Andrzej Rostek

Global demand for coal has skyrocketed in 2022 as natural gas supply is threatened in many areas of the world. In Europe, the decline in Russian natural gas exports has dramatically increased their need for coal and liquid natural gas. This shift has caused a decrease in liquid natural gas exports into Asia, causing China’s coal demand to rise due to lacking LNG. Coal production remains historically low in the U.S. after years of low demand amidst a trend against coal (toward natural gas). The few remaining U.S. coal producers, such as Peabody Energy (NYSE:NYSE:BTU), have seen profits soar as coal futures are currently up nearly 5X since 2020.

Peabody currently has a forward EPS of $6.28, giving it a very attractive forward “P/E” valuation of 3.7X. Its stock rose tremendously during the spring as coal prices rose after the Russian invasion of Ukraine, but have been flat since. Thermal coal prices have continued to grow and may be on the verge of another breakout following Russia’s complete halt of all Nord Stream 1 natural gas exports to Europe. Russia has also threatened to cut all energy exports (including coal) to Europe if price caps are created. At this point, the U.S. cannot export more natural gas than it already is as LNG production capacity is reached, meaning its coal demand may rise even higher. China’s coal price has increased due to this factor and a wave of floods that have restricted Australia’s coal export capacity.

In my view, this situation bodes well for Peabody and may cause its earnings outlook to improve further. While the collapse in metallurgical coal may continue, higher thermal coal prices and demand may offset these losses. The stock is very inexpensive and, given coal may remain expensive for years, may have the potential to deliver strong long-term returns to investors today. Of course, growing risks in China’s economy could end coal’s rally, and, in the short-run, investors should be mindful of this risk.

A Top-Down View on Coal

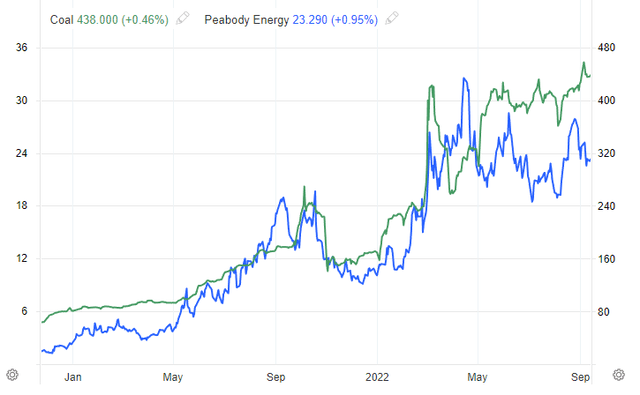

Like most energy companies, Peabody’s prospects depend highly on global economic trends. The company operates the U.S. and Australian thermal and metallurgical coal mines. Since coal is a global commodity that is generally more transportable than natural gas (overseas), trends in Europe and Asia have a significant impact on the company, even though much of its thermal coal is sold in the U.S. Peabody’s stock price has generally tracked the Asia-centric Newcastle coal futures price index. See below:

BTU price vs. Newcastle Coal Futures (Trading Economics)

As you can see, the two have been generally correlated over the past two and a half years, while coal has risen in value. Peabody sells thermal and metallurgical coal, but typically 50-70% of its sales and EBITDA come from thermal coal. This ratio was slightly lower last quarter due to growing issues in U.S. railroads that caused significant missed shipments for many coal producers.

The Powder River Basin is Peabody’s largest thermal coal mine and has struggled with growing costs and shortages related to railway issues. According to the company, all of its thermal coal tons for the year are priced and committed, but sales may not be able to occur due to railway unavailability. The potential strike in U.S. railroads may worsen as the global thermal coal shortage becomes tighter. Investors should be mindful of this black swan risk factor as there are few benefits of high prices if Peabody has no physical means of delivering its product. Of course, if coal does not flow across the U.S., prices will inevitably rise even higher.

