Diego Thomazini

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 11th, 2022.

High Income Securities Fund (NYSE:PCF) is a closed-end fund that Bulldog Investors took over. It was previously a Putnam fund. The portfolio is quite interesting. They invest primarily in other closed-end funds but aren’t limited to investing in CEFs exclusively. They also hold other income-producing assets, such as preferred shares. Additionally, they have a fairly high weighting in special purpose acquisition vehicles or SPACs.

Interestingly, Bulldog and Saba (another CEF activist) funds often share this same characteristic of having a weighting in SPAC exposure. At some level, I don’t think the SPAC exposure is bad. However, sometimes the weighting becomes too much, and I find that less attractive. This is just all my opinion, of course.

SPACs are essentially a place to store cash on the speculation that a business combination can be found. If one isn’t found, the cash is returned to investors. With hundreds of SPACs after the SPAC craze of 2020, the likelihood of a deal is quite low, in my opinion. In fact, it seems that a better outcome is that they don’t find a deal. The average losses of a SPAC after mergers are substantial.

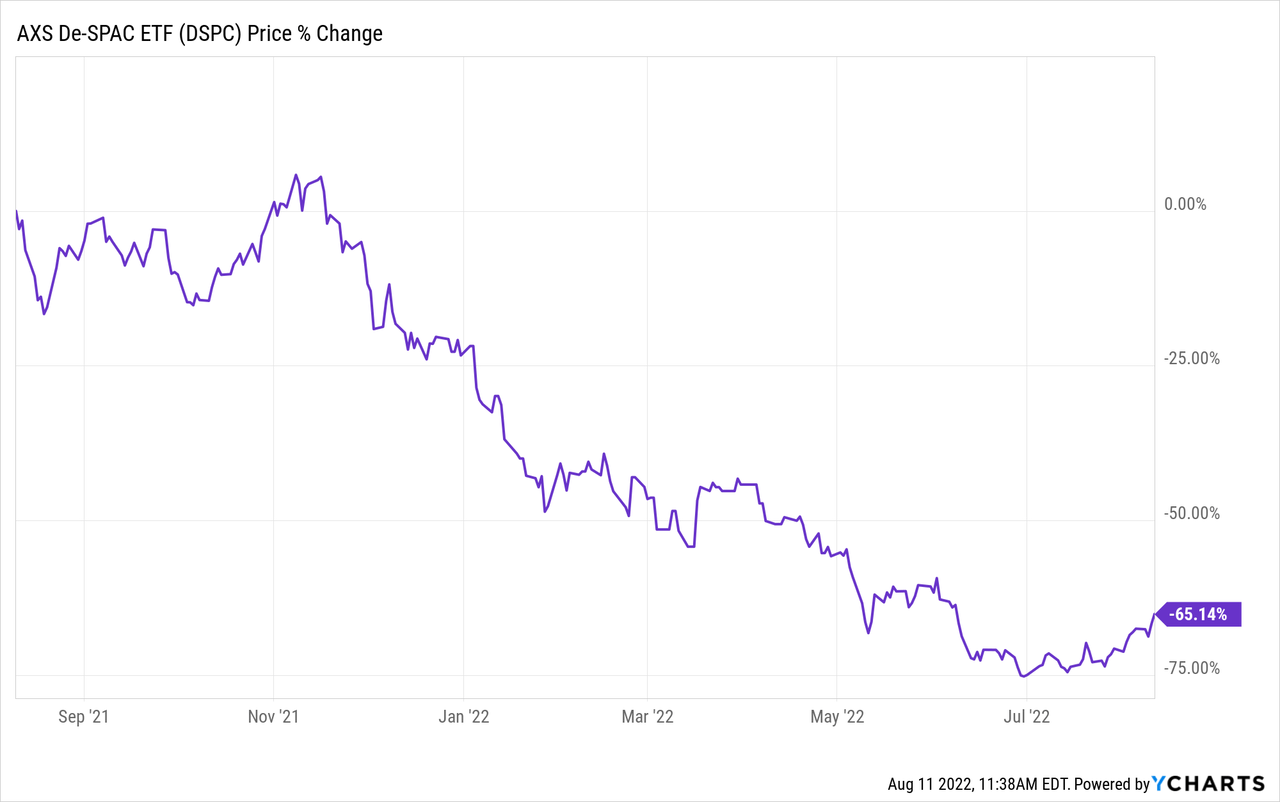

Here’s the performance of AXS De-SPAC ETF (DSPC) over the last year.

