Anchiy

Investment summary

We are bullish on Pediatrix Medical Group, Inc. (NYSE:MD) shares and view the stock is at a turning point on the chart. Our findings show high return on capital and a growing bottom line, two factors investors have been rewarding in FY22 as they step up in quality to avoid equity drawdown.

Exhibit 1. MD 12-month price action

Data: Updata

Technical studies also suggest price action may have reversed and that a newly formed uptrend is now in situ. MD also holds up well within the macro-regime and has the potential to re-rate to the upside with its strengthening bottom-line fundamentals, we estimate. We’ve priced the stock at $33 on a blend of inputs and believe there’s additional tailwinds to be realised via the effect of accruals to revenue and earnings. With a list of probable catalysts, we rate MD speculative buy.

Q1 results illustrate the fundamental picture

First turning to the quarter, and revenue came in below guidance at $432 million. Management noted the downstep arose due to the cyclicality of the company’s revenue function. Noteworthy is that the company accounts for this in pricing, which is potentially a tailwind that needs to be factored into the investment debate. A little more on this later. Operating profit printed at $40 million last quarter and has been gradual decline since 2019 (see Exhibit 2). As cost-inflation continues to present a key issue for med-tech players, declining margins are an immediate red flag in our examination.

We see a gradual lift in turnover to $2.07 billion in FY22, on a gross margin of $513 million (25.65%). This is basically in line with FY21 and illustrates the pertinent issue is that MD’s recognised a substantial slowdown in operating leverage over the past few years to date. Moreover, this looks set to continue. We’ve forecasted operating profit of $223 million in FY22 and EBITDA of $270 million, a ~$5 million gain on the year.

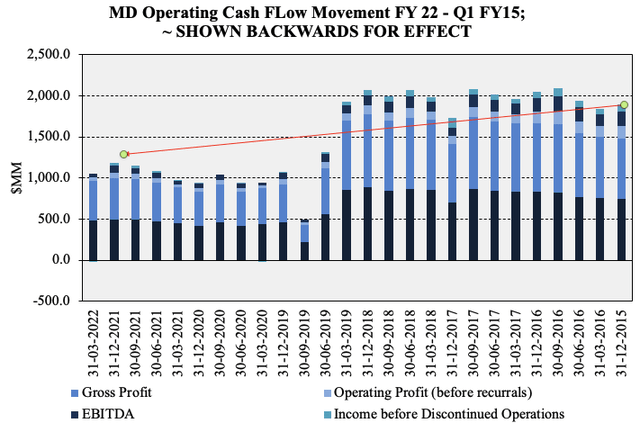

Exhibit 2. Operating leverage has wound back for MD since 2019 and remained flat

Data: MD SEC Filings; HB Insights

It also refinanced its CAPEX structure last quarter absorbing borrowings of $799 million. As such it now has gross and net leverage of ~3x using T12M EBITDA. The liability structure is evenly split between a floating/fixed structure. As a result, it now expects the quarterly interest expense to come in at ~$8 million vs. $17 million in Q4 2021.

Given it rolled its long-term liabilities over to a lower refinanced term structure this has proven to be a positive move. Core bond funds now offer starting yields of ~4-4.5% implying the high yield capital markets are a few points higher. Moreover, refinancing rates have lifted amid central bank tightening regimes. For MD, it has realized some pricing lift in its acquisition pipeline and this is in keeping with similar changes in the medtech acquisition market. Nonetheless, management noted it continues to seek out high-margin subspecialties that are complementary to the portfolio mix.

Further tailwinds

Importantly, transaction volume has remained sturdy amid an increasing cost of capital. Here it’s prudent to deconstruct MD’s revenue mix in order to understand how its reserving practices can impact revenue. Firstly accounts receivable (“AR”)gained from the last quarter by ~$16 million, lifting days sales outstanding (“DSO”) to 59 days. However, MD’s AR is predominantly unbilled AR related to its transition to R1 (NASDAQ:RCM). This agreement makes R1 the primary provider of revenue cycle management services for Pediatrix. Hence, factoring MD’s normal reserving practices on its ageing receivables, revenue could see additional leverage in H2 FY22.

In fact, one can observe the age out in DSO. Traditionally, the protocol is to add higher reserves once they age, typically after certain payment cycles, e.g. 90–180 days. On its balance sheet, MD has a ~79% allowance for this, up from 78% same time last year. This ~100bps adjustment is likely to have a circa. $15 million impact downstream to MD’s unbilled AR.

