has clearly struggled to accurately value Ebix over the years, with competing hopes and fears each enjoying their time in the sunlight. That said, for all the company’s operational complexity and controversy, at today’s price Ebix shares present an attractive buy opportunity for value investors who are capable of tuning out the noise and focusing on the numbers.

EBIX Fundamentals

To grasp the tremendous upside potential lurking in Ebix’s stagnant share price, investors need look no further than the company’s financials. As mentioned, Ebix’s revenue has grown every year since 2000. While earnings have failed to grow in recent years (following 18 years of consecutive EPS growth through 2017), Ebix remains consistently profitable and FCF-positive. Sporting a TTM P/S ratio of 0.6, P/E ratio of 9, and P/FCF of 12, Ebix is clearly attractive in an environment where cash cow companies are beginning to trade closer to the premium they deserve. The company also pays a 7.5¢/share quarterly dividend, equating to an annual yield of 1.7%.

Ebix’s balance sheet unfortunately leaves much to be desired, with nearly two-thirds of total assets comprised of goodwill and other intangibles. Accordingly, while Ebix’s reported assets outstrip its liabilities by $700 million, its tangible book value is actually -$369M. Much of this debt (and goodwill) has been accumulated in the course of the company’s acquisition-fueled expansion of its EbixCash subsidiary, and much of it is coming due in the near future. It remains to be seen whether these liabilities will turn out to be good or bad debt in the long run.

It’s worth noting that the balance sheet has improved in each of the past several years, as Ebix has slowed its investment pace in India while continuing to print cash.

Insurance Exchanges

Ebix’s insurance exchange business, which operates primarily in the US, focuses on creating and operating software-as-a-service (SaaS) platforms on behalf of financial institutions to facilitate the online selling of insurance and other financial products to consumers. As described in Ebix’s most recent Form 10-Q filing, the insurance exchange business has a number of revenue streams – including SaaS/subscription fees generated from term contracts with institutional clients, sales of software licenses, per-transaction fees, and professional service revenue, which “primarily consists of fees for setup, customization, training, or consulting services.”

The US exchange business has seen growth dry up in recent years, and ex-India exchange revenue now accounts for only about 17% of Ebix’s total revenue. (Total revenue has recently been volatile due to the sales swings of a seasonal and low-margin gift card business within the EbixCash subsidiary, but more on that later.) Nonetheless, the high-margin US exchange division contributes much of the cash necessary to the expansion of the company’s fast-growing Indian operations. While the company generally does not report the breakdown of earnings by segment, it is safe to assume that much of the stagnation in Ebix’s earnings in recent years is attributable to the stagnant growth pace of the US exchanges.

While meaningful revenue growth does not seem to be in the cards for Ebix’s ex-India exchange business, the good news is that neither does meaningful contraction. This segment has seen remarkably consistent performance (or, more pessimistically, remarkably stagnant performance) in recent years, with non-EbixCash exchanges holding steady at around $40-50 million in quarterly revenue contribution for the past 5 years. This is obviously not a great sign for the company, but it’s not an overly bad one either. As long as the insurance exchange business continues to contribute relatively stable cash flows, Ebix can continue to invest in far more exciting initiatives in India that have the potential to fuel the company’s growth for decades into the future.

EbixCash

That’s where EbixCash comes in. Ebix’s Indian subsidiary has been subject to more than its fair share of both hype and controversy in recent years, reporting heady but low-margin revenue growth while Ebix’s overall profits have stagnated. The company has taken a questionable course in building EbixCash, acquiring more than 25 smaller Indian companies, largely financed by debt, and merging them together into a single fintech company. EbixCash provides many services, including international remittance and foreign exchange, digital payment solutions, money remittance, prepaid cards, travel, insurance, and corporate & incentive solutions.

The Covid-19 pandemic had a chilling effect on Ebix’s Indian acquisition spree, resulting in the termination of its 2019 deal to acquire online travel company Yatra Online, Inc. (YTRA) at a valuation of $337.8 million. Yatra sued Ebix in Delaware Chancery Court for breach of contract, fraud, and tortious interference, but Ebix lawyered up with two partners at Skadden Arps, the same firm that represented Elon Musk in his recently-consummated acquisition of Twitter. Ebix quickly prevailed on its Motion to Dismiss in large part on the technicality that it was Yatra that had officially pulled out of the deal, not Ebix. Since that time, Ebix has announced no new major acquisitions.

EbixCash IPO

Instead, Ebix turned its attention to reviving the EbixCash IPO plans it had been forced to shelve due to the pandemic. In June 2019, Ebix had announced that “its Board of Directors has approved the process of appointment of up to five investment bankers, with an initial public offering (IPO) targeted timeline of Q2 2020 for its EbixCash operations headquartered in India.”

We all know what happened next. Covid-19 reared its ugly head across the globe, governments outlawed giant chunks of ordinary commercial activity, economies crashed, and markets tumbled. EbixCash was particularly hard-hit due to foreign exchange and remittances drying up and travel being suspended essentially across the board. Ebix couldn’t very well spin off EbixCash in that environment, so the IPO went on hold. For a while, it was far from clear that it would proceed forward at all.