Ycharts

It has been a challenging market overall, but even more challenging for these SPACs that find merger partners to IPO.

Anyway, that’s my main caution on having too much exposure to SPACs. In PCF’s case, I don’t think they are overly detrimentally weighted to SPACs. Additionally, since they are actively managed, they can exit a position before it gets completed.

Management is looking to increase SPAC exposure, so that’s something worth watching for. In this case, they want to add leverage to the fund and increase the investment parameters. Here’s what they had to say in the last semi-annual report.

As discussed previously, we sometimes have to forego investments whose risk-reward profiles are attractive, but don’t fit within the Fund’s restrictive investment parameters. In addition, we would like the flexibility to increase the Fund’s exposure to SPACs, which can provide a significantly higher return than a money market fund with a minimal risk of incurring a realized loss of principal provided that the common stock is sold or redeemed before a transaction with an operating company is completed. (Shares of SPACs held after a transaction is completed can be very volatile.) Thus, we think the Fund should have greater flexibility in selecting investments as well as the ability to use leverage to enhance its returns. Now that the rights offering has been completed and the Fund’s size has reached an acceptable level, the Board intends to consider asking stockholders to vote on proposals to broaden the Fund’s investment parameters, authorize the use of leverage, and engage an investment advisor that has demonstrated success in using activist measures to enhance the value of its clients’ investments.

The Basics

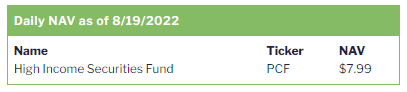

- 1-Year Z-score: -1.04 (based on NAV reported on 8/19)

- Discount: 7.38% (based on NAV reported on 8/19)

- Distribution Yield: 11.53%

- Expense Ratio: 0.84%

- Leverage: N/A

- Managed Assets: $140.4 million

- Structure: Perpetual

PCF’s investment objective is to “provide high current income as a primary objective and capital appreciation as a secondary objective.” The fund intends to achieve this by investing “under normal circumstances, at least 80% of its net assets in discounted securities of income-oriented closed-end investment companies, business development companies, fixed income securities, including debt instruments, convertible securities, preferred stocks, and special purpose acquisition companies. The fund also invests in high-yielding non-convertible securities with the potential for capital appreciation.”

As noted above, the fund doesn’t utilize leverage at this time but is considering a vote to allow leverage. Despite not having leverage on the fund level, plenty of their underlying holdings incorporate leverage as they hold other CEFs. That is one thing that I hope they consider before leveraging their portfolio too much.

I don’t think that will be a problem because they also run Special Opportunities Fund (SPE). In that fund, they utilize preferred leverage, the Special Opportunities Fund Perpetual Series C (SPE.PC). I believe that fund is moderately leveraged and not what I would consider an excessive amount of leverage.

That’s still something to consider and worth watching out for when it gets brought to the table. Any leverage is going to increase risks as well as the potential reward.

The fund’s expense ratio comes to 0.84%. That’s quite low for the CEF space. However, that doesn’t include the expenses of the underlying funds. As discussed in the next section, we get discounts on discounts, which also means fees on fees.

