Damir Khabirov/iStock via Getty Images

Main Thesis & Background

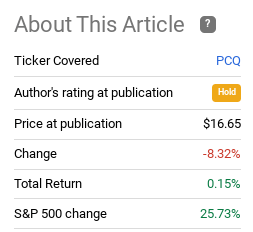

The purpose of this article is to evaluate the PIMCO California Municipal Income Fund (NYSE:PCQ) as an investment option at its current market price. The fund “invests primarily in California municipal bonds, and therefore seeks to provide current income, which is exempt from federal and California income tax, as well as the alternative minimum tax.”

It has been a while since I covered PCQ specifically, although I do write about the broader municipal bond market with regularity. With respect to PCQ, I last covered it about two years ago, when I placed a “hold/neutral” rating on the fund. Looking back, that outlook has been vindicated. While it has certainly had its ups and downs along the way, PCQ’s return has been almost as close to flat as one could imagine:

Fund Performance (Seeking Alpha)

Given this reality, I thought now was a good time to revisit PCQ and see if I should change my rating. This is especially timely because I have written a couple of pieces recently suggesting a few muni CEFs to buy. I view the broader macro-environment positive for muni funds and do see a general level of value across the space.

That said, PCQ is a good fund to zero in on because it is one that I do not see value in at the moment. Therefore, I wanted to dive into the reasons why, and emphasize to readers that while I view munis positively as a whole, I still suggest investments be discerning in what funds to buy, and at what price.

PCQ Is Just Outright Expensive

The first metric I will examine is PCQ’s valuation. This is a key reason I have been lukewarm on this fund in the past, and there hasn’t been much movement on this reality over the past two years. This relates back to how I ended the prior paragraph – just because there is value in munis as a whole does not mean there is value in all muni funds. When looking at PCQ, this should be abundantly clear.

To understand why, let us consider that PCQ’s premium to NAV is nothing short of silly. With a premium in excess of 30%, I can’t see the logic behind buying in at these levels in isolation. But even if one was so inclined to pay up for munis, why would they select PCQ within the PIMCO family given that funds exist with very similar make-ups for better prices? For comparison, the chart below shows PCQ’s premium is vastly higher than its sister funds:

PIMCO California Muni CEFs (PIMCO)

The bottom-line to me is that I would find it impossible to recommend buying PCQ right now when such better value exists not only within the CEF universe, but within the PIMCO family itself. The California Municipal Income Fund II (PCK) actually trades at a slight discount to NAV, and the California Municipal Income Fund III (PZC) is not far behind with a premium less than 1%. While these funds are not identical in every degree, a spread in excess of 30% between these options is simply not justifiable.

It shouldn’t be hard to decipher why I think this fund is overpriced, but there is additional support. I mentioned that two years ago I found PCQ to have too high of a premium. In the interim, the fund has produced a total return near 0% (although tax-savings could have resulted in a positive return for some investors). However, you want to slice this, that is a weak return. Yet, back in August 2020, PCQ had a premium near 17% when I wrote about it. That means that in a two-year period PCQ has had virtually no gain, but its cost to buy-in has increased substantially. That can only mean one thing: the fund’s underlying value has decreased significantly. And indeed it has:

| NAV on 7/31/20 | NAV on 7/29/22 | Change |

| $14.13/share | $11.50/share | (18%) |

Source: PIMCO

In fairness to PCQ, most leveraged CEFs (muni or otherwise) have fallen over the past year. But not all of these products sit with a 30% premium. To see PCQ’s NAV decline by double-digits over a two-year period and sit with a worse value proposition than it did at the start of that same two-year stretch tells me this is not a good buy here. The value just is not there.