Finally, in April 2021, EbixCash commenced its “3-year audit exercise leading to filing of the draft red herring prospectus (DRHP), with the Securities and Exchange Board of India.” At this time, the company was targeting an IPO in Q1 2022.

In the run-up to the anticipated IPO, EbixCash beefed up its Board of Directors by adding a former SEC Chief Economist, a former Chairman of the Bombay Stock Exchange, and a former Executive Director at the Reserve Bank of India. In March 2022, CEO Robin Raina declared on the company’s quarterly earnings call that that EbixCash would file its DRHP “imminently.” As promised, EbixCash filed its DRHP with the Securities and Exchange Board of India (SEBI) on March 10, 2022.

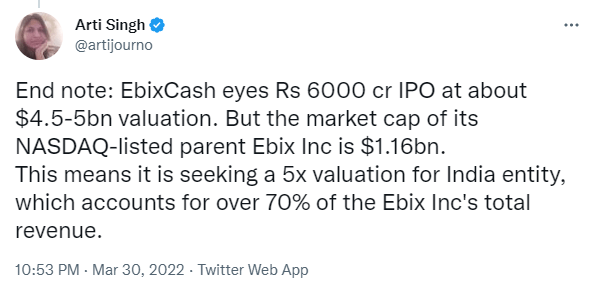

This is where it starts to get interesting. Ebix declared its intent to raise $787 million via the IPO, while retaining a significant majority stake in EbixCash. A tweet by Indian fintech reporter Arti Singh articulated well why this proposal raised so many eyebrows:

Twitter

In the months since March 2022, Ebix’s market cap has fallen to under $600 million – less than the proceeds Ebix hopes to generate by offloading a small sliver of EbixCash onto the public markets. Clearly, something doesn’t add up. But is it Ebix and its prestigious banking partners that are delusional about EbixCash’s value, or is it the US markets that are delusional in valuing Ebix? The question remains unanswered, as the EbixCash IPO has yet to take place.

There were few public updates on the IPO process until October 21, 2022, when Ebix issued a press release addressing several points. Among other things, the company stated that “its Indian subsidiary is exploring interest from a few reputed international players in taking a substantial minority investment in EbixCash, in line with the DRHP filed already.” The release also stated: “The Company is hopeful of an expeditious approval of its subsidiary’s DRHP leading to filing of the RHP and the eventual IPO. Also, EbixCash has already received in-principal approval from the two stock exchanges BSE and NSE. The Company reaffirmed its commitment to an expeditious IPO in line with the Indian regulatory and compliance guidelines.”

All it takes is basic arithmetic to see that the market does not believe EbixCash is worth even one-fifth of its contemplated IPO valuation. I believe the market is wrong. While EbixCash may not be worth $5 billion, it remains a profitable and fast-growing company with an annual revenue run rate of over $800 million.

Opportunity in India

EbixCash is the most attractive segment of Ebix not only because of its IPO plans and revenue growth, but also because it operates in one of the most advantageous markets in the world for its services. Unlike most Western countries, India has experienced significant and sustainable GDP growth in recent years. India has averaged annual GDP growth of 5.5% over the past decade, and the IMF projects continued GDP growth of over 6% in each of the next 5 years.

Unlike the economic data reported by some other fast-growing countries (such as China), India’s reported figures are as credible as any other nation’s. India’s demographic trends also lie in stark contrast to those of many other countries, with the high birthrate and large percentage of young people meaning that India will continue to see population growth and a favorable population pyramid for far longer than most Western (and many Eastern) countries.

Moreover, the Indian government and private sector have placed a huge emphasis on expanding and incentivizing the adoption of fintech products and services in the country. As a result, the Indian citizenry has become increasingly accustomed to utilizing fintech services for a wide variety of everyday transactions.

India’s total fintech transaction value is estimated to hit $138 billion next year (up from just $66 billion in 2019). While this growth has increased the number of domestic competitors EbixCash must contend with (including some with unprofitable and/or unsustainable business models), it also means that the total addressable market will continue to grow indefinitely for Indian fintech players that survive into the future. EbixCash certainly appears to fit the bill.

To that point, EbixCash’s revenues have exploded higher in recent years, rising from $217 million in 2018 to $320 million in 2019, $388 million in 2020, and a whopping $750 million in 2021. These numbers are impressive, but not as impressive as they may seem at first glance. In 2020, EbixCash would have experienced a significant decline in revenue but for $130 million of (extremely low-margin) pre-paid gift card sales recorded in Q4 2020. This effect continued in 2021, though sales of gift cards have since tapered off. EbixCash has recorded $413 million of somewhat more normalized revenue through the first half of 2022.