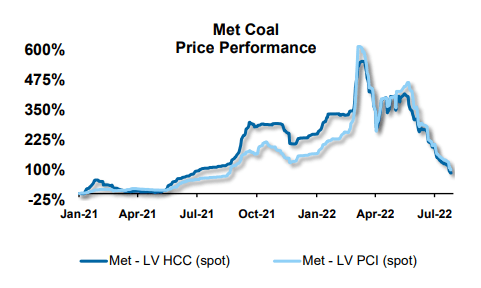

A smaller but still sizeable portion of Peabody’s sales is derived from metallurgical coal used for steelmaking. Like many coal companies, Peabody has focused on growing this segment as metallurgical coal does not carry thermal coal’s poor environmental brand. This focus was understandable in the recent past when governments worldwide sought to reduce thermal coal dependence. Unfortunately, thermal coal demand is booming today, while the metallurgical coal market has shuttered. See its price indices below:

Metallurgical coal price 2021-2022 (Peabody Energy Q2 Investor Update)

Metallurgical coal prices are still higher than at the beginning of 2021 but have erased most of their recent gains and appear to be trending lower. The construction slowdown in China initially triggered this sharp reversal as the region’s prolific steel demand collapsed. More recently, the extreme spike in European energy prices has led to widespread steel mill shutdowns across the continent, further decreasing the need for metallurgical coal. In my view, these trends are likely to continue as high energy costs, and related economic turbulence is set to continue. It is, in my opinion, very unlikely Asia or European companies will continue to invest heavily in durable goods that require steel, given the ongoing economic shift. Eventually, this segment of Peabody’s earnings may recover, but that may take years, given how overbuilt China has become.