The important fact for investors to understand here is that $15 million (or 100bps adjustment, for that matter) will be recognised back within the next few quarters in receivables. As a result of this timing component, it’s likely MD will recognise some leverage to its turnover and cash conversion cycle looking ahead, by estimate.

Positioning to absorb macro headwinds

Management noted that labour costs are within historical levels, however there was no mention of forward looking labour costs on the last earnings call. However, contradicts the data from hospitals whom are noting far higher labour costs in FY22. National hospital operating margins fell by ~48% year on year in April and have been in the red since January 2022. This came as discharges increased 0.5% YoY, and inpatient/outpatient revenues climbed 30bps and 270bps YoY respectively.

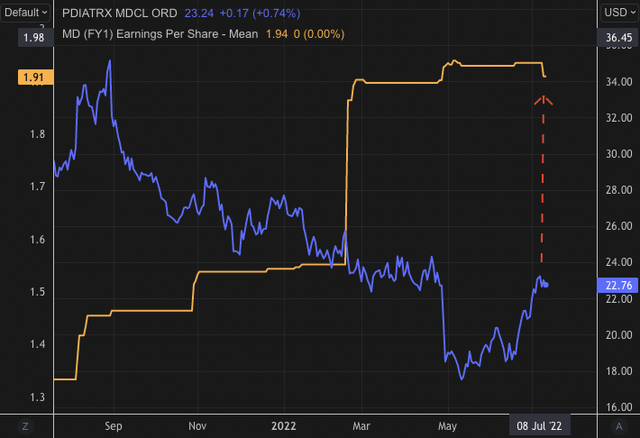

We’ve noticed investors reposition to absorb impeding macro headwinds in FY22. Predominately it is a rates story amid central bank tightening policies, however, investors are also looking to step up in quality. Hence top-line growth has been shunned into H2 FY22 and bottom-line fundamentals have been rewarded. As seen in Exhibit 3, MD is converging back up towards its EPS forward estimates, corroborating this point. With it expected to print a 16.5% YoY gain in earnings for FY22, we reckon the market will continue rewarding the company observed in the fashion seen below. Something for investors to think about in equity positioning in portfolios.

Exhibit 3. MD looks to be converging towards bottom-line fundamentals after a period of divergence

MD Share price vs. EPS Forward Estimates, Aug 2021–July 2022

Data: Refinitiv Eikon

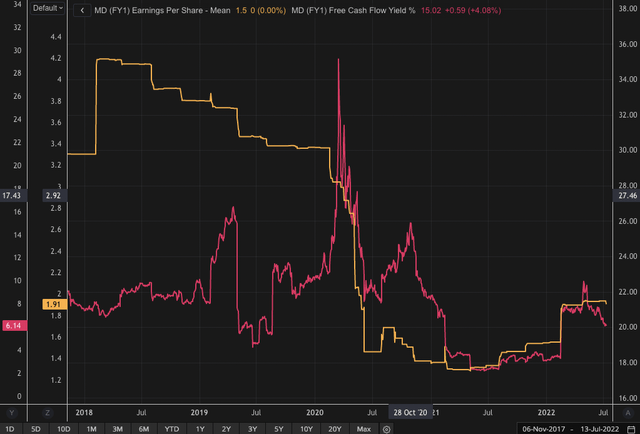

Further evidence of MD’s earnings and FCF momentum is observed below. Both earnings and FYF yield have curled up since 2022 and are offering upside premium as the market separates unprofitable names from profitable ones. We firmly believe that MD will continue to compound earnings and FCF into the coming years. Hence, current multiples present compelling value as the share has potential to re-rate back towards its late 2020 highs, by estimate.