Performance – Holding Up Well In A Volatile Year

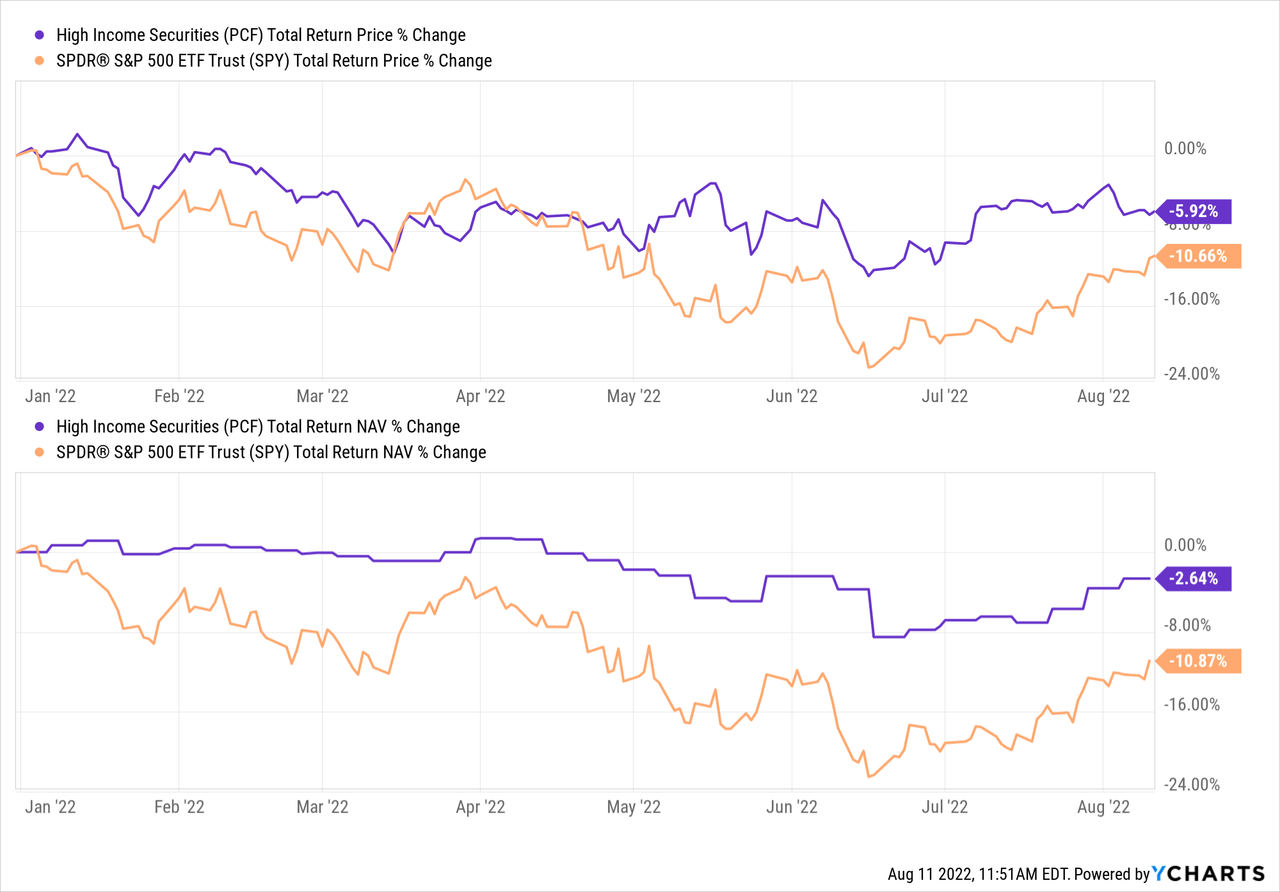

On a YTD basis, the fund has performed relatively well. I included the performance of the SPDR S&P 500 (SPY) to provide some context. Although, PCF is positioned in a wildly different manner, as touched on above. One thing that seems apparent is that the SPAC exposure seems to have limited the downside here substantially, relatively speaking.

Ycharts

When holding a basket of CEFs, you also have to consider that expanding discounts would play a role in the performance of the fund. We recently ran a screen to see how discounted CEFs were across the board. We found that CEF discounts have tightened from earlier this year but are still wider than at the end of 2021. That means they were able to pull off this performance despite working against that impact of the fund.

