12MN/iStock via Getty Images

Peabody Energy (NYSE:BTU) reported Q2 preliminary revenues of $1.31B-$1.34B. This was actually below the $1.41B analyst consensus estimate. Net income amounted to $400M-$420M and adjusted EBITDA to $570M-$590M. That’s a lot of net income and EBITDA on a $3 billion market cap in just one quarter.

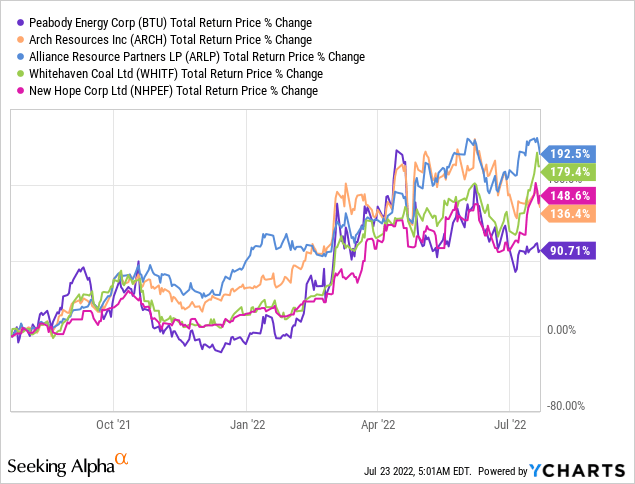

Peabody has lagged coal peers a bit over the past 12 months. Investors seem worried about the cash margin amounts the company needs to post to cover its hedges. As time goes on, the risk of margin calls on the hedging book are decreasing as Peabody has been able to deleverage and adapt to this new reality of violently swinging margin requirements. Peabody ended Q2 with $544M of cash margin posted while holding $1.12B in cash and cash equivalents. Long-term debt comes in slightly below $1.1 billion.

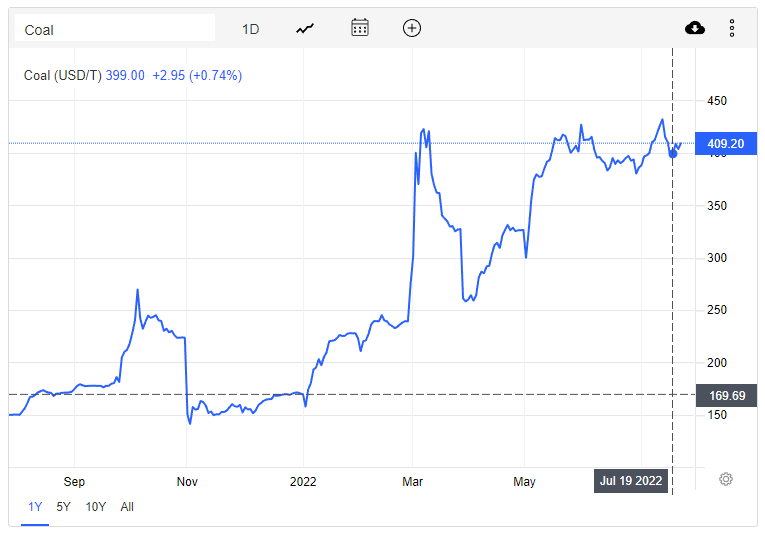

Earnings are very high because coal prices are very high this year:

coal price 2022 (Tradingeconomics.com)

According to the IEA’s latest Electricity Market Report electricity demand growth is slowing in 2022. It is slowing down from a strong post-Covid recovery in 2021. Because economic growth is weakening and energy prices have been soaring after Russia’s invasion of Ukraine. The IEA expects 2.4% demand growth for 2022, roughly in line with years before Covid shocked the world.

Strong renewable growth is displacing some fossil fuel capacity. CO2 emissions through electricity generation are likely to fall from a 2021 high on a global level in 2022.

Because of high gas prices (most notable in Europe, which is being tactically pressured on this front by Russia) coal spare capacity has been brought online. Several European countries delayed phase-outs of coal plants and/or have lifted coal import restrictions.

Chinese demand has been somewhat muted because of its rolling Covid lockdowns. This has resulted in a strong 2.6% contraction of Chinese GDP in Q2. This policy is unlikely to be continued forever. Or, as the FT put it in a recent editorial:

All of these aspects of China’s malaise have been exacerbated by Beijing’s “dynamic zero-Covid” policies, which have subjected cities to rolling lockdowns to try to contain the virus. However, the economic frailties that now characterise the Chinese economy are taking on a distinctly structural hue.

Covid should still be taken seriously. But not through ultra-strict lockdowns. Beijing should accelerate its vaccine programme, allow foreign mRNA vaccines to be administered on a nationwide scale and coax the many unvaccinated people over 60 to get a jab. The time has come for Xi and his government to jettison its vaccine nationalism and acknowledge the efficacy of foreign products.

