Adam Smigielski

Investment thesis

We are officially in a bear market with nearly all major indices below -20% YTD. This is due to the reasons mentioned earlier. Furthermore, we are seeing a higher risk of a recession coming next, putting the market down even more. In times of bear markets and recessions, few stocks are favourable to invest in. I maintain that the PIMCO Dynamic Income Fund (NYSE:PDI) is such a stock – or CEFs in this case. Due to a diversified portfolio, high quality, and a high yield paid even in recessions, we can also buy characteristics that can keep our investments saved and bring profits in every market phase.

In case you don’t know what a CEF is, I highly recommend reading this article about what a CEF is by a fellow SA author because it is critical to understand my analysis.

Market

Right now, you hear and read the words inflation, economic slowdown and recession everywhere. This is due to a record high inflation of 9.1% in the USA, disrupted supply chains and rising rates worldwide. A logical – and highly probable – consequence of these problems would be a recession. A country is officially in a recession when the GDP growth is negative for two quarters in a row. In the first quarter, the GDP of the US declined by 1.4%, and since all the problems were present in the second quarter of the year, too, the chances are high that we already are in an official recession. The data on GDP is supposed to be released this week; then, we will know more.

Since this article isn’t meant to explain this problem in detail, I can recommend this article by Lyn Schwartzer about inflation and recession for everyone wanting to dive deeper into this topic.

PDI – PIMCO Dynamic Income Fund – 13.1% yield

Offering access to PIMCO’s best income-generating ideas across multiple global fixed income sectors, the multi-sector fund seeks current income as a primary objective and capital appreciation as a secondary objective.- stated as on the PDI overview site

That’s one part of the PDI’s description and shows right away why I chose this CEF right now. The fund’s primary goal is to buy assets that generate income, which I seek in uncertain times. The monthly distribution is $0.2205, which accounts for a forward yield of 13.1%.

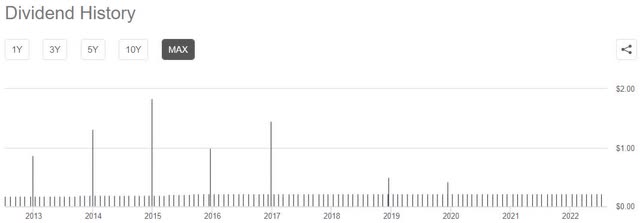

The distribution grew steadily between 2012 and has been constant since 2016 with a minimum of paying $0.2205 per month with special dividends in 7 out of 9 years.

Dividend history (seekingalpha.com)

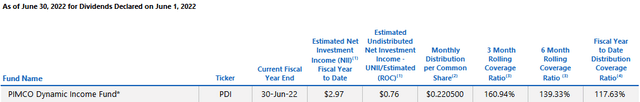

When looking at the dividend coverage, I think it is safe to say that PDI’s dividend is safe. As you can see below, the coverage ratio reaches from 117% for the entire year to 161% for the 3-month rolling coverage.

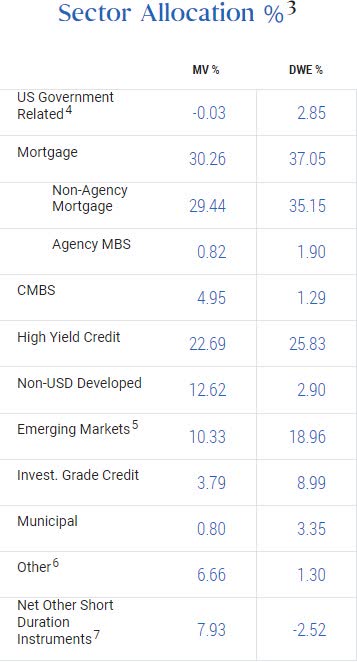

On 05/31/2022, the fund’s net asset value was $4.8 billion, divided by approximately 2000 different assets. Due to the focus on income, the current assets are chosen to be mortgages, high-yield credit, convertible bonds and sovereign issues, as much as municipal bonds and securities issued by the US government agencies Freddie Mac and Fannie Mae.

With approximately 30%, the most significant asset is mortgages, followed by high-yield credits making up about 23% of the portfolio.

Sector allocation (pimco.com)

The assets emerge mostly from recession-proof industries, as you can see below:

Top industry sectors (pimco.com)

Except for banks, the six biggest sectors have proven recession-proof. This is why I stated PDI as a pick for a recession-proof portfolio. In case of origin, more than 70% of the portfolio is settled in the United States, with the UK as the second biggest country with almost 5% of the portfolio.

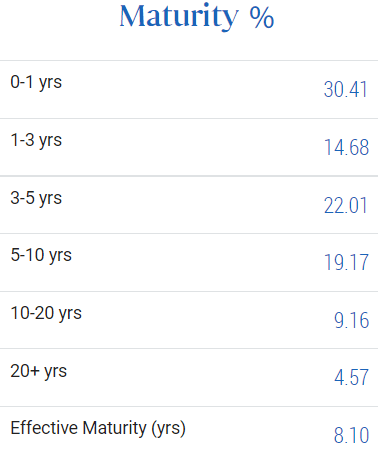

Maturity of PDIs assets (pimco.com)

The maturity in which the assets come to a stop is relatively short, with 30% maturing within a year and 55% maturing within the following ten years. The effective maturity is just over eight years and is medium or intermediate.

In times of rising rates and inflation, a medium to long maturity isn’t favourable because it could mean that the income of assets is bound to rates that are way lower than the current market rate. Therefore, PDI’s maturity isn’t something I would mention as beneficial right now.