The CEF exposure, though, isn’t just traditional CEFs. You also have exposure to business development companies in a meaningful weighting. That’s important to consider because BDCs have one thing over traditional CEFs relating to interest rates. That is, they are less sensitive to interest rates as they generally are invested in floating-rate debt with more fixed-rate leverage. That means the higher interest rates go, the higher their potential income generation can go, while the leverage expenses stay relatively flat.

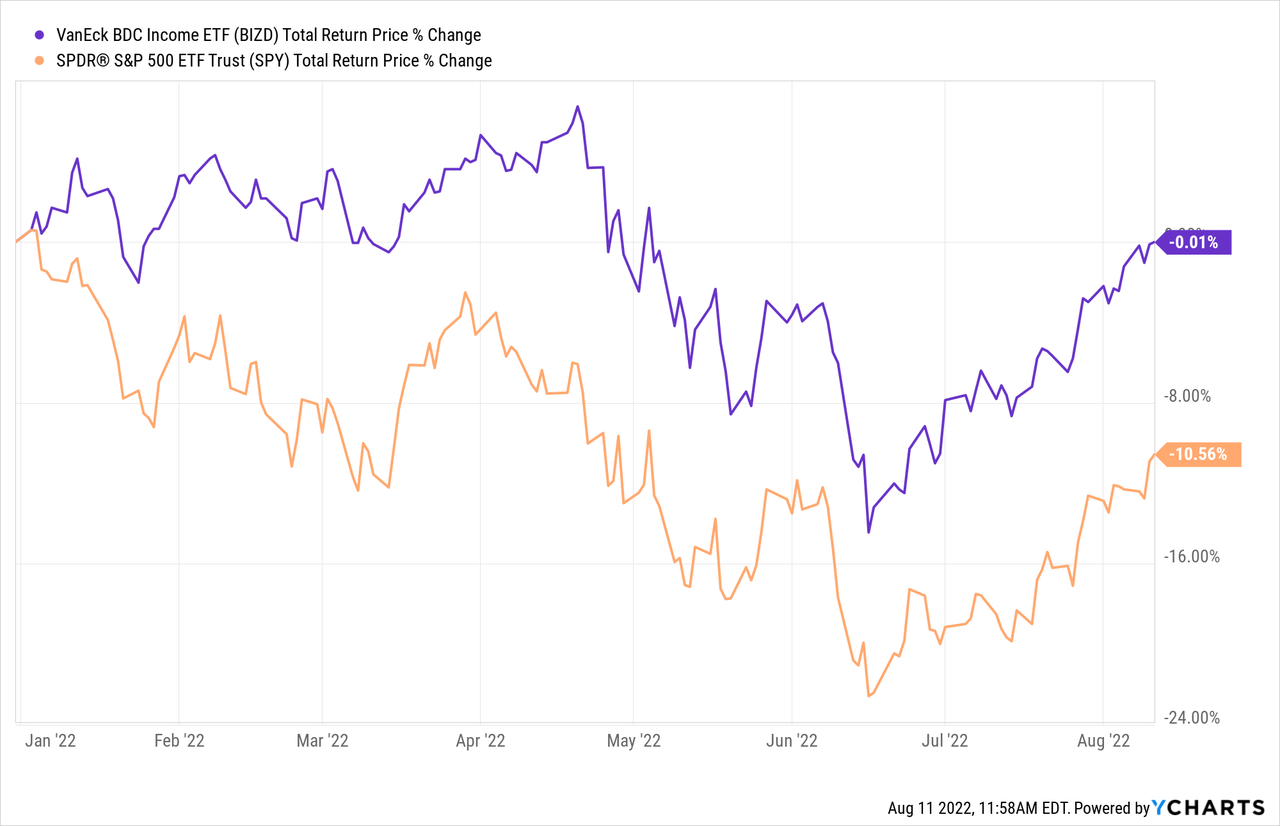

That has helped BDCs hold up fairly well on a YTD basis. Below is a look at the VanEck BDC Income ETF (BIZD) and also including SPY for some context once again.

