AerialPerspective Works

There seems to be a common misconception surrounding the CoreSite data center REIT acquisition in regards to its intended purpose for the American Tower business model. This purchase was not intended be a horizontal expansion of the company trying to diversify its revenue streams, it was intended to be a vertical integration. The evolution of communication and technology has merged two industries that have only just begun. I investigate an even further expansion of American Tower Corp’s (NYSE:AMT) vertical integration with a hypothetical acquisition.

American Tower Operations

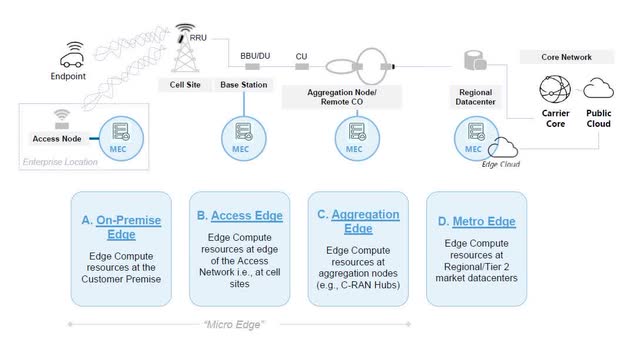

Traditionally, AMT has operated as a cell tower provider collecting rent payments from large telcos for access to their towers. Growing into the largest owner of cell towers on the planet, AMT has recently expanded its operational activities. Under the radar, they had already begun building edge data centers on location directly beneath owned cell towers before the major acquisition news of CoreSite. The forward-looking management team realized that data centers and cell towers were rapidly merging due to the rise of 5G and the Internet of Things. The opportunity to reduce latency and necessity to process data at macro tower locations is substantial as we move into a world driven by the cloud and edge computing. Depicted in the images below, we can see the process flow for data communication in the new world.

American Tower Corp Investor Presentation

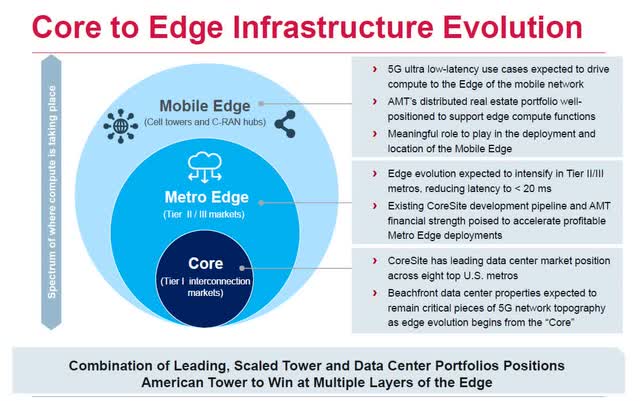

Core to Edge Infrastructure (American Tower Corp Investor Presentation)

As you can see, AMT has expanded its footprint beyond providing just an access point for data retrieval and communication. They have now moved into owning the data end points for storage and processing. By owning a small but expanding portfolio of edge access points at tower sites, the most optimal speeds for edge computing functions can be achieved that are crucial to not only efficiency but the safety of systems that rely on this data such as vehicles and manufacturing operations. With the purchase of CoreSite, AMT has staked a massive footprint in large core data centers where data is stored and connects to further data centers via the cloud. American Tower has successfully put together a business model that controls the acquisition, processing, storage, and distribution of data. Synergies associated with removing the middleman are substantial and I believe they are already beginning to take shape evidenced by the recent beat and raise earnings announcement.

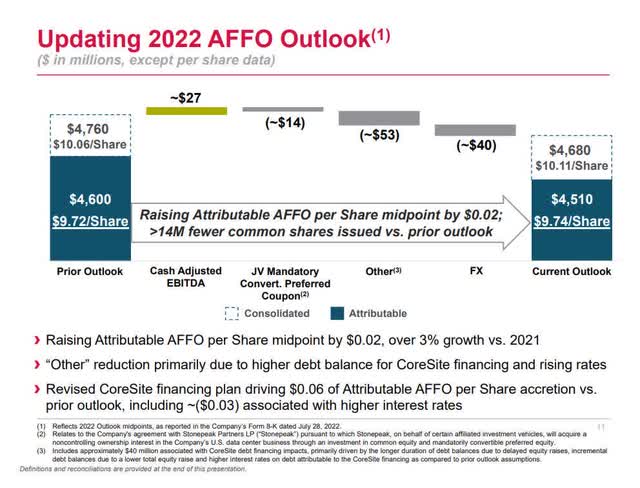

AFFO Outlook Raised (American Tower Corp 2022Q2 Earnings Report)