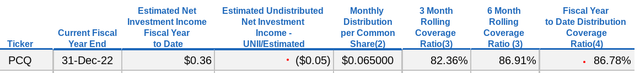

Income Metrics Are No Longer Great

The next point of focus is the fund’s distribution. This has actually been a bright spot for PCQ for a long time. In fact, it had a way of justifying a premium (perhaps not a 30% premium, but some level of premium) because the distribution was high and safe. The fund would often have a strong positive UNII balance that would put investor’s at ease in case short-term coverage ratios declined a bit. The fund had plenty of reserves to make up for any drop in earned income. In fairness, PCQ has continued to pay out the same distribution level as it had during my August 2020 review and that is something to give the fund a lot of credit for. With a current yield above 5%, before tax savings are even factored in, investors may elect to buy this option regardless of the price for the income stream. Given California’s high tax rates, there is some logic to this thesis.

The problem I have now is that the income story isn’t quite as strong as it used to be. I wouldn’t call it “bad”, given the points I just raised above. The absolute yield looks compelling enough to bring in investors. However, I am more concerned about the maintenance of this yield than I have been in the past. That is because coverage ratios all sit comfortably in the 80%-range, and the positive UNII balance has been replaced by a negative one:

PCQ’s UNII Metrics (PIMCO)

Are these figures terrible? Of course not. But if one is going to pay 30% more for a CEF than its underlying value, they should want to see “great’. Being “not terrible” doesn’t provide a whole lot of comfort.

What I am getting at here is not that PCQ is not a reasonable income play. Its yield is very attractive on a tax-adjusted basis and the distribution history is very strong. Could it see a distribution cut in the next few months or next year? Perhaps, and the likelihood has been increasing since I last looked at it. But even with a cut, the distribution will be strong enough to pique plenty of interest. While I don’t see a good enough story to warrant a buy rating for this fund, the backdrop is similarly too good for me to be “bearish”.

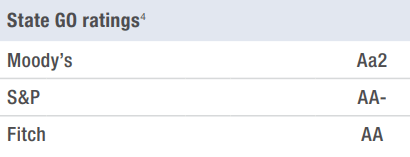

Any Good News? Yes, California GO Bonds Are In Good Shape

Through this review I have painted a not-so-great picture for PCQ. But I will again affirm I am not outright bearish on this fund. The reason being that despite the general weakness over a two-year period, the fund has not seen a negative return, so outright selling it may not have been advantageous. Further, the broader macro-environment for California debt is stable. While PCQ may not be the best way to play that, this backdrop suggests that PCQ is not going to just suddenly take a nose-dive from current levels. Do I expect under-performance from this fund compared to alternatives? Absolutely. But the reality is that PCQ has traded at elevated premium levels for a long time, and that market condition could remain in place for the second half of 2022.

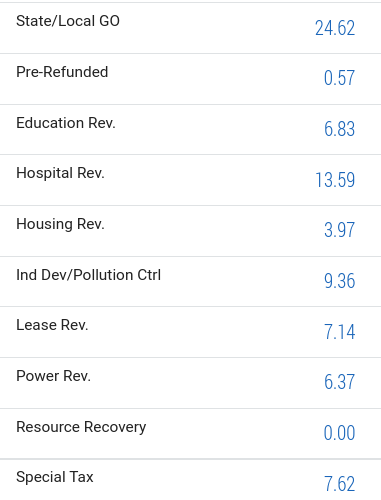

To support my analysis let us take a look at the make-up of PCQ’s portfolio. The fund is almost exclusively tied to California muni bonds, but that can still mean a number of different things. As with most investments, munis can have exposure to different sub-sectors, as well as being classified as General Obligation (GO) bonds, or Revenue Bonds. The former is backed by the general authority and status of the state and local government issuing the bond while the latter is backed to revenues from a specific project or other revenue stream.

When considering PCQ, readers should note the fund is well balanced, but it does hold a significant amount of GO bonds, at almost 25% total assets:

PCQ’s Sector Breakdown (PIMCO)

This means that the broader fiscal picture for the state of California is of paramount importance to investors in this fund.