Ycharts

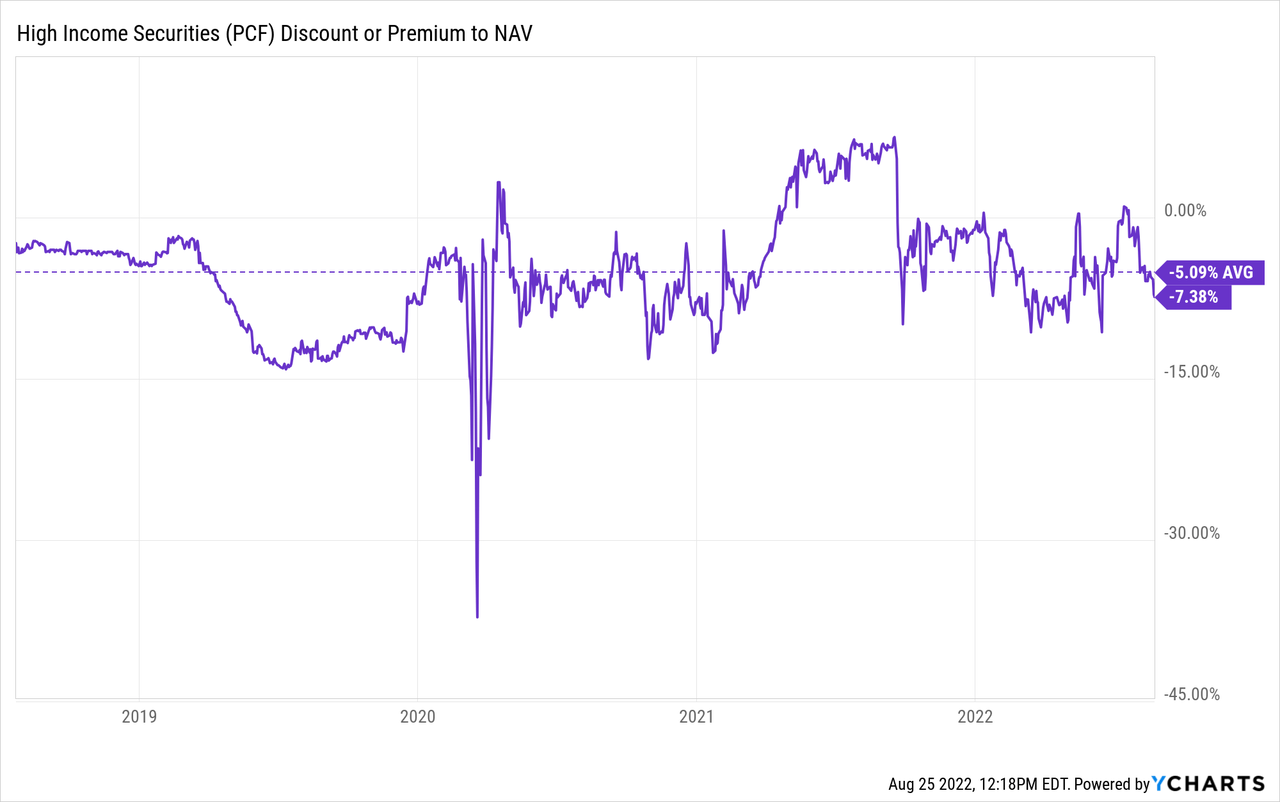

An additional benefit of CEF holdings, including BDCs, is that for PCF, that creates a discount on discount situation. Going back to July 23rd, 2018, when the fund was changed over the Bulldog, we can see that the current discount compares favorably to this period’s average at the time of writing. The premium we saw last year that was sharply wiped away was due to the rights offering we discussed previously.

Distribution – Managed 10% Rate

For PCF, the distribution is predictable. They have a 10% managed distribution plan that is reset annually. Due to not achieving that level over the last three years has resulted in a trim each year.

Under the Fund’s managed distribution plan, the Fund intends to make monthly distributions to common stockholders at an annual rate of 10% (or 0.8333% per month) for 2022, based on the net asset value of $8.75 of the Fund’s common shares as of December 31, 2021.