A noticeable rise in day-1 NOI per new tower and the AFFO guidance raise are not coincidences with the CoreSite purchase, they are products of it. Synergies from the acquisition appear to be materializing quicker than expected, a trend I believe we will continue to see.

Dividend Policy

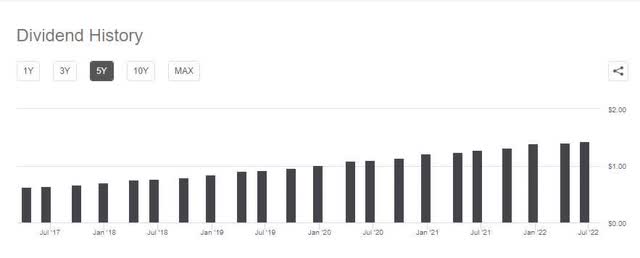

AMT possesses my favorite dividend policy available in the market, quarterly growth in the dividend. Like clockwork, every quarter AMT raises the quarterly dividend payout at an equivalent CAGR of 18%+ over the last 5 years. Combined with a respectable 2.1% yield, shareholders have enjoyed a substantial return of value over the years. To add icing to the cake, management has confirmed its target of 12.5% CAGR in the dividend for the near future.

AMT Dividend Growth (Seeking Alpha)

Growth During the 4G Buildout Cycle

One indicator we can look towards for determining growth during the 5G buildout cycle is to look at performance observed during the core 4G buildout cycle from 2010-2013. During this time period AMT saw a growth in net income of 124%, double the growth of the 62% increase in net income from 2016-2019 before 5G buildouts began. Due to delays in timing attributed to the Covid-19 pandemic, the core buildout of 5G didn’t truly pick up speed until early-to-mid 2021 so I believe there is still plenty of accelerated growth left in the 5G cycle.

Hypothetical Acquisition

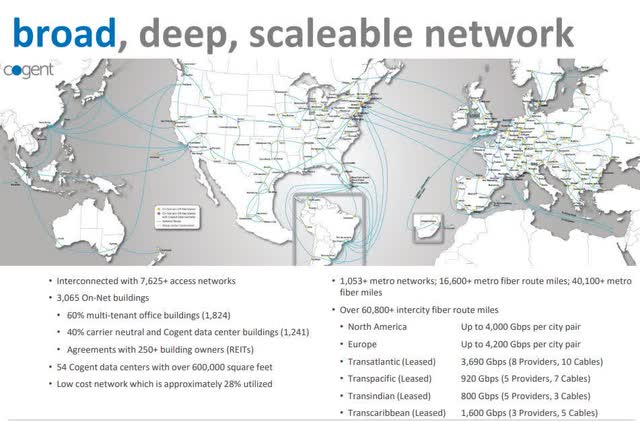

Using my experience in edge data center buildouts and integration of next gen technologies such as 5G and IoT, I can clearly see the growth opportunity that is available for American Tower. However, to fully complete the integration of the data flow process under one roof, there is one major component missing. This major component is the flow of internet and data traffic through fiber, it is a critical component to the quick transfer of data between customer use points, storage facilities, and edge computing centers. An interesting acquisition target for AMT would be Cogent Communications (CCOI) an independent service provider for high-speed internet communications and data storage that operates a “toll booth” for a major share of the world’s internet traffic. As depicted below, CCOI controls roughly 20% of the world’s data traffic via 100,000+ miles of fiber spanned across 50 countries.