There’s a war raging in Europe, winter is coming up, and the villain controls Europe’s gas supply. China is imposing rolling Covid lockdowns, which is curbing its economy and, consequently, demand for commodities (including energy). A lot of cyclicals, particularly coal producers, trade at multiples, suggesting prices are about to fall off a cliff and/or demand will disappear forever.

On the supply side of things, coal isn’t a growth market. Financing has been pulled from the coal sector on a global scale in the years prior to 2022. ESG trends have made it one of the most hated industries to bankroll. The IEA sees some U.S. production growth in 2022 but none in 2023:

In 2023, we expect coal production to total 594 MMst, about the same as 2022. Much of the decrease in coal mine capacity that has occurred since 2020 appears to be permanent. Coal producers have experienced labor and capital shortages, which we expect will continue to limit coal supply in the forecast.

It seems very unlikely that these high coal prices will revert back to long-term averages in the short to medium term.

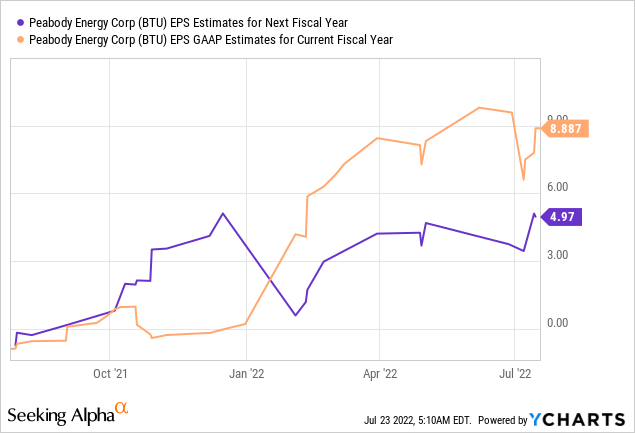

Analysts’ consensus is for $8.88 in EPS/share for this year (which we’re halfway through, and we know coal prices are really high). The consensus is for just under $5 in EPS/share for next year.

The $5 for next year is of course quite speculative. In practice, prices can fall very quickly if and when they do. For reasons mentioned before, there should be something of a floor under prices even if the widely feared recession shows up in 2023. With a share price of $20 and nearly $13 in anticipated earnings for this year and next, Peabody seems quite a good buy.

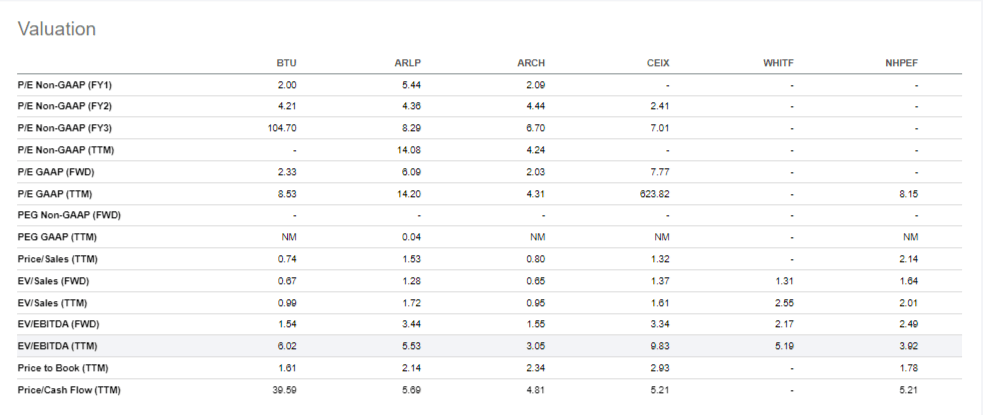

I pulled up valuations on Seeking Alpha for a number of peers including Alliance Resource Partners (ARLP), Arch Resources (ARCH) and Whitehaven Coal (OTCPK:WHITF) among others.

Coal industry valuations (SeekingAlpha.com)

BTU trades on the lower end of the range for this peer group. In particular, it trades at 1.64x forward EBITDA, 2.33x forward P/E and 1.61x book. These are helpful metrics in this industry, and BTU appears relatively attractive. Generally speaking, the valuations seem too low given the current profitability and outlook.

It is helpful to the profitability of the existing that there is essentially no long-term future for these companies. It is a very speculative endeavor to make long-term investments in this industry. Commodity industries tend to be poor investments because whenever the going is good, returns are driven down by new investments in capacity. The end of the coal industry may finally free it from that dynamic. Coal will likely disappear as a fuel over the next decade(s), but these could potentially be very profitable. Meanwhile, the shares are priced as if it’s game over in ~2025.

Be the first to comment