Exhibit 4. Both earnings and FCF yield have curled up in 2022 offering long-term upside premium

Data: Refinitiv Eikon

Valuation

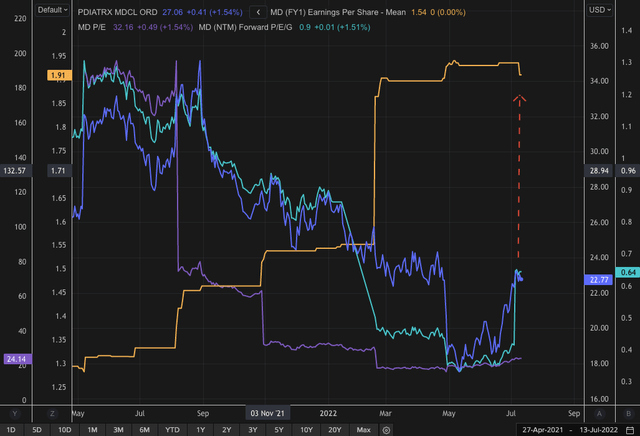

We’ve noticed a value gap in earnings to valuation for MD and this offers the potential for the share to revert back towards its previous highs. It’s priced on a forward PEG of 0.64x and trades at ~22x forward, P/E above 3-year averages and the sector median’s 12.3x forward earnings. It also trades at ~2x book and is fairly priced at 1x sales. However, these multiples have de-rated as the MD share price has compressed. The question then becomes if MD is a source of value or if the thin multiples are justified.

Exhibit 5. Multiples have de-rated alongside the MD share price, albeit with large divergence from bottom-line growth

Data: Refinitiv Eikon

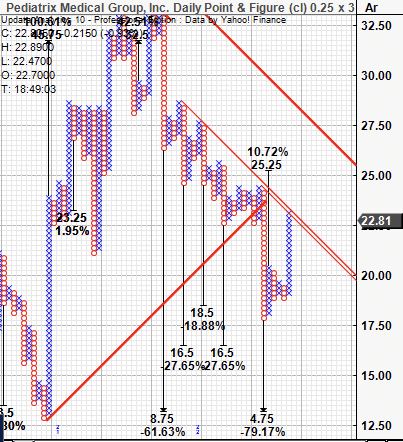

Technical studies removing the noise of time have become integral to pricing stocks in this environment. As seen below, point and figure charting shows multiple downside targets have been forecast ranging from $18.50 to $4.75. This is incredibly bearish price action and suggests there could be further downside on the way. There is one upside target however that is the latest one to be set, at $25.25. This offers a small portion of upside potential and therefore has us fairly mute on the outlook of the MD share price.

However, a forward P/E of 22x our F22 estimates of $1.90 provides a price target of $41, suggesting there’s upside to be realized yet. Moreover, the latest upside target from the P&F chart lays weight to bullish momentum yet to be priced into the stock.

Exhibit 6. Multiple downside targets have priced MD to level at $16–$18

Data: HB Insights, Updata

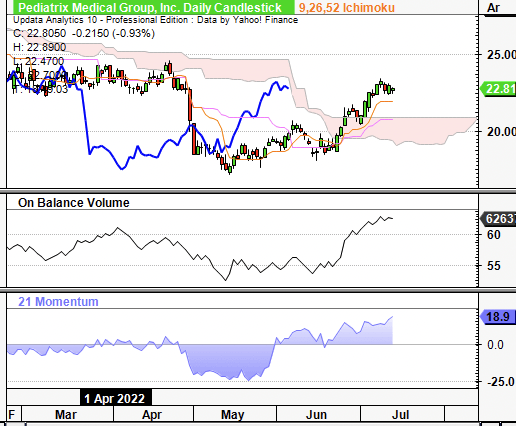

This most recent upside target should be taken notice of as it corroborates with technical studies showing trends might have reversed to the upside. Shares have punched back up above cloud support whilst OBV and momentum have confirmed the trend. Both have reversed off lows in June. The lag line on the cloud chart is now testing the cloud and if it were to break through we are bullish on MD.

Exhibit 7. Momentum indicators suggest bullish momentum if lag line breaks through cloud

Data: HB Insights, Updata

In short

MD has a list of tailwinds yet to be priced into its share price by estimation. Investors are rewarding bottom line fundamentals as they step up in quality this year and the MD share price is converging to this factor rotation. On the chart, it has caught a bid lately and momentum indicators suggest the uptrend is now in situ. This creates opportunity for price discovery as the stock reverts to the upside. We demonstrate that it has potential tailwinds to be realised in how it books unbilled accounts receivable, and that it stands up reasonably well in the macroeconomic climate.

We’ve priced MD at $33 per share and are seeking a return objective of ~46% as a speculative position to budget a small portion of risk towards. Rate speculative buy on these grounds.

Be the first to comment