Fortunately, California has had a strong credit rating for many years, which have been recently affirmed by the major rating agencies in 2022:

California Credit Ratings (By Agency) (S&P Global)

What this suggests is that the credit quality of PCQ’s largest sub-sector is strong. This bodes well for supporting the underlying asset valuations, as well as the likelihood of receiving interest payments on-time (and therefore supporting consistent distributions for PCQ investors).

Readers should consider that California as a whole came out of fiscal year 2021 on strong footing. According to recent reports from the California State Comptroller, California experienced real GDP growth of 7.8% in 2021, resulting in a big increase in tax collection. For example, sales tax collections grew by 16.6% and corporate income tax grew by 96% (year-over-year). This was primarily the result of corporate tax return deferrals from 2020. So, while it should be taken with a grain of salt, that large boost in corporate tax receipts has allowed the state to significantly increase its “rainy day” fund, placing it on solid financial footing.

The conclusion here in my mind is that California muni bonds have little chance of default or delinquency right now. State coffers are full, which is supportive of the debt even if spending plans increase in the near-term.

Watch The Hospital Sector Closely

Expanding on the sector exposure for PCQ, I want to touch on Hospital Revenues, which make up over 13% total fund assets. This is an area I think investors need to monitor very closely. While I described what I see as a pretty strong fiscal backdrop for California as a whole, the healthcare system is one that continues to be challenged. Seeing PCQ be tied so closely to this sector is a concern of mine, as this is an industry that continues to be plagued by challenges coming out of the Covid-19 pandemic.

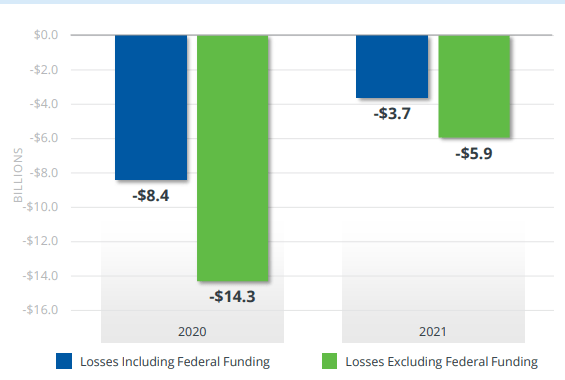

While this is a national problem, California in particular has a very strained public hospital system. Losses have been magnified from the pandemic, but they also stem from very generous public healthcare policies and chronic under-funding on a state and local level. In 2020 and 2021, losses were very steep within the California hospital system. The good news was federal support became a significant player – largely due to the pandemic. The bad news is that even with that support, the system as a whole is operating in the red:

California Hospital Losses in 2020 and 2021 Compared to 2019 (Billions) (Kaufman Hall Consulting)

The trouble here is that while the financial stress has been earlier on California hospital system, I would expect federal support to decline as we get further from the onset of the pandemic. That means revenues and margins could improve, but overall balance sheet health may still be in trouble.

I am not trying to be alarmist here, but when it comes to Health Care or Hospital sub-sector exposure within the muni space, we have to be especially selective. I discussed in a recent muni-review why investors want to shy away from senior living facilities since that is where the bulk of muni defaults are coming from. In a similar fashion, if I wanted debt backed by hospital revenues I would probably look outside the state of California.

Bottom-line

PCQ continues to hold the infamous title of most expensive CEF from the PIMCO family. While premiums can sometimes be warranted when a fund has other outstanding characteristics, I think the case is difficult to make here. Could a small premium be justified? Sure, given PCQ’s income history and the improving macro-environment for muni debt. But a 30% premium? That is just ridiculous. This case gets more ridiculous when we consider that the income metrics are not entirely comforting, and some pockets of the underlying debt holdings are facing some pressure (i.e. bonds backed by hospital revenues).

My thought here is that while muni debt, whether in California or in other states, is flashing buy signals in many areas, this is not one of them. I see a couple of headwinds and some attributes that are stronger elsewhere. Therefore, I am maintaining a “hold” rating on this fund, and suggest readers approach any positions very carefully at this time.

Be the first to comment