aluxum/iStock via Getty Images

Investment Thesis

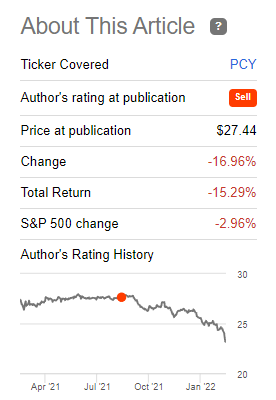

Invesco Emerging Markets Sovereign Debt Portfolio ETF (NYSEARCA:PCY) is a sovereign EM hard currency debt fund. Although it is a hard currency fund (i.e. an investor is not exposed to EM currency risk), the vehicle invests in below investment grade bonds which have experienced a rout on the back of higher rates as driven by a hawkish Fed and the current risk-off environment driven by the Ukraine conflict. We wrote an article in August 2021 highlighting why we were assigning a Sell rating to the fund. Since our piece the fund is down more than -16% on a price basis and more than -15% on a total return basis. We feel that on the back of the blow-up in EM credit spreads driven by the Ukraine conflict and the pricing of the Fed hikes in the current 10-year yield level most of the downward move is done. As a reminder when we assign a Sell rating here at Binary Tree Analytics we are looking at a vehicle through the lens of a short-seller. We feel there is not much left to squeeze out of this vehicle and a short-seller would be savvy to close said trades and move to Hold on this ticker.

PCY Performance

Since August 2021 PCY is down more than -16% on a price basis:

Fund Performance since Rating (Seeking Alpha)

On a total return basis the price move is slightly mitigated by the fund’s dividend yield, but still it exposes a massive drawdown.

This recent move has driven the total return performance for the fund in the past 5 years to almost zero:

5-Year Total Return (Seeking Alpha)

A retail buy-and-hold investor purchasing this fund for yield would have seen a negative inflation adjusted total return at this point in time. Dreadful performance. We talked in our prior article around the low Sharpe ratio the fund exposes and we can see how well the Sharpe metric serves to caution a buy-and-hold investor regarding a fund’s long term performance.

PCY Performance Drivers

The drivers for PCY’s recent poor performance are:

Duration

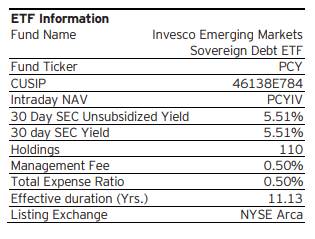

The fund runs a very high duration of 11.13 years:

Fund Duration (Fund Fact Sheet)

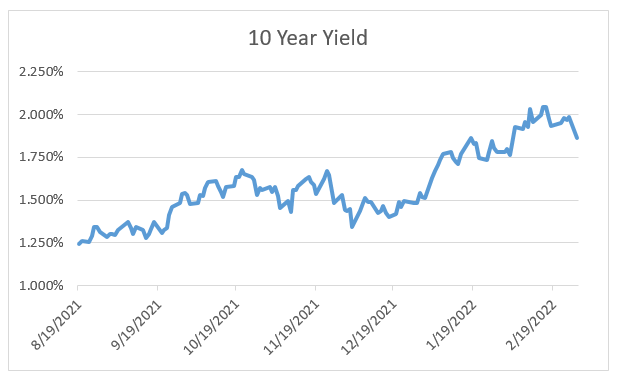

In respect to risk-free rates, the fund is fully exposed to interest rate risk, meaning that in a rising interest rate environment the underlying bond prices decline. Some funds choose to hedge via swaps some of the interest rate risk exposure. PCY runs fully naked its duration risk. The current duration metric makes the fund fall in the long-term bond duration bucket and it has been obliterated by the market pricing of higher interest rates from the Fed. 10-year yields have moved up by 75 bps since August 2021:

10-year yield (Author)

The move in yields accounts for about 6% of the total downwards move based on the fund’s duration. While in an extremely inflationary environment 10-year yields can push much higher, we expect them to be bound by the 2.25-2.5% range in 2022 under a base case scenario.

Credit Spreads

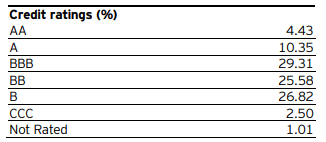

The fund generally invests in below investment grade EM bonds:

Ratings Profile (Fund Fact Sheet)

A below investment grade bond presents both a higher default risk as well as a susceptibility to credit spread widening – i.e. during a risk off event a junk bond will perform worse than an investment grade one. This goes back to Pricing 101 – an IG bond is priced by looking at maturity equivalent risk free rates plus a credit spread. In a risk off environment, for an IG bond the credit spread widens but the overall yield does not rise by as much because the risk free rates decrease. For junk bonds it is all credit spread, hence the propensity to underperform in a downward scenario.

We are fully witnessing this move in the current Ukraine conflict driven market where EM credits are being shunned. Most market participants do not fully understand or price the political risk associated with EM credits and the propensity for completely irrational decisions (from a financial standpoint) to flare up from time to time in the emerging world. The issue here is that a political decision can negatively impact the perception of the country and might result in significantly higher credit spreads without any leading indicators.

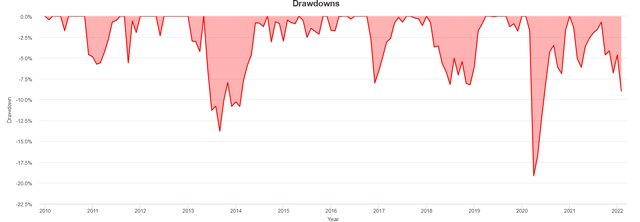

PCY Historical Drawdowns

The current Ukraine conflict driven performance is closing in on being the second largest in the past decade for the fund:

Drawdowns (Portfolio Visualizer)

We can see how the Covid market event represented the largest drawdown for the fund, but the current market price move is rapidly moving towards being the second largest for the fund in the past decade. Going by the old adage of “sell high, buy low” we feel that closing a short position in the fund when we are closing in on historical negative performances is a good action to take.

Conclusion

PCY is an EM offering from Invesco that pursues an emerging markets hard currency investment strategy. While PCY is not exposed to currency risk through its holdings, it has been negatively affected by its high duration and increase in 10-year yields as well as the Ukraine conflict through its credit spread risk. The fund has performed very poorly since August 2021 and is closing in on exposing the second largest drawdown in the past decade. From a short seller’s lens we feel most of the downward move is done and the current EM Ukraine conflict crisis is an opportune time to move to close any short positions on this fund. We thus move to Hold for this fund.

Be the first to comment