Tomo Nogi/iStock via Getty Images

Investment Thesis

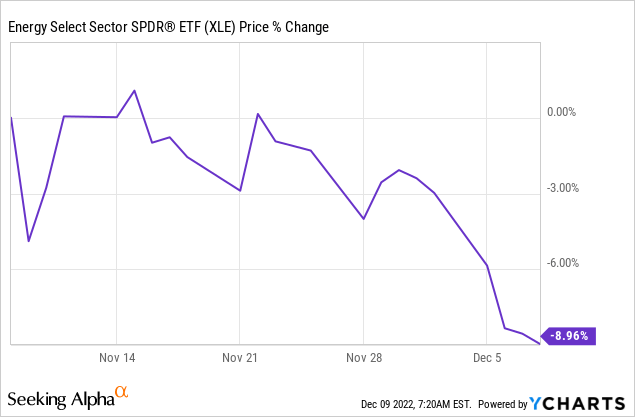

Peabody (NYSE:BTU) together with the rest of the energy complex has lost some momentum in the past several sessions.

And I believe that this is a clear ”buy the dip” opportunity.

I make the point that the energy trade isn’t dead. And perhaps more importantly of all, Peabody is going to enter 2023 in a much better position than in 2022.

And if 2023 ends up being even close to 2022, investors are being offered a very compelling risk-reward right now.

Does Anyone Still Care For Energy?

The energy sector is down nearly 10% in the past 30 days. Think about it. The Energy ETF (XLE) is a broad basket of energy stocks. And after a sizzling strong performance for the majority of 2022, it has now decidedly gone cold. Why?

This is where things get controversial. This shouldn’t be happening. And yet. And yet.

Yes, China is reopening. Also, we all finally got the memo that we need to carbonize the world a lot more in the coming years if we are to build the green infrastructure to hit our carbon targets by 2030. What?

Yes, in order to build out our modern lower-carbon world, we need to build solar panels. We must build offshore wind turbines. And a lot of them.

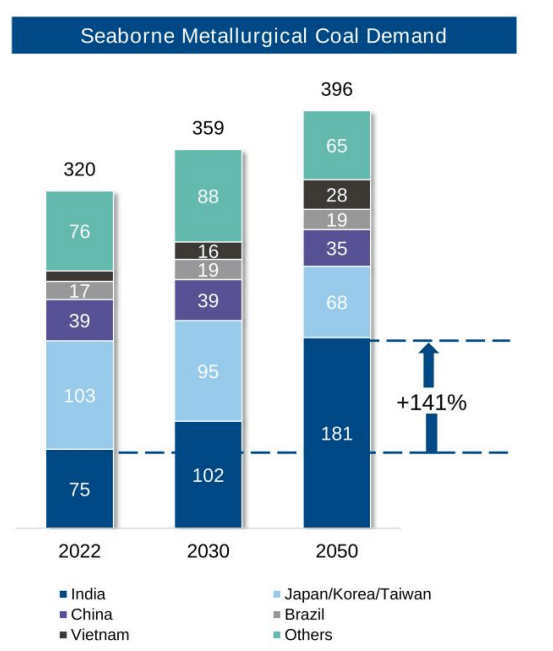

By the way, did you know that offshore wind turbines use 250 tonnes of steel? Each one! That’s about the same as 190 cars on top of each other.

And what’s become incredibly clear, is that without steel and cement, we simply can’t build the infrastructure that we need around the world. And how do you manufacture steel and cement without met coal? It’s not that it’s impossible. But it is prohibitively expensive.

And that’s why the UK has decided that it’s eager to preach about going ”green”, while at the same time ramping up met coal production, by building the first coal mine in 30 years. But we all thought coal was dead?

Is It Possible That Coal Isn’t Dead?

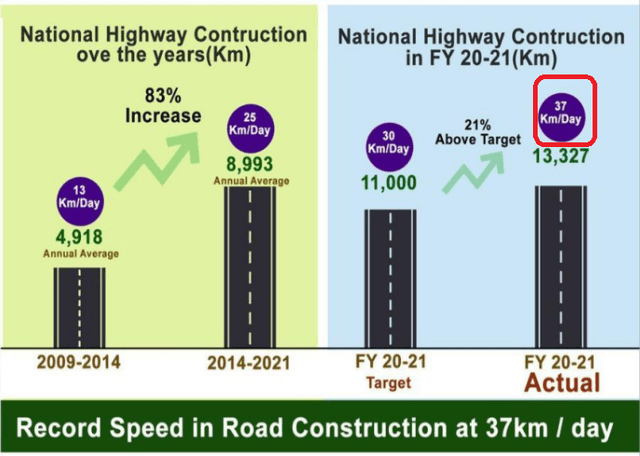

Here’s another interesting example. India has approximately 18% of the world’s population. And they need roads. They are not happy to travel on roads with problems. Roads with holes. They want highways. So that Indian people can get from point A to point B safer and quicker.

From 2014 to 2021, India was building 25 km/day of highways. And having exited 2021, India actually built highways at a pace of 37 km/day. Can you imagine how much concrete that requires?

And by extension, how much coal India needs?

BTU investor presentation

But India isn’t the only country in the world that’s attempting to improve its quality of life by increasing its number of highways. Other countries might include Brazil, China, Nigeria, etc. Basically, any country outside of the G7.

And even in the US, wasn’t there a $1 trillion infrastructure bill to spend on roads and bridges?

BTU Stock Valuation — About 3x 2023 Free Cash Flow

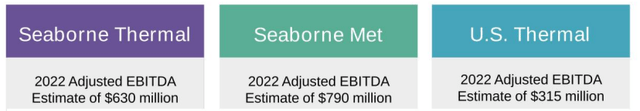

Roughly speaking, 46% of Peabody’s EBITDA comes from seaborne met, while close to 36% comes from seaborn thermal. With the remainder coming from the US Thermal.

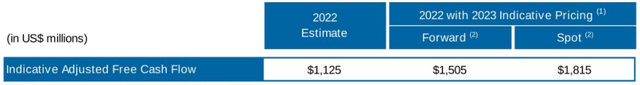

So, what happens to met coal is hugely relevant to Peabody. Meanwhile, for their part, Peabody believes that it could see around $1.5 billion of free cash flow in 2023.

Obviously, nobody knows what coal prices will be in 2023. Hence, the tables above are indicative only.

Next, let’s get to the core of the problem facing Peabody. Peabody hasn’t got a clear capital allocation strategy, since its debt has restrictive covenants. That being said, Peabody believes that it can eliminate the remaining $550 million debt liability over the next 12 months.

And if this covenant were to be removed in the coming 12 months, investors would be able to see substantial capital coming back via buybacks.

The Bottom Line

Peabody has restrictive debt covenants that are getting in the way of the company returning capital to shareholders. Peabody believes that it can remove these covenants in the coming twelve months by paying its debt.

What investors are worried about is that Peabody will end up taking their free cash flow and reinvesting back into the business.

However, this is my core argument, the demand for met and thermal coal isn’t going away in 2023 or in 2024. And with the stock priced at around 3x free cash flow, the risk-reward looks attractive.

Be the first to comment