DNY59/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

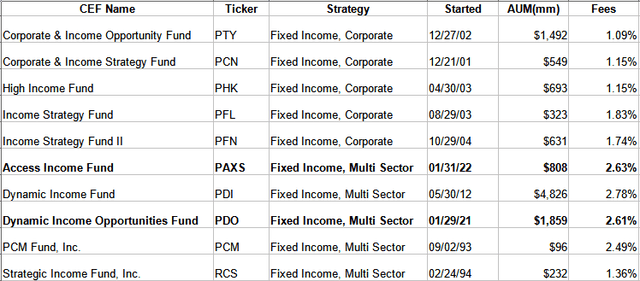

This is the fourth in a series of articles covering PIMCO taxable Fixed Income CEFS. There are links to the others at the end of this article. Dating back to when Bill Gross worked for PIMCO, this asset manager has been a leader in the fixed income closed-end-fund space. PIMCO offers a total of 21 CEFs, 10 of which are in the taxable fixed income space.

Later, I will show performance and other data for all ten of these CEFs. This article will cover both the PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) and the PIMCO Access Income Fund (NYSE:PAXS) in detail. If an investor can look beyond their short life spans (17 & 5 months, respectively), their discounts are best available for PIMCO taxable Fixed Income CEFs.

Exploring the PIMCO Dynamic Income Opportunities Fund

Seeking Alpha describes this CEF as:

The Fund seeks high current income as a primary objective and capital appreciation as a secondary objective. The Fund’s investment objectives are considered non-fundamental and may be changed by the Fund’s board of trustees without shareholder approval. There can be no assurance that the Fund will achieve its investment objectives or that the Fund’s investment program will be successful. Benchmark: ICE BofA US High Yield TR USD. PDO started in early 2021.

Source: seekingalpha.com PDO

Despite its young age, PDO has amassed $1.86b in total net assets, making it the 2nd largest PIMCO taxable Fixed Income CEF. PDO has a yield of 9.2%. The current leverage factor is 47%, funded almost entirely by Reverse Repurchase Agreements. One critical point is the fee structure:

- Management fees: 115bps

- Other expenses: 78bps

- Leverage expense: 68bps

PIMCO charges more for their Multi-sector funds than their Corporate funds (except for one) by over 100bps.

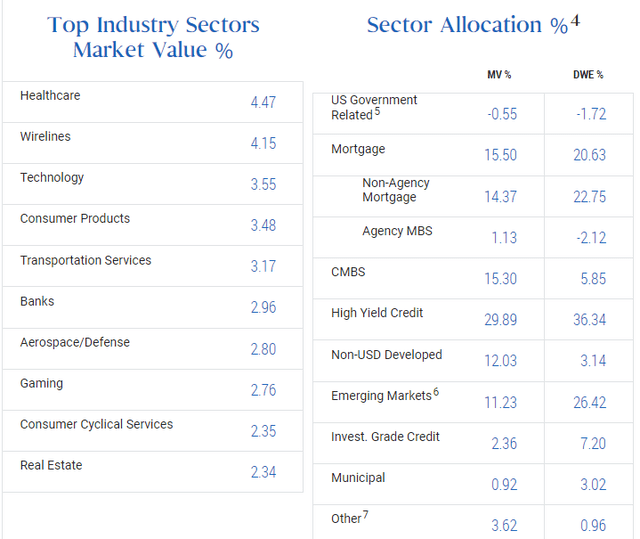

PDO holdings review

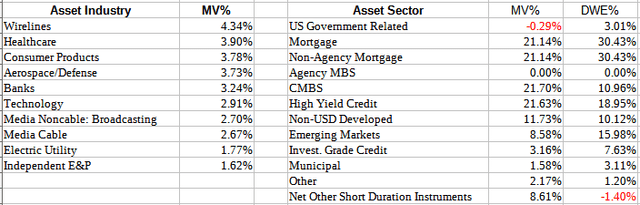

Both Industry and Sector allocations are widespread. If one includes EM debt with their HY exposure, 41% of the assets are in the High-Yield world. PDO owns little in the way of USTs or Investment-Grade debt. One site shows that being under 10% as of 12/31/21, most of which was rated BBB.

PIMCO.com PDO

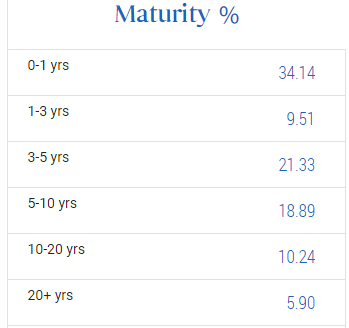

The effective maturity is 8.31 years, with a duration of 3.85 years. PDO holds almost 10% in instruments designed to shorten the portfolio’s duration. With rates increasing, having 43% of your portfolio maturing within three years should allow PDO to capture higher coupons than those maturing.

From reviewing the 3/31/22 holdings XLS, it appears the above roll together similar issues from an issuer to come up with the weights shown. These 10 weights are 26% of the portfolio that holds 667 assets.

