Joe Raedle

Peloton (NASDAQ:PTON) is currently executing a turnaround plan designed to stem cash burn from operations that came in just under $203 million for its last reported fiscal 2023 first quarter. The quarter was essentially one of transient discombobulation with revenue and earnings both coming in as a miss and net debt rising to a record high. But against this, cash burn from operations recorded two consecutive quarter-on-quarter declines and was at its lowest level since the fourth quarter of fiscal 2021. Indeed, post-period end and Peloton announced its fourth round of job cuts this year with at least 500 FTEs expected to be cut across its marketing department and some other broadly unspecified functions. This will leave the company with 3,800 employees, down from a peak of 9,000 last year.

Management billed this as the final significant move to get Peloton back on a viable footing after many operational changes this year including a decision to outsource production to Taiwanese company Rexon Industrial. Peloton has not been standing still with several new partnerships signed including a deal with Hilton (HLT) to put a Peloton Bike in every fitness center in the hospitality giant’s network. The Hilton x Peloton tie-up will see the fitness centers in nearly all 5,400 Hilton-branded hotels include at least one Peloton bike. Peloton is also partnering with DICK’S Sporting Goods (DKS) to sell its full hardware product range across several brick-and-mortar stores.

Bulls are now hinging on hope in the form of Peloton Row, the company’s latest hardware product and its official entry into the rigorous exercise class. The machine is set to retail at $3,195 and will begin deliveries next month. Management during the earnings call for their recent quarter stated that demand for Row is set to outstrip inventory for its current fiscal 2023 and that they are working to address this with Rexon.

The Runway For A Turnaround Is Limited

Peloton recently reported earnings for its fiscal 2023 first quarter saw revenue come in at $616.5 million, a 23.4% decline from the year-ago quarter and a miss by $20.56 million on consensus estimates. Contributing to this fall was a drop in app subscriptions of 11%. The company ended the quarter with 2.97 million Connected Fitness subscriptions.

This high-margin recurring revenue stream continues to form a core part of the bullish base and it provides strong visibility on the trajectory of revenue, enhances profitability, and pulls up the overall valuation attached to the commons. Previous growth allowed Peloton to achieve a market valuation beyond that which would not normally be extended to a hardware retailer.

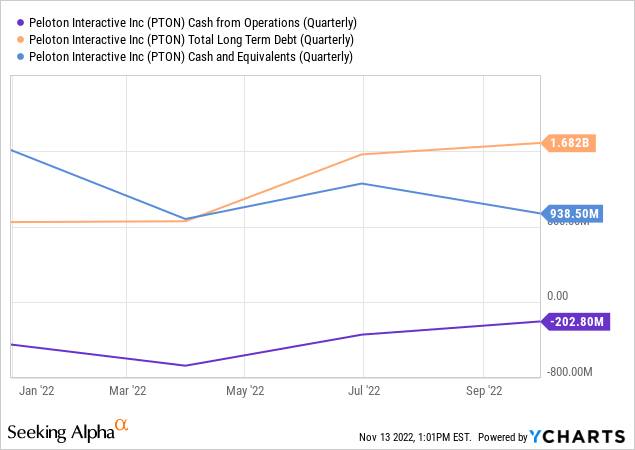

The company recorded a gross profit of $217.2 million on the back of a 35.2% gross margin. This was 20 basis points above guidance and a material improvement from a gross margin of 32.67% in the year-ago quarter. The main story was free cash outflow coming in at $246.4 million with capital expenditure of just under $44 million during the quarter. This broadly meant a decline in its liquidity position with cash and equivalents falling to $938.5 million as long-term debt rose to $1.68 billion. Interest expenses hit a new quarterly record at $21 million and will likely rocket higher as Peloton leans on debt to manage a negative cash flow position not anticipated to be at breakeven until the second half of the year.

Peloton’s Issues Run Deep As The Global Economy Stands At The Brink Of A Recession

The company’s GAAP EPS of -$1.20 was also a miss by $0.55 on consensus estimates with the cost-cutting effort still ongoing. The lingering question is whether the company has enough runway to fully turn things around. The long-term behavioural changes in the world after the pandemic have not been entirely beneficial to bulls with gyms now brimming with activity in contrast to predictions that they would go the way of Blockbuster. But the current zeitgeist still provides a unique mix of opportunities for Peloton. The Peloton Row for example will open up a new exercise class and apparel continues to be an underutilized new market. Indeed, the company added an e-commerce widget to its workout screen to allow subscribers to shop for instructor-worn apparel.

But the near-term outlook for the US economy is poor with a recession expected in the next calendar year. Hence, while interest rates are expected to peak in a few months and inflation to fall closer to the Fed target in the second half of the year, consumer discretionary spending will take a material hit. Just how crucial will high-end exercise equipment be with real incomes falling and unemployment rising? The world ahead looks very different to how it did two years ago and it might simply just be that Peloton, a great cultural reference point in the pandemic years, simply does not fit.

The benefits of physical activity will continue to form a strong use case for Peloton’s still expanding range of products. Whether this will help make the business recession-proof in the year ahead is still unknown.

Be the first to comment