Risks

Auditor Resignation

Speaking of the gift card business, investor confidence was heavily shaken in February 2021 when Ebix’s auditor, RSM US LLP, suddenly resigned. In its Form 8-K reporting this event, Ebix stated that RSM had resigned “as a result of being unable, despite repeated inquiries, to obtain sufficient appropriate audit evidence that would allow it to evaluate the business purpose of significant unusual transactions that occurred in the fourth quarter of 2020, including whether such transactions have been properly accounted for and disclosed in the financial statements subject to the Audit. RSM informed the Chairman that the unusual transactions concerned the Company’s gift card business in India.” Ebix’s stock price immediately cratered from $50 to $24 per share.

While RSM’s resignation reflected poorly on Ebix, it’s worth noting that the gift card business is not terribly important to Ebix. As mentioned, the gift card business has razor-thin margins and has never contributed much to the bottom line. For this reason, it seems unlikely that Ebix was intentionally fudging the numbers. More likely is that Ebix’s internal policies and controls simply failed to keep pace with the explosion in demand for its payment cards during 2020. Nonetheless, the incident turned off many investors and remains a dark cloud hanging over the company’s management.

Debt

Debt is another risk to bear in mind when considering an investment in Ebix, especially as we enter what is expected to be a sustained period of higher interest rates. At year-end 2021, Ebix had $631 million in long-term debt and a net tangible book value of -$369 million.

Although the balance sheet has drastically improved over the last several years and Ebix continues to generate the cash necessary to service and pay down its debt over time, it must be considered that much of the company’s debt is due early next year. Ebix does not currently have the cash on hand to make the payments due. If the EbixCash IPO falls through or is further delayed, Ebix will be forced to refinance at significantly higher rates and/or explore other outside investment options (at less attractive valuations) in order to continue servicing its debt.

Hindenburg Short Attack

Nowhere is the Ebix bear case more convincingly articulated than in the short report published by Hindenburg Research on June 16, 2022. Among other things, Hindenburg attacked Ebix over its soon-due debt, the EbixCash IPO delays, the high proportion of low-margin gift card sales as a percentage of the company’s reported revenue, multiple auditor changes over the past 18 years, and a supposedly weak digital side of the business.

Oddly, about half of the report was dedicated to alleging fraud in the gift card division – which, due to its small profit contribution, is not an especially important piece of the Ebix puzzle for astute investors. (It was also low-hanging fruit, considering RSM’s prior resignation over this same issue.) Following the short report’s publication, EBIX experienced yet another of its characteristic swings to the downside, swooning from >$23 to <$15 in a single day.

Rebutting Hindenburg is beyond the scope of this analysis, so I will instead direct the reader to Ebix’s press release responding to the short report, Mikro Investments’ Ebix: Even More Attractive After Price Drop Due To Short Attack, and TheGribbler’s Rebuttal to Hindenburg Report re Ebix, Inc. Suffice it to say, Hindenburg’s report has all the hallmarks of a classic short attack – the accumulation of a large short position in a company followed by an attempt to drive the share price down by releasing negative information. While some of the points in Hindenburg’s report surely have some merit, others appear to have none.

Hindenburg’s fraud allegations against EbixCash seem particularly irresponsible. Hindenburg also stated that it sees “significant solvency risk over the next 12 months.” Well, we’ll see how that plays out.

On July 5, 2022, Ebix obtained an Indian court order blocking the publication of the Hindenburg short report in India and directing Google and Twitter to remove certain related URLs from the Indian domain. Hindenburg, which may have been largely cashed out of its short position by then, chose not to defend itself in the action (though Google and Twitter were represented in court). While it may be reasonably assumed that an Indian court would be more sympathetic to a company operating in India than to a US short-seller, it can also be reasonably assumed that the court would not have issued the order if it believed that Hindenburg’s allegations were legitimate.

Conclusion

Ebix is set to report Q3 earnings Wednesday, November 9, and it will be interesting to see how both the US and Indian operations fared in the most recent quarter. Investors will also be looking out for an update on the status of new financing opportunities as well as the EbixCash IPO.

At the end of the day, Ebix is a complicated company. It’s a far cry from the classic Buffett-style company whose cash flows can be reliably approximated over the next 10 years. This may not be what many value investors want to hear, but any good investor knows that it’s important to understand the arguments both for and against a trade before executing it. Ebix’s lack of predictability is likely one of the primary forces driving investors way, but by the same token it is also one of the main factors contributing to the company’s undervaluation – and to its margin of safety, another Buffett priority.

Even if the EbixCash IPO does not pan out as management and investors hope – moreover, even if EbixCash turns out to be a failure altogether, which is unlikely considering its current profitability – Ebix will still be left with a profitable and fairly-valued exchange business that is not consistently growing, but generates relatively stable revenues and continues to sign new customers.

Considering the (likely) prospect of the EbixCash IPO being even moderately successful, or of EbixCash continuing to grow its revenues and profits within the high-growth Indian economy, the enormous upside potential in EBIX shares stands in stark contrast to the far more limited downside risk. With the expectation of failure already priced into Ebix’s market valuation, investors seemingly have little to lose by betting on its success.

Be the first to comment