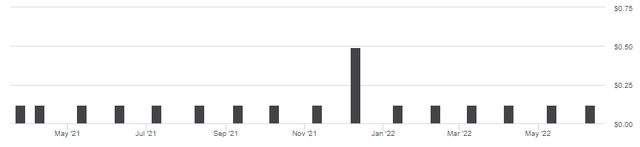

PDO distribution review

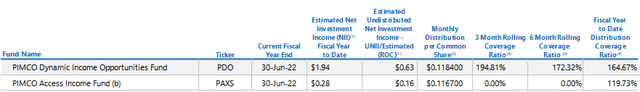

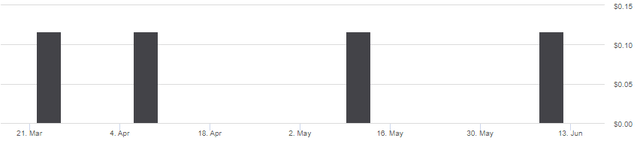

PDO has had a monthly payout of $.1184 since inception. They made a $.49 special payment last December. I saw no indication that payouts were not from NII. The UNII report shows PDO is well covered, and as of the end of April, had enough undistributed income to cover most of the rest of 2022.

I included PAXS here for easy comparison.

PDO price & NAV review

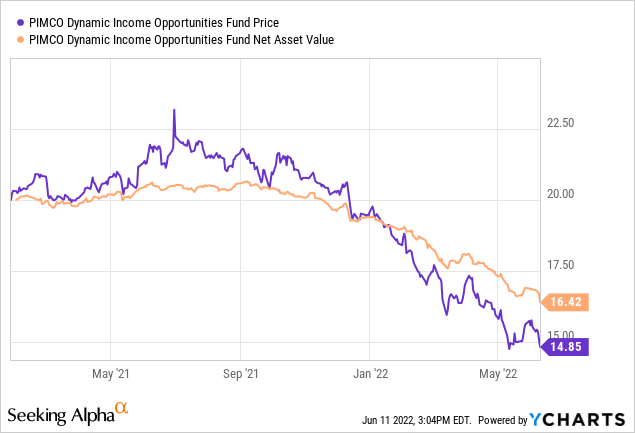

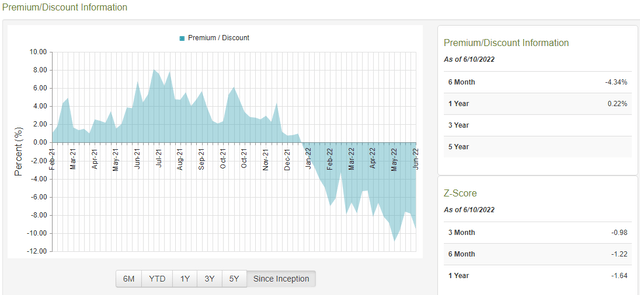

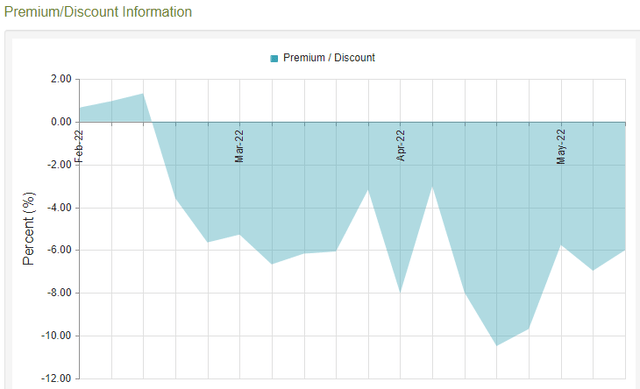

PDO moved to selling at a discount near the start of 2022 and currently shows a 9.56% discount. About the same time, PDO slipped below its offering price and NAV, and are now down 18% and 26%, respectively. That relationship is presented next.

In early May, PDO had a discount over 12%, so the current level is close to the best discount ever achieved.

Exploring the PIMCO Access Income Fund

Seeking Alpha describes this CEF as:

The fund primarily invests in corporate debt, mortgage-related and other asset-backed instruments, government and sovereign debt, taxable municipal bonds, floating-rate income-producing securities with varying maturities. It employs fundamental analysis bottom-up and top-down securities picking approach to create its portfolio. PAXS only started on 1/31/22.

Source: seekingalpha.com PAXS

PAXS has already attracted over $800m in assets. The yield is 9.2%. PAXS leverage ratio is lower at 33%, funded via Reverse Repurchased Agreements (85%) and Credit Default Swaps (15%). Its fee structure is:

- Management fees: 125bps

- Other expenses: 84bps

- Leverage expense: 54bps

PAXS holdings review

Like PDO, PAXS has a nice non-concentrated allocation across industries and sectors, except for High-Yield debt, which is near 30% when EM assets are included.