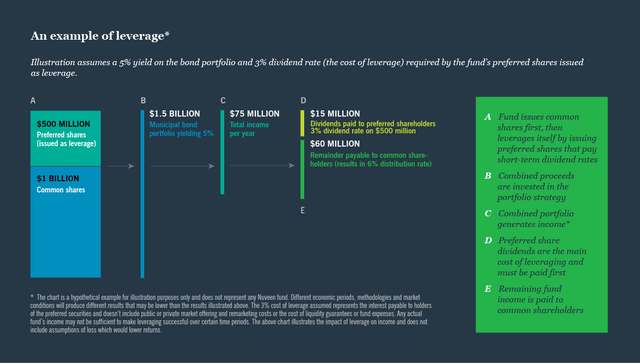

Like most CEFs, PDI uses leverage to boost its performance. In their case, the total effective leverage accounts for closely 49%, meaning that half of the assets are borrowed. Leverage is known to be good in positive but bad in negative market times. It enhances the performance in a bull market but widens losses in bear markets. Consequently, you should be worried in current times. Right? One thing is often forgotten when it comes to leverage in high-distribution CEFs. And that is the income a fund generates. It enhances the share price to the positive as much as to the negative, that is right. But it enhances the distribution too. And that is why leverage has more positive than negative aspects overall. Even in bear markets, distributions are paid if you choose the right CEF. Meaning that leverage des good in bear markets, too, with the increase of income a fund generates. This income will then be distributed to shareholders making it better in bear markets, as explained earlier.

Illustration of income generating using leverage (nuveen.com)

This is one illustration showing how leverage can increase the income of a fund and therefore boost the distribution for shareholders. It is from this article from nuveen.com that dives more profound into the use of leverage in CEFs.

Since its inception, the management of PDI has proven to be capable of choosing high-quality assets and generating high income for its investors. This is represented in a good performance beating both the broad market and similar CEFs.

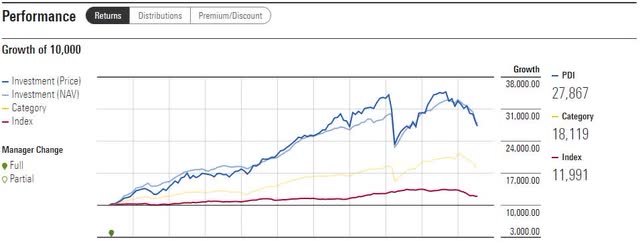

Morningstar comparison between PDI and a peer category and index (morningstar.com)

Here you can see a comparison done by Morningstar. Shown is the growth of a $10.000 investment since 2012 in PDI, the category and an index. The category is ‘Multisector Bond’, which represents a collection of bonds with the same or similar assets like PDI. The index tracks intermediate-term core-plus bond portfolios.

I like the multisector bond category better as a comparison against PDI because it isn’t as diversified and is more closely related to PDI. As you can see, PDI has outperformed its peer category by nearly $9.800, which accounts for 54% or 5.4% annually.

While talking about Morningstar, it is interesting to see that as of June 30; they updated their rating for PDI from three to four stars. This is a good signal considering the risk the market is currently at.

Apart from the last 2.5 years (since the start of Covid-19), the fund did well in delivering the same performance as the S&P 500 while paying out massive income.

10 Year total return against the S&P 500 (seekingalpha.com)

Since then, PDI couldn’t connect with its past performance due to a rough market situation for such assets as mortgages, for example. PDI’s net asset value declined due to rising rates, inflation and recession fears. So precisely the reasons the whole market fell and nothing particular of the fund itself. In my eyes, this and further evolution of such problems, like a recession, is not something to worry about. Instead, you should admire the buying opportunity and chance to lock in a 13+% yield. The distribution alone is enough to satisfy and compensate for times when the share price may disappoint.

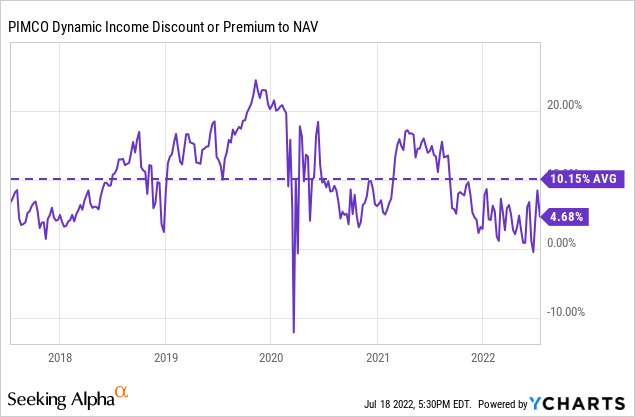

PDI currently trades with a premium to net asset value of 4.68%, coming from +/- 0% just a few days ago.

As seen above, the average premium in the last five years was 10.15%, meaning that we trade below the average valuation of the last five years. I like to use the chances to buy a CEF with a discount, but considering the characteristics of PDI, I gladly buy it below the average premium.

Risks to my thesis are there, as usual. PDI’s net asset value could further decline due to rising recession fears or recession itself, rising rates, inflation and so on. With declining net asset value comes a declining share price which could lead to capital losses. As explained earlier, this risk is nothing I would worry about since my main focus here is the income which I don’t see in danger.

Conclusion

I, personally, want to invest at any time and don’t want to wait until I think the market has bottomed, which isn’t possible regularly anyway. While waiting for the market to return to former highs, I want my money to work and generate some profits. To pursue this strategy, I invest in stocks like PDI with a very high probability of good distribution in every market phase as compensation for a possible decline in share price and only a slight chance of losses. Especially because losses here are probably only temporary since an actively managed and diversified portfolio has higher chances to outlive a recession than a single stock.

Due to the characteristics of PDI as a stock with an actively managed, high-quality and diversified portfolio, proven management, good distribution record and market-beating performance, I rate it as a buy.

Be the first to comment