First, it was $0.082 per month, then $0.078, and now in 2022, shareholders have been receiving $0.073. If it were reset at the last reported NAV, which comes in at $8.01 – we would be down to a ~$0.06675 per month distribution. There is plenty of the year left for rebounding, but I would keep expectations realistic.

PCF NAV (Bulldog)

A reduction isn’t going to look like a positive, but in this case, it is predictable. Sometimes, predictability is better as you know what to expect.

Simply put, the distribution will decrease if the fund doesn’t return 10% in a year. It will stay flat or rise if they return 10% or more.

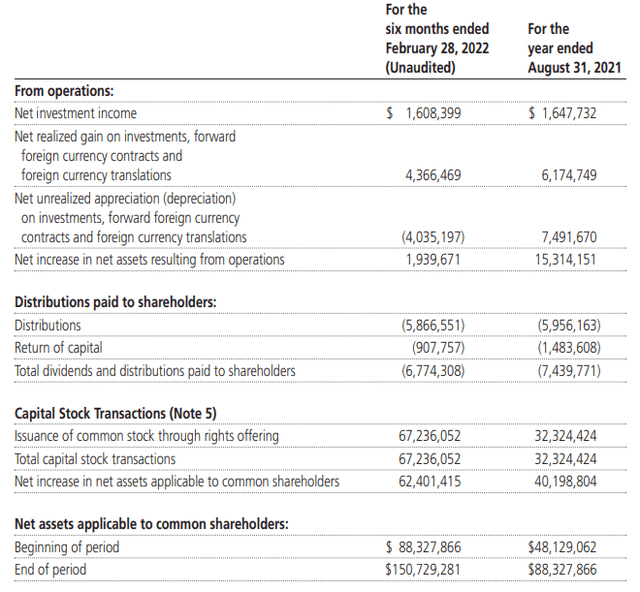

The latest report shows us that most of the distribution will rely on capital gains.

PCF’s Portfolio

Information is rather limited in Bulldog funds. They don’t provide the metrics or regular updates that we see from other significantly larger sponsors. They do provide quarterly updates on all their holdings, though. With that being said, their last semi-annual report is the latest update and provides how they were positioned at the end of February 28th, 2022. Unfortunately, that was the last data available that we touched on previously, too.

They should be providing the May 2021 quarterly holdings any day. They’ve filed the N-PORT but haven’t put it into an easier-to-read file for shareholders yet as they have done in the past.

Deciphering through that, the N-PORT shows us that positions in FS KKR Capital (FSK), Steel Partners Holdings LP (SPLP) and Highland Income Fund (HFRO) remain positions in the fund at the end of May. Those were the largest positions previously and appear to be the largest weightings still. They are 5.64%, 4.3% and 3.69% weightings, respectively. I think it highlights some interesting holdings. Not names that I would specifically hold personally or even might avoid in the case of HFRO. However, it can highlight the potential for added diversification in one’s own portfolio.

They had reported a 57% portfolio turnover rate in that six-month window, meaning they are making quite a few changes regularly. That being said, the actual weightings of the portfolio haven’t changed dramatically. In May of 2021, investment companies accounted for ~55.5% of the fund’s holdings. In February 2022, they accounted for ~43.5%. While I believe that is a material shift, I wouldn’t consider it dramatic. The investment exposure of the overall fund is still quite geared towards other investment companies.

Preferreds last year were 15.04%, and SPACs were 19.51%. Comparing that to the February weightings of 20.87% for preferreds and 19.63% in the SPACs once again shows that the broader investment exposure remained quite consistent, even with some meaningful weighting changes.

Conclusion

PCF remains an interesting fund and a way to play the Bulldog activist investor angle. They hold a diversified portfolio with a focus on other CEFs and BDCs. That provides significant diversification in holdings as those underlying positions then hold hundreds of other stocks and bonds. The fund trades at a relatively attractive discount with an appealing managed distribution plan. At this point, they haven’t been able to achieve the 10% returns needed for the distribution to stay flat. However, we do know what to expect regarding their distribution, which provides predictability.

Be the first to comment