CCOI Assets (CCOI 2022 Investor Presentation)

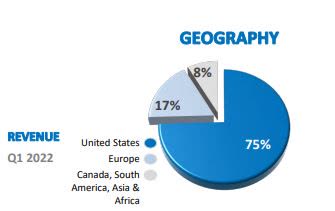

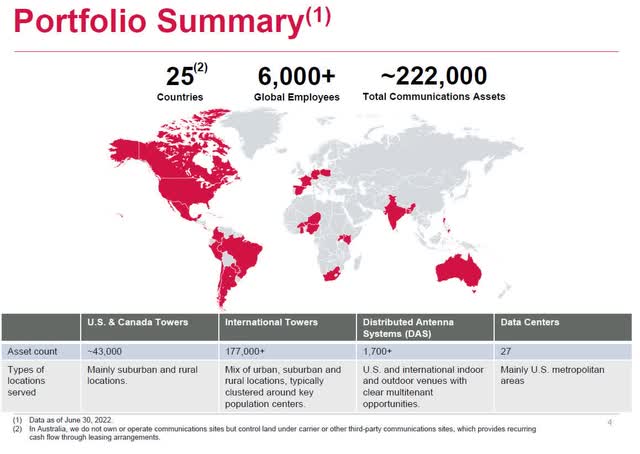

They provide on-ramp services to the cloud as well as off ramp through 1,241 different data center locations. Only 54 of these locations are owned by Cogent so I’m willing to bet that a large portion of the data centers that CCOI pays to have access to are owned by American Tower/CoreSite. The compelling aspect of this acquisition centers around synergies and expansion of CCOI in this hypothetical purchase. A significant portion of the costs associated with Cogent’s operations are the new customer acquisition costs that would be drastically reduced when folded into AMT’s operations. Nearly half of CCOI’s revenue comes from data centers and AMT has plenty of them now, allowing for Cogent revenues to scale rapidly and customer acquisition costs to ramp down quickly by becoming the preferred provider to AMT-owned data centers. Secondly, Cogent’s revenues are largely derived from the United States while AMT derives the majority of their revenue from overseas, presenting a large opportunity for expansion.

CCOI Revenue by Region (CCOI 2022 Investor Presentation)

AMT Asset Locations (AMT 2022 Investor Presentation)

Even better, the purchase of Cogent wouldn’t affect it’s classification as a REIT. This is due to two factors, the revenues produced by CCOI wouldn’t come close to 25% of total company revenue, and secondly, even if operations from CCOI expanded substantially, those revenues would still be able to be declared as rent payments from real property based on an official IRS statement.

Another benefit to this transaction would be access to cheaper debt. CCOI is currently held to debt at a 7% interest rate, a rate that would substantially decrease after being acquired. If their 7% interest rate debt was able to be converted into a similar rate recently given to AMT of 3.65%, the interest payment would drop by about $30mm in the first year. This would double the earnings from continuing operations from $30mm to $60.5mm.

From an operating income point of view, CCOI would only add $114mm in income, or 3.4% to AMT as a whole. However, as discussed previously, several large opportunities exist to expand CCOI margins.

Based on the current CCOI market cap of $3 billion and net debt of $1 billion, even with a 33% premium attached to the purchase price per share the purchase of Cogent would still be less than half of the CoreSite purchase at $5 billion. To get an idea of how these deals would compare I have compiled the chart below.

| Metric | CORE | CCOI |

| Revenues at Purchase | $655 million | $575 million |

| EBITDA at Purchase | $343 million | $203 million |

| Purchase Price | $10.1 billion | $5 billion |

| EV/EBITDA Multiple | 29.4x | 24.6x |

Based on a quick comparison on paper, CCOI would appear to be a better deal than CoreSite. There are however a multitude of factors to consider especially expenses of debt financing in the current environment. Regardless, I found this to be an interesting exercise.

Summary

Some investors may have misunderstood the purpose behind moving into the data center space. By expanding their operations, AMT has become the premiere infrastructure investment for 5G and IoT technology. I have been a long-term holder and fully expect to see healthy returns for the years to come as the 5G buildout cycle ramps up and the possibility of additional accretive acquisitions. I am a long term buy and hold investor meaning the valuation today does not have to be perfect in order for me to benefit from long-term compounding. However, for those looking to capture quicker returns, you may want to wait for a slight drop in price as current P/AFFO valuations of 23.25 are essentially directly in line with the historical average.

Be the first to comment