agafapaperiapunta/iStock Editorial via Getty Images

Deutsche Bank Aktiengesellschaft’s (NYSE:DB) stock has gone into risk-off mode this year on Russia/Ukraine concerns. However, if the latest investor update was any indication, this self-help story could massively outperform market expectations in the coming years.

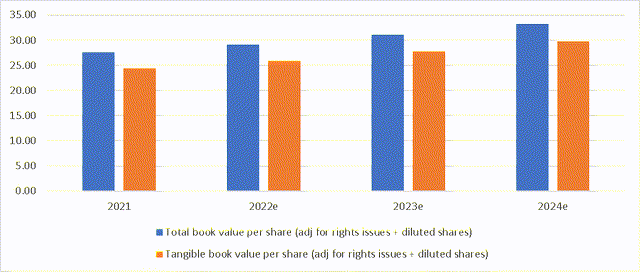

For one, the 2025 targets for the P&L, credit losses, and capital returns were largely intact, yet the market barely budged on the news and appears more focused on short-term concerns out of Russia and commodity trading (despite DB’s limited exposure). Upcoming ECB rate hikes and additional buybacks through the year should put upward pressure on the stock, particularly with the valuation at a dirt-cheap ~0.4x fwd tangible book.

New P&L Targets Pave the Way for the DB Self-Help Story

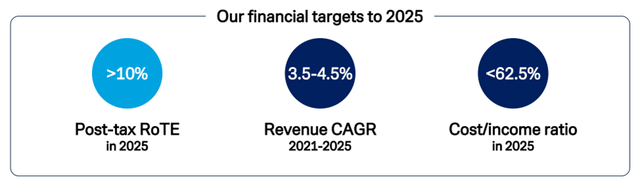

DB is now transitioning into a revenue growth story – a welcome departure from the more familiar cost reduction theme it has been touting in recent years. The goal is to achieve the >10% ROTE outlined in the DB 2025 plan, although the price action following DB’s investor update indicates the market remains highly skeptical.

The reality is that management has upped its revenue guidance for 2022 to EUR26-27bn (up from EUR25.5-26bn prior) – in contrast to concerns that the bank could suffer a revenue shock in the Russa/Ukraine aftermath. Given the guidance numbers are based on late-Feb rate curves, management has likely taken recent volatility into account, so I feel confident in underwriting the projected net interest income growth path.

Plus, FICC (fixed income, currencies & commodities) is robust and could exceed its EUR6.7bn (-4% YoY) guide for 2022 – a positive sign that things are turning around for the troubled division. Coupled with a rising rate tailwind and FICC resilience in the current environment, DB should retain ample buffer against any weakness in primary issuance revenues.

Despite revenue growth gaining importance in its 2025 plan, cost management remains a core focus area. That said, the cost guidance was less optimistic, missing consensus estimates, although this was more than offset by the improved revenue outlook. Still, the 2.5% annual inflation assumption for most of its cost lines seems modest, although DB’s multi-year contracts and relatively lower commodity price exposure should mitigate much of the near-term price increases.

On balance, the cost guidance needs to be viewed in context – DB’s cost/income ratio target of 70% for 2022 and its 2025 target of <62.5% represent tremendous progress compared to prior years and support the case for a significant ROTE uplift going forward.

Addressing Credit Quality Concerns

DB was the first European bank to clear the air on the Russia/Ukraine conflict at its investor update, alongside its commodity trading exposure. All is good on these fronts – despite the ongoing inflationary pressures and Russian sanctions, management signaled its confidence in the quality of its credit portfolio by reiterating its guidance of a ~20bp loan loss rate for 2022 (only just above the ~12bp for 2021). On Russia, DB disclosed its Russian exposure as follows – net loan exposure at EUR6bn (0.4% RWA), of which EUR0.55bn (0.16% of RWA) is offshore. Given the minimal RWA exposure, investors should expect a minimal CET1 impact even in a worst-case scenario where DB writes off its entire Russian offshore book.

|

EUR ‘bn |

% RWA |

|

|

Gross loan exposure |

1.4 |

0.40% |

|

Net loan exposure |

0.6 |

0.17% |

|

Offshore exposure |

0.55 |

0.16% |

Source: Deutsche Bank Russia Presentation

The bank has also de-risked following COVID-19, so management is confident that there will be limited deterioration in credit quality in the current inflationary backdrop. Coupled with the minimal disclosed Russia exposure, the DB update should allay any concerns about a potential near-or long-term increase in provisioning. Even in the commodities trading business, management has not guided to any increase in provisioning, so commodity-related exposure should be manageable at this point.

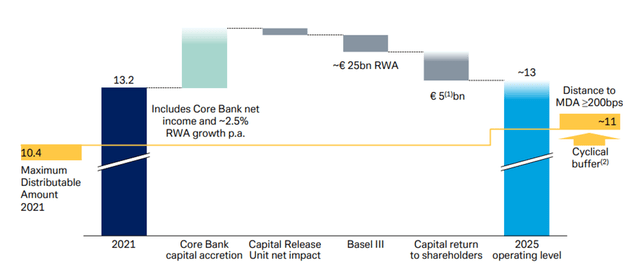

Sizing the Capital Return Potential

DB’s updated distribution target calls for ~EUR8bn over the 2021 to 2025 period (including for distributions for 2025 but payable in 2026) based on a stabilized 50% payout in 2025. In other words, DB will implement a progressive payout ratio through 2025, with most of the distribution slated for the back end (the cumulative 2021-2024 distribution amounts to ~EUR3.3bn). The remaining ~EUR4.7bn (out of the EUR8bn total) will be mostly included in the 2025 dividend (payable in 2026), with the excess allocated to buybacks through 2025.

Still, the implied dividend yield rises to ~5% for 2024, which, combined with the low-teens % buyback yield for 2024, equates to a highly attractive mid-teens % total shareholder yield for 2024 (assuming management executes to plan). This could rise further in 2015 depending on where profits land in the next few years, as well as how the capital ratio evolves.

For a sense of the scale of the optionality, each additional 50bps over the 13% target would entail an incremental <10% of the market cap to be returned by 2025. In sum, the impressive dividend growth guidance and the sheer size of the planned distribution should go a long way toward restoring DB’s appeal to an income-focused shareholder base. All that’s left is the execution.

An Underappreciated Self-Help Story

DB’s self-help story is playing out but remains underappreciated by the market. This time around, the roadmap is clear and achievable, with a combination of revenue drivers such as interest rate tailwinds and strategic investments complementing cost-out measures. Even if DB does not completely hit its ROTE and cost-income targets, the bear case looks more than priced in at this point.

DB stock is currently on offer for ~0.4x fwd tangible book, a near-distressed valuation that simply does not match its vastly improved fundamentals. Finally, investors get paid handsomely to wait – the total yield (buybacks + dividends) is on track to hit the mid-teens % by 2024, while optionality from the CET1 could unlock a significantly higher yield down the line.

Be the first to comment