Earnings Outlook for Peabody

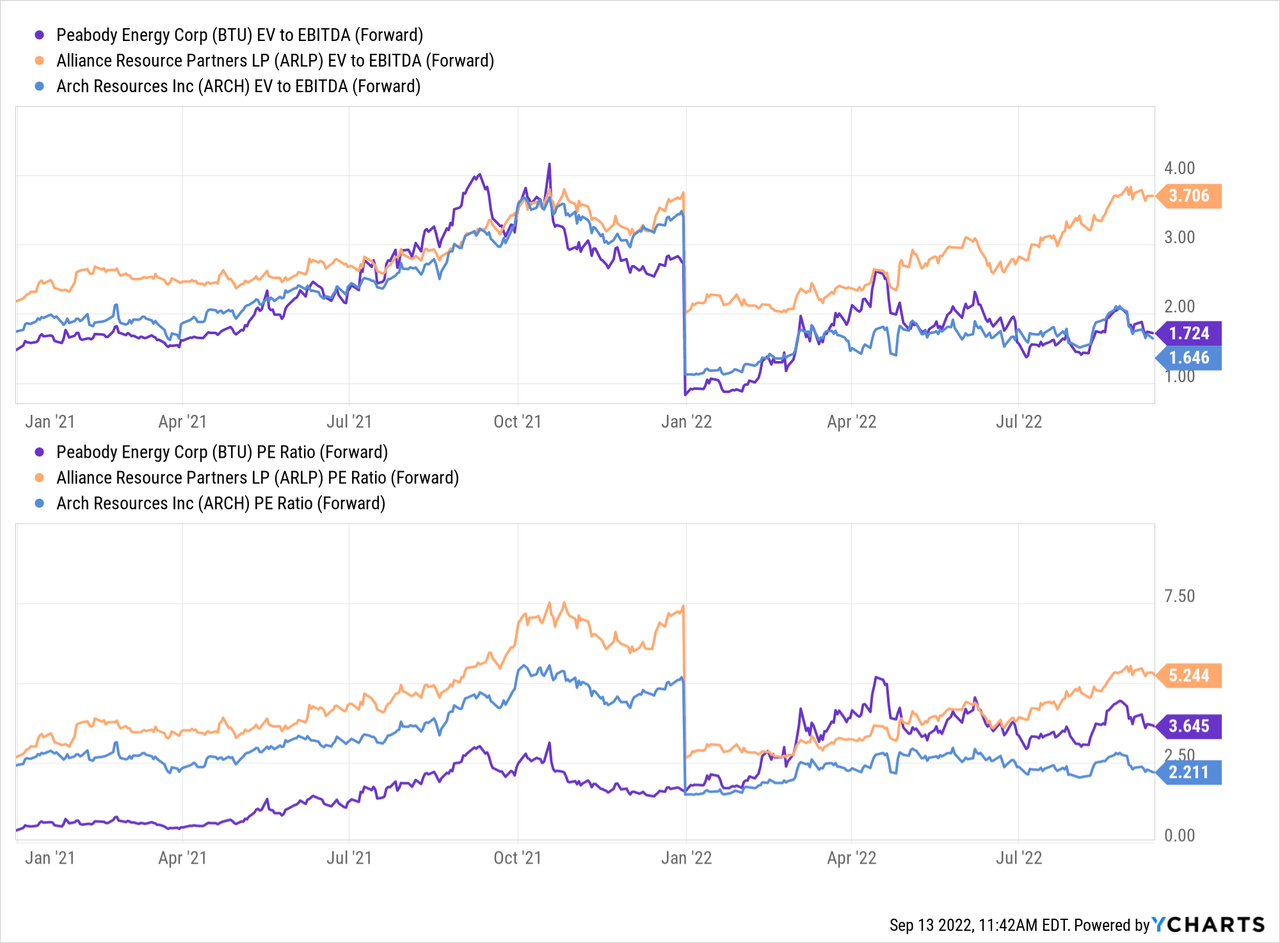

Overall, the economic trends facing Peabody vary. I believe its thermal coal segment should perform well as thermal coal prices reach new highs amidst the growing shortage in European energy supplies. Of course, this segment is highly dependent on railway transit, which remains in a precarious state as a union strike looms. While metallurgical coal generally makes up a smaller portion of Peabody’s sales, I expect this segment to see EBITDA slip as demand declines with more global steel mills reducing output. These risks are not insignificant; however, they are heavily discounted in Peabody’s valuation. See below:

Peabody currently has a forward “EV/EBITDA” of only 1.7X and a forward “P/E” of only 3.6X. This valuation makes Peabody a bit cheaper than Alliance Resource Partners (ARLP) but more expensive than Arch Resources (ARCH). Peabody is expected to earn an EPS of $6.28 this year, $4.94 in 2023, and see its EPS return toward ~$1 after that. The recent decline in metallurgical coal prices may cause its 2022 earnings to be slightly below the expected level. That said, I do not believe the company’s EPS will necessarily reverse back toward $1 by 2024 since it seems coal demand may remain high for years as countries reduce natural gas dependence.

We must remember that coal demand has declined since ~2005, not due to a surge in solar electricity (etc.), but due to a significant increase in E.U. and U.S. natural gas usage. I believe the recent experience in the natural gas market proves it is not necessarily superior to coal. It is comparatively cheap and abundant and could be cleaner using new sequestration technologies. While it is a bit environmentally cleaner, it has proven to be a logistical nightmare for Europe and has created fracking issues in the U.S. Thus, unless there is a surge in nuclear power or innovations make superior green energy solutions in the coming years (which I believe is entirely possible), coal seems likely to continue to return as a primary power source in developed countries.

The Bottom Line

I believe thermal coal demand will continue to rise this year and remain high for years until innovation allows for more effective green energy solutions. It appears the competitive landscape between natural gas and coal has shifted dramatically back in favor of coal as Russia halts its natural gas pipeline as a war tactic. Even when the natural gas pipeline is turned back on, the E.U. may continue to focus on coal to avoid repeating this situation. Given Peabody’s low valuation, I believe it may be a great long-term opportunity as thermal coal returns as a key global energy product.

That said, Peabody faces significant short-term risks which may harm its stock price. Firstly, the potential rail strike and issues in the freight transportation market could upset the company’s Q3 earnings as deliveries are impaired. Secondly, the economic slowdown in China and Europe appears likely to dramatically lower steel production, harming demand for Peabody’s metallurgical coal market. Even more, if China’s economic situation continues to spiral, its thermal coal demand may temporarily decline – a significant factor considering China is, by far, the largest global thermal coal consumer. With these risks in mind, I am neutral on Peabody for the time being and would only buy the stock with a multi-year investing horizon.

Be the first to comment