PIMCO.com PAXS

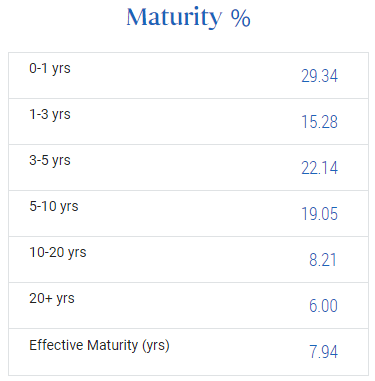

The effective maturity is shorter than PDO’s, as is the duration of 4.01 years. PAXS has over 44% of its assets maturing within three years, about the same as PDO has. When rates are rising, that is a statistic to be aware of when comparing funds.

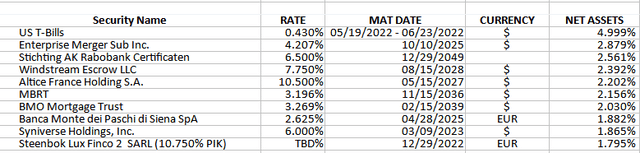

The only holdings data I found was from the end of March; Seeking Alpha shows no holdings data. Unlike PDO, this Top 10 is at the individual security level except for the T-Bills, which PIMCO’s data combined. PAXS held only 190 assets at the end of the first quarter, compared to over 450 for PDO.

PAXS distribution review

Since it started early this year, the monthly payout has been $.1167.

PAXS price & NAV review

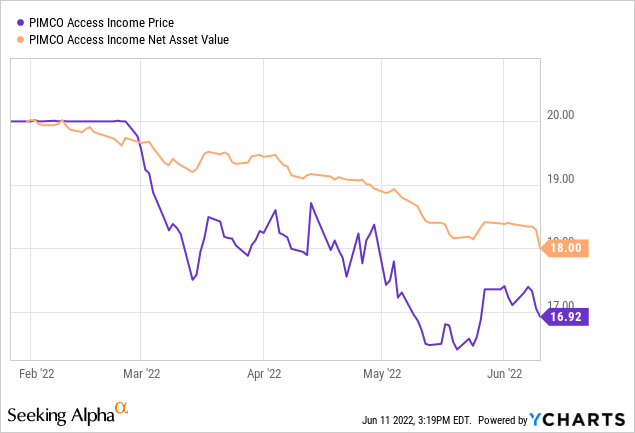

Like most Fixed Income funds, both price and NAV are down in 2022. Since inception, PAXS has seen its price drop 10% and its NAV 15%. Almost from the start, PAXS has sold at a discount, currently at 6%. It broke 10% in early May.

Comparing PIMCO Taxable Fixed Income CEFs

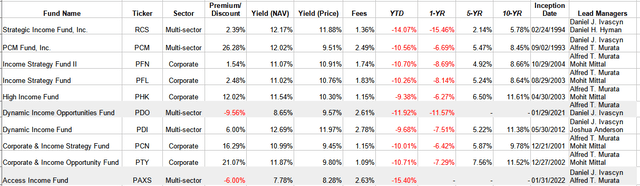

PIMCO offers ten pure Taxable Fixed Income CEFs to pick from; PDO and PAXS are the only two currently selling at a discount, though three more are close.

Glancing at PIMCO data, it appears that most of their CEFs have had their premiums shrink, and some are approaching selling at a discount. When you sort these by NAV Yield, PAXS is the lowest and PDO places 4th, which could help explain the discounts. That said, the other two lowest NAV Yields, the PCM Fund (PCM) and the Corporate & Income Strategy Fund (PCN), have two of the highest premiums! My logic would be investors are willing to bid up the price if the yield is higher. Of the funds not covered by this article, the price yields range from 9.45% to 11.97%. The Price/NAV ratios range from 1.54% to 26.28%.

Portfolio Strategy

With the funds sharing a small set of the same managers, investors seem to have a choice between two taxable-fixed-income strategies: Corporate only or Multi-Sector. Within each, they can then decide which variable is the most important to them or their belief which will drive future returns, the ultimate goal for most investors, including ones looking for income. Those possible variables include the fund’s premium/discount, yield, past returns, and present duration/maturity values.

Being the two newest taxable-fixed-income offerings could also explain why they have the only discounts as they should have younger portfolios than the longer-date funds, but that is a pure assumption on my part. It is hard to imagine that their current discounts will stay in place as their yields climb. That said, PDO’s is higher than two of the other funds already. This is also getting into an analysis realm which I consider beyond my expertise, so keep that in mind. It also shows why each investor needs to do their own due diligence after reading article on any investment site, including Seeking Alpha.

PIMCO CEFs article links

With these funds so popular, readers ask various Contributors to share their analysis on their favorite ones. While these are my links, all have multiple Contributor coverage.

PIMCO Strategic Income Fund (RCS)

PIMCO High Income Fund/PIMCO Corporate & Income Opportunity Fund (PHK) (PTY)

Be the first to comment